We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

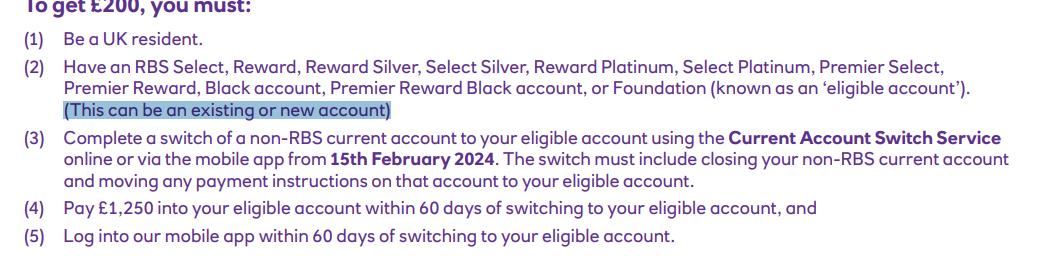

NatWest/RBS/Ulster £200 Switching Offer 15/2/2024-2/4/2024

Comments

-

Right, got accounts up and running for me and the Mrs. Both of us filled out details of the donor account to be switched during the application but don't remember there being a date to choose for the switch. Have we missed something? Not had any confirmation of switch request either.1

-

Thanks. I did read through them last night but (as I posted above) I was very tiredBridlington1 said:

From the terms:ussdave said:Ah, so as an existing customer you still need to open a new account? E.g. I can't just transfer into my existing RBS account?

So you can still switch into an existing RBS account and get the switching bonus. 0

0 -

I've just opened a NatWest and an RBS account, electing to switch into both (from Barclays and a new Chase CA), there was not an opportunity to select a switch date.pedrodelgado said:Right, got accounts up and running for me and the Mrs. Both of us filled out details of the donor account to be switched during the application but don't remember there being a date to choose for the switch. Have we missed something? Not had any confirmation of switch request either.0 -

Thanks for clarifying that, didn't think i'd seen a date. Just a waiting game then to see if they send any confirmation of the switch.northwalesd said:

I've just opened a NatWest and an RBS account, electing to switch into both (from Barclays and a new Chase CA), there was not an opportunity to select a switch date.pedrodelgado said:Right, got accounts up and running for me and the Mrs. Both of us filled out details of the donor account to be switched during the application but don't remember there being a date to choose for the switch. Have we missed something? Not had any confirmation of switch request either.1 -

I haven’t had a hard search. I have alerts set up and I’ve had a look and no hard search. Existing NatWest customer. I’ll post back if it comes through.Bridlington1 said:

In my experience opening any new current account with the NatWest group, even as an existing customer, will result in them doing a hard search.Johntea said:Sorry for the stupid questions!

So I have a Natwest current account already (Rewards 'upgraded' from Select account) which I opened in May 2019 so all good there

The app states I can simply open an additional 'new' Select account and I'll get the £200 with a switch, I have a HSBC account doing nothing as a good candidate

As an existing customer is there likely to be a credit check for doing this? And in the future can I then switch the 'new' Select account to another bank without affecting my main Rewards account

If you switch your new select account to another bank it won't affect any of you other NatWest accounts, including your reward account so you could carry on using your reward account as usual.0 -

Have others been approved straight away after applying? I was initially getting the "we can't complete your application online" message yesterday but managed to apply this morning. It let me select the switch date but at the end it said "There are a few things we need to check before we can go ahead with your application. We'll be in touch if we need anything from you. There's nothing else you need to do just now."

I was a Natwest current account holder for many years before I switched it out in Oct 23. I still have a credit card with them. Hopefully they let me open another account with them even though I closed the old one not so long ago.

0 -

Opening the account will likely be fine, it's whether you get the bonus that is tied to not having a bonus since 2020Tonski said:Have others been approved straight away after applying? I was initially getting the "we can't complete your application online" message yesterday but managed to apply this morning. It let me select the switch date but at the end it said "There are a few things we need to check before we can go ahead with your application. We'll be in touch if we need anything from you. There's nothing else you need to do just now."

I was a Natwest current account holder for many years before I switched it out in Oct 23. I still have a credit card with them. Hopefully they let me open another account with them even though I closed the old one not so long ago.

Sam Vimes' Boots Theory of Socioeconomic Unfairness:

People are rich because they spend less money. A poor man buys $10 boots that last a season or two before he's walking in wet shoes and has to buy another pair. A rich man buys $50 boots that are made better and give him 10 years of dry feet. The poor man has spent $100 over those 10 years and still has wet feet.

0 -

Ulster Select Account

I had read on this forum of others' successes in getting incentives when not strictly eligible (applying too soon after receiving previous ones, etc). A couple of months ago I decided it would be worth taking a punt by starting an Ulster Loyalty Saver as a new client, going through the HooYu ID verification procedure at that time, in the hope it would make life easier should I subsequently wish to open an Ulster current account.

Yesterday I applied for an Ulster Select Account, requesting a switch from Barclays in the process. Today I can see in the App that the Select Account has already been set up. There are also notifications that both the new debit card and PIN associated with the Select Account should be received within the next few days.

Nothing about the switch or incentive as yet.* I received a switching bonus from NatWest a year ago, so I am more hopeful than optimistic. We shall see.

*EDIT - Email received at 10:15 today confirming switch has been started. Text now received confirming switch date 23/02/2024, but still no mention of the incentive.0 -

Did Ulster Bank ask for proof id/verification like uploading proof or facial recognition etc? Usually I get accepted straight off when applying for accounts but some ask for extra security steps, can't be arsed if they do or is it just in certain circumstances. I don't have a passport or photo driving licence.HHUK said:Ulster Select Account

I had read on this forum of others' successes in getting incentives when not strictly eligible (applying too soon after receiving previous ones, etc). A couple of months ago I decided it would be worth taking a punt by starting an Ulster Loyalty Saver as a new client, going through the HooYu ID verification procedure at that time, in the hope it would make life easier should I subsequently wish to open an Ulster current account.

Yesterday I applied for an Ulster Select Account, requesting a switch from Barclays in the process. Today I can see in the App that the Select Account has already been set up. There are also notifications that both the new debit card and PIN associated with the Select Account should be received within the next few days.

Nothing about the switch or incentive as yet. I received a switching bonus from NatWest a year ago, so I am more hopeful than optimistic. We shall see.0 -

I completed the HooYu ID verification procedure when I opened the Ulster Loyalty Saver as a new client two months ago. I can't remember precisely what that entailed, but seem to recall uploading a video.Brewer21 said:Did Ulster Bank ask for proof id/verification like uploading proof or facial recognition etc? Usually I get accepted straight off when applying for accounts but some ask for extra security steps, can't be arsed if they do or is it just in certain circumstances. I don't have a passport or photo driving licence.

No further ID was required when opening the current account yesterday.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.8K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 245.9K Work, Benefits & Business

- 601.9K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards