We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The New Top Easy Access Savings Discussion Area

Comments

-

Used Tesco app early, no issues, check their is no app update?1

-

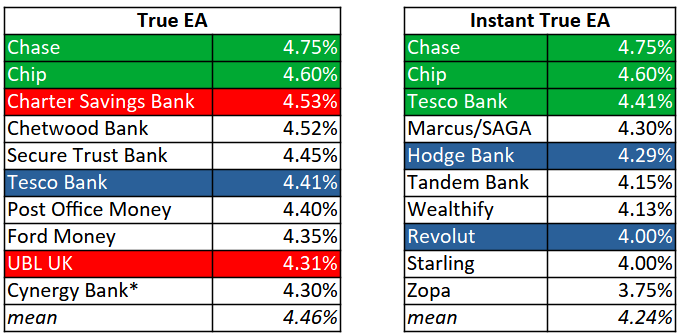

True EA accounts are easy access savings accounts which can be opened, and the headline rate earned, from a balance of £1, and allow unlimited deposits and withdrawals. This table excludes accounts limited to smaller balances, paid-for/premium accounts, and accounts from savings marketplaces. Instant Trut EA accounts are True EA accounts which advertise immediate deposit and withdrawals 24/7. Highlighted entries show changes since last time: green for rate rises, red for rate drops, and blue for new entries to the respective table.Chase and Chip engage in a cha-cha at the top of both tables seeking new customers. Tesco Bank cheekily offering 4.41% only for a few days before it relaxes back down to 4.31%. Perhaps a nervous look over the shoulder in the instant access market as Hodge Bank makes its debut not too far off the top spot (thanks again Malchester for beating moneyfacts to the scoop). Everyone's favourite not-quite-a-bank bank Revolut has joined its rivals in offering savings accounts in Monzo-style tiers. The 4.00% account that makes it to the scorecard is open to everyone on the Standard tier of Revolut. Note that funds in savings accounts are held by Clearbank and so protected up to £85k across all your Clearbank-held funds.* Marcus/SAGA also offer 4.30%, but Cynergy comes first alphabetically!I no longer check the forums as regularly as I used to. If you wish to catch my attention please remember to tag me (@ircE) so I get a notification.18

True EA accounts are easy access savings accounts which can be opened, and the headline rate earned, from a balance of £1, and allow unlimited deposits and withdrawals. This table excludes accounts limited to smaller balances, paid-for/premium accounts, and accounts from savings marketplaces. Instant Trut EA accounts are True EA accounts which advertise immediate deposit and withdrawals 24/7. Highlighted entries show changes since last time: green for rate rises, red for rate drops, and blue for new entries to the respective table.Chase and Chip engage in a cha-cha at the top of both tables seeking new customers. Tesco Bank cheekily offering 4.41% only for a few days before it relaxes back down to 4.31%. Perhaps a nervous look over the shoulder in the instant access market as Hodge Bank makes its debut not too far off the top spot (thanks again Malchester for beating moneyfacts to the scoop). Everyone's favourite not-quite-a-bank bank Revolut has joined its rivals in offering savings accounts in Monzo-style tiers. The 4.00% account that makes it to the scorecard is open to everyone on the Standard tier of Revolut. Note that funds in savings accounts are held by Clearbank and so protected up to £85k across all your Clearbank-held funds.* Marcus/SAGA also offer 4.30%, but Cynergy comes first alphabetically!I no longer check the forums as regularly as I used to. If you wish to catch my attention please remember to tag me (@ircE) so I get a notification.18 -

And today I received an email from Virgin to tell me the interest is reducing to 4.06% from 31/3.SnowMan said:

Because February has 28 days and January has 31 days (131 x 28/31 = 118)westv said:

I have £35k in mine with monthly interest.SnowMan said:westv said:When did the Virgin Defined Access savings rate drop to 4.06%? The last email I had from them in Nov last year said 4.51% but nothing since.Which version are you referring to?The Virgin defined access e saver (issue 30) which has been available to open since 13th February pays 4.06% AER.The Virgin defined access e saver (issue 27) which is the account I have and was available to open between 2/10/2024 and 19/12/2024 is still paying 4.51% AER as far as I can see.Rates for old versions are here (choose 'previously offered', 'online' then 'E-saver')

Up until Feb I was receiving £131 in interest. However, this month that has reduced to £119 with no withdrawals.1 -

I opened this Virgin Defined account (issue 21) in February 2024 with £1 in case it might become competitive in future. That was the only transaction I've ever made. I haven't loged in since, looking at it now and there is no interest earned on that £1. Should have earned at least 4p by now??? I didn't download t&c, so don't know when the interest is supposed to be paid. Does anyone know?westv said:

And today I received an email from Virgin to tell me the interest is reducing to 4.06% from 31/3.SnowMan said:

Because February has 28 days and January has 31 days (131 x 28/31 = 118)westv said:

I have £35k in mine with monthly interest.SnowMan said:westv said:When did the Virgin Defined Access savings rate drop to 4.06%? The last email I had from them in Nov last year said 4.51% but nothing since.Which version are you referring to?The Virgin defined access e saver (issue 30) which has been available to open since 13th February pays 4.06% AER.The Virgin defined access e saver (issue 27) which is the account I have and was available to open between 2/10/2024 and 19/12/2024 is still paying 4.51% AER as far as I can see.Rates for old versions are here (choose 'previously offered', 'online' then 'E-saver')

Up until Feb I was receiving £131 in interest. However, this month that has reduced to £119 with no withdrawals.0 -

From my screenshot of my application it states "Annual interest is paid on the 11th March and will be available the next working day"I've no interest, as I never funded it1

-

I thought the interest was paid in January as I opened it at the start of the year and it’s now a whole 80p up!

1 -

allegro120 said:

I opened this Virgin Defined account (issue 21) in February 2024 with £1 in case it might become competitive in future. That was the only transaction I've ever made. I haven't loged in since, looking at it now and there is no interest earned on that £1. Should have earned at least 4p by now??? I didn't download t&c, so don't know when the interest is supposed to be paid. Does anyone know?westv said:

And today I received an email from Virgin to tell me the interest is reducing to 4.06% from 31/3.SnowMan said:

Because February has 28 days and January has 31 days (131 x 28/31 = 118)westv said:

I have £35k in mine with monthly interest.SnowMan said:westv said:When did the Virgin Defined Access savings rate drop to 4.06%? The last email I had from them in Nov last year said 4.51% but nothing since.Which version are you referring to?The Virgin defined access e saver (issue 30) which has been available to open since 13th February pays 4.06% AER.The Virgin defined access e saver (issue 27) which is the account I have and was available to open between 2/10/2024 and 19/12/2024 is still paying 4.51% AER as far as I can see.Rates for old versions are here (choose 'previously offered', 'online' then 'E-saver')

Up until Feb I was receiving £131 in interest. However, this month that has reduced to £119 with no withdrawals.Allegro120 - like you I have been running my DAES(21) with £1. You were a penny out! 5p interest was paid on 11/3/25.Just when I thought this account was going to be competitive they drop the rate to 4.06% from 31/3.0 -

So I should have had some interest credited by now. I might just close it, I have dozens of similar unused accounts offering better rates.infoadict said:From my screenshot of my application it states "Annual interest is paid on the 11th March and will be available the next working day"I've no interest, as I never funded it

I didn't know you don't have to fund it. My spreadsheet says "Minimum operating balance is £1". Looks like they don't enforce it.0 -

Recently opened the Market Tracker Saver with Family BS now that the minimum is £1. I had the ISA version already, so was an existing customer. I received a letter today asking for proof of my nominated account (a Chase account, as I don’t use the same nominated account for everything.) I was able to upload the PDF online so no problem (aside from the fact that although I quickly received a secure message advising that my account was now verified and active, it comes up as inactive when I try to make a debit card deposit.) I’ll send them a secure message back if it doesn’t resolve itself overnight.

As well as wondering if anyone has had a similar experience, I wondered if it would’ve been confirmed electronically had I used a mainstream account? If not, an account for which one has online banking is the nominated account to have - as those without have to send originals or certified copies by post and no prepaid envelope is provided. Only PDF Statements can be uploaded electronically.

0 -

Messaged them this morning and received a response at lunchtime apologising that my account had not been activated properly following receipt of my bank statement, but was now ready to use. I was then able to deposit by debit card, so it isn't the case that they require an initial payment by other means.Kim_13 said:Recently opened the Market Tracker Saver with Family BS now that the minimum is £1. I had the ISA version already, so was an existing customer. I received a letter today asking for proof of my nominated account (a Chase account, as I don’t use the same nominated account for everything.) I was able to upload the PDF online so no problem (aside from the fact that although I quickly received a secure message advising that my account was now verified and active, it comes up as inactive when I try to make a debit card deposit.) I’ll send them a secure message back if it doesn’t resolve itself overnight.

As well as wondering if anyone has had a similar experience, I wondered if it would’ve been confirmed electronically had I used a mainstream account? If not, an account for which one has online banking is the nominated account to have - as those without have to send originals or certified copies by post and no prepaid envelope is provided. Only PDF Statements can be uploaded electronically.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.7K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards