We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The New Top Easy Access Savings Discussion Area

Comments

-

The rate will be reduced to 4.5% on the 20th January.WoodwardM said:PS: Interest rate is both Gross & AER. Check it out at https:// www.ulsterbank.co.uk/savings/easy-access-account.html (I'm not allowed to post links!)1 -

As mentioned above, the other big minus is that you have to have a current account with Ulster Bank in order to get that account. This technically makes it an 'exclusive' account I guess and may be the reason why it's not on the list.WoodwardM said:ULSTER LOYALTY SAVER should be listed by Martin in top Easy Access Savings (for some weeks now).

Even though it reduced its rate to 4.75% in mid October for >=£5000, it is still BETTER than Chetwood, Close & Principality that are listed as top buys.

Pluses: (1) Good interest rate. (2) Instantaneous transfer/access to UNLIMITED withdrawals. (3) Money in & out shows instantaneously / within a minute. (4) Good "buffer savings account" as you can access your base £5000 in emergencies (but you'll lose the higher rate until you replenish)

Minuses: (1) Only worth considering for £5000+, as rate for less is only 2%. (2) both of these rates will reduce by 0.25% on 20/01/25, but other top earners may do the same within this timeframe too.

Come on Martin-team - give it a mention: I only discovered it as you has as a best-buy some months/years ago!

Personally, I only tend to open new current accounts when a bank has a bit more to offer, such as a switching bonus, cashback on purchases or direct debits or access to other types of savings accounts with high rates. As far as I can see, Ulster don't offer any of these extra incentives and their range of savings accounts is actually very small (limited to just that account, a cash ISA and children's accounts). I think I still had other easy access accounts paying >5% when it first launched so didn't really have a need for another one, although I can see why it would have been attractive to others as it was the highest-paying easy access account for quite a while.

I agree that it is odd that it doesn't even get a special mention at the moment, especially when you consider that Atom is at the top of that list (if you discount the ISAs) and that top rate is only achievable if you don't make any withdrawals, which is a pretty major negative aspect of an easy access account !1 -

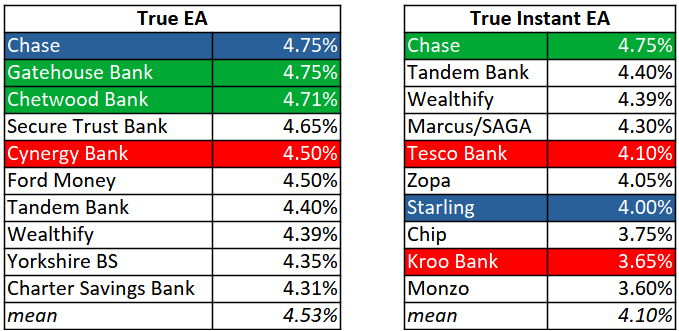

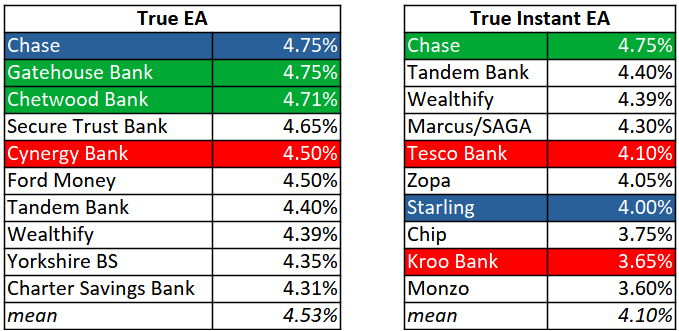

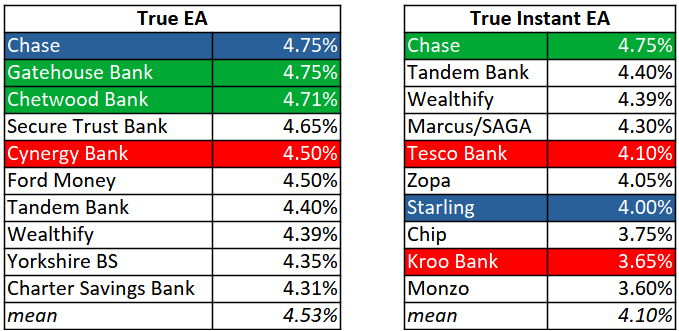

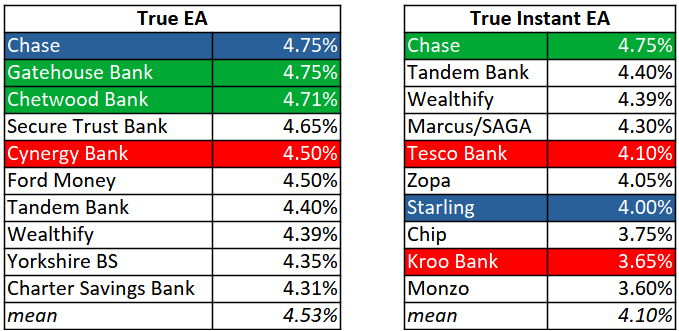

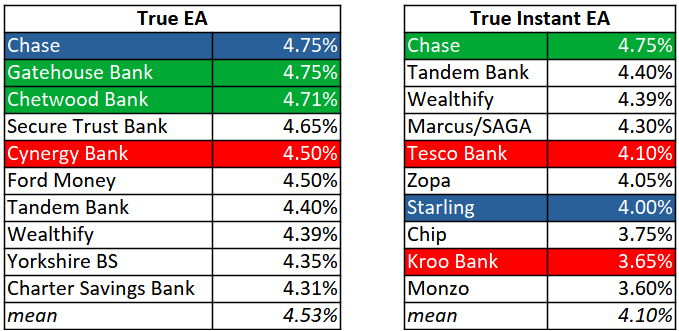

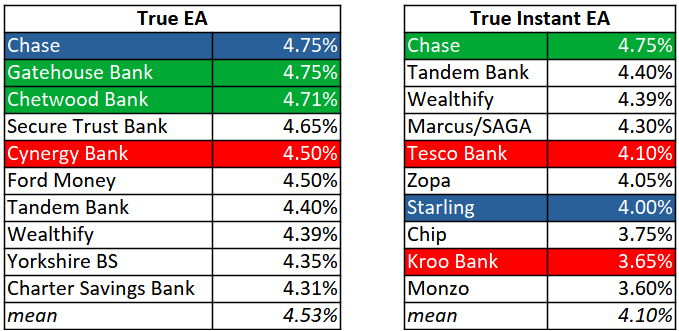

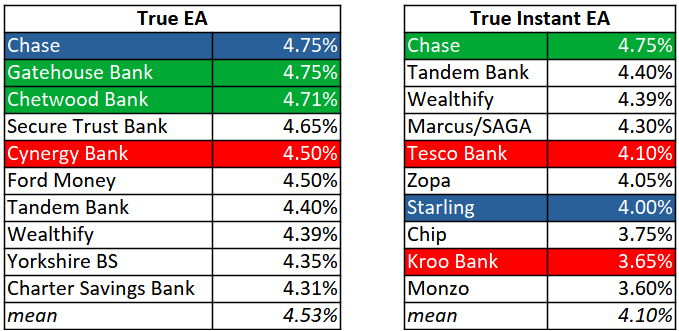

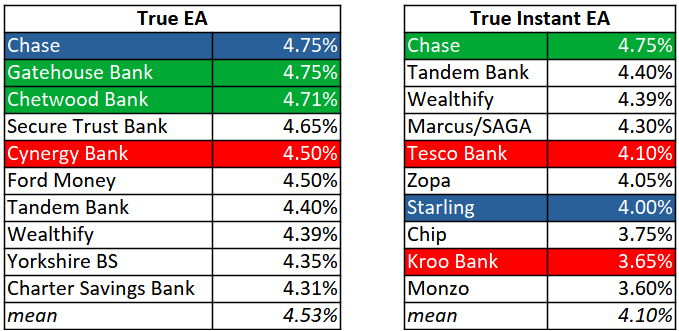

True EA accounts are easy access savings accounts which can be opened, and the headline rate earned, from a balance of just £1, and allow unlimited deposits and withdrawals. This table excludes accounts limited to smaller balances, paid-for/premium accounts and savings marketplaces. True Instant EA accounts are True EA accounts which advertise immediate deposit and withdrawal times 24/7. Red highlights are accounts whose interest rate has lowered, green highlights those which have been raised, and blue highlights are those which are new to the respective table.Some surprise moves since last time, leading to mean top rates actually being higher than last month's.Next MPC meeting next Thursday 19th.I no longer check the forums as regularly as I used to. If you wish to catch my attention please remember to tag me (@ircE) so I get a notification.21

True EA accounts are easy access savings accounts which can be opened, and the headline rate earned, from a balance of just £1, and allow unlimited deposits and withdrawals. This table excludes accounts limited to smaller balances, paid-for/premium accounts and savings marketplaces. True Instant EA accounts are True EA accounts which advertise immediate deposit and withdrawal times 24/7. Red highlights are accounts whose interest rate has lowered, green highlights those which have been raised, and blue highlights are those which are new to the respective table.Some surprise moves since last time, leading to mean top rates actually being higher than last month's.Next MPC meeting next Thursday 19th.I no longer check the forums as regularly as I used to. If you wish to catch my attention please remember to tag me (@ircE) so I get a notification.21 -

Where is the 4.75% for Chase coming from? I'm a first issue member since the off. The best they have is a 4.5% boost, that ends mid-Jan 2025. I don't like to miss a trick!ircE said: True EA accounts are easy access savings accounts which can be opened, and the headline rate earned, from a balance of just £1, and allow unlimited deposits and withdrawals. This table excludes accounts limited to smaller balances, paid-for/premium accounts and savings marketplaces. True Instant EA accounts are True EA accounts which advertise immediate deposit and withdrawal times 24/7. Red highlights are accounts whose interest rate has lowered, green highlights those which have been raised, and blue highlights are those which are new to the respective table.Some surprise moves since last time, leading to mean top rates actually being higher than last month's.Next MPC meeting next Thursday 19th.0

True EA accounts are easy access savings accounts which can be opened, and the headline rate earned, from a balance of just £1, and allow unlimited deposits and withdrawals. This table excludes accounts limited to smaller balances, paid-for/premium accounts and savings marketplaces. True Instant EA accounts are True EA accounts which advertise immediate deposit and withdrawal times 24/7. Red highlights are accounts whose interest rate has lowered, green highlights those which have been raised, and blue highlights are those which are new to the respective table.Some surprise moves since last time, leading to mean top rates actually being higher than last month's.Next MPC meeting next Thursday 19th.0 -

Cobbler_tone said:

Where is the 4.75% for Chase coming from? I'm a first issue member since the off. The best they have is a 4.5% boost, that ends mid-Jan 2025. I don't like to miss a trick!ircE said: True EA accounts are easy access savings accounts which can be opened, and the headline rate earned, from a balance of just £1, and allow unlimited deposits and withdrawals. This table excludes accounts limited to smaller balances, paid-for/premium accounts and savings marketplaces. True Instant EA accounts are True EA accounts which advertise immediate deposit and withdrawal times 24/7. Red highlights are accounts whose interest rate has lowered, green highlights those which have been raised, and blue highlights are those which are new to the respective table.Some surprise moves since last time, leading to mean top rates actually being higher than last month's.Next MPC meeting next Thursday 19th.it's for new customers only.0

True EA accounts are easy access savings accounts which can be opened, and the headline rate earned, from a balance of just £1, and allow unlimited deposits and withdrawals. This table excludes accounts limited to smaller balances, paid-for/premium accounts and savings marketplaces. True Instant EA accounts are True EA accounts which advertise immediate deposit and withdrawal times 24/7. Red highlights are accounts whose interest rate has lowered, green highlights those which have been raised, and blue highlights are those which are new to the respective table.Some surprise moves since last time, leading to mean top rates actually being higher than last month's.Next MPC meeting next Thursday 19th.it's for new customers only.0 -

...and the close it down/reopen trick doesn't work anymore :'(janusdesign said:Cobbler_tone said:

Where is the 4.75% for Chase coming from? I'm a first issue member since the off. The best they have is a 4.5% boost, that ends mid-Jan 2025. I don't like to miss a trick!ircE said: True EA accounts are easy access savings accounts which can be opened, and the headline rate earned, from a balance of just £1, and allow unlimited deposits and withdrawals. This table excludes accounts limited to smaller balances, paid-for/premium accounts and savings marketplaces. True Instant EA accounts are True EA accounts which advertise immediate deposit and withdrawal times 24/7. Red highlights are accounts whose interest rate has lowered, green highlights those which have been raised, and blue highlights are those which are new to the respective table.Some surprise moves since last time, leading to mean top rates actually being higher than last month's.Next MPC meeting next Thursday 19th.it's for new customers only.0

True EA accounts are easy access savings accounts which can be opened, and the headline rate earned, from a balance of just £1, and allow unlimited deposits and withdrawals. This table excludes accounts limited to smaller balances, paid-for/premium accounts and savings marketplaces. True Instant EA accounts are True EA accounts which advertise immediate deposit and withdrawal times 24/7. Red highlights are accounts whose interest rate has lowered, green highlights those which have been raised, and blue highlights are those which are new to the respective table.Some surprise moves since last time, leading to mean top rates actually being higher than last month's.Next MPC meeting next Thursday 19th.it's for new customers only.0 -

Ah I see...no doubt their 3.5% will be sliced in Jan too. I'll be on the hunt for something fresh, although most of my monthly savings are going to regular savers.janusdesign said:Cobbler_tone said:

Where is the 4.75% for Chase coming from? I'm a first issue member since the off. The best they have is a 4.5% boost, that ends mid-Jan 2025. I don't like to miss a trick!ircE said: True EA accounts are easy access savings accounts which can be opened, and the headline rate earned, from a balance of just £1, and allow unlimited deposits and withdrawals. This table excludes accounts limited to smaller balances, paid-for/premium accounts and savings marketplaces. True Instant EA accounts are True EA accounts which advertise immediate deposit and withdrawal times 24/7. Red highlights are accounts whose interest rate has lowered, green highlights those which have been raised, and blue highlights are those which are new to the respective table.Some surprise moves since last time, leading to mean top rates actually being higher than last month's.Next MPC meeting next Thursday 19th.it's for new customers only.1

True EA accounts are easy access savings accounts which can be opened, and the headline rate earned, from a balance of just £1, and allow unlimited deposits and withdrawals. This table excludes accounts limited to smaller balances, paid-for/premium accounts and savings marketplaces. True Instant EA accounts are True EA accounts which advertise immediate deposit and withdrawal times 24/7. Red highlights are accounts whose interest rate has lowered, green highlights those which have been raised, and blue highlights are those which are new to the respective table.Some surprise moves since last time, leading to mean top rates actually being higher than last month's.Next MPC meeting next Thursday 19th.it's for new customers only.1 -

The standard Chase saving rate is now linked to the base rate. So the Bank of England changes its interest rate, Chase will change their rate as well.Cobbler_tone said:

Ah I see...no doubt their 3.5% will be sliced in Jan too.janusdesign said:Cobbler_tone said:

Where is the 4.75% for Chase coming from? I'm a first issue member since the off. The best they have is a 4.5% boost, that ends mid-Jan 2025. I don't like to miss a trick!ircE said: True EA accounts are easy access savings accounts which can be opened, and the headline rate earned, from a balance of just £1, and allow unlimited deposits and withdrawals. This table excludes accounts limited to smaller balances, paid-for/premium accounts and savings marketplaces. True Instant EA accounts are True EA accounts which advertise immediate deposit and withdrawal times 24/7. Red highlights are accounts whose interest rate has lowered, green highlights those which have been raised, and blue highlights are those which are new to the respective table.Some surprise moves since last time, leading to mean top rates actually being higher than last month's.Next MPC meeting next Thursday 19th.it's for new customers only.2

True EA accounts are easy access savings accounts which can be opened, and the headline rate earned, from a balance of just £1, and allow unlimited deposits and withdrawals. This table excludes accounts limited to smaller balances, paid-for/premium accounts and savings marketplaces. True Instant EA accounts are True EA accounts which advertise immediate deposit and withdrawal times 24/7. Red highlights are accounts whose interest rate has lowered, green highlights those which have been raised, and blue highlights are those which are new to the respective table.Some surprise moves since last time, leading to mean top rates actually being higher than last month's.Next MPC meeting next Thursday 19th.it's for new customers only.2 -

The problem being that Chase keep arbitrarily changing the percentage below the base rate that they pay, so the whole thing is pretty meaningless.gt94sss2 said:

The standard Chase saving rate is now linked to the base rate. So the Bank of England changes its interest rate, Chase will change their rate as well.Cobbler_tone said:

Ah I see...no doubt their 3.5% will be sliced in Jan too.janusdesign said:Cobbler_tone said:

Where is the 4.75% for Chase coming from? I'm a first issue member since the off. The best they have is a 4.5% boost, that ends mid-Jan 2025. I don't like to miss a trick!ircE said: True EA accounts are easy access savings accounts which can be opened, and the headline rate earned, from a balance of just £1, and allow unlimited deposits and withdrawals. This table excludes accounts limited to smaller balances, paid-for/premium accounts and savings marketplaces. True Instant EA accounts are True EA accounts which advertise immediate deposit and withdrawal times 24/7. Red highlights are accounts whose interest rate has lowered, green highlights those which have been raised, and blue highlights are those which are new to the respective table.Some surprise moves since last time, leading to mean top rates actually being higher than last month's.Next MPC meeting next Thursday 19th.it's for new customers only.2kWp Solar PV - 10*200W Kioto, SMA Sunny Boy 2000HF, SSE facing, some shading in winter, 37° pitch, installed Jun-2011, inverter replaced Sep-2017 AND Feb-2022.2

True EA accounts are easy access savings accounts which can be opened, and the headline rate earned, from a balance of just £1, and allow unlimited deposits and withdrawals. This table excludes accounts limited to smaller balances, paid-for/premium accounts and savings marketplaces. True Instant EA accounts are True EA accounts which advertise immediate deposit and withdrawal times 24/7. Red highlights are accounts whose interest rate has lowered, green highlights those which have been raised, and blue highlights are those which are new to the respective table.Some surprise moves since last time, leading to mean top rates actually being higher than last month's.Next MPC meeting next Thursday 19th.it's for new customers only.2kWp Solar PV - 10*200W Kioto, SMA Sunny Boy 2000HF, SSE facing, some shading in winter, 37° pitch, installed Jun-2011, inverter replaced Sep-2017 AND Feb-2022.2 -

Interesting. How many times have they changed it since they announced the linking?KevinG said:

The problem being that Chase keep arbitrarily changing the percentage below the base rate that they pay, so the whole thing is pretty meaningless.gt94sss2 said:

The standard Chase saving rate is now linked to the base rate. So the Bank of England changes its interest rate, Chase will change their rate as well.Cobbler_tone said:

Ah I see...no doubt their 3.5% will be sliced in Jan too.janusdesign said:Cobbler_tone said:

Where is the 4.75% for Chase coming from? I'm a first issue member since the off. The best they have is a 4.5% boost, that ends mid-Jan 2025. I don't like to miss a trick!ircE said: True EA accounts are easy access savings accounts which can be opened, and the headline rate earned, from a balance of just £1, and allow unlimited deposits and withdrawals. This table excludes accounts limited to smaller balances, paid-for/premium accounts and savings marketplaces. True Instant EA accounts are True EA accounts which advertise immediate deposit and withdrawal times 24/7. Red highlights are accounts whose interest rate has lowered, green highlights those which have been raised, and blue highlights are those which are new to the respective table.Some surprise moves since last time, leading to mean top rates actually being higher than last month's.Next MPC meeting next Thursday 19th.it's for new customers only.1

True EA accounts are easy access savings accounts which can be opened, and the headline rate earned, from a balance of just £1, and allow unlimited deposits and withdrawals. This table excludes accounts limited to smaller balances, paid-for/premium accounts and savings marketplaces. True Instant EA accounts are True EA accounts which advertise immediate deposit and withdrawal times 24/7. Red highlights are accounts whose interest rate has lowered, green highlights those which have been raised, and blue highlights are those which are new to the respective table.Some surprise moves since last time, leading to mean top rates actually being higher than last month's.Next MPC meeting next Thursday 19th.it's for new customers only.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.7K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards