We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Trading 212 Cash ISA - Impossible to transfer ISA out!

Comments

-

qbadger said:For those who successfully completed a full transfer of their Trading 212 cash ISA to another provider, did the account close and disappear afterward?

Due to 2FA problems I couldn't access my account in the end. I sent a complaint via the web form and asked them to completely delete my complete Trading 212 online access because I didn't want to have anything more to do with them. They complied very quickly.

1 -

I've just begun an ISA transfer out of Trading 212.

As they don't have a sort code I've put 00-00-00 in the box in the forms for the receiving bank.

Let's see what happens

0 -

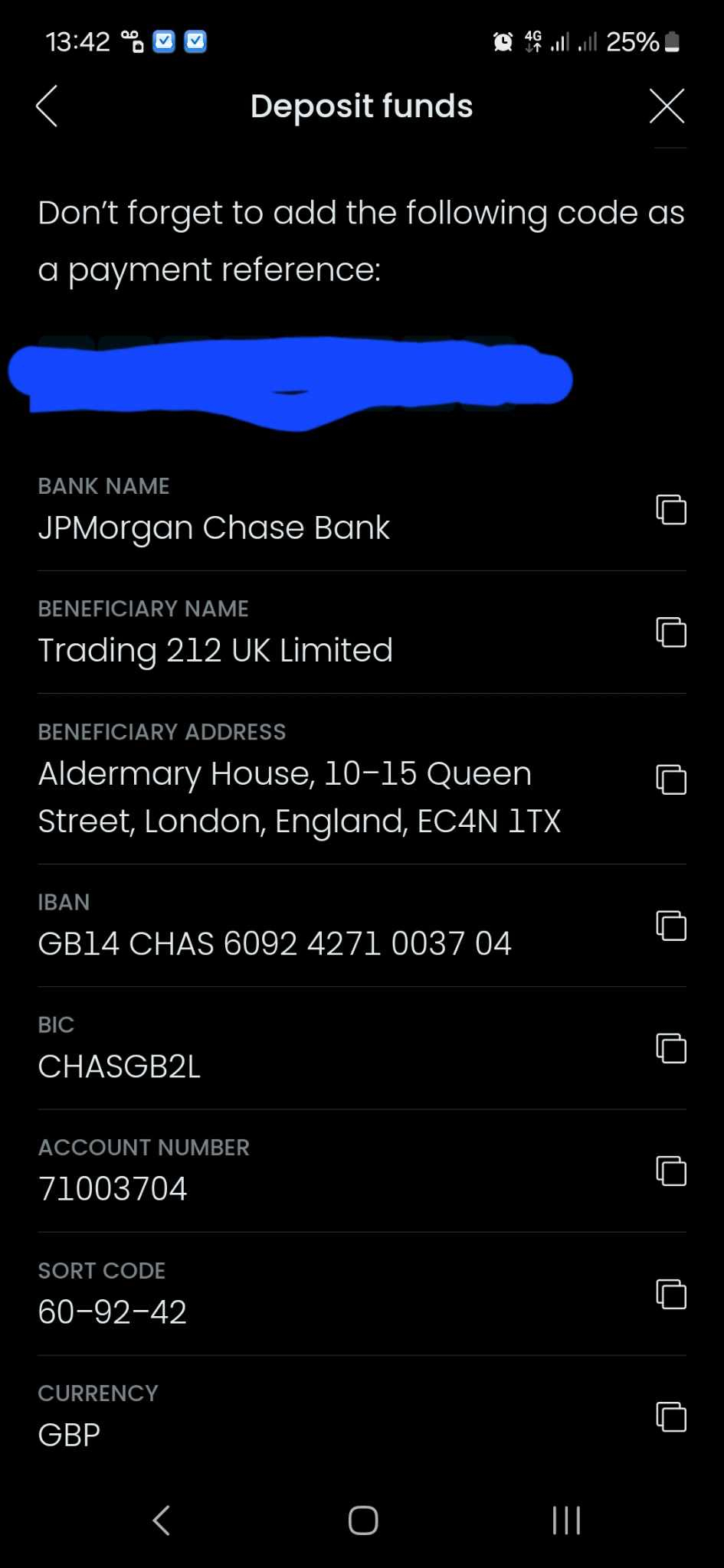

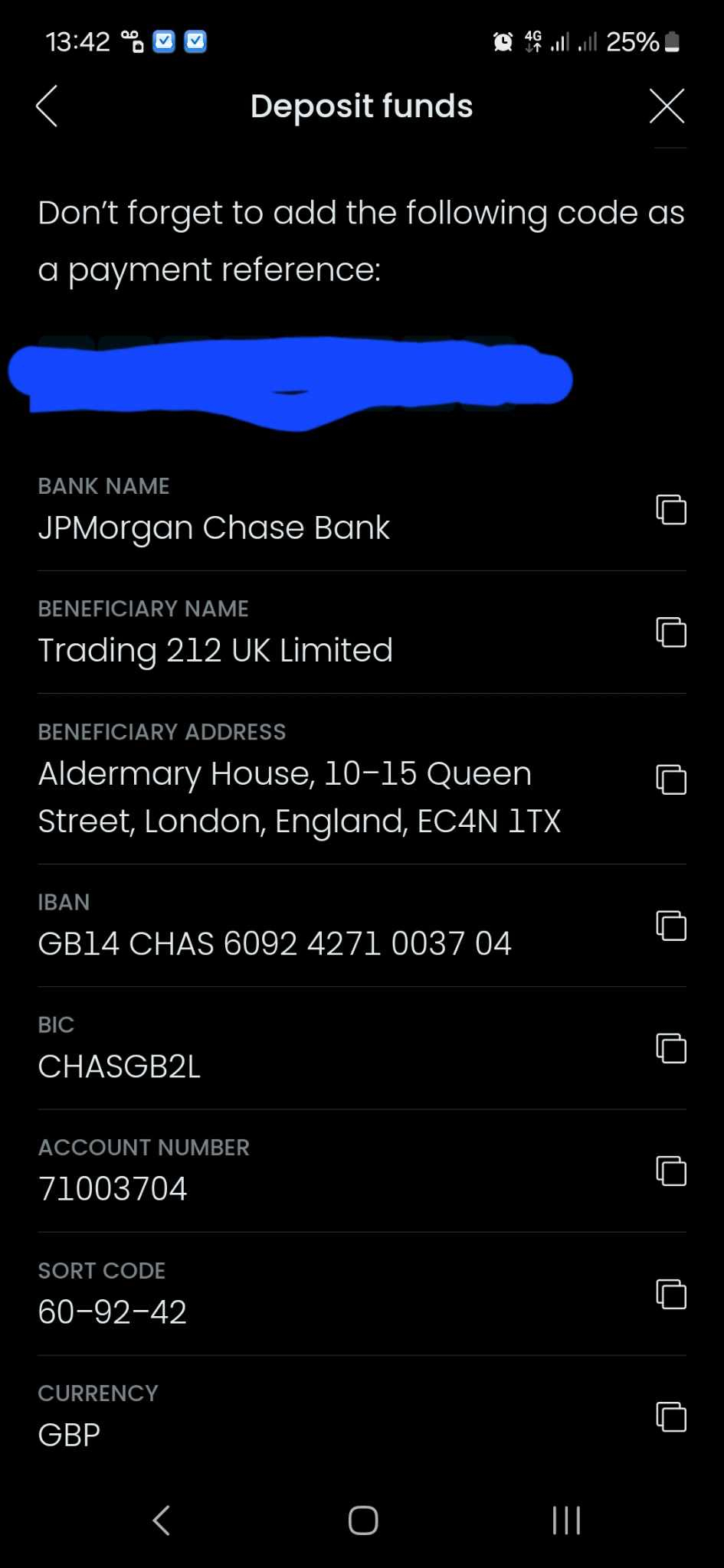

The sort code & account number for TRADING 212 is60-92-42 / 71003704You then need to find your unique reference number (which will be your account number)To find your unique reference number, click on MENU (the 3 lines, bottom right), click on MANAGE FUNDS, click DEPOSIT, click BANK TRANSFER (add your bank if needed) - your reference number will then be displayedSo when transfering out, use the sort code 60-92-42 and your unique reference number (which will be your account number)

2 -

Isn't that JP Morgan's sort code ?NipTuck said:The sort code & account number for TRADING 212 is60-92-42 / 71003704You then need to find your unique reference number (which will be your account number)To find your unique reference number, click on MENU (the 3 lines, bottom right), click on MANAGE FUNDS, click DEPOSIT, click BANK TRANSFER (add your bank if needed) - your reference number will then be displayedSo when transfering out, use the sort code 60-92-42 and your unique reference number (which will be your account number)

Trading 212 say to use 00-00-00 from what I can see0 -

Daz2009 said:

Isn't that JP Morgan's sort code ?NipTuck said:The sort code & account number for TRADING 212 is60-92-42 / 71003704You then need to find your unique reference number (which will be your account number)To find your unique reference number, click on MENU (the 3 lines, bottom right), click on MANAGE FUNDS, click DEPOSIT, click BANK TRANSFER (add your bank if needed) - your reference number will then be displayedSo when transfering out, use the sort code 60-92-42 and your unique reference number (which will be your account number)

Trading 212 say to use 00-00-00 from what I can seeIt's the account where your money is deposited, so surely that is what should be used for transfering out

0 -

I suspect the problem is that Trading 212 primarily deal in S&S ISAs, so a provider’s electronic transfer system may ask if Cash or S&S (providers aren’t obliged to accept any, only to allow you to transfer out to another provider of your choosing who will accept your ISA) and there are providers who will accept transfers only from Cash ISAs, not S&S. Providers probably assume that a Trading 212 ISA isn’t Cash ISA, therefore wrongly refuse it, with their electronic transfer system listing the usual Cash ISA suspects who are signed up to electronic transfers.You may need to hunt around for a paper transfer form for whichever provider you wish to transfer your ISA to - you still don’t need to contact Trading 212, just post, take or upload the completed form to the receiving ISA provider.0

-

Chat on Trading212 confirmed that the sort code for transfers out is 00-00-00, and the account number is the 8-digit account number which you can find under "documents", then "transaction statements" . Ensure you look at the Cash ISA number and not at the Invest Account number! You can also find this number in their emailed monthly statement of your cash ISA2

-

You see the row that says "Beneficiary name". Unless you changed your name to Trading 212 UK Limited, then that is their central client money account, which is used to receive deposits before they are transferred into your account. It should not be mistaken for your own account.NipTuck said:Daz2009 said:

Isn't that JP Morgan's sort code ?NipTuck said:The sort code & account number for TRADING 212 is60-92-42 / 71003704You then need to find your unique reference number (which will be your account number)To find your unique reference number, click on MENU (the 3 lines, bottom right), click on MANAGE FUNDS, click DEPOSIT, click BANK TRANSFER (add your bank if needed) - your reference number will then be displayedSo when transfering out, use the sort code 60-92-42 and your unique reference number (which will be your account number)

Trading 212 say to use 00-00-00 from what I can seeIt's the account where your money is deposited, so surely that is what should be used for transfering out 3

3 -

Trading 212's Cash ISA comes with one big, fat, caveat on outward bound transfers.

I have had the biggest nightmare trying to transfer a cash ISA out of Trading 212 to another institution/ a bank. This is under complaint and I will add to the post when the explanation comes from Trading as to why they decline / reject transfers without explanation to the receiving institution/ISA Manager and having done so claim no knowledge of the original mandate form (they have history on this). My point here is the following: How can Trading reject instructions to transfer they claim that they have not had in the first place? Epic screw up after screw up followed on this poor start and ended in the dizzy heights of Trading posting the wrong £ amount in the app to be transferred. I could not approve said transfer in the Trading app as Paragon, correctly, would have rejected it. Where Trading got the random figure in £ from (and an instruction to close the ISA) remains another mystery. Yet another flurry of comms followed before the £ amount was amended by Trading and I could agree it.

I have made three transfers out and all of them have taken 3 to 4 days and that is 3 to 4 days loss of value/ interest and lot of tracking and hassle. Each and every transfer was sent to a fully on-board FPS/Faster Payment receiving institution. The warning notification that funds can take up to 3 days to appear - which pops up at the end of the process - seems disingenuous at best. I have requested clarity on why Trading appear to have used BACS payments to transfer funds out three different times both in the app and in email. I never receive a response.

Diligent, I checked before downloading the app that Trading made Faster Payments in and out and yet this has not been the case. Trading also appear to be gearing up on the 'blame' game on my ISA Transfer - blaming everybody but their own platform and staff stroke admin. limitations - as the have breached the 15-day HMRC best practice guidance.

I gave Trading an experimental try on the cash ISA and, thus far, they have failed miserably. It has been a huge time-waster and not worth the extra couple of fractions in terms of the interest offered (now 4.50%) in any shape, form, or fashion.

Has anybody managed to get a straight answer out of Trading on the subject of the use of 3 working day BACS payments instead of standard Faster Payments? Please let me know as my sorry excuse of an ISA Transfer may need to go the whole way in terms of complaint management.

0 -

All of my recent withdrawals from my T212 GIA to my current account have been near instant faster payments.Comprendiamo said:Trading 212's Cash ISA comes with one big, fat, caveat on outward bound transfers.

I have had the biggest nightmare trying to transfer a cash ISA out of Trading 212 to another institution/ a bank. This is under complaint and I will add to the post when the explanation comes from Trading as to why they decline / reject transfers without explanation to the receiving institution/ISA Manager and having done so claim no knowledge of the original mandate form (they have history on this). My point here is the following: How can Trading reject instructions to transfer they claim that they have not had in the first place? Epic screw up after screw up followed on this poor start and ended in the dizzy heights of Trading posting the wrong £ amount in the app to be transferred. I could not approve said transfer in the Trading app as Paragon, correctly, would have rejected it. Where Trading got the random figure in £ from (and an instruction to close the ISA) remains another mystery. Yet another flurry of comms followed before the £ amount was amended by Trading and I could agree it.

I have made three transfers out and all of them have taken 3 to 4 days and that is 3 to 4 days loss of value/ interest and lot of tracking and hassle. Each and every transfer was sent to a fully on-board FPS/Faster Payment receiving institution. The warning notification that funds can take up to 3 days to appear - which pops up at the end of the process - seems disingenuous at best. I have requested clarity on why Trading appear to have used BACS payments to transfer funds out three different times both in the app and in email. I never receive a response.

Diligent, I checked before downloading the app that Trading made Faster Payments in and out and yet this has not been the case. Trading also appear to be gearing up on the 'blame' game on my ISA Transfer - blaming everybody but their own platform and staff stroke admin. limitations - as the have breached the 15-day HMRC best practice guidance.

I gave Trading an experimental try on the cash ISA and, thus far, they have failed miserably. It has been a huge time-waster and not worth the extra couple of fractions in terms of the interest offered (now 4.50%) in any shape, form, or fashion.

Has anybody managed to get a straight answer out of Trading on the subject of the use of 3 working day BACS payments instead of standard Faster Payments? Please let me know as my sorry excuse of an ISA Transfer may need to go the whole way in terms of complaint management.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards