We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The New Top Easy Access Savings Discussion Area

Comments

-

I've had it a few times with OTPs (especially with the NatWest group but occasionally with others) where the first OTP doesn't arrive but if I request a new one the second one does arrive.StayinAlive said:CahootDoes anyone have problems receiving OTP's from Cahoot.I have a fairly good 4G signal but on more than half the occasions that I've requested one, nothing arrived.Don't seem to have the same problem with other banks.1 -

I had this recently when I tried to make a first payment from a new account. The OTP never arrived. So I resorted to making an internal transfer to an account with an existing payee, and making my payment from there. I have since not tried a payment from the new account again, so don’t know whether it would work now.StayinAlive said:CahootDoes anyone have problems receiving OTP's from Cahoot.I have a fairly good 4G signal but on more than half the occasions that I've requested one, nothing arrived.Don't seem to have the same problem with other banks.1 -

Just had the email, Ford Flexible Saver down to 4.27% AER / 4.10% monthly from 11th August.2

-

Thanks, I only had email about ISA reducing from 4.35% to 4.18% from the same date. Await the other one. Or not. Only have £1 in Saver, more providers are no longer notifying under a specified amount (c£100). Bit rude considering it only requires an email. Be more understandable if a letter and stamp were used.4justice2 said:Just had the email, Ford Flexible Saver down to 4.27% AER / 4.10% monthly from 11th August.0 -

The most annoying thing with this is if you were to raise your balance between the email going out and the rate dropping, you still get no notification. At least that's how it worked with Cynergy when I tried it.mebu60 said:

Thanks, I only had email about ISA reducing from 4.35% to 4.15% from the same date. Await the other one. Or not. Only have £1 in Saver, more providers are no longer notifying under a specified amount (c£100). Bit rude considering it only requires an email. Be more understandable if a letter and stamp were used.4justice2 said:Just had the email, Ford Flexible Saver down to 4.27% AER / 4.10% monthly from 11th August.

0 -

I did Ford a disservice, I have just received the Saver email, albeit several hours after the ISA one. It says reduction from 4.35% to 4.18% (in lockstep with ISA) not 4.27%.mebu60 said:

Thanks, I only had email about ISA reducing from 4.35% to 4.18% from the same date. Await the other one. Or not. Only have £1 in Saver, more providers are no longer notifying under a specified amount (c£100). Bit rude considering it only requires an email. Be more understandable if a letter and stamp were used.4justice2 said:Just had the email, Ford Flexible Saver down to 4.27% AER / 4.10% monthly from 11th August.1 -

I can't say that i've ran into OTP problems with Cahoot recently - and I log into there frequently.StayinAlive said:CahootDoes anyone have problems receiving OTP's from Cahoot.I have a fairly good 4G signal but on more than half the occasions that I've requested one, nothing arrived.Don't seem to have the same problem with other banks.

worth noting that you can use the Santander app for Cahoot (but only if not already using it for Santander accounts) - you would just need to login with your Cahoot details... it has limited capability, but if all you are logging in for is to check balances, move money between Cahoot accounts etc, then it might be a quicker solution.3 -

Oops my error I'm afraid.....it is 4.18% AER on Flexible Saver.....I misread the email.... apologies.mebu60 said:

Thanks, I only had email about ISA reducing from 4.35% to 4.18% from the same date. Await the other one. Or not. Only have £1 in Saver, more providers are no longer notifying under a specified amount (c£100). Bit rude considering it only requires an email. Be more understandable if a letter and stamp were used.4justice2 said:Just had the email, Ford Flexible Saver down to 4.27% AER / 4.10% monthly from 11th August.0 -

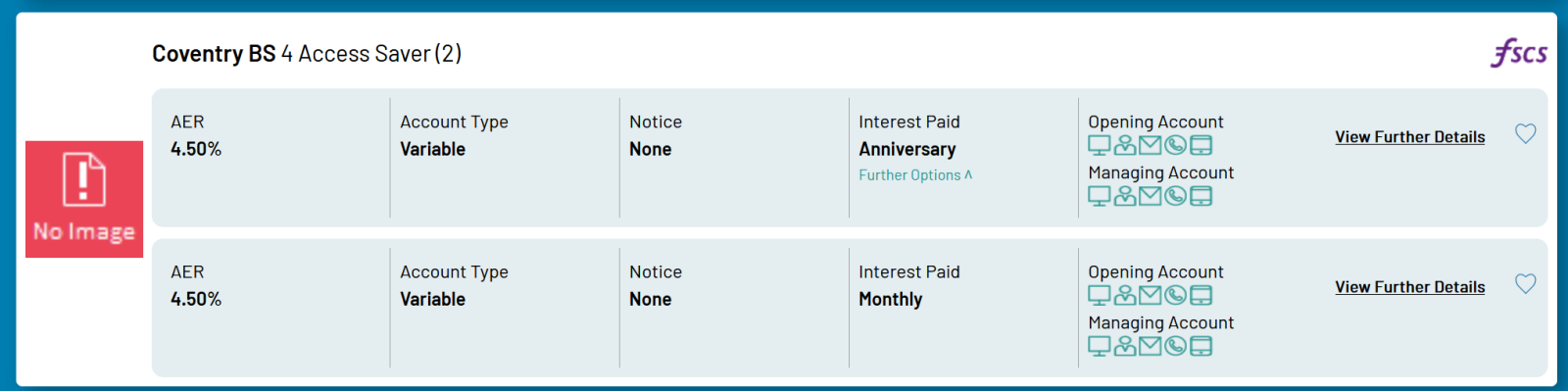

might be something might be nothing but noticed this on money facts, I know the (2) account has existed for a while but maybe they going to release a (3)? as normally when there is no image it means new account?Guess we will have to watch this space and hope it is something

might be something might be nothing but noticed this on money facts, I know the (2) account has existed for a while but maybe they going to release a (3)? as normally when there is no image it means new account?Guess we will have to watch this space and hope it is something

1 -

it seems to have disappeared off money facts so perhaps going NLA tomorrow after 9am?0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards