We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Child & Co RBS Branch to close

Comments

-

I wouldn't say it is plain Black, more Black Strips and dark gray with a purple NatWest Logo, I admit its better that the Purple one, but actual just plain Black would have been much better.TheBanker said:

I got upgraded to Natwest Premier. There are two main benefits. Firstly, the Premier Reward account pays £10 a month in cashback rather than the £5 paid by the standard Reward account, for the same monthly fee. Secondly you get a nice plain black card instead of that vile thing that everyone else has to put up with.PloughmansLunch said:

Absolutely, I'm fully aware that mine is only a common or garden RBS Select account albeit with a 'w*nky' card as someone on here eruditely put it. If there was also a poncy NatWest equivalent instead of the horrendous primary school art project runner-up that is their current debit card design then I'd use ancient legacy forms to obtain one of those too.gary1312 said:

Interesting to see the different Child statements through the professional eye of @PloughmansLunch and I can certainly see the dip in quality, but Child accounts can't be classed as a premium product and, as @WillPS has pointed out, the real benefit to the accounts is having a bank card which isn't some ghastly picture of a beach hut and being able to write pretty gift cheques.trient said:Cater Allen use special paper.

I'm not normally that bothered about card designs, but the standard Natwest card is truly awful. It's almost like they designed it for their kids' accounts and then issued it to adults by accident.0 -

What a strange exchange I have just read. I think all they have done is to move from some pre-printed headed paper stationary to print as you go blank paper. Obviously you cannot achieve the same level of quality on the logos from Lito and Digital printing (pretty confident that the C&C stationary quality - paper weight and Lito print - was not different than the other branding of the group).

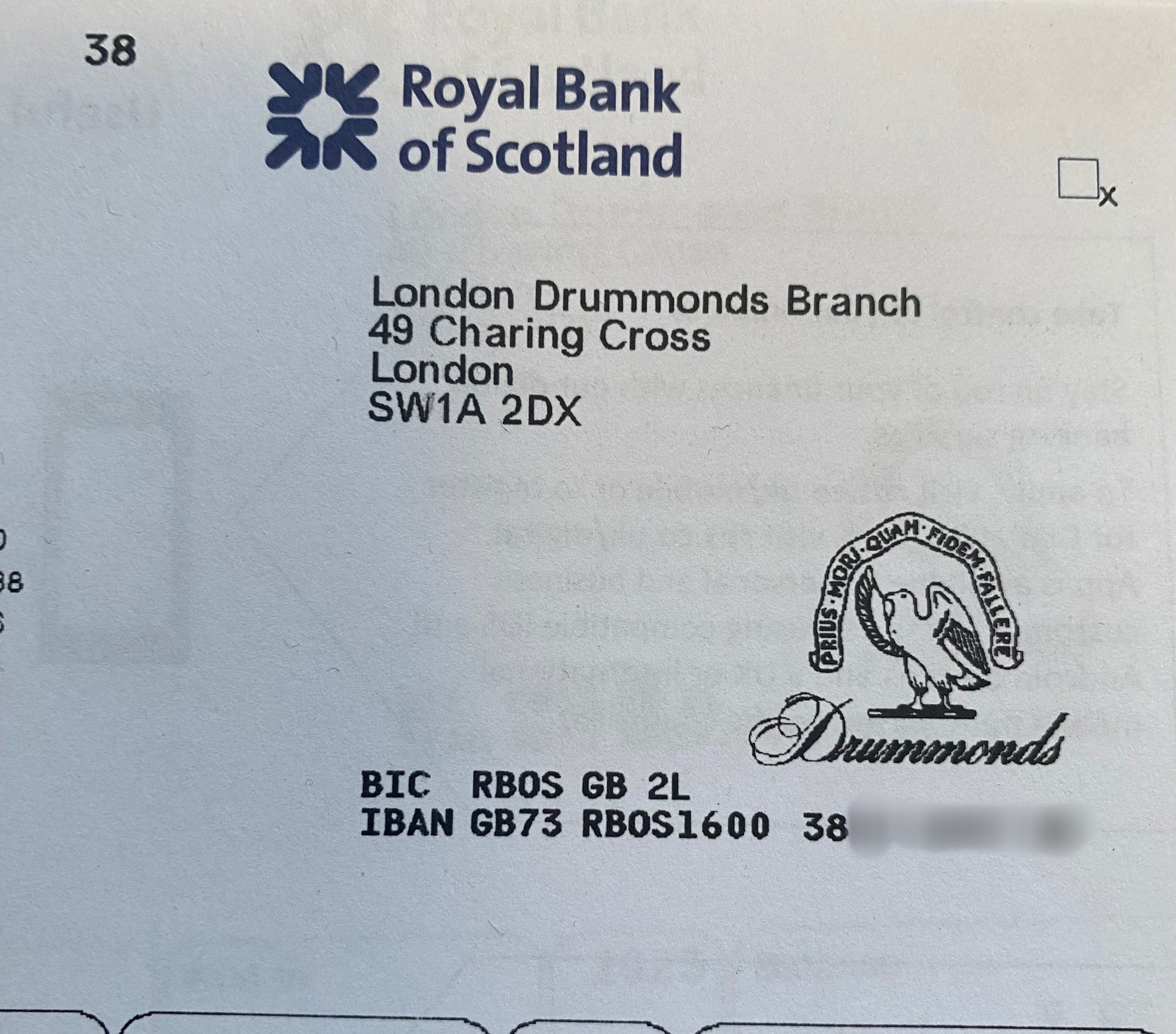

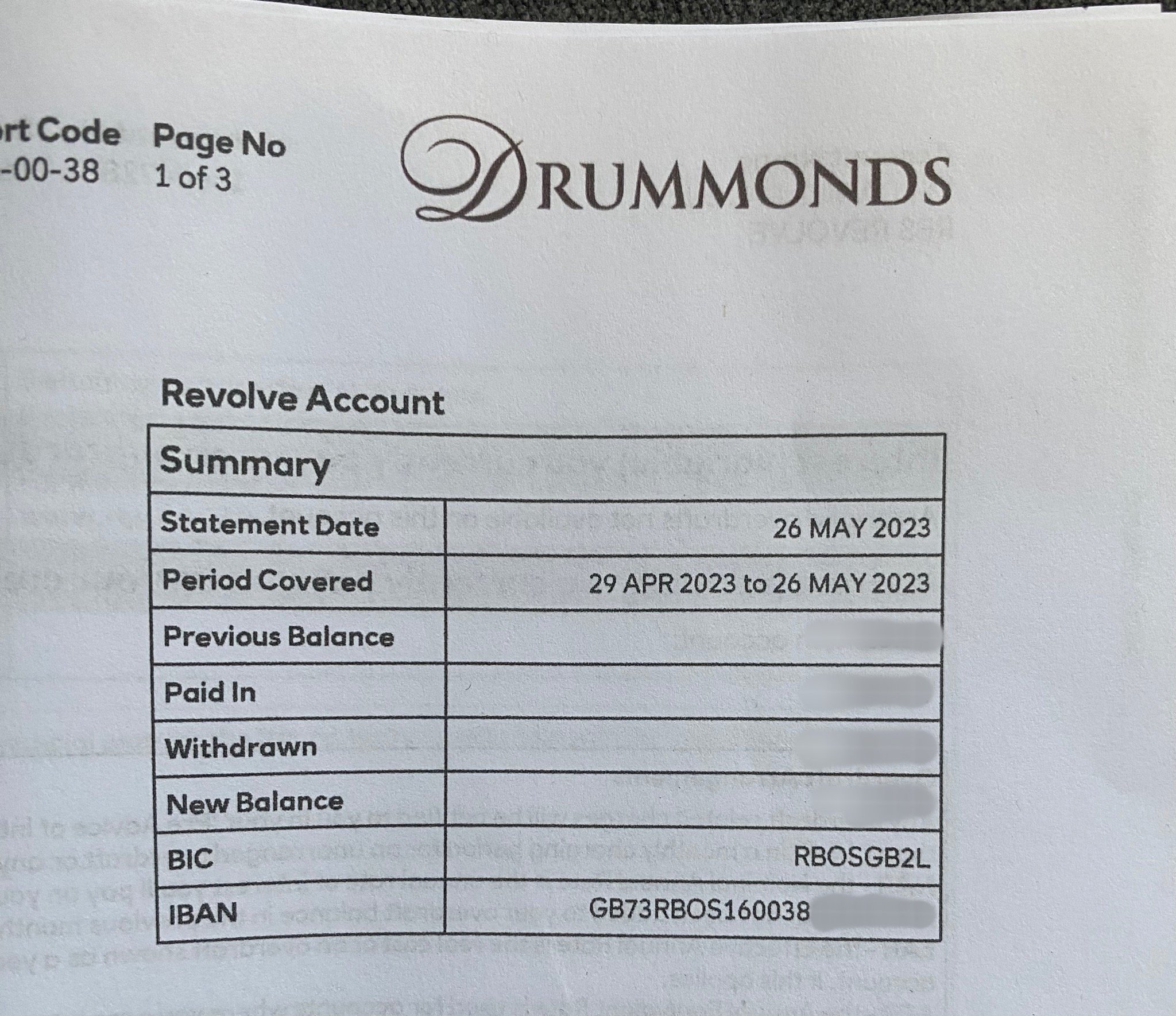

Having said that, the Drummonds printed statement has actually improved (pictures attached of my kids statements as I have been on digital only for some times):

0 -

I don't find it strange at all, in the context of this thread, which is entirely about trying to get a branded card purely for the sake of having a card saying "Child and Co". The entire thread and ambition to obtain this card would seem strange to some.0

-

As the originator of the thread, this was about Child & Co branch closing and it evolved in ways of still opening a bank account with them and/or using Drummonds as one of the other two branded branches remaining within RBS.[Deleted User] said:I don't find it strange at all, in the context of this thread, which is entirely about trying to get a branded card purely for the sake of having a card saying "Child and Co". The entire thread and ambition to obtain this card would seem strange to some.

there are different, older thread specifically discussing obtaining the card.

In any case, the strange exchange was about the “quality” of the stationary , which was never of better or lower quality than the rest of the ex RBS /NatWest group, in terms of quality of paper and Lito printed templates, just different branding Lito stamped onto that. Now they have changed across the group to standardised A4 printing, without pre-printed lithographic headed paper across the group, so the supposed argument that this action has meant a loss of perceived prestige of the C&C brand is very strange at the very least.0 -

These are the same thing.Marchitiello said:

As the originator of the thread, this was about Child & Co branch closing and it evolved in ways of still opening a bank account with them and/or using Drummonds as one of the other two branded branches remaining within RBS.Deleted_User said:I don't find it strange at all, in the context of this thread, which is entirely about trying to get a branded card purely for the sake of having a card saying "Child and Co". The entire thread and ambition to obtain this card would seem strange to some.

there are different, older thread specifically discussing obtaining the card.

In any case, the strange exchange was about the “quality” of the stationary , which was never of better or lower quality than the rest of the ex RBS /NatWest group, in terms of quality of paper and Lito printed templates, just different branding Lito stamped onto that. Now they have changed across the group to standardised A4 printing, without pre-printed lithographic headed paper across the group, so the supposed argument that this action has meant a loss of perceived prestige of the C&C brand is very strange at the very least.

It wasn't strange at all, at least two members raised it. The older statements were of higher quality. We know that RBS wanted the brand to be maintained as higher quality, that is why they invested and a refreshment of the branch only a few years ago. We know that some banks do consider higher quality paper as part of the package. The reasons behind the change are irrelevant, I am referring simply to the Child brand and having lower quality statements does not match with maintaining a higher quality brand. RBS may have now decided they don't care any longer.

I am certainly not going to spend any more of a Friday night discussing paper with a forum member, so we will to agree to disagree.0 -

Not content with clutching at straws to justify an argument, you're now clutching at straws to justify the worthiness of the discussion.

Perhaps a good cue to leave this where it is, as Natwest Group (not just Child & Co) clearly have done with their older format statements.

