We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

How much longer will this bear market go on for?

Comments

-

SonOfPearl said:Whilst not wishing to single out any individuals in particular, I can't help but feel that this thread is an excellent example of the truth of the quote: “The fundamental cause of the trouble in the modern world today is that the stupid are cocksure while the intelligent are full of doubt.”—Bertrand Russell.

I like one from the 'Many Happy Returns' podcast recently: Pessimists make themselves sound smart. Optimists make money.

Which was basically saying that if you shout about a terrible crash all the time then once in a blue moon you'll be right and can crow about it (ignoring all the other times you were wrong). Meanwhile people who quietly invest will have actually made money, even if there's a crash.

3 -

Linton said:

When? A deadline would be helpful so we can check your predictions.Type_45 said:The scramble for the exit is going to be epic.

As I've already pointed out, you guys (retail investors) are delaying it.

The Fed has said in no uncertain terms that it will keep raising rates until it has inflation under control.

(Or, it will keep raising rates until something breaks.)

But the stock market has assumed, and priced in, that the Fed will pivot. And so people are buying back in and inflating asset prices in anticipation of the loosening of policy.

So with asset prices going up, inflation at ~9%, jobs (allegedly) full, then why would the Fed do anything other than keep raising rates?

They will keep raising rates until the market gets the message through its head that the Fed is serious and will not pivot.

So this process will keep going on for as long as it takes the market to wake up to reality. And in the meantime the market is making its own fall all the more spectacular the more it inflates.0 -

Those who are interested in Technical Analysts. The S&P500 is currently meeting the strong resistance level/zone after leg up this week. This resistance level/zone will need to be broken first before another leg up. If they just swing in that zone, that suggest the resistance level/zone is not broken. Last week moment was quite accurately represented in the Fear and Greed index + The VIX, from the diagram in the previous post.The Chartmaster's key levels to watch for the market CNBC Television Aug 6, 2022. There is another more accurate indicator used by some traders in CNBC fastmoney e.g S&P short range oscillator, but this one is not available for free.Just be aware of, the technical analysis is not 100% accurate. So we use this analysis with our own risk.0

-

Empty vessels make the most noiserenegade1 said:

He's purposely being ambiguous so he won't get called out on it. Posts like these are just designed to invoke responses and stir up panic. It's textbook trolling.

1 -

Type_45 said:Linton said:

When? A deadline would be helpful so we can check your predictions.Type_45 said:The scramble for the exit is going to be epic.

As I've already pointed out, you guys (retail investors) are delaying it.

The Fed has said in no uncertain terms that it will keep raising rates until it has inflation under control.

(Or, it will keep raising rates until something breaks.)

But the stock market has assumed, and priced in, that the Fed will pivot. And so people are buying back in and inflating asset prices in anticipation of the loosening of policy.

So with asset prices going up, inflation at ~9%, jobs (allegedly) full, then why would the Fed do anything other than keep raising rates?

They will keep raising rates until the market gets the message through its head that the Fed is serious and will not pivot.

So this process will keep going on for as long as it takes the market to wake up to reality. And in the meantime the market is making its own fall all the more spectacular the more it inflates.The "Fed" are not stupid........they might make mistakes, who doesn't in hindsight, but they aren't going to blindly keep raising interest rates, if it becomes clear that doing so is having little effect in forcing US inflation down.However, at some point they will stop raising rates and start reducing them...... just like they always have.1 -

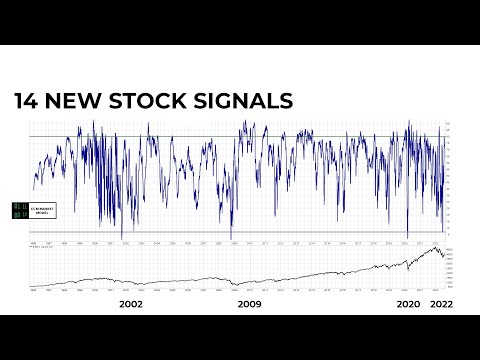

I posted this earlier but I suggest the doomers here watch this video to put the probability of an 80% crash into context. This guy is completely unbiased as you will see from his earlier videos from around the June lows.

https://www.youtube.com/watch?v=RDudZZiPPIQ

https://www.youtube.com/watch?v=RDudZZiPPIQ

0 -

"And I would have succeeded, if it hadn't been for these meddling kids."Type_45 said:

5 -

It’s a pity you couldn’t predict a 30% decline on your GJGB holding before you purchased 19/04. Still holding or did you take the loss?Type_45 said:I am clearly more ahead of the curve than anyone on this forum. My predictions come true like clockwork. I thought maybe your crypto predictions would be better, but seems not. The decline in GJGB you said was second only to the decline your crypto had suffered. Worse than 30% by June, now look at it. Ouch!

I thought maybe your crypto predictions would be better, but seems not. The decline in GJGB you said was second only to the decline your crypto had suffered. Worse than 30% by June, now look at it. Ouch! Your portfolio in June was 1/3rd cash, the rest in SGLN, SSLN, GJGB and crypto. Zero equities.With the markers set at what you described then as a murder scene, I wonder how would you describe it now?

Your portfolio in June was 1/3rd cash, the rest in SGLN, SSLN, GJGB and crypto. Zero equities.With the markers set at what you described then as a murder scene, I wonder how would you describe it now?

Can we have an update for August?6

Can we have an update for August?6 -

Type_45 said:Prism said:

The returns on the FTSE 100 have easily exceeded inflation between 1999 and 2022. The index itself is not relevant. In performance terms it kept up with MCSI World until 2015 when the Brexit vote was announced.Millyonare said:

Sounds like some folks may not be up-to-date with the very latest, modern terms.Prism said:

You don't seem to understand the FTSE 100 at allMillyonare said:Apodemus said:

While this is true for the World as a whole, there will be many UK self-investors who are (perhaps naively) over-exposed to the UK market which has been pretty flat for five or so years, with the exception of the Covid dip period. Where the UK market will go is anyone's guess, but while these investors have probably not made the same gains in the past five years, they've not experienced the same drops in the last five months. Such investors need to be wary of viewing this as evidence of a less volatile portfolio, or a lower risk one.It is now the bear market and stock market has been trending down slowly since November 2021.

The FTSE100 has been in a bear market for almost quarter of a century. It has moved nowhere for the past 23 years. Some call it a Jurassic dinosaur market. It has gone beyond the bear.

In real terms, the FTSE100 has plunged a huge -30% between 1999 and 2022. It has moved nowhere, in nominal terms, for a quarter of a century. One of the worst-performing major stockmarkets in history. That is not a bear. It is a dinosaur. Some now call it the Jurassic market.

Keeping up with inflation over a 20 year period isn't much of a boast. That's the minimum expectation of investing.

FTSE100 peaked at 6930 in 1999...

FTSE100 today sits at 7440 in 2022...

The index has barely moved +7% in 23 years...

That is pretty much 0% average growth per year for a quarter of a century...

Zero index growth this century makes it one of the worst-performing major stockmarkets in history...

The FTSE100 is a Jurassic dinosaur market. It has gone "beyond the bear"...

The Financial Times covered the topic extensively, a few months ago.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards