We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a very Happy New Year. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

How much longer will this bear market go on for?

Comments

-

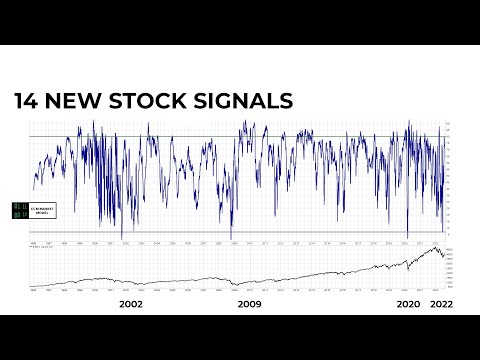

Swipe said:I posted this earlier but I suggest the doomers here watch this video to put the probability of an 80% crash into context. This guy is completely unbiased as you will see from his earlier videos from around the June lows.

https://www.youtube.com/watch?v=RDudZZiPPIQ

https://www.youtube.com/watch?v=RDudZZiPPIQ

TA is only part of a much bigger picture.

I didn't watch all of it. What does this guy (whoever he is) say about sovereign debt, geo-politics, the death of the current currencies, the Chinese economy on the verge of collapse, the US being $30tn in debt, the new financial system when this one is gone?

These guys are lightweights. They have no clue how it all fits together.0 -

Says the person who didn't even know what shorting was until a few months agoType_45 said:Swipe said:I posted this earlier but I suggest the doomers here watch this video to put the probability of an 80% crash into context. This guy is completely unbiased as you will see from his earlier videos from around the June lows. https://www.youtube.com/watch?v=RDudZZiPPIQ

https://www.youtube.com/watch?v=RDudZZiPPIQ

These guys are lightweights. They have no clue how it all fits together.5 -

Millyonare said:Type_45 said:Prism said:

The returns on the FTSE 100 have easily exceeded inflation between 1999 and 2022. The index itself is not relevant. In performance terms it kept up with MCSI World until 2015 when the Brexit vote was announced.Millyonare said:

Sounds like some folks may not be up-to-date with the very latest, modern terms.Prism said:

You don't seem to understand the FTSE 100 at allMillyonare said:Apodemus said:

While this is true for the World as a whole, there will be many UK self-investors who are (perhaps naively) over-exposed to the UK market which has been pretty flat for five or so years, with the exception of the Covid dip period. Where the UK market will go is anyone's guess, but while these investors have probably not made the same gains in the past five years, they've not experienced the same drops in the last five months. Such investors need to be wary of viewing this as evidence of a less volatile portfolio, or a lower risk one.It is now the bear market and stock market has been trending down slowly since November 2021.

The FTSE100 has been in a bear market for almost quarter of a century. It has moved nowhere for the past 23 years. Some call it a Jurassic dinosaur market. It has gone beyond the bear.

In real terms, the FTSE100 has plunged a huge -30% between 1999 and 2022. It has moved nowhere, in nominal terms, for a quarter of a century. One of the worst-performing major stockmarkets in history. That is not a bear. It is a dinosaur. Some now call it the Jurassic market.

Keeping up with inflation over a 20 year period isn't much of a boast. That's the minimum expectation of investing.

FTSE100 peaked at 6930 in 1999...

FTSE100 today sits at 7440 in 2022...

The index has barely moved +7% in 23 years...

That is pretty much 0% average growth per year for a quarter of a century...

Zero index growth this century makes it one of the worst-performing major stockmarkets in history...

The FTSE100 is a Jurassic dinosaur market. It has gone "beyond the bear"...

The Financial Times covered the topic extensively, a few months ago.Words fail me. If the index has moved +7% in 23 years, but the total return is +175%, what does that tell you about using the index value as a measure of returns?It is unbelievably foolish of a journalist at the Financial Times to print something so false and misleading. They should lose their job. Hopefully you don't feel too bad about being misled by it.13 -

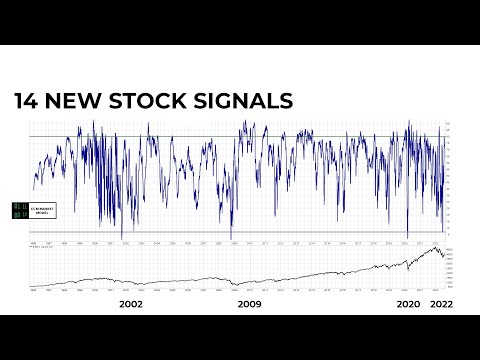

Type_45 said:Swipe said:I posted this earlier but I suggest the doomers here watch this video to put the probability of an 80% crash into context. This guy is completely unbiased as you will see from his earlier videos from around the June lows.

https://www.youtube.com/watch?v=RDudZZiPPIQ

https://www.youtube.com/watch?v=RDudZZiPPIQ

TA is only part of a much bigger picture.

I didn't watch all of it. What does this guy (whoever he is) say about sovereign debt, geo-politics, the death of the current currencies, the Chinese economy on the verge of collapse, the US being $30tn in debt, the new financial system when this one is gone?

These guys are lightweights. They have no clue how it all fits together.Well do not under estimate lightweight. It could end up like this real life examples, Heavy weight not always win

0 -

Why do you continue to ignore dividends?Millyonare said:Type_45 said:Prism said:

The returns on the FTSE 100 have easily exceeded inflation between 1999 and 2022. The index itself is not relevant. In performance terms it kept up with MCSI World until 2015 when the Brexit vote was announced.Millyonare said:

Sounds like some folks may not be up-to-date with the very latest, modern terms.Prism said:

You don't seem to understand the FTSE 100 at allMillyonare said:Apodemus said:

While this is true for the World as a whole, there will be many UK self-investors who are (perhaps naively) over-exposed to the UK market which has been pretty flat for five or so years, with the exception of the Covid dip period. Where the UK market will go is anyone's guess, but while these investors have probably not made the same gains in the past five years, they've not experienced the same drops in the last five months. Such investors need to be wary of viewing this as evidence of a less volatile portfolio, or a lower risk one.It is now the bear market and stock market has been trending down slowly since November 2021.

The FTSE100 has been in a bear market for almost quarter of a century. It has moved nowhere for the past 23 years. Some call it a Jurassic dinosaur market. It has gone beyond the bear.

In real terms, the FTSE100 has plunged a huge -30% between 1999 and 2022. It has moved nowhere, in nominal terms, for a quarter of a century. One of the worst-performing major stockmarkets in history. That is not a bear. It is a dinosaur. Some now call it the Jurassic market.

Keeping up with inflation over a 20 year period isn't much of a boast. That's the minimum expectation of investing.

FTSE100 peaked at 6930 in 1999...

FTSE100 today sits at 7440 in 2022...

The index has barely moved +7% in 23 years...

That is pretty much 0% average growth per year for a quarter of a century...

Zero index growth this century makes it one of the worst-performing major stockmarkets in history...

The FTSE100 is a Jurassic dinosaur market. It has gone "beyond the bear"...

The Financial Times covered the topic extensively, a few months ago.1 -

Millyonare said:Type_45 said:Prism said:

The returns on the FTSE 100 have easily exceeded inflation between 1999 and 2022. The index itself is not relevant. In performance terms it kept up with MCSI World until 2015 when the Brexit vote was announced.Millyonare said:

Sounds like some folks may not be up-to-date with the very latest, modern terms.Prism said:

You don't seem to understand the FTSE 100 at allMillyonare said:Apodemus said:

While this is true for the World as a whole, there will be many UK self-investors who are (perhaps naively) over-exposed to the UK market which has been pretty flat for five or so years, with the exception of the Covid dip period. Where the UK market will go is anyone's guess, but while these investors have probably not made the same gains in the past five years, they've not experienced the same drops in the last five months. Such investors need to be wary of viewing this as evidence of a less volatile portfolio, or a lower risk one.It is now the bear market and stock market has been trending down slowly since November 2021.

The FTSE100 has been in a bear market for almost quarter of a century. It has moved nowhere for the past 23 years. Some call it a Jurassic dinosaur market. It has gone beyond the bear.

In real terms, the FTSE100 has plunged a huge -30% between 1999 and 2022. It has moved nowhere, in nominal terms, for a quarter of a century. One of the worst-performing major stockmarkets in history. That is not a bear. It is a dinosaur. Some now call it the Jurassic market.

Keeping up with inflation over a 20 year period isn't much of a boast. That's the minimum expectation of investing.

FTSE100 peaked at 6930 in 1999...

FTSE100 today sits at 7440 in 2022...

The index has barely moved +7% in 23 years...

That is pretty much 0% average growth per year for a quarter of a century...

Zero index growth this century makes it one of the worst-performing major stockmarkets in history...

The FTSE100 is a Jurassic dinosaur market. It has gone "beyond the bear"...

The Financial Times covered the topic extensively, a few months ago.

Do you know what a dividend is?

Do you know what an index actually is?

Do you know what total return is?

3 -

Market rising in anticipation of a pivot?

Its not gonna happen right now...0 -

We'll never know since no-one has to give their reasoning behind buying or selling shares.

2

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards

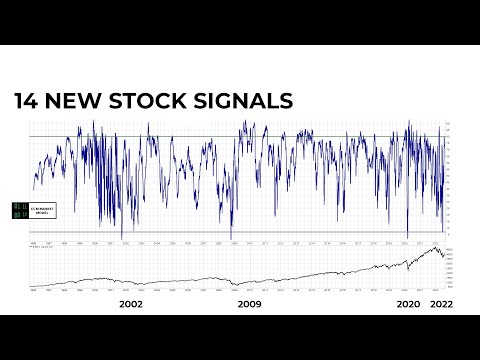

https://www.youtube.com/watch?v=KUSwTLGweOM

https://www.youtube.com/watch?v=KUSwTLGweOM https://www.youtube.com/watch?v=l_ktbMh6ixc&t=202s

https://www.youtube.com/watch?v=l_ktbMh6ixc&t=202s