We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Covid crash #2 started

Comments

-

The human mind is incredibly good at seeing trends in hindsight where there isn't necessarily one to see.coastline said:Nobody knows when a crash will happen but history shows markets have rallies and then either go sideways or correct. Looking at main indices such as the Dow and S&P 500 you can see many examples when a rally gets way above the 200 day average on a chart then corrects.

The 1987 crash was a prime example of a parabolic rise which ended badly . The S&P stood at 330 and the 200 day moving average around 220. At 50% above this is a rare event.

https://ivanhoff.com/wp-content/uploads/2016/10/spy1987-weekly.png

Generally when the index gets 10% and more above the 200 day average there's a correction of some sort. In the link below there's three. First was the virus in February then September and October recently.

https://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=1&mn=0&dy=0&id=p27848000232&a=226295345&listNum=1

Set this link below to 5 years and you can see clearly these mini parabolic moves way above the 200 day average. Although they may only be 10% or more they show the same chart pattern. I think the link will go back a few decades if anybody wants to see more. Basically if any investor is concerned about holding onto profits it's certainly worth watching the indices if the 10% region is breached. Apart from that its pretty difficult to predict anything really.

https://stockcharts.com/h-sc/ui1 -

Well to be more accurate I asked those questions. This thread, like all threads on here doesn't have a voice.DiggerUK said:

This thread asks those questions. You listen to the arguments, you do your own research, you hold your own counsel.AlanP_2 said:....Have we had GFC2? Are we currently in GFC2? Is it a possible event at an unknown point in the future? When does normal market movements become a GREAT FINANCIAL CRASH?Don't worry about missing it, you'll know full well when it happens..._

I take it from your response that GFC2 hasn't happened yet so it is a possible event at an unkown point in the future (with the added proviso that commentators attach the label GFC2 to it afterwards).

Well that really helps to define a savings and investment strategy, thanks.0 -

From what I can see most ( not all) of the regular posters on this forum actively discourage speculation about future market movements and usually warn less inexperienced posters to avoid listening too much to the news and think long term .The_Green_Hornet said:

All this talk about potential crashes is just that, all talk.Shocking_Blue said:All this talk about potential crashes is a little concerning, particularly for moderately informed non-pro investors. Crystal balls aside, it seems to make sense that the markets will fall due to recent Covid developments, fallout from the whole Covid situation, and perhaps even the influence of the credit crunch. I'm mid 50s, and have some higher equity funds alongside core balanced ones. I have been thinking about possibly selling the higher eq ones to protect myself a little bit in anticipation of some such crash, and then potentially buying back in again. Not sure if this is sensible.

If all these self appointed financial experts actually knew anything they wouldn't be sitting at their computer screens posting rubbish on a money saving forum day in day out.

5 -

After decades of buy and hold I ditched the idea to use a simple mechanical system after looking at lower indicators on charts. Yes it's not for everyone and I don't expect any posters to follow the same track. After a few years of simply watching the markets and charts I developed my own method with various tools. I'm not a day trader but I use my ideas short term with a few ETF's and sometimes shares. All are invested in ISA's SIPP's to save all the paperwork bother.Another_Saver said:

The human mind is incredibly good at seeing trends in hindsight where there isn't necessarily one to see.coastline said:Nobody knows when a crash will happen but history shows markets have rallies and then either go sideways or correct. Looking at main indices such as the Dow and S&P 500 you can see many examples when a rally gets way above the 200 day average on a chart then corrects.

The 1987 crash was a prime example of a parabolic rise which ended badly . The S&P stood at 330 and the 200 day moving average around 220. At 50% above this is a rare event.

https://ivanhoff.com/wp-content/uploads/2016/10/spy1987-weekly.png

Generally when the index gets 10% and more above the 200 day average there's a correction of some sort. In the link below there's three. First was the virus in February then September and October recently.

https://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=1&mn=0&dy=0&id=p27848000232&a=226295345&listNum=1

Set this link below to 5 years and you can see clearly these mini parabolic moves way above the 200 day average. Although they may only be 10% or more they show the same chart pattern. I think the link will go back a few decades if anybody wants to see more. Basically if any investor is concerned about holding onto profits it's certainly worth watching the indices if the 10% region is breached. Apart from that its pretty difficult to predict anything really.

https://stockcharts.com/h-sc/ui

The 10% rule is one of my alerts but not a trigger. My main trigger is extremes on lower indicators on charts. When they show signs of turning I buy and I have a 10 day moving average in place as a guide. Selling is of course at the opposite end of the indicator. The OP started this thread the day I bought back in 28th October. If you look at the link below the Slow Stochastic indicator was turning up and also the excess above the 200 day average was also burnt off. So far so good .

https://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=1&mn=0&dy=0&id=p27848000232&a=226295345&listNum=1

Regarding your hindsight comment have a look at the link below. The index is 12% above the 200 day day average. The blog had similar ideas to me.

https://realinvestmentadvice.com/wp-content/uploads/2020/02/SPY-1.png

More ideas also with a lower indicator on the same chart. There's some nice little gains to be had there considering most investors would be happy with10% per year. I'm not trying to bombard people just I'm not rigid with buy and hold etc.

https://pbs.twimg.com/media/EL6feCqWoAAHSjh.png:large

Just to show my buy of 545p on the 28th of October simply add the Slow Stochastic in the lower indicators. There's money to be made even in a sideways market.

https://stockcharts.com/h-sc/ui?s=ISF.L

3 -

It's not for me to make your decision, the best I can do is maybe influence you. I lay out my thoughts and you decide if anything I say is valid. My posts on this thread are on p.11,19, 20 and 21.AlanP_2 said:

Well that really helps to define a savings and investment strategy, thanks.DiggerUK said:

This thread asks those questions. You listen to the arguments, you do your own research, you hold your own counsel.AlanP_2 said:....Have we had GFC2? Are we currently in GFC2? Is it a possible event at an unknown point in the future? When does normal market movements become a GREAT FINANCIAL CRASH?Don't worry about missing it, you'll know full well when it happens..._

At the end of the day it's your counsel that prevails..._0 -

Another total bloodbath in the markets today. It's relentless. Am starting to wonder if we invested above our volatility tolerance as I haven't a clue how we are going to spend all this money. We will be hiding behind the sofa pretending to be out when the wealth managers come knocking on the door. Some days it would have been better to just stay in bed. The warning signs were flashing and we just kept regularly contributing through the dips like idiots. Should have taken action earlier to cut our gains. So many regrets...

10 -

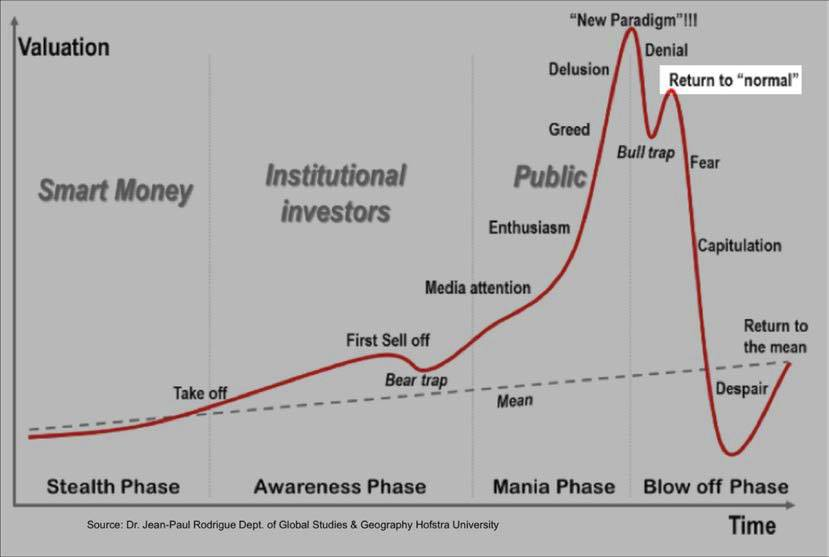

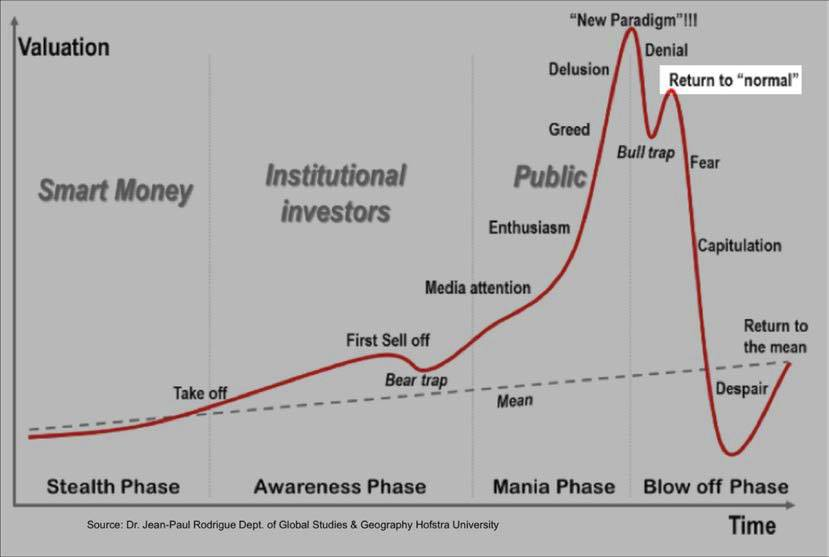

Unless it's a Bull trapAlexland said:Another total bloodbath in the markets today. It's relentless. Am starting to wonder if we invested above our volatility tolerance as I haven't a clue how we are going to spend all this money. We will be hiding behind the sofa pretending to be out when the wealth managers come knocking on the door. Some days it would have been better to just stay in bed. The warning signs were flashing and we just kept regularly contributing through the dips like idiots. Should have taken action earlier to cut our gains. So many regrets...

Although, there's already a lot of Bull going around

Retired 1st July 2021.

This is not investment advice.

Your money may go "down and up and down and up and down and up and down ... down and up and down and up and down and up and down ... I got all tricked up and came up to this thing, lookin' so fire hot, a twenty out of ten..."2 -

Must be - it's Common Sensequirkydeptless said:Unless it's a Bull trap

1

1 -

I've only just managed to calm the cat down. He's still upset about the exaggerated reports of his demise.quirkydeptless said:

Unless it's a Bull trapAlexland said:Another total bloodbath in the markets today. It's relentless. Am starting to wonder if we invested above our volatility tolerance as I haven't a clue how we are going to spend all this money. We will be hiding behind the sofa pretending to be out when the wealth managers come knocking on the door. Some days it would have been better to just stay in bed. The warning signs were flashing and we just kept regularly contributing through the dips like idiots. Should have taken action earlier to cut our gains. So many regrets...

Leave the bull out of it.1 -

Do yourself a favour - don't be looking at the Dow Jones / S&P today....Alexland said:Another total bloodbath in the markets today. It's relentless. Am starting to wonder if we invested above our volatility tolerance as I haven't a clue how we are going to spend all this money. We will be hiding behind the sofa pretending to be out when the wealth managers come knocking on the door. Some days it would have been better to just stay in bed. The warning signs were flashing and we just kept regularly contributing through the dips like idiots. Should have taken action earlier to cut our gains. So many regrets...0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.1K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards