What happens now?

We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Santander £185 Switch Offer: 18/03/24

Comments

-

Your credit report will show if you have ever had a Santander Current Account under Credit Accounts>Closed.FIREmenow said:Thinking of going for this one.For those serial switchers, does anyone have a full record of Santander's past switcher deals please? I haven't done any for years, but did quite a few in the past but can't remember when or if one was Santander. 0

0 -

You have to assume they have included this term after analysing data from previous switch offers and concluded it is the correct strategic decision? I am inclined to agree since most of us now have donor accounts that we use for these switch offers but also have "keepers" that offer long term value as I do with the Santander Edge. But if you still disagree you could apply to be Santander's strategic commercial director and reverse the decision7sefton said:Santander need to learn they can’t be too sniffy with disqualifying previous switchers. I switched over 5 years ago to them, and would consider switching back to them and staying with their Edge account. But won’t if they won’t pay me the bonus. They need to update their world view: switching every few years is the new norm 3

3 -

If I have an existing Edge account as a joint account, could both myself and my partner switch in a current account and then both get the £185 bonus? i.e. - Would we get £370?0

-

Because what I read I had in mind existing customer.RG2015 said:

Why not just open a new Everyday account online for a £185 payday.B0bbyEwing said:Saw the title & fancied taking them up on the offer.

Then I see on page 1 I'm to either go in branch or phone them up because I have an existing account.

No thanks, can't be bothered with that. I should be able to just fill a form out & that's that.

I'd jump through the DD hoops but I can't be faffed with the other hurdles.

Stick end of and wrong. 0

0 -

Was he/she sacked ?blueste said:

You have to assume they have included this term after analysing data from previous switch offers and concluded it is the correct strategic decision? I am inclined to agree since most of us now have donor accounts that we use for these switch offers but also have "keepers" that offer long term value as I do with the Santander Edge. But if you still disagree you could apply to be Santander's strategic commercial director and reverse the decision7sefton said:Santander need to learn they can’t be too sniffy with disqualifying previous switchers. I switched over 5 years ago to them, and would consider switching back to them and staying with their Edge account. But won’t if they won’t pay me the bonus. They need to update their world view: switching every few years is the new norm 0

0 -

I suspect Santander are encouraging the take up of the Edge current account, because as has rightly been pointed out the criteria for the switch are similar to the requirements of the Edge C/A, however @pecunianonolet you should be able to avoid the triggering of the charge and pay-in requirement by paying in £1,500 in bits, each bit being less than £500.pecunianonolet said:

Thanks and if the fee doesn't stop even if the requirements are no longer met it has to be a new account, which I was trying to avoid and was hoping I can just switch in to my Edge account. The extra £25 cashback will be sweeten the deal indeed. Going to a branch would be easy for me as we as we still got one, even a newly refurbished branch.FIREmenow said:

I asked something similar on a thread about the Edge Saver when someone mentioned this no-fee loophole.pecunianonolet said:

Good point made here.SaveTheEuro said:

Is this so that a staff member can review one's existing accounts with Santander and highlight how you never set up direct debits or paid a monthly fee on your Edge account (yet still qualified for the saver account earning 7% interests on balances up to £4,000)?Lumiona said:I have been with Santander for years but haven't had any incentives from them so I'm planning on giving it a try, however the website is saying that current customers have to do the switch in branch which seems bizarre.

The Edge current account was needed to get the edge saver at the time.

There were many pages of debate concluding that if you don't set up direct debits the fee will never materialise. Indeed I use my Edge current account regularly but as I don't have direct debits set up I never paid any fee.

Santander says:We’ll take care of your switch, using the Current Account Switch Service. 60 days after you tell us to switch your account, we’ll check to make sure you’re eligible and then pay £185 into your account within the next 30 days.So, to me this sounds like from the day you initiated the switch, e.g. 20th March, they check in 60 days eligibility so 20th May and pay within 30 days after if all good. That would take it to 20th June (if they take the full 30 days).

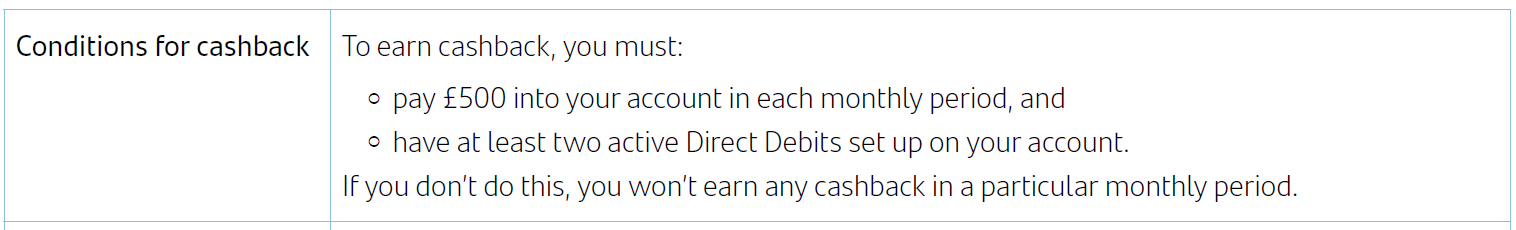

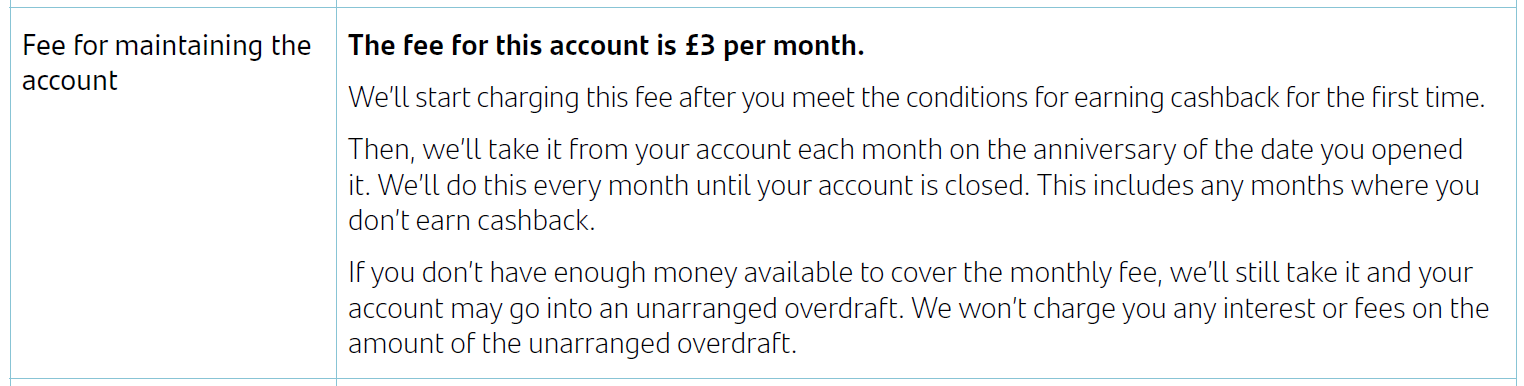

The Edge page saysPay a £3 monthly fee to maintain the account yAs I have to now set up 2 direct debits and have to make a £1500 one off pay in, it sounds like that for at least 1 month they would charge the fee (if I only pay in the £1500 in one month but stay under £500 the other 2 months).

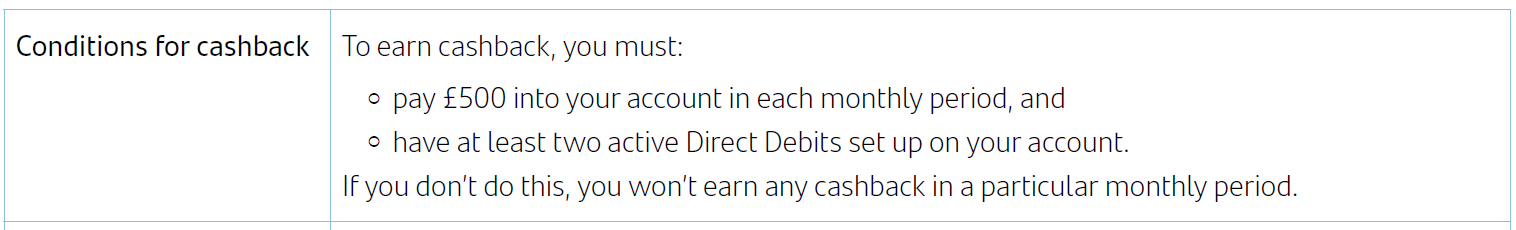

Pay at least £500 into your account each month

Have 2 active Direct Debits

With regular use above the £500 monthly it looks like that I should better calculate with 3 months of having to pay a fee. Once the incentive has been paid I should be able to move the 2 direct debits and the account should be fee free again?

Looks like the only other way would be to open a new Everyday Current account and switch into this one to avoid the fee at the expense of a hard search or accept that the incentive would be £176 (£185 incentive - £9 account fee over 3 months).

Does this make sense or am I overcomplicating things?

At least one person said that on one of their 123 accounts, which also has the loophole, once you have started paying the monthly fee it doesn't stop again even if you stop meeting the terms, so I don't think you will be able to start and then stop the fees. But haven't seen anyone confirm for the Edge account.

If it helps sweeten the deal, you can also get £25 from topcashback.

I've applied as the £185+ £25 + about £40 pa more interest on the Edge Saver than my other easy access means it's worth it for as long as the Saver rate stays competitive even with the monthly fee.

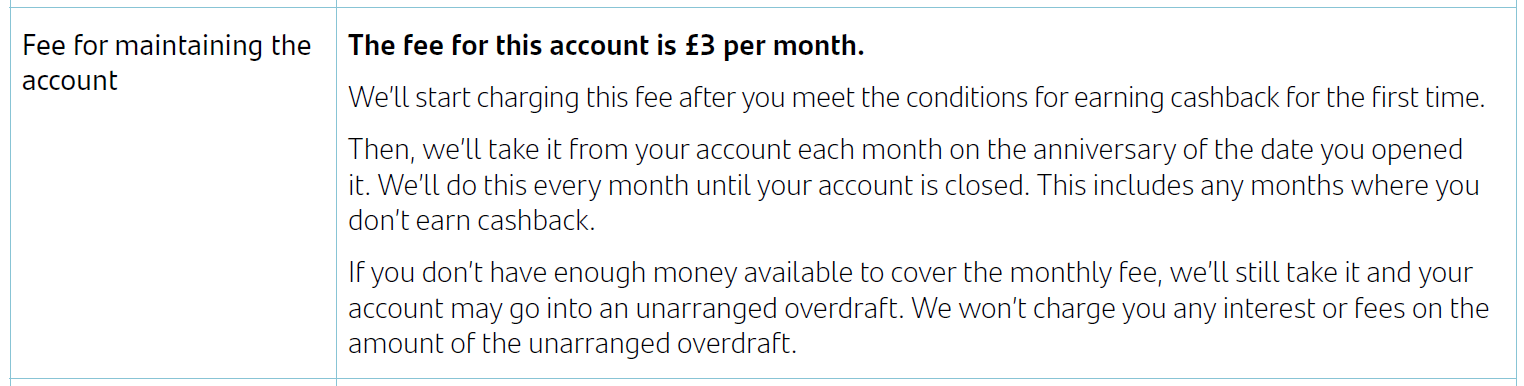

According to the key facts document ...

Don't pay-in £500 and you won't meet the first condition for cashback for the first time.

You may need to go to a branch to switch to your pre-existing Edge account according to the Switcher terms, but I have read you may be able to do this over the phone.

Edit: On second thoughts I don't think this will work because you would have to keep your payment below £500 each month and you only have 60 days for the £1,500.0 -

Can the two required direct debits be set up on the new Santander account now or should I wait until after the switch completes?0

-

I think you should be able to do it now, I have changed one of my DDs.@SickGroove said:Can the two required direct debits be set up on the new Santander account now or should I wait until after the switch completes?

The Welcome e-mail had this ...Your account is ready to use. We'll send you your bank card and PIN in the next 5-7 days.If you’re not already registered for Online Banking, we’ll send your log on details to you in a few days.Here’s what you can do using Online and Mobile Banking.Our convenient and secure Online and Mobile Banking service lets you:--•--view your balances and transactions--•--pay your bills--•--set up or change Direct Debits--•--plus a range of other features like FREE account alerts to your mobile phone or email1 -

I have opened just the simple current account and gave switch details. Was open in seconds, switch confirmed and account was visible in the app straight away. Was trying to avoid another hard search to clear up my credit file a bit but in the end the capitalist in me won.dealyboy said:

I suspect Santander are encouraging the take up of the Edge current account, because as has rightly been pointed out the criteria for the switch are similar to the requirements of the Edge C/A, however @pecunianonolet you should be able to avoid the triggering of the charge and pay-in requirement by paying in £1,500 in bits, each bit being less than £500.pecunianonolet said:

Thanks and if the fee doesn't stop even if the requirements are no longer met it has to be a new account, which I was trying to avoid and was hoping I can just switch in to my Edge account. The extra £25 cashback will be sweeten the deal indeed. Going to a branch would be easy for me as we as we still got one, even a newly refurbished branch.FIREmenow said:

I asked something similar on a thread about the Edge Saver when someone mentioned this no-fee loophole.pecunianonolet said:

Good point made here.SaveTheEuro said:

Is this so that a staff member can review one's existing accounts with Santander and highlight how you never set up direct debits or paid a monthly fee on your Edge account (yet still qualified for the saver account earning 7% interests on balances up to £4,000)?Lumiona said:I have been with Santander for years but haven't had any incentives from them so I'm planning on giving it a try, however the website is saying that current customers have to do the switch in branch which seems bizarre.

The Edge current account was needed to get the edge saver at the time.

There were many pages of debate concluding that if you don't set up direct debits the fee will never materialise. Indeed I use my Edge current account regularly but as I don't have direct debits set up I never paid any fee.

Santander says:We’ll take care of your switch, using the Current Account Switch Service. 60 days after you tell us to switch your account, we’ll check to make sure you’re eligible and then pay £185 into your account within the next 30 days.So, to me this sounds like from the day you initiated the switch, e.g. 20th March, they check in 60 days eligibility so 20th May and pay within 30 days after if all good. That would take it to 20th June (if they take the full 30 days).

The Edge page saysPay a £3 monthly fee to maintain the account yAs I have to now set up 2 direct debits and have to make a £1500 one off pay in, it sounds like that for at least 1 month they would charge the fee (if I only pay in the £1500 in one month but stay under £500 the other 2 months).

Pay at least £500 into your account each month

Have 2 active Direct Debits

With regular use above the £500 monthly it looks like that I should better calculate with 3 months of having to pay a fee. Once the incentive has been paid I should be able to move the 2 direct debits and the account should be fee free again?

Looks like the only other way would be to open a new Everyday Current account and switch into this one to avoid the fee at the expense of a hard search or accept that the incentive would be £176 (£185 incentive - £9 account fee over 3 months).

Does this make sense or am I overcomplicating things?

At least one person said that on one of their 123 accounts, which also has the loophole, once you have started paying the monthly fee it doesn't stop again even if you stop meeting the terms, so I don't think you will be able to start and then stop the fees. But haven't seen anyone confirm for the Edge account.

If it helps sweeten the deal, you can also get £25 from topcashback.

I've applied as the £185+ £25 + about £40 pa more interest on the Edge Saver than my other easy access means it's worth it for as long as the Saver rate stays competitive even with the monthly fee.

According to the key facts document ...

Don't pay-in £500 and you won't meet the first condition for cashback for the first time.

You may need to go to a branch to switch to your pre-existing Edge account according to the Switcher terms, but I have read you may be able to do this over the phone.

Edit: On second thoughts I don't think this will work because you would have to keep your payment below £500 each month and you only have 60 days for the £1,500.

I have basically done all switches last year but missed out on Santander as I was on holiday so this is most likely the last one for me for the next couple of years and £185 + £25 TCB is £210 I don't want to miss.0 -

Hello Pecunia ... as you may now know my suggestion wouldn't have worked anyway (I edited my post) ... trying to help for old time's sake@pecunianonolet said:

I have opened just the simple current account and gave switch details. Was open in seconds, switch confirmed and account was visible in the app straight away. Was trying to avoid another hard search to clear up my credit file a bit but in the end the capitalist in me won.dealyboy said:

I suspect Santander are encouraging the take up of the Edge current account, because as has rightly been pointed out the criteria for the switch are similar to the requirements of the Edge C/A, however @pecunianonolet you should be able to avoid the triggering of the charge and pay-in requirement by paying in £1,500 in bits, each bit being less than £500.pecunianonolet said:

Thanks and if the fee doesn't stop even if the requirements are no longer met it has to be a new account, which I was trying to avoid and was hoping I can just switch in to my Edge account. The extra £25 cashback will be sweeten the deal indeed. Going to a branch would be easy for me as we as we still got one, even a newly refurbished branch.FIREmenow said:

I asked something similar on a thread about the Edge Saver when someone mentioned this no-fee loophole.pecunianonolet said:

Good point made here.SaveTheEuro said:

Is this so that a staff member can review one's existing accounts with Santander and highlight how you never set up direct debits or paid a monthly fee on your Edge account (yet still qualified for the saver account earning 7% interests on balances up to £4,000)?Lumiona said:I have been with Santander for years but haven't had any incentives from them so I'm planning on giving it a try, however the website is saying that current customers have to do the switch in branch which seems bizarre.

The Edge current account was needed to get the edge saver at the time.

There were many pages of debate concluding that if you don't set up direct debits the fee will never materialise. Indeed I use my Edge current account regularly but as I don't have direct debits set up I never paid any fee.

Santander says:We’ll take care of your switch, using the Current Account Switch Service. 60 days after you tell us to switch your account, we’ll check to make sure you’re eligible and then pay £185 into your account within the next 30 days.So, to me this sounds like from the day you initiated the switch, e.g. 20th March, they check in 60 days eligibility so 20th May and pay within 30 days after if all good. That would take it to 20th June (if they take the full 30 days).

The Edge page saysPay a £3 monthly fee to maintain the account yAs I have to now set up 2 direct debits and have to make a £1500 one off pay in, it sounds like that for at least 1 month they would charge the fee (if I only pay in the £1500 in one month but stay under £500 the other 2 months).

Pay at least £500 into your account each month

Have 2 active Direct Debits

With regular use above the £500 monthly it looks like that I should better calculate with 3 months of having to pay a fee. Once the incentive has been paid I should be able to move the 2 direct debits and the account should be fee free again?

Looks like the only other way would be to open a new Everyday Current account and switch into this one to avoid the fee at the expense of a hard search or accept that the incentive would be £176 (£185 incentive - £9 account fee over 3 months).

Does this make sense or am I overcomplicating things?

At least one person said that on one of their 123 accounts, which also has the loophole, once you have started paying the monthly fee it doesn't stop again even if you stop meeting the terms, so I don't think you will be able to start and then stop the fees. But haven't seen anyone confirm for the Edge account.

If it helps sweeten the deal, you can also get £25 from topcashback.

I've applied as the £185+ £25 + about £40 pa more interest on the Edge Saver than my other easy access means it's worth it for as long as the Saver rate stays competitive even with the monthly fee.

According to the key facts document ...

Don't pay-in £500 and you won't meet the first condition for cashback for the first time.

You may need to go to a branch to switch to your pre-existing Edge account according to the Switcher terms, but I have read you may be able to do this over the phone.

Edit: On second thoughts I don't think this will work because you would have to keep your payment below £500 each month and you only have 60 days for the £1,500.

I have basically done all switches last year but missed out on Santander as I was on holiday so this is most likely the last one for me for the next couple of years and £185 + £25 TCB is £210 I don't want to miss. Santander were my original bank before I started my switch run and I have done the same as you, shouldn't be too bad ... I guess you always say no to an overdraft, like me. 0

Santander were my original bank before I started my switch run and I have done the same as you, shouldn't be too bad ... I guess you always say no to an overdraft, like me. 0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards