We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

C1 Scotland Inventory

Comments

-

see in bold above.jordanm90 said:Hello all,

Just a little background information before I list my questions below. I am the only executor. My mother owned her house, she didn't jointly own it she was the only owner. Her estate and belongings are to be left to me, my brother and sister.

Was wondering if anyone could help with a few sections of the C1 form I'm unsure of. I am my mothers executor and I am named on her will. However, my address has changed and is different to the one mentioned on her will. I'm struggling with the wording for section 2 of the declaration which begins "That I am". Can anyone assist with this? I've seen previous comments with the wording but none that include how to word it with a change of address.In said will I am designed as residing at [address] a former address.

You will find examples in the Grant of Confirmation thread

https://forums.moneysavingexpert.com/discussion/4965475/grant-of-confirmation/p69

The little section below which reads "have entered or" I have the option of 'are' or 'am'. These both seem pretty similar so I'm unsure of what to choose there.

am - if a single executor

If I've understood correctly, I don't have to fill out any of the IHT400 form as the value does not exceed £325,000. Am I correct to think this?If gross value of estate for IHT purposes is less than £325k (and other criteria are met) then it is an excepted estate and IHT400 not required.

https://www.gov.uk/valuing-estate-of-someone-who-died/check-type-of-estate#:~:text=What counts as an excepted,civil partner who died first

Sections 21 and 22 of the form, I have ticked yes for section 21 because the estate is not an excepted estate due to the value being less than £325,000, am I correct with this? Section 22 I'm unsure if this is a yes or no based on my previous answer. Sections 23, 24, 25 and 26 I have entered £0.00 as there is no IHT due as the value is less than £325,000, am I correct to think this?Box 21 is yes - if it is an excepted estate

Box 22 tick no if value for IHT less than £325k

The carried forward amount at the bottom of the inventory is £134,892.40. My mother had a funeral plan which covered the majority of her funeral expenses but not all, do I include the total amount of her funeral expenses in box 12 titled 'Less funeral expenses'?Box 23 - in many cases this will be the same as the gross value for confirmation (box 11). But where, for example, there are items such as non-exempt gifts, or property which passes by survivorship, this total will be greater than box 11.

Box 24 - This is the box 23 value minus funeral costs and liabilities. Where box 11 equals box 23, box 24 is likely to be same as box 15

In this case box 25 will have the same value as box 24.

In box 12 enter the additional funeral costs.0 -

@buddy9 thank you so much for replying so quickly. As I am the only executor, should I leave box 3 blank as there is no other executor or should I put something in there to acknowledge that I haven't missed anything?

my wording now looks like this for box 2:

the executor nominate of the said deceased conform to her will dated the 28th of June 2022 herewith exhibited and docquetted and signed by me as relative hereto and that I am the son of the said deceased. In said will I am designed as residing at (address)

For box 12, just to confirm I'm only entering the difference between the total cost of the funeral and the value of the funeral plan rather than the total cost of the funeral?

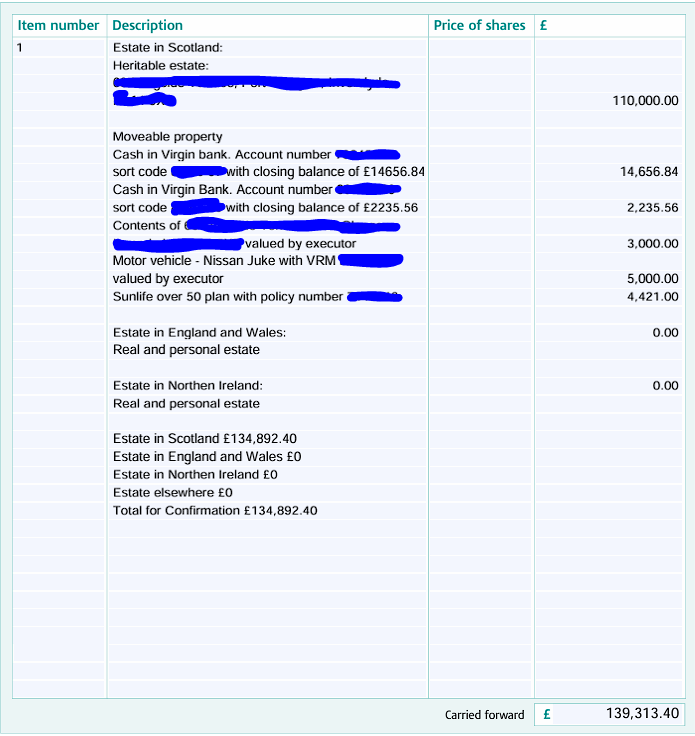

This is my inventory, could you tell me if this looks OK?

0 -

Apologies, after address I do have "a former address" after it.0

-

In the first box in para 3 enter your full name. Leave the second box empty. Strikethrough the words ‘along with the said’

Para 2 entry looks ok

Box 12 approach looks ok

Inventory

Based on the size of the entry, the house description (which is obscured) might be a bit short and capable of being improved. If in the land register something like:

Semi-detached Dwelling house 27 Small Street, Paisley PA2 5SA being the subjects described in the Land Register of Scotland under title number REN 0000

Valued by executor

If a flat, the description could be longer.

(I assume that you are certain that your mother is shown as the sole owner in the Land Register?)

Better to use ‘moveable estate’ rather than ‘moveable property’

The moveable estate items should be given list numbers in the first column.

I assume ‘Virgin Bank’ should read ‘Virgin Money’

If the Virgin Money accounts are in a Scottish branch they can be entered as estate in Scotland - and the branch should be included in the description. Otherwise they will be estate in England and Wales.

Best to include the Sun life policy under England and Wales.

The second column entry ‘estate elsewhere’ should appear after the ‘Total for Confirmation’ entry.

1 -

Thank you very much. I've made those changes. I now need a second page for the inventory because of the changes made, do you know where I can find this? And a question about this box below, is it only my name that goes into this box?

0

0 -

Your full name and address goes in the box.

There are extra inventory pages on the HMRC webpage (designated C2)

https://www.gov.uk/government/publications/inheritance-tax-confirmation-c1Or there is a version of the C1 with extra inventory pages (described as a combined C1 and C2). If you use this, you can omit the unused pages and manually renumber the final two pages.

1 -

Thanks very much, buddy9. I've since been paid approximately £800 from the DWP that was owed to my mother. Since this was paid into my bank account and not one of the two bank accounts belonging to my mother on the inventory, would I need to include this somewhere on the inventory and if so how would that be added?0

-

The inventory is a statement of the estate at the date of death so it usually doesn't matter how a payment is subsequently made. The amount should be listed as a separate item of estate.

Staff at different courts seem to have varying acceptance as to whether a DWP debt owing due to dwp underpayment should be shown as moveable estate in Scotland or as personal estate in England and Wales.

1 -

@buddy9 thank you so much, I couldn't have done this without your help. I'd say I'm 95% of the way there now with it.

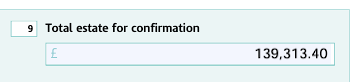

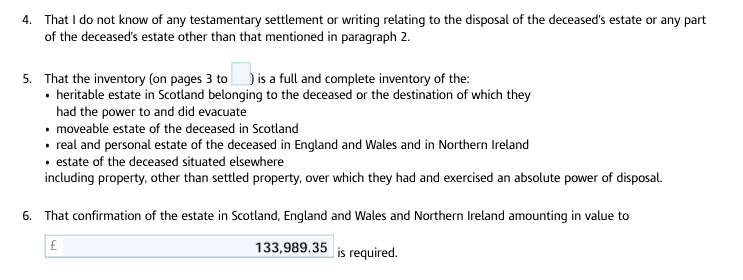

Can you advise the amount to go in this box below? The amount currently showing is the total estate which includes the funeral costs, is this correct?

Same question for the below image, this amount is the total amount not including the funeral costs. Should I leave that as it is or enter the full amount including funeral costs?

My mother wasn't self employed and never had been, is it OK to leave the unique tax payer reference box blank? I've entered her NI number of the box to the right of the UTR one.0 -

Box 11 on page 4, box 9 on page 1, and the box in para. 6 on page 2 all have the same value - the gross inventory total.

UTR can be shown as ‘Not Known’

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.7K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.2K Mortgages, Homes & Bills

- 178.2K Life & Family

- 260.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards