We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Halifax Scrapping £5/Cinema ticket Rewards.

Comments

-

King_Of_Fools said:Personally, I would be surprised if they keep the Club Lloyds rewards.

Other than that, the new Halifax and the BoS current accounts are identical to Lloyds.The rewards have been marketed pretty extensively over the last 2 years - both in terms of Club Lloyds and also Premier (which is essentially a beefed up Club Lloyds type account with the same monthly rewards). I can't imagine Premier would have launched with the same set of rewards if those rewards are on the list to cull.1 -

Agreed. I think people may be overlooking the fact they have already replaced the old rewards with something they consider adequate. Can't see them changing it again for a year or two. I need to keep mine open for YouGov points, and so there seems little point in downgrading them (since they'll need to be active in some capacity for the points), so why not push £1.5k through them. I'll still be feeding a Halifax and BoS RS manually (as is my wont) and it gives me a chance to read (or mark read) my statements while I'm there.danny13579 said:I can't really see them ever offering the old rewards again. Yeah, it only takes seconds to cycle £1,500 through 3 Reward Accounts per month but how long are people going to keep doing that before getting a bit fed up that they're getting next to nothing in return?

I agree that it feels different this time. It feels like Halifax is being put out to pasture.2 -

I have the ultimate rewards account which is £19/m, but with the £5 reward it made it worth while to me. After the change was announced, I looked into other options and the Lloyd's Silver seemed to be a worth while alternative.

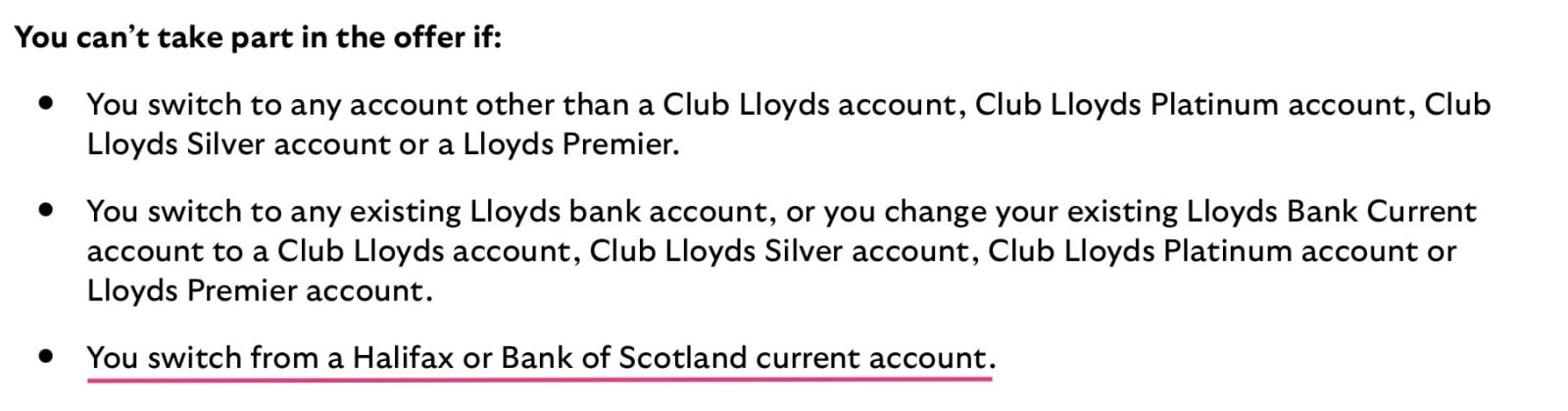

Unfortunately, according to Lloyd's T&C's you can't open it if you're moving from a Halifax or BoS current account.

Looks like I need to look at other options after September, which is a shame as I've been with Halifax for over 30 years.0 -

Are you sure or is it that you don't qualify for any switching bonus?skeat12 said:I have the ultimate rewards account which is £19/m, but with the £5 reward it made it worth while to me. After the change was announced, I looked into other options and the Lloyd's Silver seemed to be a worth while alternative.

Unfortunately, according to Lloyd's T&C's you can't open it if you're moving from a Halifax or BoS current account.2 -

You can open the Lloyds account but if you switch the Halifax or BoS into it you won't qualify for the bonus.

I don't think you're going to have time to do the Lloyds offer unless you have another current account other than the Halifax or BoS, with 3 direct debits on it and a payment has been taken from each direct debit. The offer ends on the 28th July.

Maybe move the Halifax with one of the other switching offers and come back to Lloyds when they do their next offer?1 -

Can anyone please remind me when we will be doing the last £500+ debit card spend for the £5 reward on the Halifax Reward c/account? I'm thinking the last month when we need to do the spend will be September but not sure.

(I'm aware that we will need to keep going indefinitely with £1500+deposit per calendar month into each Halifax Reward account held to avoid the £3 fee)1 -

Yes, it's September.Hattie627 said:Can anyone please remind me when we will be doing the last £500+ debit card spend for the £5 reward on the Halifax Reward c/account? I'm thinking the last month when we need to do the spend will be September but not sure.

(I'm aware that we will need to keep going indefinitely with £1500+deposit per calendar month into each Halifax Reward account held to avoid the £3 fee)

Let's Be Careful Out There4 -

Yes, you have to make a transaction within 30 days before the renewal.WillPS said:PRAISETHESUN said:kuepper said:Not much point in staying with them but I wondered when was the best time to close to avoid being charged £3 fee, is it as soon as you're paid your outstanding rewards in October?

If you're intent on closing them then yes, I'd wait until they pay the outstanding rewards in Oct. Personally I'm keeping mine open, partly because mine are linked to YouGov, but also partly to see what they end up offering (if anything) down the line. I've automated the monthly paying by SO so it's no extra effort on my end either way.

You could just downgrade to the free Current Account. That'd keep the YouGov link alive and stop the need to hoop-jump (although you'd probably need to do something to make sure it didn't go dormant/lack sufficient activity for YouGov).0 -

I've chanced renewing an account with no activity in the previous 6 months, but I'd be reluctant to risk much more than that.allegro120 said:

Yes, you have to make a transaction within 30 days before the renewal.WillPS said:PRAISETHESUN said:kuepper said:Not much point in staying with them but I wondered when was the best time to close to avoid being charged £3 fee, is it as soon as you're paid your outstanding rewards in October?

If you're intent on closing them then yes, I'd wait until they pay the outstanding rewards in Oct. Personally I'm keeping mine open, partly because mine are linked to YouGov, but also partly to see what they end up offering (if anything) down the line. I've automated the monthly paying by SO so it's no extra effort on my end either way.

You could just downgrade to the free Current Account. That'd keep the YouGov link alive and stop the need to hoop-jump (although you'd probably need to do something to make sure it didn't go dormant/lack sufficient activity for YouGov).0 -

It lasted around 15 years which in banking terms is a long time as moving the goal posts is std banking practice .

The fiver did drop to three quid then two quid for awhile before going back up to five quid .

That got rid of a few .1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards