We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The New Top Easy Access Savings Discussion Area

Comments

-

winkowinko said:

Thank you. Took less than 5 mins to get it up and running, and all but £1 transferred over to the new account.allegro120 said:

It's all done online. The details you put in the application form (providing they are the same) will trace your ID, your account opens almost immediately, you get an e-mail and you can see it online. Very straight forward, at least in my experience (I have 11 accounts with Cahoot).winkowinko said:

Ah, fair enough.allegro120 said:

it is available to all. Issue 2 pays 4.75% AER, which is currently a very good rate for instant access account. I wouldn't close it. You should be able to open issue 5. I have all issues (except issue 1 that has already served its term), I've never had problems with opening new issues whilst the older ones are still running.winkowinko said:So the Cahoot sunny day saver (issue 5) paying 5% is only available to new customers?

I have a sunny day saver with them (issue 2), but it's currently paying only 4.65%. Is there anything I can do about that?

I guess that I wrongly assumed that the below meant you can only have one Sunny Day Saver sole account, whereas presumably it means you can only have one of any particular issue?- You can have a maximum of 1 sole account and 1 joint account per person.

If I were to open issue 5, would I still have the same log in details? Would I need to wait for some kind of verification code to come through the post etc, or can it all just be done online?

You can leave it at zero

0 -

Happy new tax year everyone.

True EA accounts are easy access savings accounts which can be opened (and the headline rate earned) with a balance of £1, and allow unlimited deposits and withdrawals. This table excludes accounts limited to smaller balances, paid-for/premium accounts, and accounts from savings marketplaces/platforms. Instant True EA accounts are True EA accounts which advertise immediate deposit and withdrawal times 24/7. Highlighted entries show changes since last time: green for rate rises, red for rate drops, and blue for new entries to the respective table.Chip and Chase continue to do battle for new customers and prop up the average top rate; Charter and Tesco maintain their leads across all savers in their respective tables.I no longer check the forums as regularly as I used to. If you wish to catch my attention please remember to tag me (@ircE) so I get a notification.22

True EA accounts are easy access savings accounts which can be opened (and the headline rate earned) with a balance of £1, and allow unlimited deposits and withdrawals. This table excludes accounts limited to smaller balances, paid-for/premium accounts, and accounts from savings marketplaces/platforms. Instant True EA accounts are True EA accounts which advertise immediate deposit and withdrawal times 24/7. Highlighted entries show changes since last time: green for rate rises, red for rate drops, and blue for new entries to the respective table.Chip and Chase continue to do battle for new customers and prop up the average top rate; Charter and Tesco maintain their leads across all savers in their respective tables.I no longer check the forums as regularly as I used to. If you wish to catch my attention please remember to tag me (@ircE) so I get a notification.22 -

Has someone got a link for the Sunny Day Saver, please?0

-

It is on their homepage www.cahoot.comSeriousHoax said:Has someone got a link for the Sunny Day Saver, please?1 -

I think either Charter or I have lost some of their marbles!

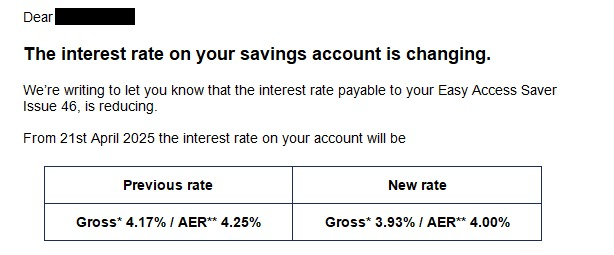

From an email today .....

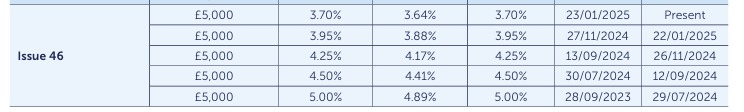

I thought I did not recognise the "Previous Rates" so I looked at their Interest Rate Summary for the EA Issue 46 ....

They appear to have picked the "previous rate" from 13/09 to 26/11. There have been 2 rate drops since then, so their "new rate" actually represents an increase from actual current rates!

Just to really mess with my head, I actually closed Issue 46 earlier this morning, so is this just really bad timing . Someone please tell me I've not lost the plot! Actually, someone better tell me if I have lost it, too! Compiler of the RS League Table.

. Someone please tell me I've not lost the plot! Actually, someone better tell me if I have lost it, too! Compiler of the RS League Table.

Being nosey... How many Regular Saver accounts do you have? — MoneySavingExpert Forum0 -

From Charter this morning:

The interest rate on your savings account is changing.

We’re writing to let you know that the interest rate payable to your Easy Access Issue 56, is reducing.

From 21st April 2025 the interest rate on your account will bePrevious rate New rate Gross* 4.57% / AER** 4.57% Gross* 4.32% / AER** 4.32% This change is in accordance with paragraph 20.2 of the General Savings Conditions and affects your Easy Access Issue 56 account. If you hold any Fixed Rate accounts, they will not be changing. 1 -

At least the rates look right for Issue 56, unlike Issue 46!Sherbertfizz said:From Charter this morning:The interest rate on your savings account is changing.

We’re writing to let you know that the interest rate payable to your Easy Access Issue 56, is reducing.

From 21st April 2025 the interest rate on your account will bePrevious rate New rate Gross* 4.57% / AER** 4.57% Gross* 4.32% / AER** 4.32% This change is in accordance with paragraph 20.2 of the General Savings Conditions and affects your Easy Access Issue 56 account. If you hold any Fixed Rate accounts, they will not be changing. Compiler of the RS League Table.

Being nosey... How many Regular Saver accounts do you have? — MoneySavingExpert Forum1 -

I had the same Iss 56 rate reduction email this morning.Charter Savings Bank plays the same game with existing customers as Kent Reliance (both owned by One Savings Bank).I opened a new Iss 58, transferred the balance and closed the old Iss 56.It only takes a few minutes to play the game.2

-

Archerychick said:

The terms do state you can’t hold two, but the system isn’t preventing it as things stand. I didn’t know this until after I’d applied for issue 5. I’ve currently got the previous issue with a few pence in and only issue 5 with a decent amount in.winkowinko said:

Ah, fair enough.allegro120 said:

it is available to all. Issue 2 pays 4.75% AER, which is currently a very good rate for instant access account. I wouldn't close it. You should be able to open issue 5. I have all issues (except issue 1 that has already served its term), I've never had problems with opening new issues whilst the older ones are still running.winkowinko said:So the Cahoot sunny day saver (issue 5) paying 5% is only available to new customers?

I have a sunny day saver with them (issue 2), but it's currently paying only 4.65%. Is there anything I can do about that?

I guess that I wrongly assumed that the below meant you can only have one Sunny Day Saver sole account, whereas presumably it means you can only have one of any particular issue?- You can have a maximum of 1 sole account and 1 joint account per person.

If I were to open issue 5, would I still have the same log in details? Would I need to wait for some kind of verification code to come through the post etc, or can it all just be done online?There is nothing to stop you opening the issue 5.Can anyone confirm that, if you do have multiple Sunny Day accounts then you do actually receive interest for deposits above the £3K limit for a single account?My worry is that although the system may let you open multiple Sunny Day accounts, you only receive interest on the first £3K:-========What you’ll get

- 5.00% AER/gross (variable) for 1 year on balances up to £3,000.

- No interest paid on balances over £3,000.

Things to keep in mind

- Minimum opening balance £1, maximum £2 million.

- You can have a maximum of 1 sole account and 1 joint account per person.

- This is a paper-free account – learn more in ‘How do I open and manage my account?’ below.

The Key Facts PDF document also says:-"You can have a maximum of two cahoot Sunny Day Saver accounts – one in your sole name and one you can hold jointly with someone else.

If you don’t keep to these terms, we might switch your account to a cahoot Savings Account."

0 -

I can't confirm until the end of the month. I've got two SDSs, both fully loaded, set up to pay interest monthly.Can anyone confirm that, if you do have multiple Sunny Day accounts then you do actually receive interest for deposits above the £3K limit for a single account?

If they don't generate the expected, then one will be emptied sharpish.

Unless someone can confirm the bad news earlier?0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.7K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards