We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The Old Regular Savers Discussion Thread 28/12/24-29/1/26

Comments

-

At least Coventry has a 7% regular saver via Cooperative bank. When my 8% tiddler regular saver matures this week the only YBS accounts I'll have are those I use to generate small value direct debits.Speculator said:

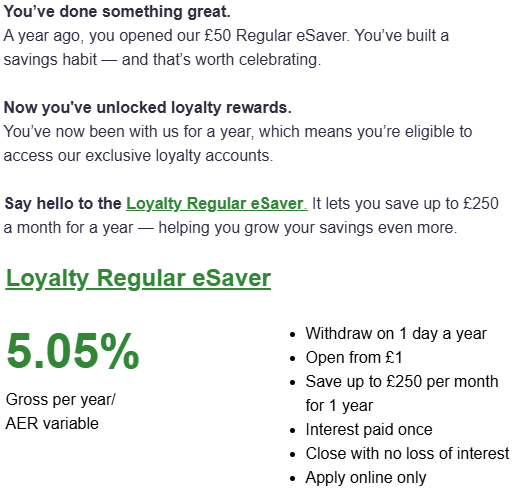

Same with Coventry. Second and third biggest building societies in the UK offering very poor regular savers.apt said:Have had an email from YBS bigging up their Loyalty Regular eSaver at 5.05% variable. Interest rate would have to be at least 1% higher to interest me. A few years ago YBS was frequently top of the interest rate tables for regular savers. Things are very different now.1 -

Disappointing? That's borderline misleading, and at best sly and underhand, not to mention that timetabled rate cut.happybagger said:

Given that they gave notification of an incoming reduction of this account to 4.85% some time ago, it's disappointing the email doesn't say as such

And it's a poor rate regardless of the cut.5 -

Darlington BS - regular saver maturities.Apparently Darlington have a long-standing glitch in their online system which means online withdrawal requests to nominated accounts with certain external sort codes are likely to fail - Santander sort codes being an example.The suggested work-arounds are either to send a secure message requesting the withdrawal, or changing your nominated account to one which isn't affected. Barclays, HSBC, and LBG were suggested as ones which aren't affected.I went with the second option as the secure message will only be actioned when someone gets around to it, whereas changing the nominated account is something the user can action, and only needs to be done once. That said, the nominated account amendment process is also glitchy, which might need a phone call/secure message to get sorted.5

-

Poor show but I would imagine this is just a generic 'end of regular saver' term workflow that pulls options from live products, presumably that's why the rate is today's rather than then one that applies from 2nd Oct.Speculator said:

Received this email this morning. I've been with them for over 30 years.WillPS said:Not sure why there's so much pessimism YBS will be able to offer 8% again, Saffron had no problem offering the same rate (and even extending out eligibility via their refer-a-friend offering). Recent offers from Darlington and Monmouthshire have been on an upwards trajectory. To be clear I'm not saying they will definitely offer a repeat run or an improvement, but it wouldn't be a surprise to me if they did.

As for the tiny pay ins... if you're aiming to keep the number of accounts you have down I can kind of understand but if not surely every little helps? It's not as though sending to 1 extra account each month is particularly burdensome.

0 -

YBS LReS 5.05%Aidanmc said:

Also had this email today, close this RS couple of months ago to free up funds for other RS's.apt said:Have had an email from YBS bigging up their Loyalty Regular eSaver at 5.05% variable. Interest rate would have to be at least 1% higher to interest me. A few years ago YBS was frequently top of the interest rate tables for regular savers. Things are very different now.

Was nearly going to re apply today, then i seen the rate is reducing to 4.85% on 2 October.

I'll be closing this account on 2nd October, 4.85% is too low.2 -

I absolutely hate when organisations have an internal issue and then put the onus on customers to sort it, or put customers in a position where they are potentially inconvenienced. Very poor.Section62 said:Darlington BS - regular saver maturities.Apparently Darlington have a long-standing glitch in their online system which means online withdrawal requests to nominated accounts with certain external sort codes are likely to fail - Santander sort codes being an example.The suggested work-arounds are either to send a secure message requesting the withdrawal, or changing your nominated account to one which isn't affected. Barclays, HSBC, and LBG were suggested as ones which aren't affected.I went with the second option as the secure message will only be actioned when someone gets around to it, whereas changing the nominated account is something the user can action, and only needs to be done once. That said, the nominated account amendment process is also glitchy, which might need a phone call/secure message to get sorted.2 -

Offering two workarounds for a problem, one of which is viable for everyone, is not putting the onus on the customer.OrangeBlueGreen said:

I absolutely hate when organisations have an internal issue and then put the onus on customers to sort it, or put customers in a position where they are potentially inconvenienced. Very poor.Section62 said:Darlington BS - regular saver maturities.Apparently Darlington have a long-standing glitch in their online system which means online withdrawal requests to nominated accounts with certain external sort codes are likely to fail - Santander sort codes being an example.The suggested work-arounds are either to send a secure message requesting the withdrawal, or changing your nominated account to one which isn't affected. Barclays, HSBC, and LBG were suggested as ones which aren't affected.I went with the second option as the secure message will only be actioned when someone gets around to it, whereas changing the nominated account is something the user can action, and only needs to be done once. That said, the nominated account amendment process is also glitchy, which might need a phone call/secure message to get sorted.

There's a reality that bugs take to fix - customer service teams are ethically and legally compelled to provide good customer outcomes. Both options advised offer far better outcomes than waiting an unknown amount of time for the issue to be fixed.

The only piece I don't understand is why they couldn't submit the message to the correct department themselves, but there probably is a good reason for that.0 -

Although they do highlight the upcoming rate reduction in the app. for each account that will be affected.flaneurs_lobster said:

Disappointing? That's borderline misleading, and at best sly and underhand, not to mention that timetabled rate cut.happybagger said:

Given that they gave notification of an incoming reduction of this account to 4.85% some time ago, it's disappointing the email doesn't say as such

And it's a poor rate regardless of the cut.0 -

Question regarding the new Yorkshire loyalty saver - do you have to add money to it every month and if so how little can you add?

I am pondering if its worth the effort of opening this new Loyalty saver just to keep loyalty status with Yorkshire at least as far as September 2026... Or is it worth holding off incase they have a Christmas saver again which would mature at the end of October 2026 (if it follows the pattern of last year)

Looking at my list for Yorkshire accounts all of my savers mature in September, October or November 2025 and then I will only have the standard regular saver which matures May 2026 - (and even that I might reduce the standing order to the minimum)“Create all the happiness you are able to create; remove all the misery you are able to remove. Every day will allow you, --will invite you to add something to the pleasure of others, --or to diminish something of their pains.”0 -

It’s still onus on the customer in that the issue is not of the customer’s making (unless Darlington were to explicitly state which sort codes are the issue at application and the customer still chooses to open an account and to nominate a particular account knowing it is affected.) Both workarounds are just that and require the customer to take action beyond the expected log in and request closure of the matured account.WillPS said:

Offering two workarounds for a problem, one of which is viable for everyone, is not putting the onus on the customer.OrangeBlueGreen said:

I absolutely hate when organisations have an internal issue and then put the onus on customers to sort it, or put customers in a position where they are potentially inconvenienced. Very poor.Section62 said:Darlington BS - regular saver maturities.Apparently Darlington have a long-standing glitch in their online system which means online withdrawal requests to nominated accounts with certain external sort codes are likely to fail - Santander sort codes being an example.The suggested work-arounds are either to send a secure message requesting the withdrawal, or changing your nominated account to one which isn't affected. Barclays, HSBC, and LBG were suggested as ones which aren't affected.I went with the second option as the secure message will only be actioned when someone gets around to it, whereas changing the nominated account is something the user can action, and only needs to be done once. That said, the nominated account amendment process is also glitchy, which might need a phone call/secure message to get sorted.

There's a reality that bugs take to fix - customer service teams are ethically and legally compelled to provide good customer outcomes. Both options advised offer far better outcomes than waiting an unknown amount of time for the issue to be fixed.

The only piece I don't understand is why they couldn't submit the message to the correct department themselves, but there probably is a good reason for that.

I would be less negative about it had they communicated the issue to everyone and provided a comprehensive list of accounts that could be used without issue. I would want to use either Nationwide, NatWest or Chase, but all of these would be a lottery as things stand.2

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards