We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

SLLM (Single Lady Large Mortgage)

Comments

-

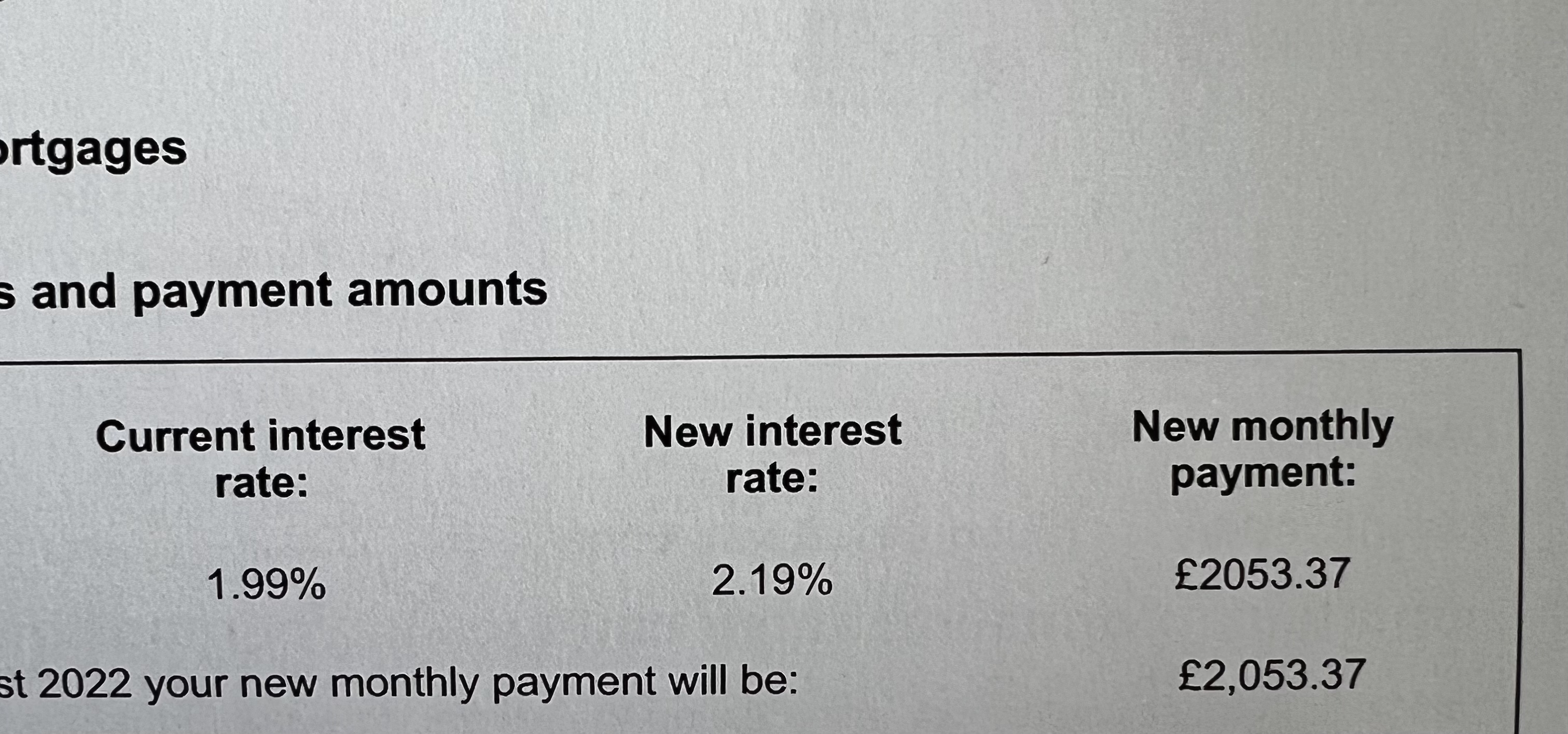

Hope it’s going ok, sorry to read about the rise. Are there any fixed deals you can move to in the event that rates may go up?Sistergold said:Mortgage update

Got a letter informing me of yet another rate increase. Over 2% now! ☹️ DH, 2 DD and 2 cats. aiming to be mortgage free at 51, 10 years to go! Feb 19 £358k, Jan 21 £283K (using savings)July 22 £246K down to 17 year term, Mar 25 £177k 11.8 year term0

DH, 2 DD and 2 cats. aiming to be mortgage free at 51, 10 years to go! Feb 19 £358k, Jan 21 £283K (using savings)July 22 £246K down to 17 year term, Mar 25 £177k 11.8 year term0 -

@Sistergold ouch on the 2%. I am feeling nervous on taking on a big mortgage when its just me and I like to feel free and not stressed especially with being self employed.

I have started looking a bit but feeling spring next year feels more likely. I want to get to £100k deposit (so 20% down) plus £15k costs/stamp duty etc plus an EF of £15k before making the leapDON'T BUY STUFF (from Frugalwoods)

No seriously, just don’t buy things. 99% of our success with our savings rate is attributed to the fact that we don’t buy things... You can and should take advantage of discounts.... But at the end of the day, the only way to truly save money is to not buy stuff. Money doesn’t walk out of your wallet on its own accord.

https://forums.moneysavingexpert.com/discussion/6289577/future-proofing-my-life-deposit-saving-then-mfw-journey-in-under-13-years#latest0 -

@LadyWithAPlan, you are right at this moment everything makes one nervous! As you know I am on a variable rate and the letters announcing a rate increase are coming in faster than I can open them. Getting a mortgage now could make you feel really nervous for sure. Also with all that is going on with the economy and at the back of the chaotic and unrealistic house price increases due to covid and stamp duty holiday, one wonders if this is a good time to buy? £15k emergency fund is a good plan as I have discovered the things that can need doing in a “new” house can be endless!Like you have suggested next year might be a good time to buy not even just to see if prices could go down but to just have a bit of sanity prevail in viewing houses, making offers over and above and bidding wars which have been the norm a while back. As a single you are being sensible in making sure all finances have wiggle room to avoid unnecessary stress. With the payment delays you have had with your invoices it’s good you plan to have money on the side after buying to cover periods of delayed payments!

As you are also casually looking for properties if one should come up that you really like there is nothing wrong with biting the bullet as you are buying a home and overtime you can ride any house prices rises and falls so not need to worry about whether it’s right time or not.At this rate @LadyWithAPlan you might just save and pay for the house outright! 🚀🥳Initial mortgage bal £487.5k, current £258k, target £243,750(halfway!)

Mortgage start date first week of July 2019,

Mortgage term 23yrs(end of June 2042🙇🏽♀️),Target is to pay it off in 10years(by 2030🥳).MFW#10 (2022/23 mfw#34)(2021 mfw#47)(2020 mfw#136)

£12K in 2021 #54 (in 2020 #148)

MFiT-T6#27

To save £100K in 48months start 01/07/2020 Achieved 30/05/2023 👯♀️

Am a single mom of 4.Do not wait to buy a property, Buy a property and wait. 🤓0 -

My current mortgage deal ends ~May 2023 so I am tied in till then. I will not want to pay ERC so have to wait it out. When next year comes I should suspect rates might be at their highest and will get a deal for just 2yrs at that point as I would not want to fix for too long on a high rate. Although my mortgage is a tracker it is discounted so it’s not too bad except it’s going up by the day! I should be able to cope up to 10% at which point mmmmm I will be scratching my head! Otherwise everything is going okay on this end. XxSweetie83 said:

Hope it’s going ok, sorry to read about the rise. Are there any fixed deals you can move to in the event that rates may go up?Sistergold said:Mortgage update

Got a letter informing me of yet another rate increase. Over 2% now! ☹️ Initial mortgage bal £487.5k, current £258k, target £243,750(halfway!)

Initial mortgage bal £487.5k, current £258k, target £243,750(halfway!)

Mortgage start date first week of July 2019,

Mortgage term 23yrs(end of June 2042🙇🏽♀️),Target is to pay it off in 10years(by 2030🥳).MFW#10 (2022/23 mfw#34)(2021 mfw#47)(2020 mfw#136)

£12K in 2021 #54 (in 2020 #148)

MFiT-T6#27

To save £100K in 48months start 01/07/2020 Achieved 30/05/2023 👯♀️

Am a single mom of 4.Do not wait to buy a property, Buy a property and wait. 🤓0 -

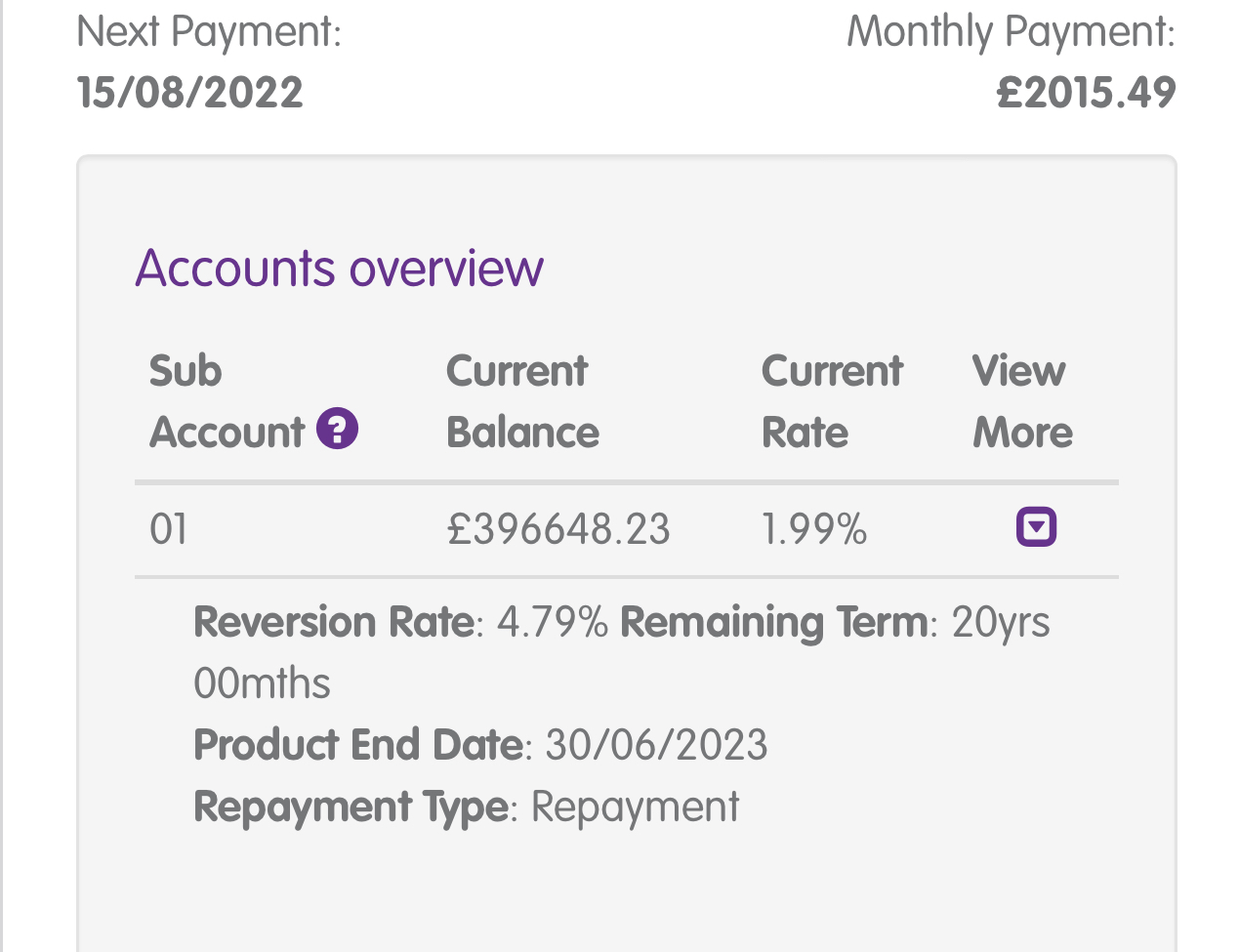

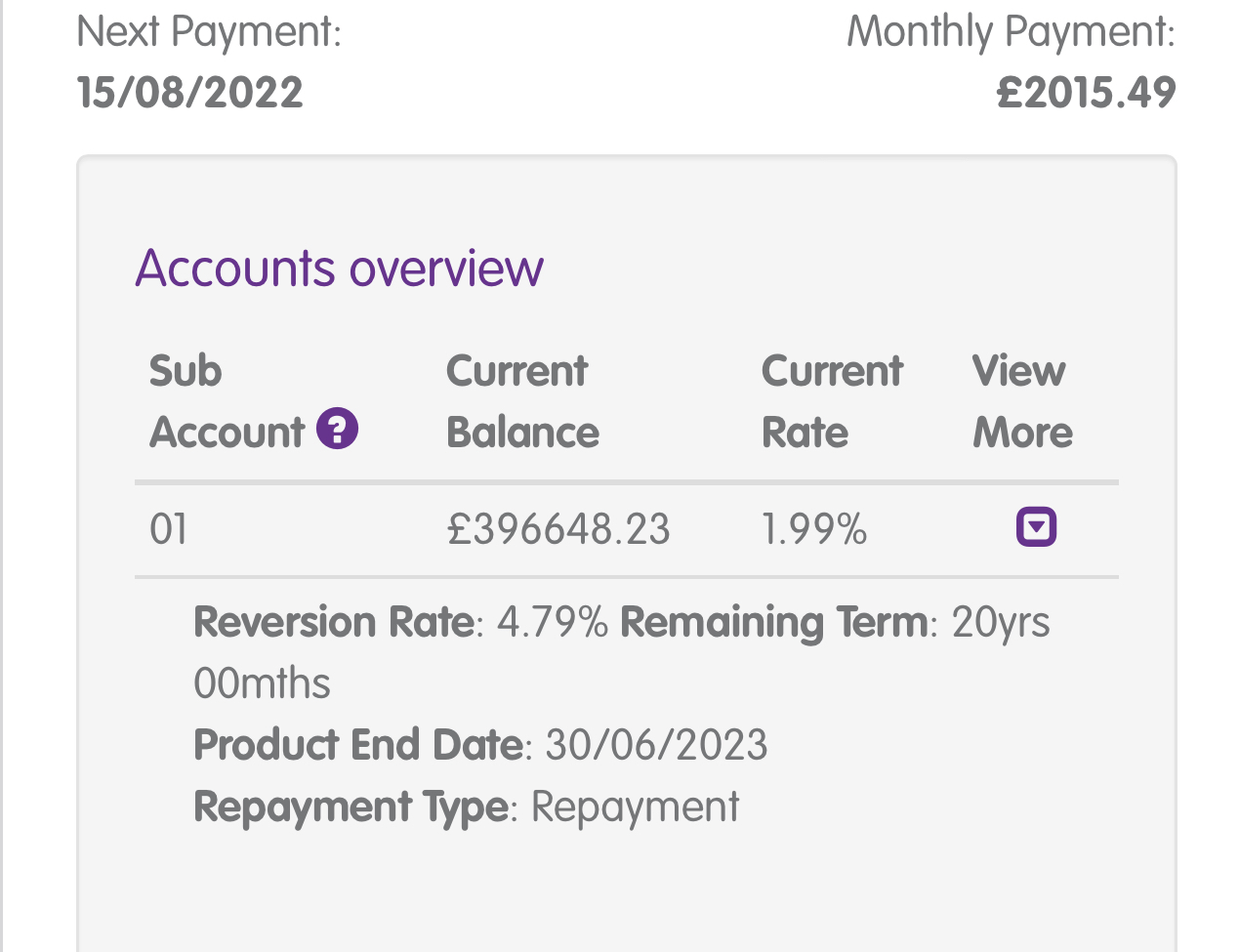

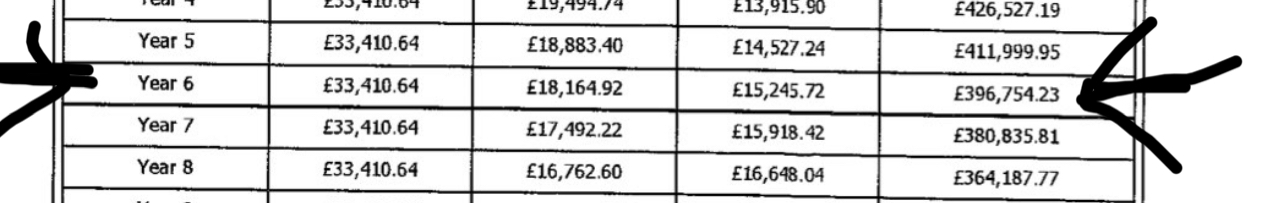

Just realised that on the 14th of July my mortgage balance was the same as it was estimated to be at 6yrs on my mortgage illustration. Have paid now for 3.5yrs. Am a bit behind what I hoped due to reduced OPs.Sistergold said:Hello everyone. Hope you are all fine and pressing on with DIY since we have the long days. Just a financial update. Mortgage went out on the 14th of July.New balance Only managing OP of £100, hopefully I will be able to increase it soon but looking like not going to happen soon.

Only managing OP of £100, hopefully I will be able to increase it soon but looking like not going to happen soon. Initial mortgage bal £487.5k, current £258k, target £243,750(halfway!)

Initial mortgage bal £487.5k, current £258k, target £243,750(halfway!)

Mortgage start date first week of July 2019,

Mortgage term 23yrs(end of June 2042🙇🏽♀️),Target is to pay it off in 10years(by 2030🥳).MFW#10 (2022/23 mfw#34)(2021 mfw#47)(2020 mfw#136)

£12K in 2021 #54 (in 2020 #148)

MFiT-T6#27

To save £100K in 48months start 01/07/2020 Achieved 30/05/2023 👯♀️

Am a single mom of 4.Do not wait to buy a property, Buy a property and wait. 🤓0 -

If it goes up to over 10% we will all be in the ************. Although I am old enough to remember having to pay 17%. It just kept going up & up. Fixes were not the norm then.

0 -

Yes this is the dream - buy cashSistergold said:@LadyWithAPlan, you are right at this moment everything makes one nervous! As you know I am on a variable rate and the letters announcing a rate increase are coming in faster than I can open them. Getting a mortgage now could make you feel really nervous for sure. Also with all that is going on with the economy and at the back of the chaotic and unrealistic house price increases due to covid and stamp duty holiday, one wonders if this is a good time to buy? £15k emergency fund is a good plan as I have discovered the things that can need doing in a “new” house can be endless!Like you have suggested next year might be a good time to buy not even just to see if prices could go down but to just have a bit of sanity prevail in viewing houses, making offers over and above and bidding wars which have been the norm a while back. As a single you are being sensible in making sure all finances have wiggle room to avoid unnecessary stress. With the payment delays you have had with your invoices it’s good you plan to have money on the side after buying to cover periods of delayed payments!

As you are also casually looking for properties if one should come up that you really like there is nothing wrong with biting the bullet as you are buying a home and overtime you can ride any house prices rises and falls so not need to worry about whether it’s right time or not.At this rate @LadyWithAPlan you might just save and pay for the house outright! 🚀🥳 I may need Agent Million but in the meantime NSD and watching a tioght budget is my own super power and in my control.

I may need Agent Million but in the meantime NSD and watching a tioght budget is my own super power and in my control.

Although prices may out shoot my savings.... I do have some of my deposit money invested in the one business I work at at an amazing interest rate which i think should hedge some of this price move upwards plus as I see the books I feel safe

I do think though having a mortgage would make me panic so much I would be focused on OP and lots of extra jobs though it would stop me allowing myself to drift. I keep looking at everyones OP's with jealousy!

it would stop me allowing myself to drift. I keep looking at everyones OP's with jealousy!

Too many years being free as a bird and single but a flat is definitely part of the next 2-3 years plans at the very least.

Having a hobby turn into a potentially very lucrative side hustle - did one paid work so far and talk of a lot more - so I am thinking of paying a few hundred - £1000 to get techied up and up to speed with a consultant as quick as possible - I am self taught and there is a tech gap I figure i can just pay someone for an hour to sort so I can up my learning speed. If i want to stay working where I am on 2/3 days a week this could be a great option.DON'T BUY STUFF (from Frugalwoods)

No seriously, just don’t buy things. 99% of our success with our savings rate is attributed to the fact that we don’t buy things... You can and should take advantage of discounts.... But at the end of the day, the only way to truly save money is to not buy stuff. Money doesn’t walk out of your wallet on its own accord.

https://forums.moneysavingexpert.com/discussion/6289577/future-proofing-my-life-deposit-saving-then-mfw-journey-in-under-13-years#latest0 -

6 years - so you OP 2.5 years ! Incredible whilst saving for your renovations and all your kids! Superwoman in the houseSistergold said:

Just realised that on the 14th of July my mortgage balance was the same as it was estimated to be at 6yrs on my mortgage illustration. Have paid now for 3.5yrs. Am a bit behind what I hoped due to reduced OPs.Sistergold said:Hello everyone. Hope you are all fine and pressing on with DIY since we have the long days. Just a financial update. Mortgage went out on the 14th of July.New balance Only managing OP of £100, hopefully I will be able to increase it soon but looking like not going to happen soon.

Only managing OP of £100, hopefully I will be able to increase it soon but looking like not going to happen soon.

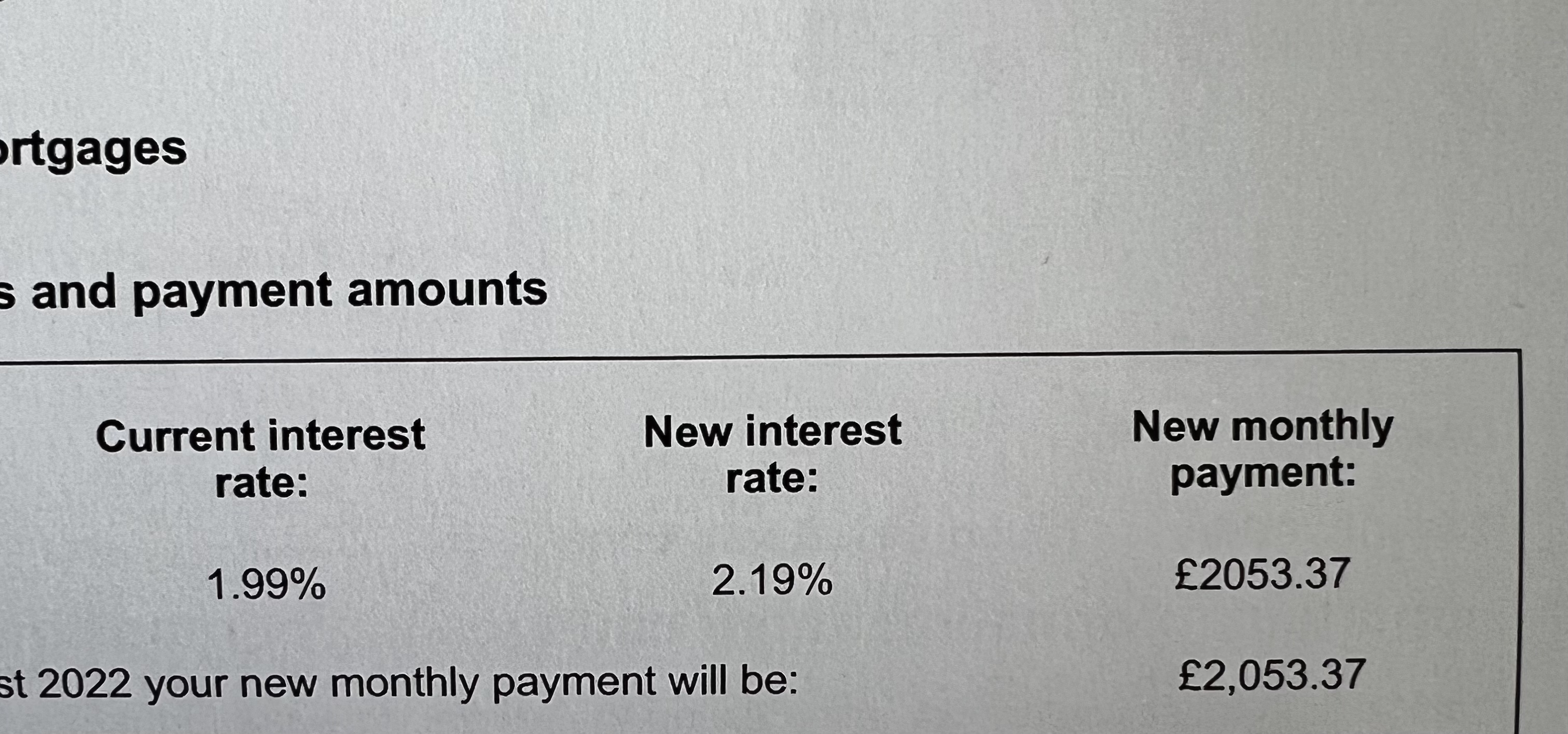

Looking at your house payment I could afford £2k a month if I was honest - maybe I am being too cowardly for my own good.

I will casually look at flats a bit harder DON'T BUY STUFF (from Frugalwoods)

DON'T BUY STUFF (from Frugalwoods)

No seriously, just don’t buy things. 99% of our success with our savings rate is attributed to the fact that we don’t buy things... You can and should take advantage of discounts.... But at the end of the day, the only way to truly save money is to not buy stuff. Money doesn’t walk out of your wallet on its own accord.

https://forums.moneysavingexpert.com/discussion/6289577/future-proofing-my-life-deposit-saving-then-mfw-journey-in-under-13-years#latest0 -

Oh @badmemory if the interests rates go to 17%, I think at that point the bankers will have decided they want to repossess as many houses as they can! House Prices have gone up so much the payments will be ridiculous! Well we just pray for the worst not to happen! I really need to ramp up my OPs in the meantime. Xbadmemory said:If it goes up to over 10% we will all be in the ************. Although I am old enough to remember having to pay 17%. It just kept going up & up. Fixes were not the norm then.Initial mortgage bal £487.5k, current £258k, target £243,750(halfway!)

Mortgage start date first week of July 2019,

Mortgage term 23yrs(end of June 2042🙇🏽♀️),Target is to pay it off in 10years(by 2030🥳).MFW#10 (2022/23 mfw#34)(2021 mfw#47)(2020 mfw#136)

£12K in 2021 #54 (in 2020 #148)

MFiT-T6#27

To save £100K in 48months start 01/07/2020 Achieved 30/05/2023 👯♀️

Am a single mom of 4.Do not wait to buy a property, Buy a property and wait. 🤓0 -

@LadyWithAPlan, that’s really lucky that the side hustle has become another stream of income! Well done! As it’s promising to give a return and you say you enjoy it it’s good to invest in yourself to bump up your skills so that you can do even more! So getting a one to one training is a good idea as you can learn what is relevant to you and fill the knowledge gaps. I think yes you should be able to afford £400k mortgage as it’s the amount at present for which I am paying just over £2k. You have also mentioned that you don’t mind stretching the term so that should lower it even further! Being single means you need to future proof by getting the longest term and then OP as you go along.I think part of your delay in buying might just be that you have not “fallen too much in love” with any particular flat on sale! When it’s the right time you will be pushing to get “that flat”!Initial mortgage bal £487.5k, current £258k, target £243,750(halfway!)

Mortgage start date first week of July 2019,

Mortgage term 23yrs(end of June 2042🙇🏽♀️),Target is to pay it off in 10years(by 2030🥳).MFW#10 (2022/23 mfw#34)(2021 mfw#47)(2020 mfw#136)

£12K in 2021 #54 (in 2020 #148)

MFiT-T6#27

To save £100K in 48months start 01/07/2020 Achieved 30/05/2023 👯♀️

Am a single mom of 4.Do not wait to buy a property, Buy a property and wait. 🤓1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards