We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a very Happy New Year. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

New Natwest / RBS / Ulster Bank £200 Switch Incentive

Comments

-

Hi @worriednoob ... don't be worried (and you're not so new now) ...

@Bridlington1 is right. If you haven't received any incentives from NatWest, RBS and UB prior to 14th Feb 2023 (from 1st Oct 2017) you can expect the bonus from a successful switch application to each of the three after 13th Feb. Cora (bot) was just quoting the general condition but sloppily.

If your account applications are successful then the credit checks have passed, the banks must then pay the incentives according to the switcher T&Cs.

I would hope and expect you and your partner to receive 3x£200 for 3 accounts each.2 -

Thanks very much for clarifying and easing my concerns @Bridlington1 and @dealyboy - Sorry, but can't help but worry, especially when so many credit checks have impacted our credit score massive. I'll withdraw the £1250, so the account will be back.

Yes, you're right that we've never had NatWest, RBS and UB accounts at all, so hopefully that should help.

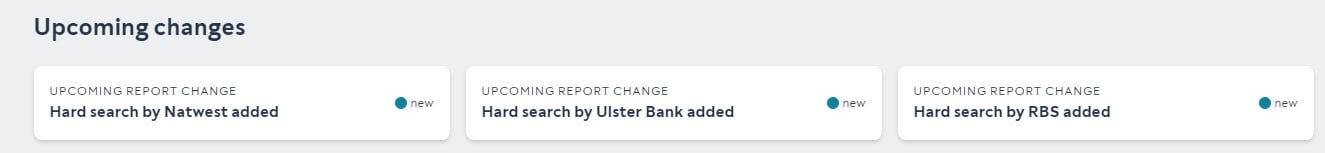

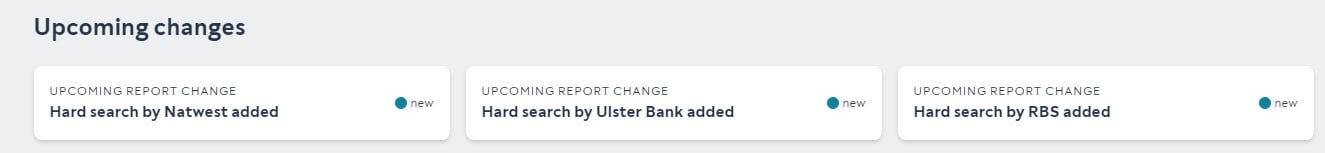

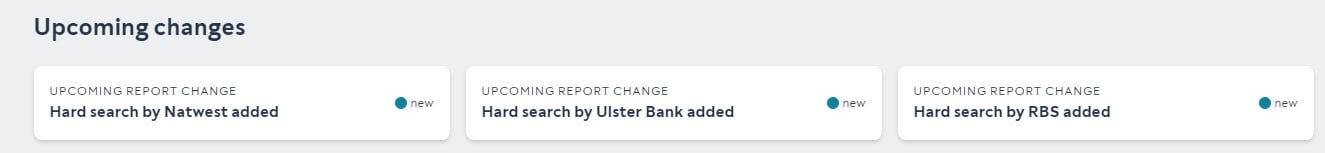

Both of our Clearscore reports show 3 hard checks:-

Just to add that we've also today have also received the Ulster bank paperwork and we've completed it and posted it back, so hopefully should hear something from them soon. Is all the UB bank paperwork/statements done via snail mail or is it the case that once they receive our signed paperwork, they open the account and send everything online?3 -

I did my switches a few months ago now, but from what I've read the UB process hasn't changed significantly; communications will now be by e-mail with card reader to arrive in the post, eventually. (BTW if needed you can use any standard bank card reader e.g. NW, NatWest, RBS).@worriednoob said:Thanks very much for clarifying and easing my concerns @Bridlington1 and @dealyboy - Sorry, but can't help but worry, especially when so many credit checks have impacted our credit score massive. I'll withdraw the £1250, so the account will be back.

Yes, you're right that we've never had NatWest, RBS and UB accounts at all, so hopefully that should help.

Both of our Clearscore reports show 3 hard checks:-

Just to add that we've also today have also received the Ulster bank paperwork and we've completed it and posted it back, so hopefully should hear something from them soon. Is all the UB bank paperwork/statements done via snail mail or is it the case that once they receive our signed paperwork, they open the account and send everything online?

See a couple of timelines ...

https://forums.moneysavingexpert.com/discussion/comment/79918524/#Comment_79918524

https://forums.moneysavingexpert.com/discussion/comment/79920105/#Comment_79920105

Many of us have done several switches with credit checks being performed when opening, these can be 'softened' if no overdraft facility is requested. Although an account application may be refused for 'reasons', once the account is opened the checks will not affect the payment of the incentive.

The impact of credit checks on one's financial affairs is not direct and most people (including me) do not suffer any consequences, however there are some who have been refused accounts or even had accounts closed for speculated reasons. My own view is that a bank or BS will accept a new customer unless there is something that rings an alarm bell, there can be many triggers ... insufficient income, having been declined, lots of credit applications ... but I don't think several account applications of themselves cause a rejection.

Of course if one is looking to take out a loan or mortgage I can understand that checks and credit scores may well have an impact.1 -

Many thanks dealyboy for the helpful info and timeline. We're willing to wait for ulster and just hope at least 2 out of the 3 banks pay. We can live with the credit check as we don't have any immediate plans to apply for further credit.dealyboy said:

I did my switches a few months ago now, but from what I've read the UB process hasn't changed significantly; communications will now be by e-mail with card reader to arrive in the post, eventually. (BTW if needed you can use any standard bank card reader e.g. NW, NatWest, RBS).@worriednoob said:Thanks very much for clarifying and easing my concerns @Bridlington1 and @dealyboy - Sorry, but can't help but worry, especially when so many credit checks have impacted our credit score massive. I'll withdraw the £1250, so the account will be back.

Yes, you're right that we've never had NatWest, RBS and UB accounts at all, so hopefully that should help.

Both of our Clearscore reports show 3 hard checks:-

Just to add that we've also today have also received the Ulster bank paperwork and we've completed it and posted it back, so hopefully should hear something from them soon. Is all the UB bank paperwork/statements done via snail mail or is it the case that once they receive our signed paperwork, they open the account and send everything online?

See a couple of timelines ...

https://forums.moneysavingexpert.com/discussion/comment/79918524/#Comment_79918524

https://forums.moneysavingexpert.com/discussion/comment/79920105/#Comment_79920105

Many of us have done several switches with credit checks being performed when opening, these can be 'softened' if no overdraft facility is requested. Although an account application may be refused for 'reasons', once the account is opened the checks will not affect the payment of the incentive.

The impact of credit checks on one's financial affairs is not direct and most people (including me) do not suffer any consequences, however there are some who have been refused accounts or even had accounts closed for speculated reasons. My own view is that a bank or BS will accept a new customer unless there is something that rings an alarm bell, there can be many triggers ... insufficient income, having been declined, lots of credit applications ... but I don't think several account applications of themselves cause a rejection.

Of course if one is looking to take out a loan or mortgage I can understand that checks and credit scores may well have an impact.

Cheers again and I'll keep you posted on any updates.1 -

So I think we've established that you can in fact claim the bonus from each bank, but does anyone know if it will still work if you switch from Ulster to RBS?0

-

Lol I would imagine thats highly unlikelyNetherspark said:So I think we've established that you can in fact claim the bonus from each bank, but does anyone know if it will still work if you switch from Ulster to RBS?0 -

There's nothing in the T&C's to prohibit this, but there is a risk you could be setting yourself up for a fight to get the incentive and/or a black mark within this banking group if you do this. There's not much extra work in setting up a donor account. You don't even need direct debits.Netherspark said:So I think we've established that you can in fact claim the bonus from each bank, but does anyone know if it will still work if you switch from Ulster to RBS?

2 -

It's not definite but I think it will almost certainly work. They just don't seem to check.Netherspark said:So I think we've established that you can in fact claim the bonus from each bank, but does anyone know if it will still work if you switch from Ulster to RBS?0 -

Following on from above, has anybody received the £200 incentive swapping an account within the Natwest group without issues?

My 2 donor accounts had ended up being with RBS and Natwest, both new accounts which had received the incentives. I switched the Natwest account to Ulster and met all T&Cs, but haven't received the £200. An advisor on live chat confirmed I have met the criteria and advised me to raise a complaint about not receiving the £200.

I'm wary of doing this in case it causes issues with the banking group overall. has anybody else had to do this that can share the outcome please?0 -

How long has it been since you completed all the requirements?Beckyy said:

My 2 donor accounts had ended up being with RBS and Natwest, both new accounts which had received the incentives. I switched the Natwest account to Ulster and met all T&Cs, but haven't received the £200. An advisor on live chat confirmed I have met the criteria and advised me to raise a complaint about not receiving the £200.

1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards