We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The New Top Easy Access Savings Discussion Area

Comments

-

There is a post by irce on this page of the thread that gives a table -jimmeee said:Need to move away from Chase now that the boost is expired.

Does anyone know which providers use faster payments in and out of their savings account?

I'd like to replicate the functionality that I have in Chase where I can quickly move cash between savings and my normal Chase current account.

I'm tempted by Marcus. They are Which recommended and their FAQ says faster payments in and out of linked bank account. Anyone had experience with them?

Thanks

https://forums.moneysavingexpert.com/discussion/comment/81203642#Comment_81203642In addition Cahoot Rainy day saver is instant payments but limited to £3k. I’ve twinned this up with another account to put anything over £3k into.1 -

Just a warning to everyone moving their money out of Chase. Don’t close your current account as you won’t be able to reopen again!2

-

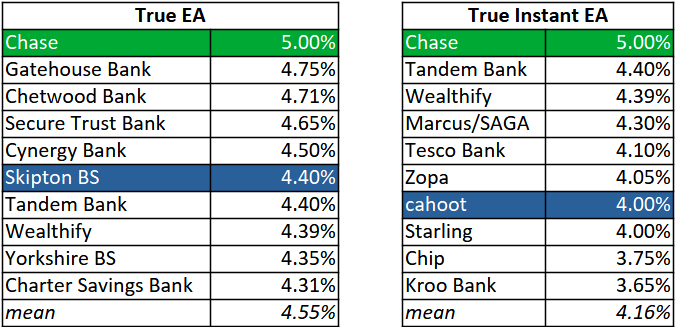

So looking at this Kroo is the highest paying one that also allows standing orders, and direct debits am I correct?ircE said:Happy new year everyone. True EA accounts are easy access savings accounts which can be opened, and the headline rate earned, from a balance of just £1, and allow unlimited deposits and withdrawals. This table excludes accounts limited to smaller balances, paid-for/premium accounts and savings marketplaces. True Instant EA accounts are True EA accounts which advertise immediate deposit and withdrawal times 24/7. Green highlights are accounts who have raised interest rates, and blue highlights are those which are new to the respective table.A quiet but not completely uneventful festive period. Since last time, Chase's already table-topping offering has risen. At the same time, Skipton launched a new account with a bonus rate and cahoot's latest Simple Saver allows it to return to the scorecard.1

True EA accounts are easy access savings accounts which can be opened, and the headline rate earned, from a balance of just £1, and allow unlimited deposits and withdrawals. This table excludes accounts limited to smaller balances, paid-for/premium accounts and savings marketplaces. True Instant EA accounts are True EA accounts which advertise immediate deposit and withdrawal times 24/7. Green highlights are accounts who have raised interest rates, and blue highlights are those which are new to the respective table.A quiet but not completely uneventful festive period. Since last time, Chase's already table-topping offering has risen. At the same time, Skipton launched a new account with a bonus rate and cahoot's latest Simple Saver allows it to return to the scorecard.1 -

Cahoot Sunny Saversoulsaver said:

If that's the 12 month term downgrade can you not 'refresh' them for the 4.75%?wiseonesomeofthetime said:

Cahoot Sunny Saverinfoadict said:Just received an email from Cahoot, saying to check messages regarding interest rate drop.All Sunny Day Saver rates are dropping to 4.75% on 31st March 2025

I got the same, however, mine downgrades on 8 March 2025, so do I now get a rate rise (obv not)

(obv not)

That is certainly a possibility. Given that Cahoot give something like 60 days notice on rate reductions too.0 -

It's fine to close the Saver account if you no longer need it. If they were to launch a new Boosted Saver at a higher rate, you'd need to open a new one anyway.Archerychick said:Chase Savings AccountNow that I’ve lost my boosted saving rate with Chase I’ve moved my savings from that account, leaving 49p. Is there any reason to keep this savings account open?

I have a current account. I just can’t remember if this is one of the banks where if you close an account you can’t have it again, or if that only applies if you close everything?

It's the current account you need to keep open, as they do state you won't be able to open another in future if you close it.4 -

s71hj said:So looking at this Kroo is the highest paying one that also allows standing orders, and direct debits am I correct?I believe so. There is also Nationwide's FlexDirect current account @ 5.00% for balances up to £1,500 for the first year.Before you open an account with Kroo I would suggest you have a look at this thread in which other forumites have shared their experiences.I no longer check the forums as regularly as I used to. If you wish to catch my attention please remember to tag me (@ircE) so I get a notification.1

-

I already have Kroo, albeit I don't currently use for s.o or d.d's, but am planning to as interest rate for money sitting waiting to go out is better than Santander. I will check the thread out first to see if it speaks of any pitfalls I should be aware of, so thank you.ircE said:s71hj said:So looking at this Kroo is the highest paying one that also allows standing orders, and direct debits am I correct?I believe so. There is also Nationwide's FlexDirect current account @ 5.00% for balances up to £1,500 for the first year.Before you open an account with Kroo I would suggest you have a look at this thread in which other forumites have shared their experiences.0 -

Tesco

I've got the version at 4.76% but it's not got long before the interest drops.

Can anyone explain why withdrawals made between 00.01 and 00.12, requested by me and clearly accepted by Tesco as same day withdrawals, then show as having been made the previous day?0 -

Tescoschiff said:

Can anyone explain why withdrawals made between 00.01 and 00.12, requested by me and clearly accepted by Tesco as same day withdrawals, then show as having been made the previous day?

Couldn't be anything to do with the clock settings on your device, could it? I can't remember the organisation concerned now, but I had a issue a while back with an app not performing as expected. A helpful customer services agent got me to check my clock was on an automatic setting (which it wasn't). It was only a few seconds out, and I couldn't see how it could possibly affect the matter in hand, but to my surprise the fix worked.1 -

Furness Double Access interest rate has reduced today.

Tried to transfer out to an external account, but keeps coming up with 'Try again later'.

Is this because I have only just added the external account details ? Do I need to wait overnight or twenty four hours ?1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.4K Work, Benefits & Business

- 602.7K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards