We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Moving on with things

Comments

-

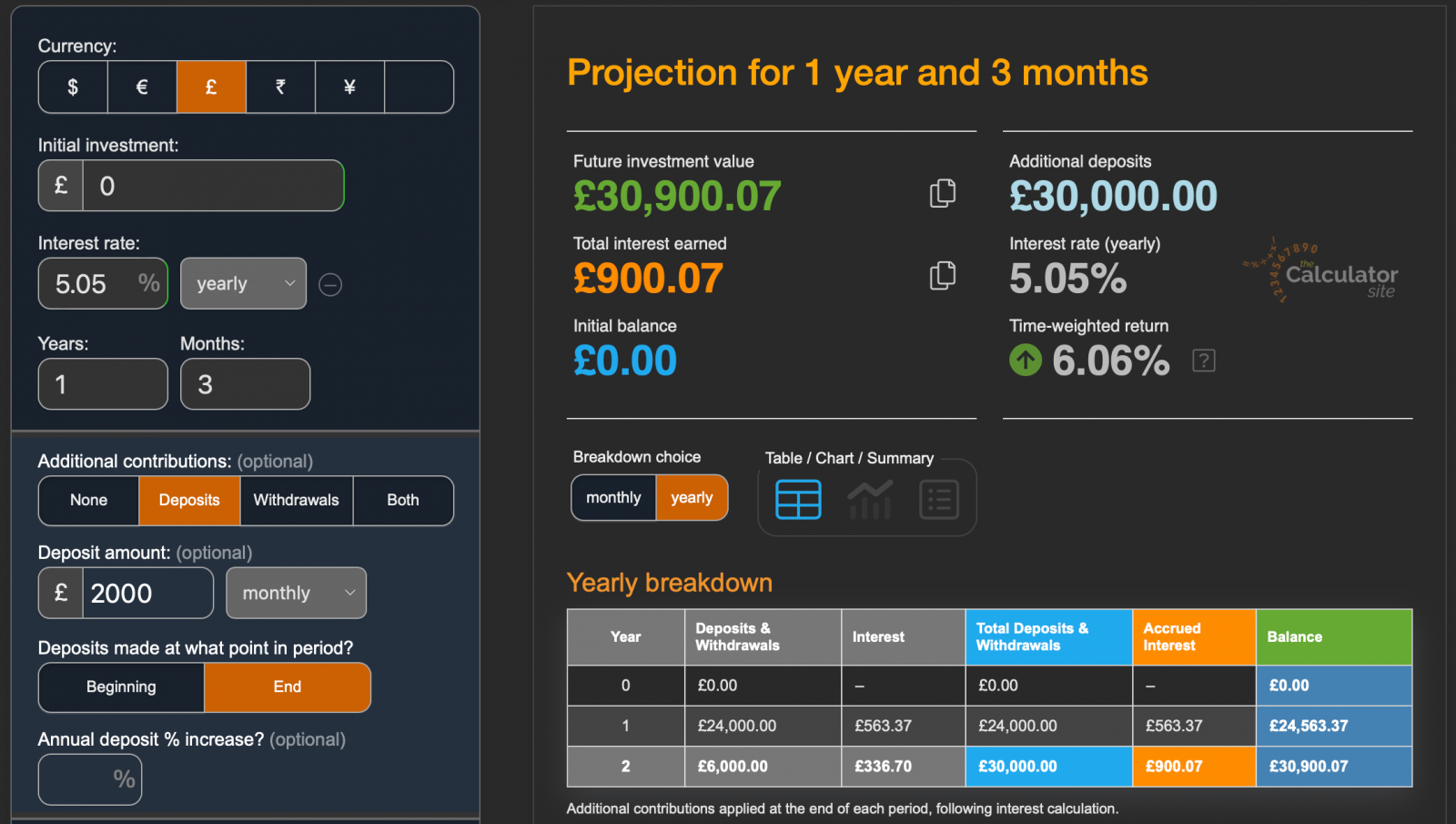

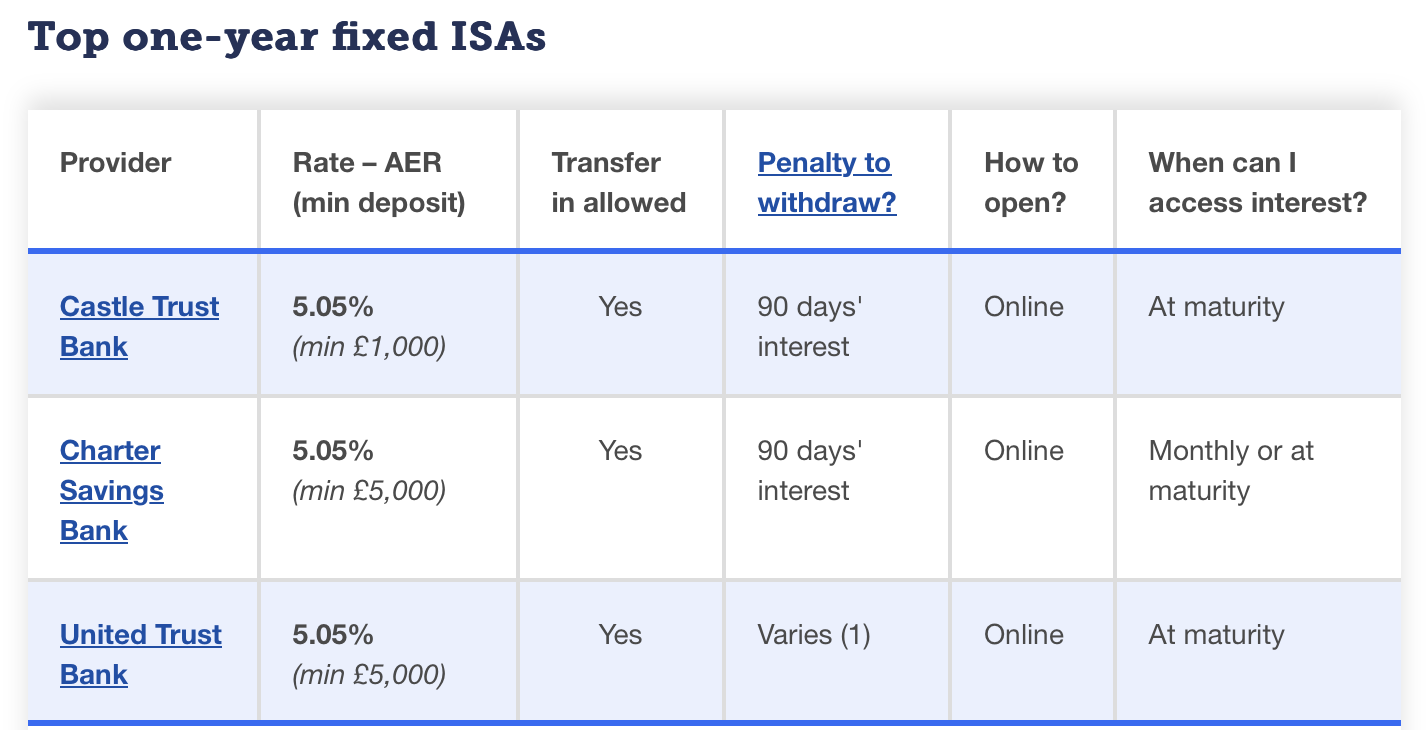

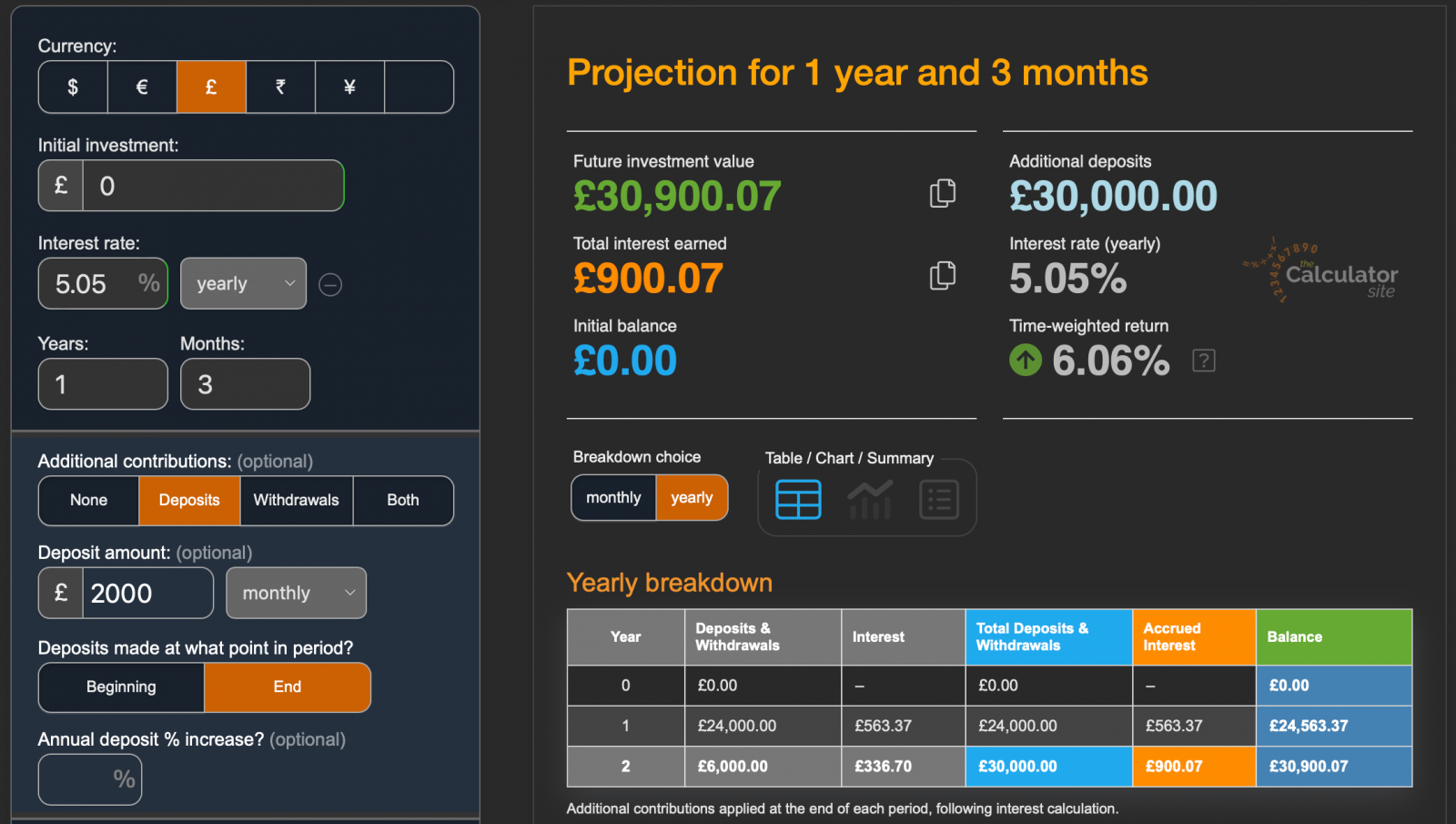

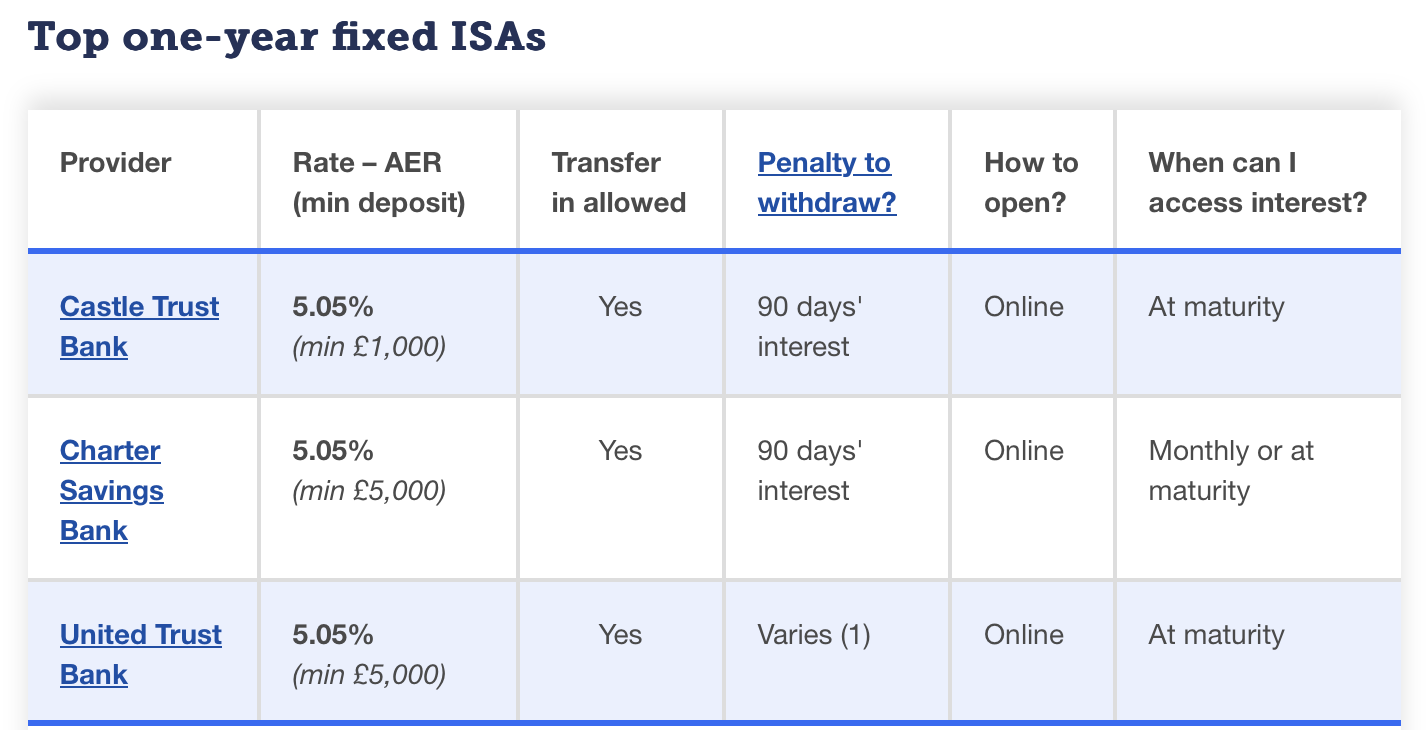

Appreciate this is going down the easy Cash ISA road and assuming the rate continues for another 3 months (few easy access at those kind of rates) rather than anything more risky/ higher yielding but £900 for doing !!!!!! all, seems very tempting rn.0 -

If it was me I would prefer to pay the minimum to the card and save the rest and make a bit of free money. I know I am disciplined enough to not touch the money. I would look for an ISA which I could withdraw from quickly in case my situation or mindset changed so I could access the money promptly if I wished to clear the card.

Remember you won't have the whole £2k a month to save as you will need to make the minimum payment.

Only you can decide which is best for you and your family.Fashion on a ration 2025 0/66 coupons spent

79.5 coupons rolled over 4/75.5 coupons spent - using for secondhand purchases

One income, home educating family2 -

Perhaps you could do a half and half strategy. Pay half into the ISA and half off the cards. That way you can still see the card balance dropping but at the same time you are saving.1

-

I also would be able to save and not touch it.

However something tells me it might not be right for you just yet, that the build up of cash might trigger some thoughts that aren't great for you. I know that's not very specific and might be over cautious but its going so well at the moment as it is. Perhaps you could do both? Half to debt, half to savings.1 -

Ha ha , great minds think alike

1

1 -

Wow what a difference to when you started. That card will be gone this year unless as you say you reduce repayments to £1k a month to repay within the 15 month deal period and save/invest the other £1k. Well done.alt80 said:It's been an ok day, not great but not bad either. I am buzzing to have got the transfers done better late than never. One card remaining with a 0% balance, under £15k. Well, under £14.5k just. Idk how I've got here. There is a part of me tempted just to pay the minimum and clear the balance at the end of the 0% in 15 months time whilst accruing the c.£2k a month in an ISA paying about 5% until I've got the balance just sitting there waiting to go. Make a bit of free money from the bank for once in my life, ha. Tbf I think just getting it gone will probably be better for my mindset but idk it's tempting.

March 24

Card Balances

CC1 ………………………….£14,490 (0% for 15 months)

CC2 ………………………….£0 (Cleared)

CC3…………………………..£0 (Day-to-day card, not overspent, so no balance accrued)

CC4 ………………………….£0 (Bye!)

Total Card Balance…………£14,490

Total Reduction in March….£2,010

If I recall part of your mortgage is on interest only so is it your plan to repay that after the cards are gone?I’m a Forum Ambassador and I support the Forum Team on the Debt free Wannabe, Budgeting and Banking and Savings and Investment boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.

Save £12k in 2026 Challenge £12000/£2000

365 day 1p Challenge 2026 £667.95/£110

Click on this link for a Statement of Accounts that can be posted on the DebtFree Wannabe board: https://lemonfool.co.uk/financecalculators/soa.php1 -

It's good you wouldn't be tempted. So much more disciplined than me!

I think the others have a point of considering half and half. Could support your mindset of saving and paying off together.

XSeptember 2017 Debt = £25330

Starting afresh.

You can do anything if you put your mind to it. x1 -

Normally fixed rate ISAs don’t allow monthly deposits. They are usually for a lump sum. You can only put in £20k in one ISA too each year. Regular savers may be worth exploring but you would need to open several. You can’t get them in an ISA wrapper but you should have a personal savings allowance each year anyway depending on your tax status.alt80 said:

Appreciate this is going down the easy Cash ISA road and assuming the rate continues for another 3 months (few easy access at those kind of rates) rather than anything more risky/ higher yielding but £900 for doing !!!!!! all, seems very tempting rn.I’m a Forum Ambassador and I support the Forum Team on the Debt free Wannabe, Budgeting and Banking and Savings and Investment boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.

Save £12k in 2026 Challenge £12000/£2000

365 day 1p Challenge 2026 £667.95/£110

Click on this link for a Statement of Accounts that can be posted on the DebtFree Wannabe board: https://lemonfool.co.uk/financecalculators/soa.php1 -

Also to remember, if you chuck that £2k at the CC each month then that's only 7 months to pay it off, you'd still be able to put £2k a month into a saver/ISA afterwards, so you would only be losing the first 7 months of interest not the whole 15. Saying that, I would put it into an easy access saver or ISA if I was in your position then pay off the lump sum at the end of the 0%.

1 -

regular savings are quite good at the moment after being a little poorly. I started 2 for me and one for OH £650 a month at 6.5% and as the interest will be paid while I am not working will have £1000 interest that won't be taxed for me and £1000 for OH. You must be good at administering different money streams so wouldn't be too difficult to add another couple of banks for you and OH to get you well over £1K per month. Most regular savers allow you to close or withdraw 1-3 times so not locking it away.I think I saw you in an ice cream parlour

Drinking milk shakes, cold and long

Smiling and waving and looking so fine1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards