We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Barclays Blue Rewards

Comments

-

I have no more switches to go for, however, will obviously cancel Blue Rewards. Becomes pointless account for me then.0

-

The Post Office DDs end in February so that aligns perfectly with the demise of Blue Rewards. Saves me a job in finding alternative DDs! Farewell PO and Barclays.0

-

Devil is in the detail. If you get to multiply the reward payment (e.g. with CASS uses, as have previously been offered) then there is still life in it.

1 -

How is there still in it? May as well cancel the blue rewards and leave it as a standard account as a donor for a switch.0

-

True but that surely only works if 1. they offer a double up incentive for the rewards and 2. that offer is also still open for existing customers.WillPS said:Devil is in the detail. If you get to multiply the reward payment (e.g. with CASS uses, as have previously been offered) then there is still life in it.

It has been a couple of years since they last offered a double up on the rewards ( i was able to benefit twice) but there is no telling if they will decide to do a double up bonus and also leave it open for existing customers as well.

For me, it was good whilst it lasted, but I will switch elsewhere. nothing stopping me applying for a new barclays account down the line if they do offer a switch/double up rewards down the line.

But to be honest this seems to be a cost cutting exercise (possibly designed to reduce the number of current account only customers, especially as they are keeping extra rewards for mortgage/loan customers the same) so can't see them offering that for a while.MFW#105 - 2015 Overpaid £8095 / 2016 Overpaid £6983.24 / 2017 Overpaid £3583.12 / 2018 Overpaid £2583.12 / 2019 Overpaid £2583.12 / 2020 Overpaid £2583.12/ 2021 overpaid £1506.82 /2022 Overpaid £2975.28 / 2023 Overpaid £2677.30 / 2024 Overpaid £2173.61 Total OP since mortgage started in 2015 = £37,286.86 2025 MFW target £1700, payments to date at April 2025 - £1712.07..1 -

I used it as a type of regular saver.

I gave them £4pm and they added £3pm to my savings.

Could get similar return if I switched to NatWest (not eligible for any incentive as getting RBS one), £2pm + £5pm, but cba tbh.0 -

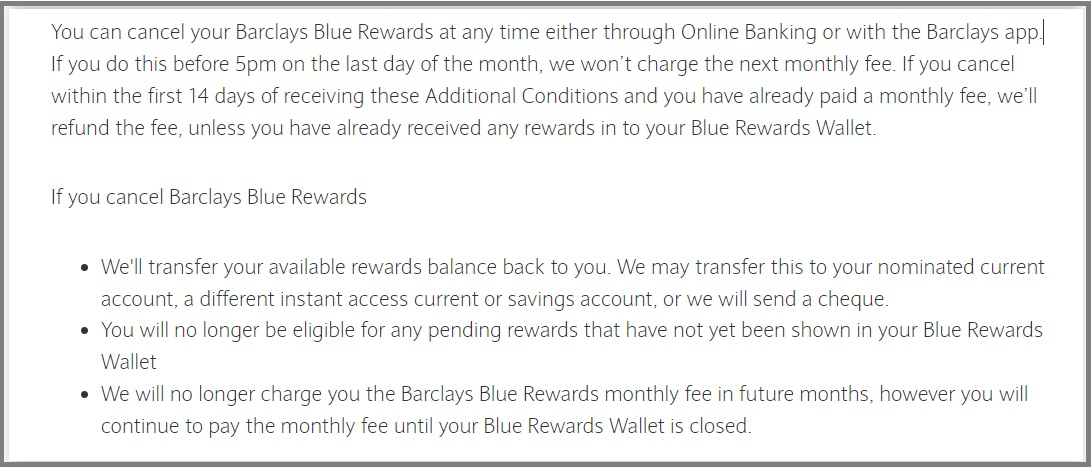

For those just wanting to cancel their Rewards membership:

3 -

So should I cancel after getting February reward as any payment in March will be on the new T&C?0

-

If I’m right you can still get your usual £7 with £4 fee in March 2022 as their terms say the new terms come in March but won’t affect accounts until April. So as soon as £7 reward received on 2nd March and £4 fee deducted I will transfer my two credit card DDs to other banks manually before closing the Barclays current account (by the end of March at the latest or the new fees will be applied in April/ or downgraded account) which has been my dustbin account for years for old current accounts that I wanted rid of so switched to Barclays, lucky them getting about fifteen switches for nothing. Trouble is it’s impossible to edit all the payment details transferred in in the app and in online banking it simply wouldn’t work. That’s Barclays. Or I might switch it to a tsb account where I can edit out all the chaff.poshrule_uk said:So should I cancel after getting February reward as any payment in March will be on the new T&C?2 -

Barclays used to be really good for offers, now they are appalling.

there really is no reason to stay.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.7K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards