We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Chase UK discussion

Comments

-

I never noticed that before, but looking at the Amazon page it does seem like that doesn't it.cymruchris said:TwiceNightly said:Chase are sending out emails to let people know that they're about to start reporting to credit reference agencies. For me this is a good thing as I didn't like that this account was 'invisible'.

Also the talk of negative balances seems like another step towards a credit card. Here's the email:We're sharing details of your Chase current account with credit agencies, and we're pleased to tell you that in the coming months, you'll begin to see Chase on your credit profile.

We'll start with TransUnion, and report monthly. Just so you know, all major banks do this already.

By doing this, lenders get a more accurate picture of your finances, so they can make the right decisions for you.

What we'll share – and what we won't

We'll share some of your personal info – such as your name, when you opened your account, and details of any negative balances – but we won't share what you buy or your login details with the credit agencies.

Don't worry, there's nothing you need to do – we're just keeping you in the loop.

I'll put a £1 on the fact that Chase will move into credit cards with the launch of a new co-branded Amazon product. The original credit card with Newday recently ended, and Amazon has since had a placeholder saying that a new card is coming soon in Chase blue colours. Amazon is also promoting the Chase account - and Chase also provides the Amazon US credit cards.

I wonder how the rewards would work? Seems like on the US card they're a cashback card that earns more cashback on spend at Amazon?0 -

Will the change mean that my Chase account will show in my Moneydashboard?0

-

No, but incidentally they are due to start supporting proper open banking as soon as next month, so keep finger crossed.Cressida100 said:Will the change mean that my Chase account will show in my Moneydashboard?0 -

My 1% cashback just got extended to April 2023. Looks like they couldn’t roll out whatever they have planned in time as replacement by end of February.0

My 1% cashback just got extended to April 2023. Looks like they couldn’t roll out whatever they have planned in time as replacement by end of February.0 -

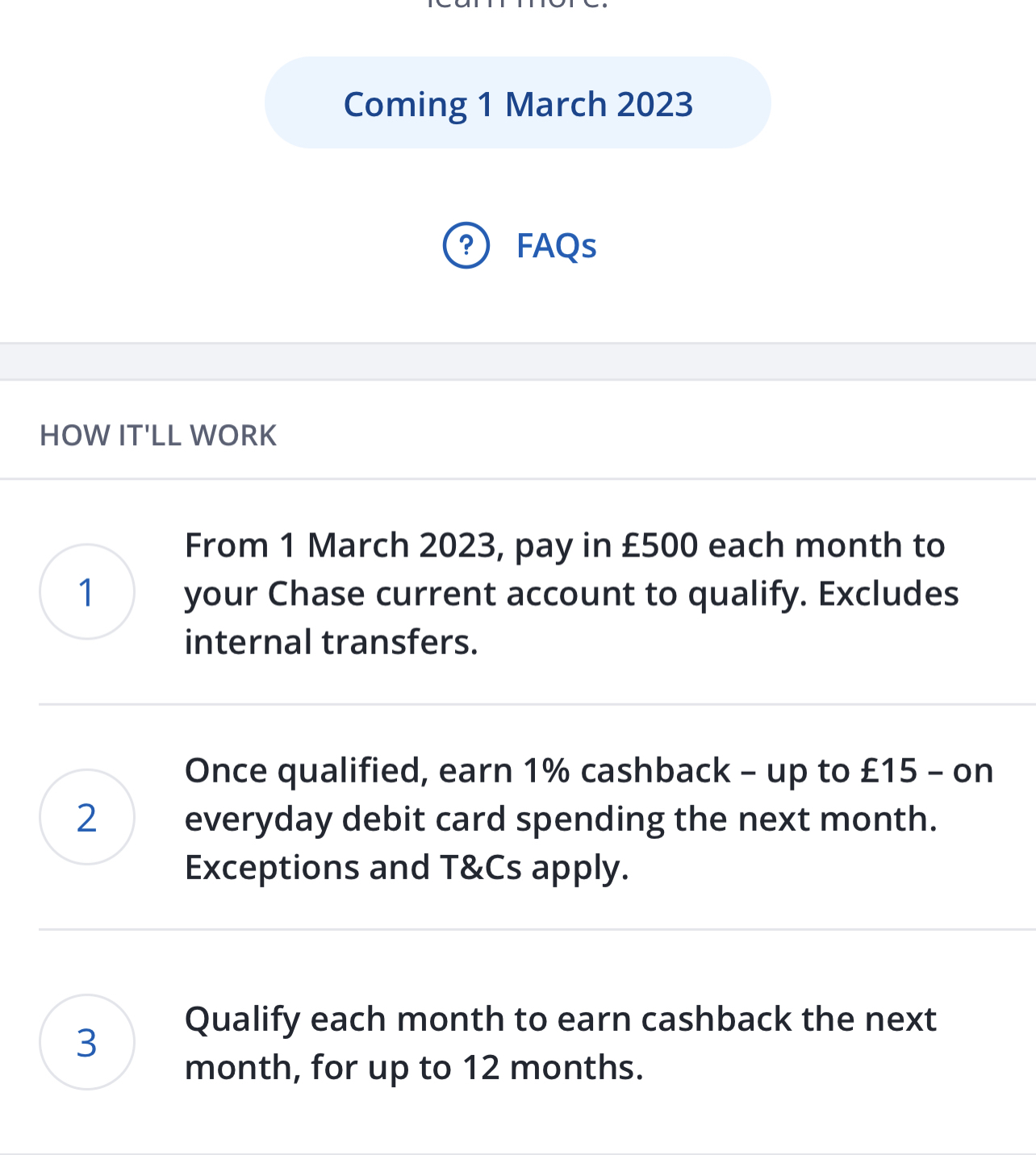

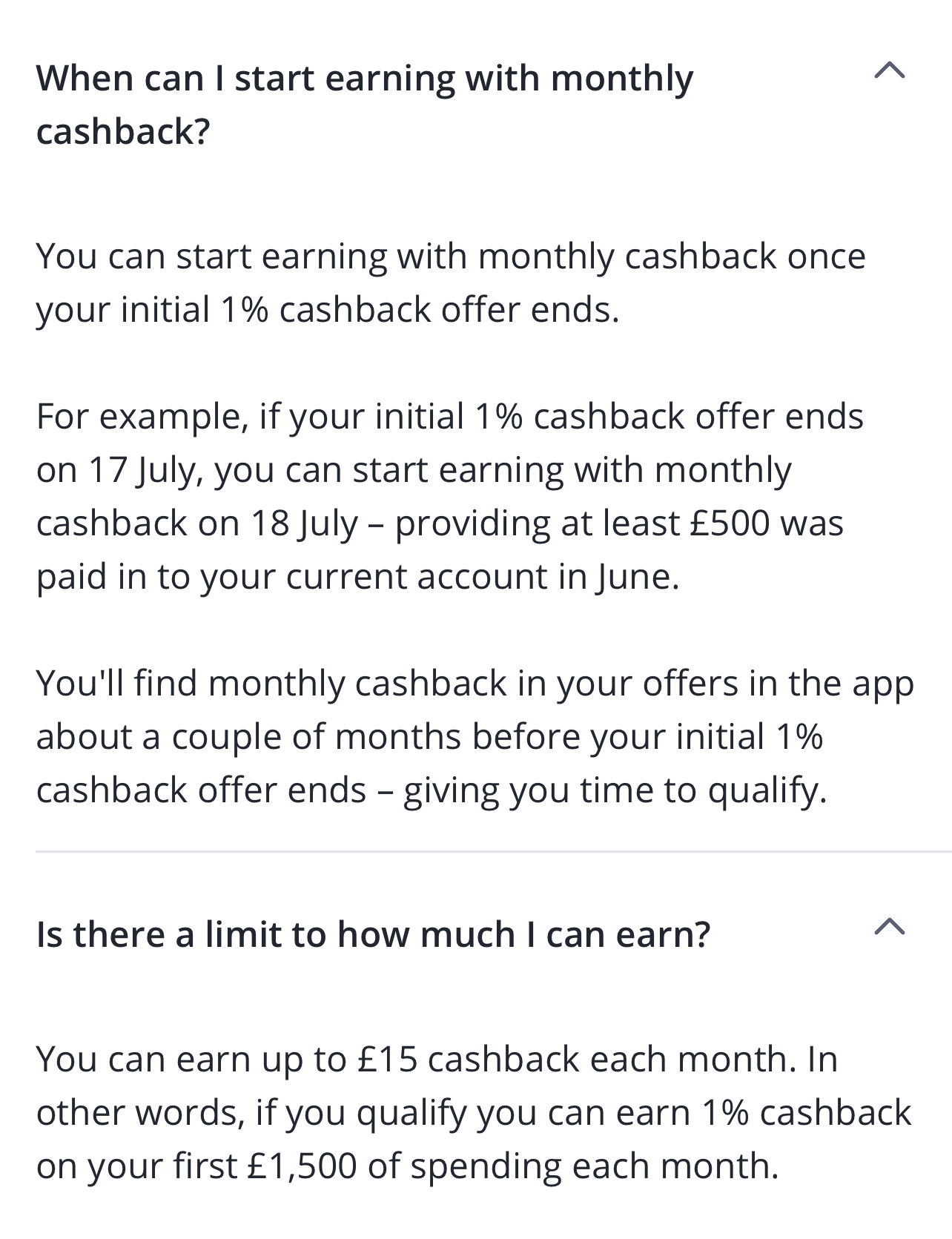

Apparently it depends; my cashback was ending on 28/02 but today there's a new offer in the app stating that from 01/03/23 I need to deposit £500pm to my current account to qualify for 1% cashback capped at £15pm.tannedpotato said: My 1% cashback just got extended to April 2023. Looks like they couldn’t roll out whatever they have planned in time as replacement by end of February.0

My 1% cashback just got extended to April 2023. Looks like they couldn’t roll out whatever they have planned in time as replacement by end of February.0 -

I have the same offer, and it looks this is now the new kind of cashback offer for everybody once their current offer expires.

1

1 -

Well, I'm pretty pleased with this new offer at first glance. Unless you're a big spender, basically the same as long as you stick £500 a month in there. Unless I've missed anything?

1 -

Presumably the £500 doesn't need to stay in the current account? Could you for example move some of it to the savings account?0

-

Looks good - just pay in £500 and get same 1% back. Usual exclusions apply I expect and as it is capped at £15 then no point in using it for big spends ie over £1500 a month.

* what you may have missed ** the example above shows you need to pay in the £500 the month before eg in June to get cashback in July. So pay in £500 in FEB to get the cashback in March.

0 -

Nope. Mine currently go direct to my Chase Savings account, so with a little adjustment, job doneNameWithheld said:Presumably the £500 doesn't need to stay in the current account? Could you for example move some of it to the savings account?

1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.2K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards