We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

BITCOIN

Comments

-

I mean, a few weeks back, tab 218, I was fully ready for a 22k price. I was thinking this level just based on reversion to the 200 week moving average which has happened multiple times before.Reaper said:This thread suddenly went quiet. I wonder if it is related to the current market capitulation, demonstrating once again its volatility and its unsuitability as a currency.

I believe we have been down to the 300 week, which has also happened before. So while I am down a good chunk none of this is particularly surprising.

The speed we reached this does surprise me a bit though, I was expecting it a couple of months from now with a relief rally in the middle. And if this still comes through then we have a good chunk lower to go.

This run on celsius, the liquidity issues with binance, the STETH issues, the LUNA saga, wars, covid, inflation, rate rises.. what a year, maybe just better to take the advice of some pundits and head to the Winchester and wait for this all to blow over1 -

Bitcoin is not intended to be a currency (he says for the fourteenth time)Reaper said:This thread suddenly went quiet. I wonder if it is related to the current market capitulation, demonstrating once again its volatility and its unsuitability as a currency.

Honestly, nothing has changed regarding the long term thesis despite recent price action. Bitcoin is crashing? Err.. its still up more than any index from its pre-covid level.

The Fed are hiking because of inflation (inflation that, remember, Bitcoiners said would happen and central bankers and their army of PhD economists assured us was impossible back in 2020). This is a correlation 1 event where everything is going down; that's normal in a liquidity crisis. Its also normal that people that bought Bitcoin without understanding it are vomiting their positions before other 'safer' holdings. If you doubt this, you need only look at this guy with 2.3k posts on an investment forum who has done a complete 180 on an investment in little more than 3 days;jasonwatkins said:Recent events have shown me why I should never, ever, go anywhere near Bitcoin.

I bought on the 10th of June through Revolut when it was at £23.7k. Then the crash happened. When it hit £20k I was pretty heavily down so thought I might as well punt and bail out to re-buy at £20k. I figured that if it recovered back to the £27-£28k mark it was last week I'd at least claw back some, or most, of my losses.

It just continued to fall so I eventually decided to cut my losses at £17k and bail out for good. And then it started to climb again and it's currently back to about £18.8k and, knowing my luck, will probably continue to recover throughout the day.

I'm pretty heavily down but at least it's money I could afford to lose, even though I hate losing money.

(And yes, I'm fully aware that I handled all of this very poorly .. )

)

Over time, those people that buy spot BTC with reasonable allocations will come to dominate BTC holdings. Meanwhile, in the RE and Equity markets participants clamour for central bankers to bail them out 'for the good of the system.' One system trends to extreme stability and strength over time, one system trends to short term thinking and weak participants.

There are two options right now;

(1) Hike rates to kill inflation. Seriously, just hike by like 8% tomorrow - we are told this has worked in the past and will work now. So, why isn't this being done? Because, of course, you'll also kill the indices, make every pensioner a pauper, destroy the pension funds of anyone retiring in the next decade and cause a majority of businesses to go bankrupt. People too when you nuke their home values putting them all in negative equity whilst managing increasing mortgage costs and probably losing their jobs from those bankrupt employers. Not to mention that at this level it probably makes many sovereign states default; if ECB raises rates to tame inflation in Germany then Italy & Greece are screwed. However, I've said before that the biggest threat to Bitcoin is responsible central bank monetary policy - If you choose this option, Bitcoin goes to zero.

(2) We continue the charade until something breaks, and central banks reverse course knowing that inflation is preferable to the violent societal collapse the previous option presents. This happens somewhere between 2.5% and 5% interest rates (laughable that its so low really). Debt/GDP, Corporate Debt, Household Debt all at ridiculous highs - Western economies just can't sustain rising interest rates. When the central bank reverses, more money gets printed than last time, more and more people come to realise that there is no endgame, that moral hazard persists, they aren't the beneficiaries of this printing and that you don't want to be left holding dollars or pounds at the end of the ponzi. They, or us, if we are more mature about it, instead decide to opt out in to a more robust monetary system. This leads to Bitcoin succeeding.

I am perfectly fine with either option. If you want to raise rates by 8% tomorrow, I'm in. My Bitcoin goes to zero, but the working and middle classes have reasonable home and equity valuations again and can actually build wealth like their predecessor generations did. As a mid-30s educated graduate, I will easily do well in that system. Until then, I'll call the Fed/ECB/BoE's bluff and continue to buy Bitcoin - because that's just unlikely to happen. Also looking forward to rising interest rates tanking home valuations over the next year a little and loading up on debt seems like a good play for the next decade.

Buy Bitcoin. Be liquid. Take on serviceable fiat debt after interest rates nuke again. Wait 10 years. Easy game.

2 -

I hadn't looked at the price since last Thursday and wow! I remember pages and pages back some talk of whether the price would hit £100K or £20K first, I think the price was around £25-30K. It took a while but the £20K bet has one <EDIT (won! do'h!!!)> that one!

<My hands type faster than my brain works, and I'm a slow typist > 1

> 1 -

why was my response to malthusian and their original comment deleted?0

-

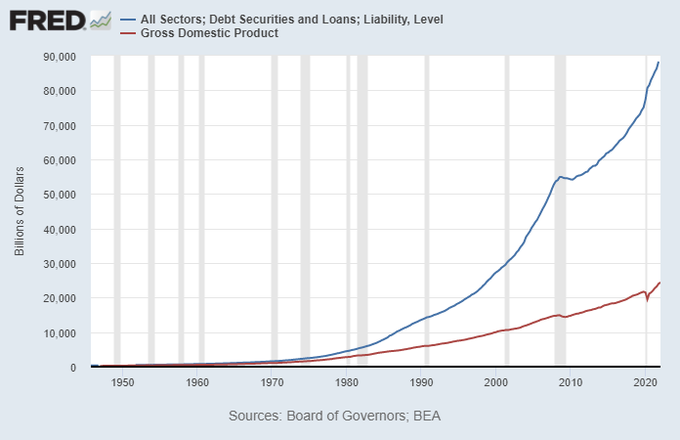

You just have to look at this extremely clear image from the US - parabolic debt vs a GDP that cannot ever pay it back.darren232002 said:

Bitcoin is not intended to be a currency (he says for the fourteenth time)Reaper said:This thread suddenly went quiet. I wonder if it is related to the current market capitulation, demonstrating once again its volatility and its unsuitability as a currency.

Honestly, nothing has changed regarding the long term thesis despite recent price action. Bitcoin is crashing? Err.. its still up more than any index from its pre-covid level.

The Fed are hiking because of inflation (inflation that, remember, Bitcoiners said would happen and central bankers and their army of PhD economists assured us was impossible back in 2020). This is a correlation 1 event where everything is going down; that's normal in a liquidity crisis. Its also normal that people that bought Bitcoin without understanding it are vomiting their positions before other 'safer' holdings. If you doubt this, you need only look at this guy with 2.3k posts on an investment forum who has done a complete 180 on an investment in little more than 3 days;jasonwatkins said:Recent events have shown me why I should never, ever, go anywhere near Bitcoin.

I bought on the 10th of June through Revolut when it was at £23.7k. Then the crash happened. When it hit £20k I was pretty heavily down so thought I might as well punt and bail out to re-buy at £20k. I figured that if it recovered back to the £27-£28k mark it was last week I'd at least claw back some, or most, of my losses.

It just continued to fall so I eventually decided to cut my losses at £17k and bail out for good. And then it started to climb again and it's currently back to about £18.8k and, knowing my luck, will probably continue to recover throughout the day.

I'm pretty heavily down but at least it's money I could afford to lose, even though I hate losing money.

(And yes, I'm fully aware that I handled all of this very poorly .. )

)

Over time, those people that buy spot BTC with reasonable allocations will come to dominate BTC holdings. Meanwhile, in the RE and Equity markets participants clamour for central bankers to bail them out 'for the good of the system.' One system trends to extreme stability and strength over time, one system trends to short term thinking and weak participants.

There are two options right now;

(1) Hike rates to kill inflation. Seriously, just hike by like 8% tomorrow - we are told this has worked in the past and will work now. So, why isn't this being done? Because, of course, you'll also kill the indices, make every pensioner a pauper, destroy the pension funds of anyone retiring in the next decade and cause a majority of businesses to go bankrupt. People too when you nuke their home values putting them all in negative equity whilst managing increasing mortgage costs and probably losing their jobs from those bankrupt employers. Not to mention that at this level it probably makes many sovereign states default; if ECB raises rates to tame inflation in Germany then Italy & Greece are screwed. However, I've said before that the biggest threat to Bitcoin is responsible central bank monetary policy - If you choose this option, Bitcoin goes to zero.

(2) We continue the charade until something breaks, and central banks reverse course knowing that inflation is preferable to the violent societal collapse the previous option presents. This happens somewhere between 2.5% and 5% interest rates (laughable that its so low really). Debt/GDP, Corporate Debt, Household Debt all at ridiculous highs - Western economies just can't sustain rising interest rates. When the central bank reverses, more money gets printed than last time, more and more people come to realise that there is no endgame, that moral hazard persists, they aren't the beneficiaries of this printing and that you don't want to be left holding dollars or pounds at the end of the ponzi. They, or us, if we are more mature about it, instead decide to opt out in to a more robust monetary system. This leads to Bitcoin succeeding.

I am perfectly fine with either option. If you want to raise rates by 8% tomorrow, I'm in. My Bitcoin goes to zero, but the working and middle classes have reasonable home and equity valuations again and can actually build wealth like their predecessor generations did. As a mid-30s educated graduate, I will easily do well in that system. Until then, I'll call the Fed/ECB/BoE's bluff and continue to buy Bitcoin - because that's just unlikely to happen. Also looking forward to rising interest rates tanking home valuations over the next year a little and loading up on debt seems like a good play for the next decade.

Buy Bitcoin. Be liquid. Take on serviceable fiat debt after interest rates nuke again. Wait 10 years. Easy game.

If people cant understand that there is a very serious problem with fiat currencies ....

0 -

According to the graph, in 2000 US debt was about 3 X GDP, in 2010 it was about 3.8 X GDP and now the ratio is about the same. What is the issue? What has happened in the past 12 years to suggest we are now much closer to global doom?

It is prudent to assume that anyone who displays long duration inherently exponential data on a linear scaled graph is trying to deceive. For example debt going from $80Bn to $90Bn is increasing by 12.5% yet occupies the same space as a 100% rise from $10Bn to 20Bn.

PS What is "parabolic debt"?1 -

Note it only covers until 2020.... what will it look like by 2030 and beyond?

I should say exponential debt.... can you honestly say that looking at that graph, that it's not a concern?0 -

Your post was too long to respond to everything so I just picked out this question for now. Raising rates discourages borrowing & spending, which can take the edge off inflation BUT that doesn't work if inflation isn't being caused by overheated debt-fuelled demand. If people are already spending less because petrol, gas, grain etc are going up due to supply shortages (eg war and sanctions) then raising interest rates just makes people and companies poorer for no benefit and leads to recession, maybe even the dreaded stagflation.darren232002 said:

Hike rates to kill inflation. Seriously, just hike by like 8% tomorrow - we are told this has worked in the past and will work now. So, why isn't this being done?

1 -

Look at the numbers, not the picture. The latter is misleading as I explained. For example you could draw a similar graph showing mortgage loans against average borrower income. That would show the loan apperently racing away from the income. However the loan/income and thus the affordability probably wont have changed very much.Zola. said:Note it only covers until 2020.... what will it look like by 2030 and beyond?

I should say exponential debt.... can you honestly say that looking at that graph, that it's not a concern?

We dont know what will happen by 2030. From the graph there is no indication that the GDP/debt ratio will change drastically.1 -

(1) Household debt at record highs. Debt/GDP at levels not seen since WWII. Credit card debt increased by something preposterous like 20% in April IIRC. The argument that debt isn't an issue seems to not fit the data.Reaper said:

Your post was too long to respond to everything so I just picked out this question for now. Raising rates discourages borrowing & spending, which can take the edge off inflation BUT that doesn't work if inflation isn't being caused by overheated debt-fuelled demand. If people are already spending less because petrol, gas, grain etc are going up due to supply shortages (eg war and sanctions) then raising interest rates just makes people and companies poorer for no benefit and leads to recession, maybe even the dreaded stagflation.darren232002 said:

Hike rates to kill inflation. Seriously, just hike by like 8% tomorrow - we are told this has worked in the past and will work now. So, why isn't this being done?

(2) If your argument is that raising rates won't do anything to quell inflation, then why are they being raised? Doesn't make sense.

(3) Arguing that war and sanctions have anything to do with current inflation levels is beyond stupid. Inflation was at 7.5% in January BEFORE Putin invaded Ukraine. Its a convenient narrative that doesn't fit the data at all. This is an absolute gaslighting of the public - this mess has been caused by government and central bank policy.

Hiking rates seemed to work just fine for Russia's CB, as the Ruble is now outperforming the USD. But of course, their economy isn't over indebted, its energy self sufficient and it has hard money reserves.2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards