We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Child & Co RBS Branch to close

Comments

-

Deleted_User said:It's an entire product, the point I was trying to raise to you in the Barclays thread, but seemed to go over your head. A bank account is a product, if it is a premium product, all aspects should reflect that.What is? Royal Bank of Scotland aren't marketing Child & Co at all, leave alone as some sort of premium product.Even if they did, and having a fancy debit card/chequebook was part of that I very much doubt 'nicely printed statements' would be.2

-

You (and the other two likers) have missed my point I'm afraid. I was speaking generally, a produce is a whole. In the old days they knew how to do it. Even the statement is part of it, like when banks used to give you cheque book holders. Indeed Child and Co did at some stage long ago.WillPS said:Deleted_User said:It's an entire product, the point I was trying to raise to you in the Barclays thread, but seemed to go over your head. A bank account is a product, if it is a premium product, all aspects should reflect that.What is? Royal Bank of Scotland aren't marketing Child & Co at all, leave alone as some sort of premium product.Even if they did, and having a fancy debit card/chequebook was part of that I very much doubt 'nicely printed statements' would be.

Very obtuse people on these boards at times...0 -

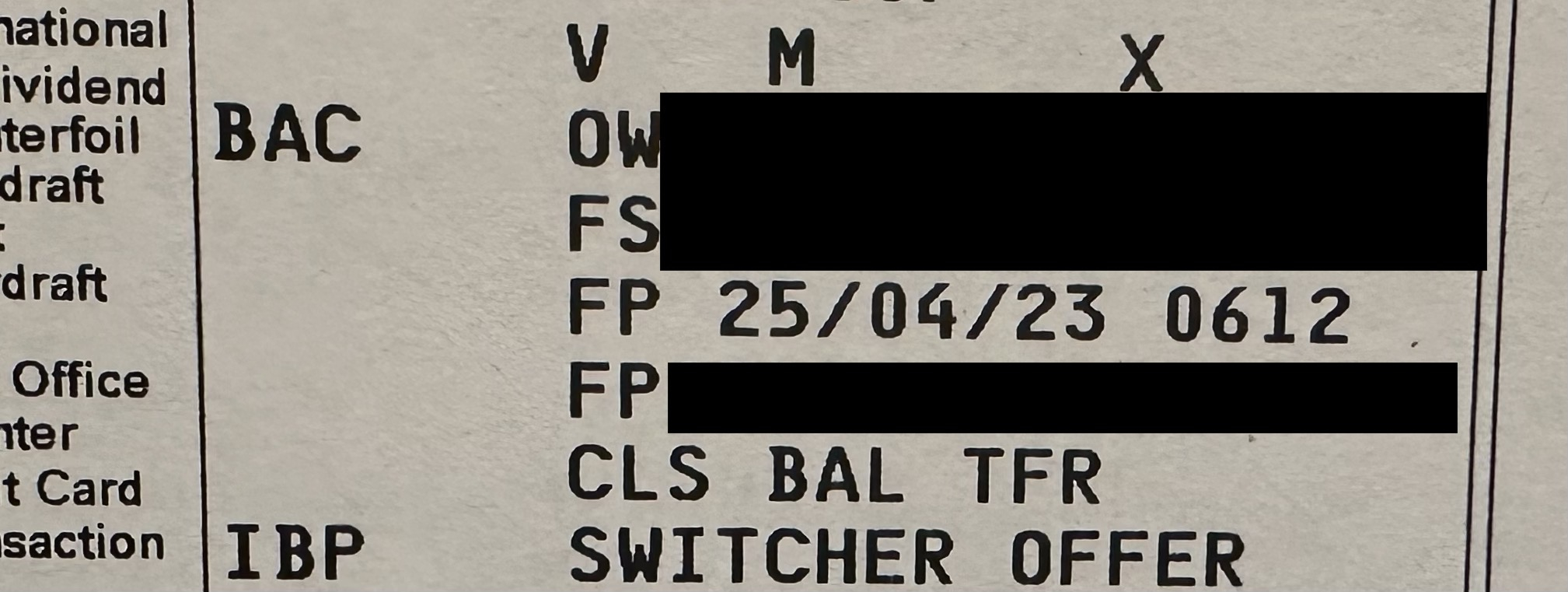

Ok I see what you mean now. The paper and printing are both higher quality on the old statements - however I think the formatting of the new statements is better - each transaction fits on 2 lines, on the old statements it could sometimes be 5 lines:PloughmansLunch said:If, like me, you like to spend your days looking at bank statements through a printer’s loupe, the difference is pretty striking. Bottom is the newer style.

0 -

Obtuse might be expecting a "premium" service when none was offered. Natwest Group clearly do not consider printed statements an integral part of their product range, and in fact I suspect would prefer you didn't have one at all.Deleted_User said:

You (and the other two likers) have missed my point I'm afraid. I was speaking generally, a produce is a whole. In the old days they knew how to do it. Even the statement is part of it, like when banks used to give you cheque book holders. Indeed Child and Co did at some stage long ago.WillPS said:Deleted_User said:It's an entire product, the point I was trying to raise to you in the Barclays thread, but seemed to go over your head. A bank account is a product, if it is a premium product, all aspects should reflect that.What is? Royal Bank of Scotland aren't marketing Child & Co at all, leave alone as some sort of premium product.Even if they did, and having a fancy debit card/chequebook was part of that I very much doubt 'nicely printed statements' would be.

Very obtuse people on these boards at times...

2 -

Deleted_User said:It's an entire product, the point I was trying to raise to you in the Barclays thread, but seemed to go over your head. A bank account is a product, if it is a premium product, all aspects should reflect that.

What other bank accounts in the £70k-£100k minimum salary range offer different statements (in terms of paper/printing) compared to their standard accounts?

All of the 'premium' accounts offer more than the standard accounts that are far more useful. For example, RBS offer a better rewards rate on their premier rewards account. HSBC offer free travel insurance and a higher interest free overdraft limit. Barclays offer an Avios current account that is only available to premier customers and also a a higher interest free overdraft limit. Based on my experience with all 3, it's also easier faster to call customer services versus the regular account.

I've also got experience with the tier up from Barclays Premier - Barclays Wealth. Apart from the statement having a slightly different colour scheme, the printing and paper remains identical to my previous premier account. What is useful is the more personal customer service - my dedicated private banker and his team are great, and I've also had a couple of very fancy free meals out courtesy of Little Book of Wonders. You also get £1000 interest free overdraft limit, and not that I've used it but the standard overdraft rate is 9.7%.

Seeing as paper statements are turned off by default on all new accounts, I can't really see anyone basing their decision on a premium account (even only slightly) based on the quality of the paper and printing of the statement. I also think its a perfectly acceptable cost saving measure to standardise the statements across a banking group, and use the cheapest paper and printing that still produces a legible, robust statement.4 -

OT, is there an eligibility path to Barclays Wealth (Banking not WM) based on income rather than savings or investments? Their website is very vague.Se1Lad said:

I've also got experience with the tier up from Barclays Premier - Barclays Wealth. Apart from the statement having a slightly different colour scheme, the printing and paper remains identical to my previous premier account. What is useful is the more personal customer service - my dedicated private banker and his team are great, and I've also had a couple of very fancy free meals out courtesy of Little Book of Wonders. You also get £1000 interest free overdraft limit, and not that I've used it but the standard overdraft rate is 9.7%.0 -

I'm not sure - I qualified via investments and pension. I think you can only get Wealth Banking if you qualify for Wealth Management though.trient said:

OT, is there an eligibility path to Barclays Wealth (Banking not WM) based on income rather than savings or investments? Their website is very vague.Se1Lad said:

I've also got experience with the tier up from Barclays Premier - Barclays Wealth. Apart from the statement having a slightly different colour scheme, the printing and paper remains identical to my previous premier account. What is useful is the more personal customer service - my dedicated private banker and his team are great, and I've also had a couple of very fancy free meals out courtesy of Little Book of Wonders. You also get £1000 interest free overdraft limit, and not that I've used it but the standard overdraft rate is 9.7%.1 -

I have already told you I was speaking generally. We will have to agree to disagree on this matter. WillPS and Se1Lad. People have different ideas. I prefer the old days when a product was a whole. These days it doesn't happen anymore.WillPS said:

Obtuse might be expecting a "premium" service when none was offered. Natwest Group clearly do not consider printed statements an integral part of their product range, and in fact I suspect would prefer you didn't have one at all.Deleted_User said:

You (and the other two likers) have missed my point I'm afraid. I was speaking generally, a produce is a whole. In the old days they knew how to do it. Even the statement is part of it, like when banks used to give you cheque book holders. Indeed Child and Co did at some stage long ago.WillPS said:Deleted_User said:It's an entire product, the point I was trying to raise to you in the Barclays thread, but seemed to go over your head. A bank account is a product, if it is a premium product, all aspects should reflect that.What is? Royal Bank of Scotland aren't marketing Child & Co at all, leave alone as some sort of premium product.Even if they did, and having a fancy debit card/chequebook was part of that I very much doubt 'nicely printed statements' would be.

Very obtuse people on these boards at times...0 -

I worked for a different bank, and we used to use premium (heavier) paper for our premium account statements.

We switched to normal paper because (i) it's cheaper, (ii) it reduces print costs because all the statements can go in the same file with no need for the printers to change the paper part way through (iii) as it's simply plain A4 paper, we no longer had a dependency on a specific supplier.

We took the view that as the majority of our customers didn't actually receive paper statements, and those that did would contain exactly the same information as before, there was no benefit in continuing to use premium paper. As far as I recall, none of our customers even commented on the change, let alone expressed any dissatisfaction.1 -

Out of interest did you find a premium account which offered higher quality statements?[Deleted User] said:

I have already told you I was speaking generally. We will have to agree to disagree on this matter. WillPS and Se1Lad. People have different ideas. I prefer the old days when a product was a whole. These days it doesn't happen anymore.WillPS said:

Obtuse might be expecting a "premium" service when none was offered. Natwest Group clearly do not consider printed statements an integral part of their product range, and in fact I suspect would prefer you didn't have one at all.Deleted_User said:

You (and the other two likers) have missed my point I'm afraid. I was speaking generally, a produce is a whole. In the old days they knew how to do it. Even the statement is part of it, like when banks used to give you cheque book holders. Indeed Child and Co did at some stage long ago.WillPS said:Deleted_User said:It's an entire product, the point I was trying to raise to you in the Barclays thread, but seemed to go over your head. A bank account is a product, if it is a premium product, all aspects should reflect that.What is? Royal Bank of Scotland aren't marketing Child & Co at all, leave alone as some sort of premium product.Even if they did, and having a fancy debit card/chequebook was part of that I very much doubt 'nicely printed statements' would be.

Very obtuse people on these boards at times...1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards