We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

How much longer will this bear market go on for?

Comments

-

Based on what? TA?Type_45 said:coastline said:

Nothing special in what I'm doing just a simple reading of momentum indicators and a 10 day simple moving average on a chart. Playing the extremes for buying and selling and no TA courses attended . All picked up from watching and learning .Type_45 said:coastline said:Just to add to the above I've mentioned when rallies are the real deal they tend not to give much back from the initial move. This is something I've picked up over the years. So in this case the June low was around 3650 on the SP 500 . Could well be 4,000 for the next low . We can only see at the end of the day. It's mid term elections in the US and markets tend to drift lower anyway. ?

Something to note for holders of global funds and trackers. The chart below looks nice back to the highs.

Chart Tool | Trustnet

The weekly view of the Dollar Index is very extended. Not saying it will fall but you never know ?

Public ChartLists | StockCharts.com

One can read into tea leaves whatever one wants.

Here's the calls I posted live last year and the one I posted around the low in June. FTSE originally 7040 now 7500 . Points from the system over 1500 . 20% ? and buying lower . Dividends well if I buy a ETF tracker I also get the dividends along the way. Short term trading not day trading . I'd be clueless at that.

Economy crash =/= stock market crash? - Page 88 — MoneySavingExpert Forum

Economy crash =/= stock market crash? - Page 123 — MoneySavingExpert Forum

June wasn't the low. We are experiencing a bear market rally.0 -

1

-

You can't possibly know - however you can't deny there was a low in June which is what coastline was talking about.Type_45 said:coastline said:

Nothing special in what I'm doing just a simple reading of momentum indicators and a 10 day simple moving average on a chart. Playing the extremes for buying and selling and no TA courses attended . All picked up from watching and learning .Type_45 said:coastline said:Just to add to the above I've mentioned when rallies are the real deal they tend not to give much back from the initial move. This is something I've picked up over the years. So in this case the June low was around 3650 on the SP 500 . Could well be 4,000 for the next low . We can only see at the end of the day. It's mid term elections in the US and markets tend to drift lower anyway. ?

Something to note for holders of global funds and trackers. The chart below looks nice back to the highs.

Chart Tool | Trustnet

The weekly view of the Dollar Index is very extended. Not saying it will fall but you never know ?

Public ChartLists | StockCharts.com

One can read into tea leaves whatever one wants.

Here's the calls I posted live last year and the one I posted around the low in June. FTSE originally 7040 now 7500 . Points from the system over 1500 . 20% ? and buying lower . Dividends well if I buy a ETF tracker I also get the dividends along the way. Short term trading not day trading . I'd be clueless at that.

Economy crash =/= stock market crash? - Page 88 — MoneySavingExpert Forum

Economy crash =/= stock market crash? - Page 123 — MoneySavingExpert Forum

June wasn't the low. We are experiencing a bear market rally.

0 -

From the front page of the Financial Times today:Type_45 said:coastline said:

Nothing special in what I'm doing just a simple reading of momentum indicators and a 10 day simple moving average on a chart. Playing the extremes for buying and selling and no TA courses attended . All picked up from watching and learning .Type_45 said:coastline said:Just to add to the above I've mentioned when rallies are the real deal they tend not to give much back from the initial move. This is something I've picked up over the years. So in this case the June low was around 3650 on the SP 500 . Could well be 4,000 for the next low . We can only see at the end of the day. It's mid term elections in the US and markets tend to drift lower anyway. ?

Something to note for holders of global funds and trackers. The chart below looks nice back to the highs.

Chart Tool | Trustnet

The weekly view of the Dollar Index is very extended. Not saying it will fall but you never know ?

Public ChartLists | StockCharts.com

One can read into tea leaves whatever one wants.

Here's the calls I posted live last year and the one I posted around the low in June. FTSE originally 7040 now 7500 . Points from the system over 1500 . 20% ? and buying lower . Dividends well if I buy a ETF tracker I also get the dividends along the way. Short term trading not day trading . I'd be clueless at that.

Economy crash =/= stock market crash? - Page 88 — MoneySavingExpert Forum

Economy crash =/= stock market crash? - Page 123 — MoneySavingExpert Forum

June wasn't the low. We are experiencing a bear market rally.

" Investors are raising red flags over a stock market rally that has added more than $7tn in value to US equities since June, with many of the gains being driven by hedge funds unwinding bearish bets rather than newfound conviction that it is time to buy.

Traders at Goldman Sachs, Morgan Stanley and JPMorgan Chase have warned clients that the bounce in shares is not underpinned by confidence that the surge can last, according to interviews with traders and brokerage reports seen by the Financial Times.

Instead, the rally has been fuelled by hedge funds covering short bets structured to profit from the market decline this year, they said.

Morgan Stanley and JPMorgan have found that clients have been selling out of long term wagers, suggesting they have little faith that the rally can last. Some are already betting that the recovery will peter out, with Goldman's hedge funds clients reloading bearish bets.

'The rhetoric has shifted to be less bearish, but the flows we've seen have been all short coverings' said a banker at one of the largest prime brokers. If they really believed in the rally, the would be buying longs and we don't see that"

I'm guessing they agree with you?0 -

It looks that way. Glad the FT has caught up with my posts.Expotter said:

From the front page of the Financial Times today:Type_45 said:coastline said:

Nothing special in what I'm doing just a simple reading of momentum indicators and a 10 day simple moving average on a chart. Playing the extremes for buying and selling and no TA courses attended . All picked up from watching and learning .Type_45 said:coastline said:Just to add to the above I've mentioned when rallies are the real deal they tend not to give much back from the initial move. This is something I've picked up over the years. So in this case the June low was around 3650 on the SP 500 . Could well be 4,000 for the next low . We can only see at the end of the day. It's mid term elections in the US and markets tend to drift lower anyway. ?

Something to note for holders of global funds and trackers. The chart below looks nice back to the highs.

Chart Tool | Trustnet

The weekly view of the Dollar Index is very extended. Not saying it will fall but you never know ?

Public ChartLists | StockCharts.com

One can read into tea leaves whatever one wants.

Here's the calls I posted live last year and the one I posted around the low in June. FTSE originally 7040 now 7500 . Points from the system over 1500 . 20% ? and buying lower . Dividends well if I buy a ETF tracker I also get the dividends along the way. Short term trading not day trading . I'd be clueless at that.

Economy crash =/= stock market crash? - Page 88 — MoneySavingExpert Forum

Economy crash =/= stock market crash? - Page 123 — MoneySavingExpert Forum

June wasn't the low. We are experiencing a bear market rally.

" Investors are raising red flags over a stock market rally that has added more than $7tn in value to US equities since June, with many of the gains being driven by hedge funds unwinding bearish bets rather than newfound conviction that it it is time to buy.

Traders at Goldman Sachs, Morgan Stanley and JPMorgan Chase have warned clients that the bounce in shares is not underpinned by confidence that the surge can last, according to interviews with traders and brokerage reports seen by the Financial Times.

Instead, the rally has been fuelled be hedge funds covering short bets structured to profit from the market decline this year, they said.

Morgan Stanley and JPMorgan have found that clients have been selling out of long term wagers, suggesting they have little faith that the rally can last. Some are already betting that the recovery will peter out, with Goldman's hedge funds clients reloading bearish bets.

'The rhetoric has shifted to be less bearish, but the flows we've seen have been all short coverings' said a banker at one of the largest prime brokers. If they really believed in the rally, the would be buying longs and we don't see that"

I'm guessing they agree with you?0 -

masonic said:

Is there still going to be a melt-up before the 80% crash later this year, or has the failure of central banks to slash interest rates according to your expectations scuppered that?Type_45 said:coastline said:

Nothing special in what I'm doing just a simple reading of momentum indicators and a 10 day simple moving average on a chart. Playing the extremes for buying and selling and no TA courses attended . All picked up from watching and learning .Type_45 said:coastline said:Just to add to the above I've mentioned when rallies are the real deal they tend not to give much back from the initial move. This is something I've picked up over the years. So in this case the June low was around 3650 on the SP 500 . Could well be 4,000 for the next low . We can only see at the end of the day. It's mid term elections in the US and markets tend to drift lower anyway. ?

Something to note for holders of global funds and trackers. The chart below looks nice back to the highs.

Chart Tool | Trustnet

The weekly view of the Dollar Index is very extended. Not saying it will fall but you never know ?

Public ChartLists | StockCharts.com

One can read into tea leaves whatever one wants.

Here's the calls I posted live last year and the one I posted around the low in June. FTSE originally 7040 now 7500 . Points from the system over 1500 . 20% ? and buying lower . Dividends well if I buy a ETF tracker I also get the dividends along the way. Short term trading not day trading . I'd be clueless at that.

Economy crash =/= stock market crash? - Page 88 — MoneySavingExpert Forum

Economy crash =/= stock market crash? - Page 123 — MoneySavingExpert Forum

June wasn't the low. We are experiencing a bear market rally.

I think the US is accelerating into a deep recession, perhaps even a depression, over the next few quarters. And that the Fed won't have any choice but to loosen.

At the same time China's economy is teetering on the brink, and the US recession will suck China down with it.

There is so much dry tinder that it won't take much for the whole thing to collapse, which it will. We are one Black Swan or spark away.0 -

Type_45 said:coastline said:Just to add to the above I've mentioned when rallies are the real deal they tend not to give much back from the initial move. This is something I've picked up over the years. So in this case the June low was around 3650 on the SP 500 . Could well be 4,000 for the next low . We can only see at the end of the day. It's mid term elections in the US and markets tend to drift lower anyway. ?

Something to note for holders of global funds and trackers. The chart below looks nice back to the highs.

Chart Tool | Trustnet

The weekly view of the Dollar Index is very extended. Not saying it will fall but you never know ?

Public ChartLists | StockCharts.com

One can read into tea leaves whatever one wants.I remember someone is preaching a lot about the stock markets and trading making a bold statement like this Where he did not even understand a very basic thing such as "shorting" in the stock market. Also a few of that predictions have been proven to be wrong. Yet to be proven in this second half of the year the stock market to fall at 80% level. Sensible people could easily see the probability that event will ever happen.The statement above regarding TA is another solid evidence comparing reading tee leaves (or tarot?) with technical analysts (TA).TA is based on science, financial mathematics, statistics, probability and psychology in predicting the future outcomes. The modern TA now starts adding AI, optimising the use of snowflake diagram for visualisation.People develop the stochastic in the TA as an analytical tool to predict the future outcomes for instance do not base that tools from the thin air. Markov Chain used in the stochastic as the future price in the stock market price resembles the Markov Chain / process.Fear and Geed index is developed based on the statistics, probability and psychology models in the stock market.Fibonacci retracement in TA is developed based on the Fibonacci numbers, sequence, golden ratios which is already well known in maths since a few hundred years ago. Apart from in finance and in the stock market it has also been used in many other areas in science.Not to mention the very basic TA, identifying the support and resistance levels/zones, moving averages. If it is used correctly, any person with common sense could easily understand that your prediction is at least better than a person who base their prediction by simply tossing a coin, reading Tea Leaves (or Tarot)As mentioned previously there are other factors that could effect the stock market which is not reflected in TA (or when get picked up from price/volume action it is already too late) such as fundamental of the companies, market / sector rotations, geopolitical issues, economics, black swan event, etc. Those who use the TA sensibly, will identify their limitations.Another point here is that, it is not easy, need a lot of practise and to back-test it. It is very easy to misinterpret, to misuse / mishandle it, especially those who can not control their emotion. For People who do not use it sensibly, they will lose money instead of making money.0

Where he did not even understand a very basic thing such as "shorting" in the stock market. Also a few of that predictions have been proven to be wrong. Yet to be proven in this second half of the year the stock market to fall at 80% level. Sensible people could easily see the probability that event will ever happen.The statement above regarding TA is another solid evidence comparing reading tee leaves (or tarot?) with technical analysts (TA).TA is based on science, financial mathematics, statistics, probability and psychology in predicting the future outcomes. The modern TA now starts adding AI, optimising the use of snowflake diagram for visualisation.People develop the stochastic in the TA as an analytical tool to predict the future outcomes for instance do not base that tools from the thin air. Markov Chain used in the stochastic as the future price in the stock market price resembles the Markov Chain / process.Fear and Geed index is developed based on the statistics, probability and psychology models in the stock market.Fibonacci retracement in TA is developed based on the Fibonacci numbers, sequence, golden ratios which is already well known in maths since a few hundred years ago. Apart from in finance and in the stock market it has also been used in many other areas in science.Not to mention the very basic TA, identifying the support and resistance levels/zones, moving averages. If it is used correctly, any person with common sense could easily understand that your prediction is at least better than a person who base their prediction by simply tossing a coin, reading Tea Leaves (or Tarot)As mentioned previously there are other factors that could effect the stock market which is not reflected in TA (or when get picked up from price/volume action it is already too late) such as fundamental of the companies, market / sector rotations, geopolitical issues, economics, black swan event, etc. Those who use the TA sensibly, will identify their limitations.Another point here is that, it is not easy, need a lot of practise and to back-test it. It is very easy to misinterpret, to misuse / mishandle it, especially those who can not control their emotion. For People who do not use it sensibly, they will lose money instead of making money.0 -

I had no idea TA was a cult in the same way BTC/crypto is.

Interesting that we rarely hear owners of property, land, gold and silver defend their chosen asset classes in this way. (The latter do, but there is an attempt at a squeeze in progress which requires publicity.)0 -

TA does tend to breed cult-like behaviours. Like a good horoscope, you can cherry pick elements that appear to have been predictive. Then you have a small number of people who are lucky enough to make it appear to work. Like many cults, including those based on conspiracy theories, there is a gain of truth at the core, but this gets distorted by layers of nonsense, whether it's Illuminati or Fibonacci.Type_45 said:I had no idea TA was a cult in the same way BTC/crypto is.Type_45 said:Interesting that we rarely hear owners of property, land, gold and silver defend their chosen asset classes in this way. (The latter do, but there is an attempt at a squeeze in progress which requires publicity.)In my experience, there are evangelists of all of those assets, who hold very one-sided views of their virtues.1

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards

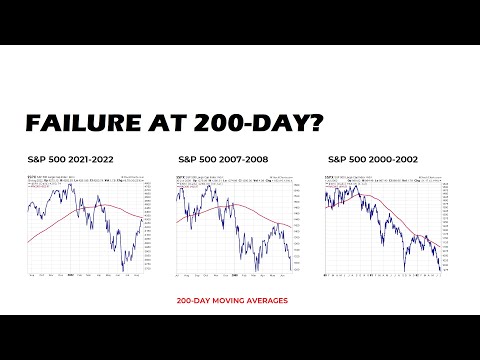

https://www.youtube.com/watch?v=IMr1XYFP-8k

https://www.youtube.com/watch?v=IMr1XYFP-8k