0 -

@Willps I am not sure why you are becoming slightly bitter with your reply. I'm not really sure what you mean. I can only recount the facts and apply my opinion to them. If you don't agree that's fine, you don't have to get into a spin about it old chap. But it's not unusual for your replies to me across various threads. And if the discussion is worthless, is not the entire 10 threads on Child worthless, seeing as we are discussing sort codes, closed down branches, accounts which offer nothing whatsoever in benefit apart from a different logo on a card? please.WillPS said:Not content with clutching at straws to justify an argument, you're now clutching at straws to justify the worthiness of the discussion.

Perhaps a good cue to leave this where it is, as Natwest Group (not just Child & Co) clearly have done with their older format statements.

1. The older statements were of higher quality.We know that RBS wanted the brand to be maintained as higher quality due to branch works, at least in the past.

2. We know that some banks do consider higher quality paper as part of the package of delivering a quality experience for a customer.

3.While the change to the statement may simply be down to a wider Natwest change, it does not change the impact (however minimal) on Child and Co.

Indeed, Natwest have left the brand behind pretty much. My option is not going to change because the internet says it should. I know thats the general feeling these days, you must obey because lots of people say something is the new ideas on the Internet, but it isn't going to work with me. 1000 MSE members can state I am wrong, I know I am right. Cheap statements make the brand look cheap. And that's it. I'm not suggesting someone at Natwest went out of their way to do this, they likely don't even care, but again, doesn't change the impact on the brand, even if hardly any of the customers care.

0 -

I think the point here is that it’s all down to personal opinion and not who is right or wrong. In your opinion cheap statements make the brand look cheap. No one else who has commented has the same opinion, but that doesn’t make yours any less valid, I think you are correct in saying ‘hardly any of the customers care’ so your opinion will therefore be in the minority.Deleted_User said:

@Willps I am not sure why you are becoming slightly bitter with your reply. I'm not really sure what you mean. I can only recount the facts and apply my opinion to them. If you don't agree that's fine, you don't have to get into a spin about it old chap. But it's not unusual for your replies to me across various threads. And if the discussion is worthless, is not the entire 10 threads on Child worthless, seeing as we are discussing sort codes, closed down branches, accounts which offer nothing whatsoever in benefit apart from a different logo on a card? please.WillPS said:Not content with clutching at straws to justify an argument, you're now clutching at straws to justify the worthiness of the discussion.

Perhaps a good cue to leave this where it is, as Natwest Group (not just Child & Co) clearly have done with their older format statements.

1. The older statements were of higher quality.We know that RBS wanted the brand to be maintained as higher quality due to branch works, at least in the past.

2. We know that some banks do consider higher quality paper as part of the package of delivering a quality experience for a customer.

3.While the change to the statement may simply be down to a wider Natwest change, it does not change the impact (however minimal) on Child and Co.

Indeed, Natwest have left the brand behind pretty much. My option is not going to change because the internet says it should. I know thats the general feeling these days, you must obey because lots of people say something is the new ideas on the Internet, but it isn't going to work with me. 1000 MSE members can state I am wrong, I know I am right. Cheap statements make the brand look cheap. And that's it. I'm not suggesting someone at Natwest went out of their way to do this, they likely don't even care, but again, doesn't change the impact on the brand, even if hardly any of the customers care.If it is important to have fancier paper statements it’s already confirmed elsewhere that Handelsbanken still offer them, so maybe this is the current account for you?1 -

Yes I agree with that. My original comment (I believe one other poster also made a similar comment) was a minor comment and it seems to have set some people off. If people disagree there is nothing wrong with that. But it a sign of the times that nobody could consider the possibility.Se1Lad said:

I think the point here is that it’s all down to personal opinion and not who is right or wrong. In your opinion cheap statements make the brand look cheap. No one else who has commented has the same opinion, but that doesn’t make yours any less valid, I think you are correct in saying ‘hardly any of the customers care’ so your opinion will therefore be in the minority.Deleted_User said:

@Willps I am not sure why you are becoming slightly bitter with your reply. I'm not really sure what you mean. I can only recount the facts and apply my opinion to them. If you don't agree that's fine, you don't have to get into a spin about it old chap. But it's not unusual for your replies to me across various threads. And if the discussion is worthless, is not the entire 10 threads on Child worthless, seeing as we are discussing sort codes, closed down branches, accounts which offer nothing whatsoever in benefit apart from a different logo on a card? please.WillPS said:Not content with clutching at straws to justify an argument, you're now clutching at straws to justify the worthiness of the discussion.

Perhaps a good cue to leave this where it is, as Natwest Group (not just Child & Co) clearly have done with their older format statements.

1. The older statements were of higher quality.We know that RBS wanted the brand to be maintained as higher quality due to branch works, at least in the past.

2. We know that some banks do consider higher quality paper as part of the package of delivering a quality experience for a customer.

3.While the change to the statement may simply be down to a wider Natwest change, it does not change the impact (however minimal) on Child and Co.

Indeed, Natwest have left the brand behind pretty much. My option is not going to change because the internet says it should. I know thats the general feeling these days, you must obey because lots of people say something is the new ideas on the Internet, but it isn't going to work with me. 1000 MSE members can state I am wrong, I know I am right. Cheap statements make the brand look cheap. And that's it. I'm not suggesting someone at Natwest went out of their way to do this, they likely don't even care, but again, doesn't change the impact on the brand, even if hardly any of the customers care.If it is important to have fancier paper statements it’s already confirmed elsewhere that Handelsbanken still offer them, so maybe this is the current account for you?

Ah Handelsbanken, I have a colleague who banks with them and I have tried to get in a long time ago, put simply I was too common for them, at least the London branch. Not to mention they seemed to cater only for higher earners (100k plus) in London. (each branch is meant to run on it's own terms so outside London branches may be a different story)0 -

@[Deleted User] and you are failing to understand and keep arguing a baseless point (independently of opinions):[Deleted User] said:

@Willps I am not sure why you are becoming slightly bitter with your reply. I'm not really sure what you mean. I can only recount the facts and apply my opinion to them. If you don't agree that's fine, you don't have to get into a spin about it old chap. But it's not unusual for your replies to me across various threads. And if the discussion is worthless, is not the entire 10 threads on Child worthless, seeing as we are discussing sort codes, closed down branches, accounts which offer nothing whatsoever in benefit apart from a different logo on a card? please.WillPS said:Not content with clutching at straws to justify an argument, you're now clutching at straws to justify the worthiness of the discussion.

Perhaps a good cue to leave this where it is, as Natwest Group (not just Child & Co) clearly have done with their older format statements.

1. The older statements were of higher quality.We know that RBS wanted the brand to be maintained as higher quality due to branch works, at least in the past.

2. We know that some banks do consider higher quality paper as part of the package of delivering a quality experience for a customer.

3.While the change to the statement may simply be down to a wider Natwest change, it does not change the impact (however minimal) on Child and Co.

Indeed, Natwest have left the brand behind pretty much. My option is not going to change because the internet says it should. I know thats the general feeling these days, you must obey because lots of people say something is the new ideas on the Internet, but it isn't going to work with me. 1000 MSE members can state I am wrong, I know I am right. Cheap statements make the brand look cheap. And that's it. I'm not suggesting someone at Natwest went out of their way to do this, they likely don't even care, but again, doesn't change the impact on the brand, even if hardly any of the customers care.

1- RBS never differentiated C&C for the quality of the statement (once again, same paper weight, same type of lithographic printing, just different logos), it was never printed on “Conqueror” type of paper.

2- was never the case for RBS, if anything Drummonds is the more prestigious brand of the two, and the statement were simply printed on RBS standard Lithographic paper where the additional logo was part of the low resolution digital overprint.

3- based on the above, super moot point, aside of the fact that obviously banks have successfully driven customers to digital statement and I would bet that the more realistic and historic customers with accounts at those two sort codes have probably mostly migrated

Finally, as one of the few here that regularly used the branch at Fleet Street and are now continuing to use the branch at Trafalgar Square (and know my personal banker and branch manager by name), can tell you that the branch refurbishment (for both) was planned way long ago when there was plans to sell off the RBS’ English branches and retain just those three (Holts being the third). Fleet Street was still fairly busy with lawyers and local businesses, and so it made sense to refresh the branch. The level of customer interactions at that branch has always been higher than the average branch (not even matched by Drummonds as they only have a door concierge, who now basically help you use the machines for self service or put you in the queue to see someone).Covid has effectively killed that branch as it become a 0 footfall branch all of a sudden.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards