We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Santander £185 Switch Offer: 18/03/24

Comments

-

Basically cashback sites get money for promoting products/services, and a bit of this money is passed onto people who buy those products/services when they click through the cashback website. It's actually a good idea to use cashback sites for things you were going to buy anyway. Just don't let the tail wag the dog as they say (or in other words, don't feel tempted to buy stuff just because there's a cashback offer). But for things you're going to buy regardless, it's always worth checking to see if you can get cashback. If Topcashback don't have any cashback available for something then Quidco might. Also be aware that there's some kind of "plus" subscription that takes a bit of cashback away as payment every month but gives you a slightly higher cashback rate plus some other perks. Unless you buy a lot of things it's probably not worth it and will cost you more than you get back, so best to opt out of that.eastcorkram said:

Even though I've been on this forum for quite some time, I've no idea what Top cashback is .pecunianonolet said:

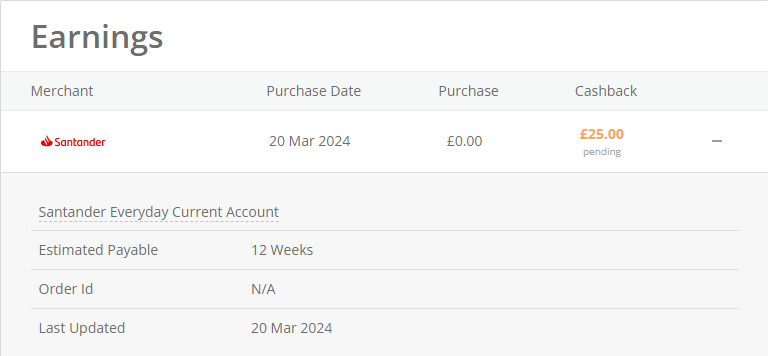

Topcashback gives £25 cashback so you could make £210 in total out of this offer.danny13579 said:

Yes.12Charlen80 said:I have the edge saving account already that I’ve recently opened. Would I be able to open the everyday account and switch in from another bank for the switch offer? Thanks

I've just had a look at it, and still not sure I understand it! Though it does seem to involve buying something, so probably rules me out 😄1 -

Yes, when you buy something online or in this case open a new account you have two options:eastcorkram said:

Even though I've been on this forum for quite some time, I've no idea what Top cashback is .pecunianonolet said:

Topcashback gives £25 cashback so you could make £210 in total out of this offer.danny13579 said:

Yes.12Charlen80 said:I have the edge saving account already that I’ve recently opened. Would I be able to open the everyday account and switch in from another bank for the switch offer? Thanks

I've just had a look at it, and still not sure I understand it! Though it does seem to involve buying something, so probably rules me out 😄

1. Head to Santander and open a new account, get all the requirements sorted and if all goes to plan Santander is going to pay you £185

2. You head to Top Cashback (easier if you already have an account) and sign up or sign in. You go and type Santander in the search box and select the account you'd wish to open and click on "Get £25 Cashback". The site is now going to redirect you to Santander. You open your account as usual or as you would do in 1). Again, if all goes well your transaction is tracked and shows £25 as pending transaction. In around 12 weeks time if all went ok TopCashback is adding £25 to your account and you can withdraw to your bank account.

Essentially, for somebody signed up it is an affair of 30 seconds to grab another £25

I have made hundreds of pounds with TCB over the years for all sorts of things, booking travel, opening bank accounts, and many more.

3 -

Plan on doing this in in the not to distant future and went to the Santander website to read about it. Unfortunately does seem to be pretty clear that existing customers need to visit a branch to qualify for this offer. Very annoying, I will still do it though.0

-

That is for switching to an existing account. You should be able to open a new account (and switch in) from the website or online banking, many have done this already, including me. An Everyday Current Account may be the best option purely for the switch, no fee, can have several.@fun4everyone said:Plan on doing this in in the not to distant future and went to the Santander website to read about it. Unfortunately does seem to be pretty clear that existing customers need to visit a branch to qualify for this offer. Very annoying, I will still do it though.

Edit: P.S. You should be aware that a hard search is done on your credit file(s) when opening a new Santander current account, how important that is depends on your circumstances and borrowing/mortgaging outlook. Refusing an overdraft facility with the account may potentially limit any impact. This is a whole topic on its own and covered comprehensively in dedicated threads. I myself have opened many current accounts in short spaces of time and have never been refused accounts or credit.2 -

I hope thats true. The wording on https://www.santander.co.uk/about-santander/media-centre/press-releases/santander-launches-ps185-switcher-offer-for-new-and does say "Existing Santander UK customers must visit a branch to take advantage of this offer." To me I am an existing customer and therefore must visit a branch.dealyboy said:

That is for switching to an existing account. You should be able to open a new account (and switch in) from the website or online banking, many have done this already, including me. An Everyday Current Account may be the best option purely for the switch, no fee, can have several.@fun4everyone said:Plan on doing this in in the not to distant future and went to the Santander website to read about it. Unfortunately does seem to be pretty clear that existing customers need to visit a branch to qualify for this offer. Very annoying, I will still do it though.

Not saying your wrong dealyboy, in fact I am sure you are correct, but if so that page is badly worded imo.0 -

Note my edit @fun4everyonedealyboy said:

That is for switching to an existing account. You should be able to open a new account (and switch in) from the website or online banking, many have done this already, including me. An Everyday Current Account may be the best option purely for the switch, no fee, can have several.@fun4everyone said:Plan on doing this in in the not to distant future and went to the Santander website to read about it. Unfortunately does seem to be pretty clear that existing customers need to visit a branch to qualify for this offer. Very annoying, I will still do it though.

Edit: P.S. You should be aware that a hard search is done on your credit file(s) when opening a new Santander current account, how important that is depends on your circumstances and borrowing/mortgaging outlook. Refusing an overdraft facility with the account may potentially limit any impact. This is a whole topic on its own and covered comprehensively in dedicated threads. I myself have opened many current accounts in short spaces of time and have never been refused accounts or credit. . 0

. 0 -

Yes, I am aware of the possibility of a hard search and what it means when applying for a current account. I've opened lots of bank accounts up over the years as well (although miniscule amounts in comparison to most on here). Funnily enough I opened several current accounts recently. Only a couple hard searched me.dealyboy said:

Note my edit @fun4everyonedealyboy said:

That is for switching to an existing account. You should be able to open a new account (and switch in) from the website or online banking, many have done this already, including me. An Everyday Current Account may be the best option purely for the switch, no fee, can have several.@fun4everyone said:Plan on doing this in in the not to distant future and went to the Santander website to read about it. Unfortunately does seem to be pretty clear that existing customers need to visit a branch to qualify for this offer. Very annoying, I will still do it though.

Edit: P.S. You should be aware that a hard search is done on your credit file(s) when opening a new Santander current account, how important that is depends on your circumstances and borrowing/mortgaging outlook. Refusing an overdraft facility with the account may potentially limit any impact. This is a whole topic on its own and covered comprehensively in dedicated threads. I myself have opened many current accounts in short spaces of time and have never been refused accounts or credit. .

.

EDIT : That Santander page is annoyingly badly worded.0 -

I'm giving it a go as a serial bank swapper since 2014 I can't resist even though I and my wife have both had bonuses before. I did make an error tis time by thinking I could do the swap later after opening the accounts. It turns out you need to visit a branch. I therefore opened another two accounts and switched there and then. I am not expecting bonus but 4 Topcashback have tracked so maybe £100 with any luck.Cheers!!!1

-

It is worded for existing customers switching to an existing account. They probably expect existing customers to just want to switch to their existing account, and not be opening accounts, but by opening a new account online it means that you don’t need to make an appointment at a branch.fun4everyone said:

Yes, I am aware of the possibility of a hard search and what it means when applying for a current account. I've opened lots of bank accounts up over the years as well (although miniscule amounts in comparison to most on here). Funnily enough I opened several current accounts recently. Only a couple hard searched me.dealyboy said:

Note my edit @fun4everyonedealyboy said:

That is for switching to an existing account. You should be able to open a new account (and switch in) from the website or online banking, many have done this already, including me. An Everyday Current Account may be the best option purely for the switch, no fee, can have several.@fun4everyone said:Plan on doing this in in the not to distant future and went to the Santander website to read about it. Unfortunately does seem to be pretty clear that existing customers need to visit a branch to qualify for this offer. Very annoying, I will still do it though.

Edit: P.S. You should be aware that a hard search is done on your credit file(s) when opening a new Santander current account, how important that is depends on your circumstances and borrowing/mortgaging outlook. Refusing an overdraft facility with the account may potentially limit any impact. This is a whole topic on its own and covered comprehensively in dedicated threads. I myself have opened many current accounts in short spaces of time and have never been refused accounts or credit. .

.

EDIT : That Santander page is annoyingly badly worded.0 -

I already have a joint account on Santander. Do you think opening a new account will still trigger a hard search?dealyboy said:

That is for switching to an existing account. You should be able to open a new account (and switch in) from the website or online banking, many have done this already, including me. An Everyday Current Account may be the best option purely for the switch, no fee, can have several.@fun4everyone said:Plan on doing this in in the not to distant future and went to the Santander website to read about it. Unfortunately does seem to be pretty clear that existing customers need to visit a branch to qualify for this offer. Very annoying, I will still do it though.

Edit: P.S. You should be aware that a hard search is done on your credit file(s) when opening a new Santander current account, how important that is depends on your circumstances and borrowing/mortgaging outlook. Refusing an overdraft facility with the account may potentially limit any impact. This is a whole topic on its own and covered comprehensively in dedicated threads. I myself have opened many current accounts in short spaces of time and have never been refused accounts or credit.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards