We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

BITCOIN

Comments

-

There is no doubt that the Youtube & Twitter "scene" is absolutely full of fraudsters, shillers, scammers and unsavoury folks.

Thats why "Bitcoin Maxis" are typically so aggressive to everything thats not bitcoin, as many people get sucked into buying alt coins and clear scams and get badly burned by it. You could argue about being burned with Bitcoin, but its about having the correct time horizon (over 4 years).

These downturns are nothing new for Bitcoin and show no signs of stabilising any time soon. Ultimately in the long run, it has to improve on the perpetual boom and bust for it to be globally accepted and respected. The protocol remains unchanged, it will take time. This thing is only 13 years old, risen from nothing..

Where this all goes remains to be seen, long term holders have seen this all before and whilst no cycle is the same, history seems to be repeating. Exchanges need closely monitored and should have a mandate to provide proof of funds.

I would say if ever there was a time to buy a little bit of Bitcoin, put it into a wallet, write your seed phrase down, store it safely and forget about it for couple of years, its now... 0

0 -

2 US Senators (1 Democrat and 1 Republican) have just put a Crypto bill to the senate, to regulate all things crypto.

I believe (hope) it will get through eventually in some kind of finalised bill after a great deal of rewording. This will finally give the relevant parties the framework to regulate.

I expect it will be some time before we see how it all fits in to law etc, but this will legitimise it, which in turn will allow all the institutional money to pile in

Here’s What’s In Senator Lummis’ Bitcoin Bill - Bitcoin Magazine

1 -

Adyinvestment said:2 US Senators (1 Democrat and 1 Republican) have just put a Crypto bill to the senate, to regulate all things crypto.

I believe (hope) it will get through eventually in some kind of finalised bill after a great deal of rewording. This will finally give the relevant parties the framework to regulate.

I expect it will be some time before we see how it all fits in to law etc, but this will legitimise it, which in turn will allow all the institutional money to pile in

Here’s What’s In Senator Lummis’ Bitcoin Bill - Bitcoin Magazine

More institutional take up will increase the price, in a couple of years the price will likely be at a new high. But what is clear is that the big investments that are already holding bitcoin mean it now no longer follows its own path. It is very much a risk off asset, sensitive to wider markets and yields. It may become like holding a 4x leverage equities element in the portfolio.0 -

fwor said:And when he's not using lots of words to say next to nothing, he's saying things like "and decide to flee the fiat system" which, frankly, is nonsensical.How can anyone "flee the fiat system" when your employer will only pay you in fiat, your government will only accept your tax payments in fiat, your local shop will only let you pay for your shopping in fiat?He says repeatedly (fourteen times, apparently) that Bitcoin is not a currency. So what do you use as currency when you "flee the fiat system"?

If I get paid in GBP, live in the UK and thus conduct all my spending in GBP as well as paying taxes in GBP, but decide to convert my salary to USD instantly upon receipt and save in USD; Which currency system am I living in? Which currency system am I most exposed to? In other words, what am I using to denominate my wealth?Frequentlyhere said:@darren232002 I'm curious, how financially invested are you in bitcoin? Despite everything you say in support of it, I somehow feel you fight for it more as a concept rather than going all in on it - or am I wrong?

Also, as you clearly saw inflation coming a mile off and presumably the associated changes in monetary policy, did you change your allocation to bitcoin at least temporarily perhaps as a result?

I was a fresh graduate during the GFC and we need to remember that this was the catalyst for the creation of Bitcoin. I bought my first Bitcoin in 2014 ($250) and was in an industry that was very well suited to early adoption since I had to regularly send large amounts of money overseas and deal with the hassles my bank threw at me because of it. A lot of my peers had substantial amounts of BTC, but I believed, incorrectly, that the GFC was a one off and would not happen again. In April 2020, as governments around the world proceeded to print ten times the amount printed during the GFC, I had a lot of cash available and put it all in to Bitcoin. It seemed obvious at the time that helicoptering money to everyone would cause rampant inflation, that the incentives of the economic system weren't correctly aligned and that faith in central bankers would continue to decline (and rightly so, given their competence). I'd say that thesis was correct.

I've said on here before that Bitcoin represented something like 90%+ of my net worth at the time. I haven't bought any for a year and built a cash position instead, so its a bit less now, but suffice to say, my money is where my mouth is. The caveat is that I live on ~20% of my salary and have my rent/utilities paid for me; so I'm incredibly liquid and have no need to sell, which is why I can maintain such an allocation.Frequentlyhere said:

I did write a rambling reply to your long post, but in short whilst I agree with how you see things panning out in the near term for the economy, I basically see this as 'situation normal' for the current global picture.

We'll have a big recession, inflation will ease, and we'll go from there. I very very much doubt we'll need to reinvent the global monetary wheel. Even if we did, then Governments and their armies aren't going to cede it to a cadre of bitcoin billionaires. In my view.

I have no issue with 'boom & bust' being 'situation normal' if it generates growth and prosperity at a higher average rate than any other system. The problem is that this system is creaking under its own weight. Interest rates have been on a long term downtrend for decades because every recession we go through more debt is added to the pile and the economy is less able to return to 'normality' before some part of the system breaks. When I first got my ISA in the mid 00's, it was paying 5%/yr on cash balances but we are now in a situation where that kind of interest rate would cause mass bankruptcies. In 2018, interest rates got to 3% ish before the Fed were forced to pivot. The economy is becoming less resilient over time and there will come a point where we won't just be able to 'go from there.' That might be now, it might be the next great crisis.

Taking away the punch bowl right now would result in a depression, not a recession, which is something many people have only read about in textbooks; so the choice becomes do you debase the currency or take the depression. I don't blame CB's for choosing the former, its probably the better option, but it leads to currency collapse eventually.

As for the latter, they won't have a choice. I've mentioned the story here before of the pacific islanders that kept their wealth in large quarried limestone rocks from a nearby island who were disrupted when an outsider brought dynamite to the area and began flooding the market with his own, identical but easier to acquire, rocks. When this happened, locals tried to ban people from accepting these 'fake' stones. This obviously failed. Money is a competition that you can not opt out of and the winner will be the thing with the best monetary properties. Secondly, there will be plenty of countries that welcome digital workers bringing their wealth with them for the tax, investment and knowledge benefits that will bring. What is the army going to do? Ban people from memorising a seed phrase? Ban people from leaving the country? That's the point of self custody.Frequentlyhere said:

I would hope Darren & co would acknowledge that alongside the libertarian crusaders, the scene in general is chockful of shysters, fraudsters, highly unstable exchanges and 'innovations' (e.g. Terra/Luna). All of it screams for the need for more regulation, but that goes against the grain of the whole idea.

Absolutely no sympathy for people who put money in Terra/Luna. But this is a Bitcoin thread, which sits apart from every other 'crypto' out there.

Luna was always going to fail because it had no revenue. I've posted here before that there are real crypto protocols generating real revenue out there in the billions. Find them. But they also aren't trying to be money either, that category has been won and Bitcoin is the winner. Thinking that these 'coins' are all trying to be 'currencies' is beyond ignorance.Frequentlyhere said:

Meanwhile, whilst Darren says he's sanguine about the value of BTC, whether we actually use it as money or not I don't see how it can be of no consequence that BTC is now worth 70% less than a few months ago to his ideals.

The end state of Bitcoin will be a globally adopted asset that is incredibly liquid and stable. It will be the boring asset you plan for your retirement in, like bonds today. The volatility is decreasing over time and will continue to do so. But the time for buying it for returns at that point will be gone. You're welcome to wait for this to happen and forgo the volatility, but you'll end up paying a few hundred $k or more for your Bitcoin. If people want to be cautious, that's fine. Just don't come asking for 'windfall' taxes on people who 'got lucky' by buying Bitcoin early.Frequentlyhere said:

I think we're all agreed we're not going to be seeing mainstream goods priced in BTC instead of £, so to be of value BTC has by definition to hold its value against those currencies. But it's not. At the first sight of interest rates rising, it's collapsing. Perhaps that will reverse, but why would we want to swap out of an inflating fiat currency to one that's also suffering from inflation by virtue of being valued against those fiat currencies, and is down hugely to boot?

I think there are an absolute boatload of factors that are currently causing Bitcoin to drop, not least of which is that people that bought in the last two years without understanding it are currently selling it to maintain liquidity in other, more traditional, investments due to the rate rises. But this is a mistake; Bitcoin is the risk off asset and I think that will be vindicated in time.Frequentlyhere said:

Put more plainly, if I really believed BTC was the one true money and converted any earnings I had to BTC immediately as a matter of course, I'd be S***ting it right now, wouldn't you? It's down 70% in 7 months, and 35% in the last 2 weeks alone. That's not money.

Firstly, what do you think this does to the participants of the network over time? The people that stick around and maintain their investment are long term thinkers, with high time preference, who are unlikely to be forced sellers. Contrast this with the equity or RE market that at the slightest downturn turn to the government for liquidity or a bail out. There is a reason why moral hazard persists in regular markets and because all that matters is whatever year, or sometimes even quarter, you are in. This is the exact point I made in an earlier post; that one system tends to stability and strength over time and one is fragile and weak.

Secondly, its funny that you started your post with;Frequentlyhere said:Reflecting more on this, the problem for people who really believe that Bitcoin is somewhere we'd all somehow flee is that they seem to be ignoring the practical reality on the ground of what's happened so far with it.

and then go on to make the argument you did in the last paragraph about Bitcoin being down 70%.

At the covid bottoms;

S&P500 2300 to (Currently) 3800 for a 65% return

BTC Under $4k to (Currently) $21.3k for a 430% return.

Its not me that's ignoring the practical reality on the ground. My investment, at the time I made it, is still far outperforming the S&P or wherever else I could have put it. This continues to be a math test, and people keep failing it even though graphs are only a google search away.

By the way, money is a tool to propagate excess value created today in to the future. Fiat currencies can't be that, because they are guaranteed, neigh targeted, to lose their value over time.2 -

Adyinvestment said:2 US Senators (1 Democrat and 1 Republican) have just put a Crypto bill to the senate, to regulate all things crypto.

I believe (hope) it will get through eventually in some kind of finalised bill after a great deal of rewording. This will finally give the relevant parties the framework to regulate.

I expect it will be some time before we see how it all fits in to law etc, but this will legitimise it, which in turn will allow all the institutional money to pile in

Unfortunately it is unlikely to pass as it is. The best that can be hoped for is that it starts the ball rolling. I agree regulation is essential but I fear it won't lead to a rush of institutional money. Instead it will reveal the dirty underside of crypto. Stable coins such as Tether will be shown to lack the assets they claim are backing up their coins. A spotlight on Ethereum will highlight utterly illegal (in the stock market) practices such as "front running" are being actively encouraged, allowing miners to rip off investors. Most institutions won't touch crypto until it is has all been cleaned up.

Even if nothing negative is found against Bitcoin the whole crypto marketplace will be damaged by the spotlight in the same way Luna negatively impacted confidence in all crypto.

Yes I am looking forward to regulation (though doesn't that contradict the beliefs of many crypto investors?) but I don't expect it to have a positive benefit on Bitcoin for many years.2 -

I can’t be bothered to quote all of that post.

“But they also aren't trying to be money either, that category has been won and Bitcoin is the winner.”

Really? Because Bitcoin is pretty useless as money. In the same way that I could use a shovel to play cricket, both a bat and fiat are far better suited to the job.1 -

Hi darren232002

Forgive the question without highlighting your specific posts but I’m trying not to make my question indigestible.

I haven’t worked my way through all of this thread but have read a few of your later posts which without wishing to sound patronising I have found to be thoughtful and articulately and impressively argued. I’m interested in clarifying and crystallising your view of BTC into something more simple so I can understand. So I just wanted to check whether or not I have understood you.Is your position basically that you are not claiming or stating that you believe BTC to be a currency or a “traditional” investment (which you seem to be wrongly accused of believing) but simply see it as a punt or gamble more comparable with other types of bets but with this “bet” you feel able to place your bet with a personal belief of a more informed grasp of the background economic variables against which BTC might more likely perform. So your “investment” edge is your economic knowledge and judgements about BTC’s trajectory. Are you saying that you basically see BTC as simply being something to be bought and sold?

Is it also your position that in simple terms the current drop in BTC value is most likely attributable to short-termism amongst more traditionalists flighting back to buy opportunities in traditional investments but that these markets are in economies where the medicines and levers needed to “repair” economies are more likely to kill the patients than cure them and that this might inevitably lead to flight and swing back into BTC in the future.

Am I grasping it?Hope my question doesn’t seem so dumb they are too irritating.

Thanks,

Jeff0 -

Firstly, echoing Jeff, I too find your posts genuinely thought-provoking Darren, even if I don't agree with them. The discussion is definitely interesting.

To take the last point first, I think we should avoid using short-term performance as any sort of indicator of investment quality. Gamestop is still up >3000% since the covid lows, does that make it even better than bitcoin as an investment?

My reference to the 70% drop wasn't to illustrate that BTC is a bad investment - that doesn't prove that. It was to say it's currently bad money. It's almost equally as bad that it's up whatever hundreds of percent since the covid lows. In my view your comparision point there is the £ or $, not the S+P 500.

If we look at a typical definition of money, we see it includes the need for it to be recognisable, and stable. Well, it's clearly not stable and it's clearly not being recognised for the vast majority of worldwide transactions either. From that list, I'd also argue it's nowhere near portable enough given the perils of storing it conveniently with any 3rd party at present.

Re: the economic outlook, I don't disagree with your views on interest rates, but for me still there's an awful lot of words missing in how "challenging macroeconomic outlook and downward pressure on interest rates" becomes "bitcoin is the answer".

I've seen the "they won't have a choice' argument put forward before in reference to Govts, and I simply don't see how that can be the case. China has already banned bitcoin hasn't it? They seem to have had the choice. Meanwhile, in more delicate terms, the Western World is clearly on a path to regulate crypto extensively. It's well within their remit and power to do so.

If a Government says "bitcoin is illegal" whilst still theoretically being possible to transact in bitcoin using VPN's and specialist software, how many people in a normal population are going to be up for that? I'd put it at about 1%? That's not a viable option.

Re: "the volatility is decreasing over time" - is it? It's fallen faster and further in % terms than it did in 2018, doesn't seem like it to me.

Re: "Bitcoin is the risk off asset and I think that will be vindicated in time" Well, it's certainly not behaving like one, and never has done yet in it's short history.

Re: "I have no issue with 'boom & bust' being 'situation normal' if it generates growth and prosperity at a higher average rate than any other system"

Well, so far capitalism under the $ has generated growth and prosperity by far and away better than any other system. Look at how rich the World has become since 100 or even 50 years ago - hugely.

Meanwhile, let's say all the hurdles were overcome, if we all adopted bitcoin as a society, how would it be better? That's a genuine question. Would it abolish inflation without abolishing economic growth, somehow? Would it reduce inequality? Would it place power in better hands, and who would those hands be?

You say "The end state of Bitcoin will be a globally adopted asset that is incredibly liquid and stable".

Well, if that's right, but the path is potentially very long and uncertain as you seem to acknowledge, what's the value in buying so much of it now?

Because as the hypothetical gradual population level realisation of its inevitability dawns, Bitcoin will either:

a) shoot up hugely in real asset-buying value, leaving oligarchic wealth in your hands and abject poverty to almost everyone else. Governments powerless to provide core services as they no longer hold the money. Normal people's pensions worthless, whilst Michael Saylor rules the World. Is that what we actually want the future of money to look like?

or

b) Be boringly stable, in which case why are you bothering to pin so much of your wealth right now in it when it's too soon and very difficult to say when all of this will happen?

It just doesn't all add up for me, Darren. The arguments twist in the wind. It's both a much superior and stable financial system that is also going to shoot hugely up in value when adoption occurs meaning we should get in early ideally, but that doesn't matter because of how darn stable it's going to be.

3 -

Want to buy some tulip bulbs?darren232002 said:

The end state of Bitcoin will be a globally adopted asset that is incredibly liquid and stable.

You might be able to find enough bag holders to maintain the price, but BTC is not an asset.

1 -

I'm overdoing the bitcoin thread today, but I do find it interesting.

I think with the history you've refreshed us on Darren, I'm starting to see why you feel the way you do.

In buying lots of BTC in April 2020, you feel vindicated by the idea of escaping the consequences of the FED's money printing with how much it has soared in value against the $. Your thesis seems to have been correct.

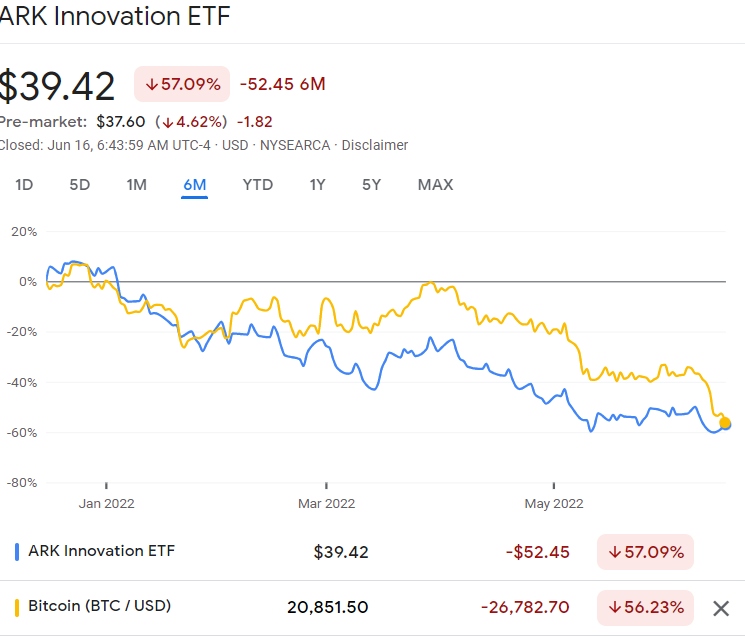

In my view though, your thesis is faulty. You did well, but not really for the reasons you bought it for. You're in a not much different position to the spec-tech investors going big on Peloton and Zoom and ARKK. You've ridden the wave of a hyper-accommodative monetary policy, which is now being reversed.

Whilst I suppose it could still theoretically be correct, the difficult position your thesis has is that it's currently being systematically dismantled.

It's falling just like a tool of rampant speculation would.

Inflation is becoming worse, but Bitcoin is falling harder.

A war started in Ukraine, and people fled to Gold, not Bitcoin.

It's not becoming less volatile, it's becoming more.

Your argument that BTC is still up from COVID lows higher than the stock market doesn't really hold water, and you know it.

Because, look, so is GME. So is Dogecoin, for crying out loud.

Why do I pick those 2 to compare against? And why are those two still up against the stock market despite any rational person knowing that they're worth nowhere near that?

Well the other leading thesis is that they've all become a cult. Their temporary success has blinded a (now diminishing) cadre of people to their flaws, leading to all sorts of implausible claims engineered to create belief that number will continue to go up. There are diminishing but real sets of people who still believe in all of them.

It's also why ARKK hasn't had the good fortune to still be looking good. Ultimately, it's an investment in a hotchpotch collection of tech firms, not "the future of money". It doesn't have a story for people to believe in.

I think at this stage, everything has to go in reverse for your competing idea to be right. It's not enough for people not to trust the FED and go through a recession to suddenly love bitcoin. What's happening right now shows that. They also have to find a reason to believe in Bitcoin.

The trouble is that all Bitcoin is doing at present is giving people lots of reasons not to trust it.

2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards