We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The New Top Easy Access Savings Discussion Area

Comments

-

I sent them a secure message on 1st Sep (as I said I would do on my post earlier on in this thread) pointing out that the rate had been cut without notification which was a breach of FCA rules and if it wasn't rectified I would be making a formal complaint to the FCA. I'm not taking credit, as I'm sure many people contacted them, but I do think it was people pointing it out or complaining that forced them to revert to the original rate, they didn't do it just because they were being nice.mebu60 said:

I expect it's more likely the volume of direct contact that alerts them to issues.CuparLad said:BestSeagull said:Just in case anyone else doesn't tend to read the individual subject threads (I don't usually) I saw on the Cynergy one that @SnowMan noticed that issue 90 has been returned to 4.45% https://forums.moneysavingexpert.com/discussion/6535288/have-you-received-cynergys-notification-of-rate-reductions#latestThank you @BestSeagull for bringing this to our attention. I certainly hadn't spotted it.I do wonder whether marketing folks keep an eye on these forums to get indications of customer sentiment, brewing issues etc. Over the years there's been a few incidents where something blows up on the forums and things quietly change.1 -

Myself and others on here were on their case via secure message three days earlier on Friday 29th. Today I finally got a response after four working days (supposed to reply in three) saying they have passed it on to the relevant department and will respond within five working days!!cwep2 said:

I sent them a secure message on 1st Sep (as I said I would do on my post earlier on in this thread) pointing out that the rate had been cut without notification which was a breach of FCA rules and if it wasn't rectified I would be making a formal complaint to the FCA. I'm not taking credit, as I'm sure many people contacted them, but I do think it was people pointing it out or complaining that forced them to revert to the original rate, they didn't do it just because they were being nice.mebu60 said:

I expect it's more likely the volume of direct contact that alerts them to issues.CuparLad said:BestSeagull said:Just in case anyone else doesn't tend to read the individual subject threads (I don't usually) I saw on the Cynergy one that @SnowMan noticed that issue 90 has been returned to 4.45% https://forums.moneysavingexpert.com/discussion/6535288/have-you-received-cynergys-notification-of-rate-reductions#latestThank you @BestSeagull for bringing this to our attention. I certainly hadn't spotted it.I do wonder whether marketing folks keep an eye on these forums to get indications of customer sentiment, brewing issues etc. Over the years there's been a few incidents where something blows up on the forums and things quietly change.1 -

That and I like the account pays interest daily.crumpet_man said:

4.35 is still a top rate for easy access though. I've been using it for a bit and had no issues, just have to be aware of extra time may be required for deposit and withdrawals.frosch411 said:Just got this email from Snoop:

We’re lowering the interest rate on your Snoop Easy Access Savings Account (Issue 1).

Your old rate was 4.60% AER / 4.50% gross (variable)

Your new rate is 4.35% AER / 4.26% gross (variable)

Your rate will go down on Thursday 18 September.

Sadness..but it was always a question of time 😭0 -

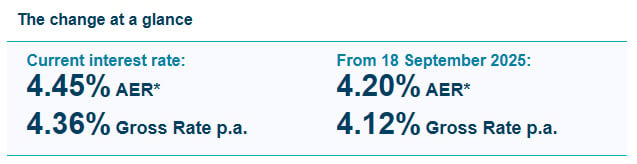

Secure Trust Bank Access Account Iss 22 down to 4.2%.

2

2 -

from 18th September (for those that can't view the images) - it's now NLA, replaced by Issue 23 paying 4.20%. @soulsaverdosh37 said:Secure Trust Bank Access Account Iss 22 down to 4.2%1 -

Hoping people on this thread might be able to offer their thoughts / inputs regarding Family BS.

We have Issue 11 and Issue 9 accounts still paying 4.6% and 4.5% respectively, and they have implemented the rate reduction on their other EA accounts (possibly trackers) as of 1 September, but I was wondering what might be the timeline for them to apply to NLA accounts?

Personal Responsibility - Sad but True

Sometimes.... I am like a dog with a bone0 -

cloud_dog said:Hoping people on this thread might be able to offer their thoughts / inputs regarding Family BS.

We have Issue 11 and Issue 9 accounts still paying 4.6% and 4.5% respectively, and they have implemented the rate reduction on their other EA accounts (possibly trackers) as of 1 September, but I was wondering what might be the timeline for them to apply to NLA accounts?I had a similar thought (have Issues 10 & 9) and sent them a secure message towards the end of August about this, prior to making some large deposits...Thank you for your secure message.

The Online Saver rates are not linked directly to the Bank of England base rate; the rates on these accounts are reviewed by our Board regularly, we have not been advised of any changes but you would be notified prior to any rate change.

as they have to give 14 days notice, there won't be a rate change now before the next BoE meeting on the 18th September (unless one comes in the next few hours lol). I would suspect there might be a reduction after that regardless of whether the base rate drops again, but who knows.to be fair, they are good at sending email notifications on future rate changes.1 -

Thanks. I'll wait with baited breath thenjanusd said:cloud_dog said:Hoping people on this thread might be able to offer their thoughts / inputs regarding Family BS.

We have Issue 11 and Issue 9 accounts still paying 4.6% and 4.5% respectively, and they have implemented the rate reduction on their other EA accounts (possibly trackers) as of 1 September, but I was wondering what might be the timeline for them to apply to NLA accounts?I had a similar thought (have Issues 10 & 9) and sent them a secure message towards the end of August about this, prior to making some large deposits...Thank you for your secure message.

The Online Saver rates are not linked directly to the Bank of England base rate; the rates on these accounts are reviewed by our Board regularly, we have not been advised of any changes but you would be notified prior to any rate change.

as they have to give 14 days notice, there won't be a rate change now before the next BoE meeting on the 18th September (unless one comes in the next few hours lol). I would suspect there might be a reduction after that regardless of whether the base rate drops again, but who knows.to be fair, they are good at sending email notifications on future rate changes. Personal Responsibility - Sad but True

Personal Responsibility - Sad but True

Sometimes.... I am like a dog with a bone0 -

Secure Trust Bank Access Account Iss 22 went NLA at 28/07 when at 4.45%. There is a rate reduction to 4.20% wef 18/09.

Iss 23 is available (04/09) at 4.20% - doesn't quite qualify for ToTP listing....... yet 5

5 -

Cahoot Simple Saver (Issue 10) @ 4.55% (NLA) dropping to 4.40% on 2nd December.11

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards