We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

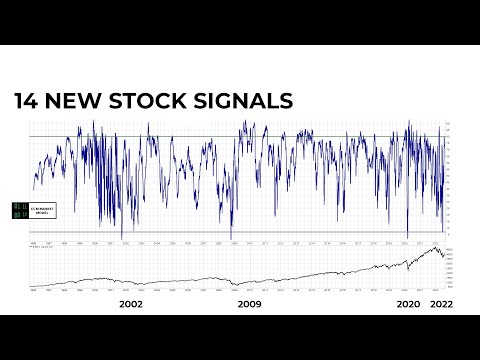

How much longer will this bear market go on for?

Comments

-

Hardly a boast. Its not like I am trying to take credit for it. Besides, does that chart look like keeping up with?Type_45 said:Prism said:

The returns on the FTSE 100 have easily exceeded inflation between 1999 and 2022. The index itself is not relevant. In performance terms it kept up with MCSI World until 2015 when the Brexit vote was announced.Millyonare said:

Sounds like some folks may not be up-to-date with the very latest, modern terms.Prism said:

You don't seem to understand the FTSE 100 at allMillyonare said:Apodemus said:

While this is true for the World as a whole, there will be many UK self-investors who are (perhaps naively) over-exposed to the UK market which has been pretty flat for five or so years, with the exception of the Covid dip period. Where the UK market will go is anyone's guess, but while these investors have probably not made the same gains in the past five years, they've not experienced the same drops in the last five months. Such investors need to be wary of viewing this as evidence of a less volatile portfolio, or a lower risk one.It is now the bear market and stock market has been trending down slowly since November 2021.

The FTSE100 has been in a bear market for almost quarter of a century. It has moved nowhere for the past 23 years. Some call it a Jurassic dinosaur market. It has gone beyond the bear.

In real terms, the FTSE100 has plunged a huge -30% between 1999 and 2022. It has moved nowhere, in nominal terms, for a quarter of a century. One of the worst-performing major stockmarkets in history. That is not a bear. It is a dinosaur. Some now call it the Jurassic market.

Keeping up with inflation over a 20 year period isn't much of a boast. That's the minimum expectation of investing.5 -

Haven't we been through all this before? You cannot ignore dividends. To do so is the rookiest of all rookie mistakes.Millyonare said:

Sounds like some folks may not be up-to-date with the very latest, modern terms.Prism said:

You don't seem to understand the FTSE 100 at allMillyonare said:Apodemus said:

While this is true for the World as a whole, there will be many UK self-investors who are (perhaps naively) over-exposed to the UK market which has been pretty flat for five or so years, with the exception of the Covid dip period. Where the UK market will go is anyone's guess, but while these investors have probably not made the same gains in the past five years, they've not experienced the same drops in the last five months. Such investors need to be wary of viewing this as evidence of a less volatile portfolio, or a lower risk one.It is now the bear market and stock market has been trending down slowly since November 2021.

The FTSE100 has been in a bear market for almost quarter of a century. It has moved nowhere for the past 23 years. Some call it a Jurassic dinosaur market. It has gone beyond the bear.

In real terms, the FTSE100 has plunged a huge -30% between 1999 and 2022. It has moved nowhere, in nominal terms, for a quarter of a century. One of the worst-performing major stockmarkets in history. That is not a bear. It is a dinosaur. Some now call it the Jurassic market.8 -

Type_45 said:

Keeping up with inflation over a 20 year period isn't much of a boast. That's the minimum expectation of investing.Prism said:

The returns on the FTSE 100 have easily exceeded inflation between 1999 and 2022. The index itself is not relevant. In performance terms it kept up with MCSI World until 2015 when the Brexit vote was announced.Millyonare said:

Sounds like some folks may not be up-to-date with the very latest, modern terms.Prism said:

You don't seem to understand the FTSE 100 at allMillyonare said:Apodemus said:

While this is true for the World as a whole, there will be many UK self-investors who are (perhaps naively) over-exposed to the UK market which has been pretty flat for five or so years, with the exception of the Covid dip period. Where the UK market will go is anyone's guess, but while these investors have probably not made the same gains in the past five years, they've not experienced the same drops in the last five months. Such investors need to be wary of viewing this as evidence of a less volatile portfolio, or a lower risk one.It is now the bear market and stock market has been trending down slowly since November 2021.

The FTSE100 has been in a bear market for almost quarter of a century. It has moved nowhere for the past 23 years. Some call it a Jurassic dinosaur market. It has gone beyond the bear.

In real terms, the FTSE100 has plunged a huge -30% between 1999 and 2022. It has moved nowhere, in nominal terms, for a quarter of a century. One of the worst-performing major stockmarkets in history. That is not a bear. It is a dinosaur. Some now call it the Jurassic market. It's delivered about twice inflation over that period overall, but inflation has been pretty low for most of it. It's a sad fact that back in the early 2000s the FTSE100 was pushed as an "international index" with 70% of earnings coming from overseas, and many UK investors saw themselves as being globally diversified by holding it. Some still have a large UK bias in their portfolios.It's become common to substitute the FTSE250 for FTSE100 to get better exposure to the domestic fortunes of the UK and higher returns, but I don't think UK investors will be rewarded much in the short term.

It's delivered about twice inflation over that period overall, but inflation has been pretty low for most of it. It's a sad fact that back in the early 2000s the FTSE100 was pushed as an "international index" with 70% of earnings coming from overseas, and many UK investors saw themselves as being globally diversified by holding it. Some still have a large UK bias in their portfolios.It's become common to substitute the FTSE250 for FTSE100 to get better exposure to the domestic fortunes of the UK and higher returns, but I don't think UK investors will be rewarded much in the short term.

1 -

The scramble for the exit is going to be epic.0

-

The original prediction was during 2022. I am sure there will be no attempts to move the goalposts at this point.

2 -

-

Whilst not wishing to single out any individuals in particular, I can't help but feel that this thread is an excellent example of the truth of the quote: “The fundamental cause of the trouble in the modern world today is that the stupid are cocksure while the intelligent are full of doubt.”—Bertrand Russell.

6 -

He's purposely being ambiguous so he won't get called out on it. Posts like these are just designed to invoke responses and stir up panic. It's textbook trolling.

4

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards

https://www.youtube.com/watch?v=RDudZZiPPIQ

https://www.youtube.com/watch?v=RDudZZiPPIQ