We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Regular Savings Accounts: The Best Currently Available List!

Comments

-

Aha! yBS increasing to 5.75%alrk said:Ive had my halifax and YBS regular accounts since march. I think they have been 5.5% since I opened them and are still top of the interest rates. Why are there so few at 5.5 and they dont seem to have increased with the bank rates!

thanks for your ideas0 -

That's for the Xmas 2023 regular saver up by 0.25%alrk said:

Aha! yBS increasing to 5.75%alrk said:Ive had my halifax and YBS regular accounts since march. I think they have been 5.5% since I opened them and are still top of the interest rates. Why are there so few at 5.5 and they dont seem to have increased with the bank rates!

thanks for your ideas

The regular e-saver is also up by 0.25% to 5.25%

Loyalty regular saver also up 0.25% to 6.25%

All WEF 10th August

0 -

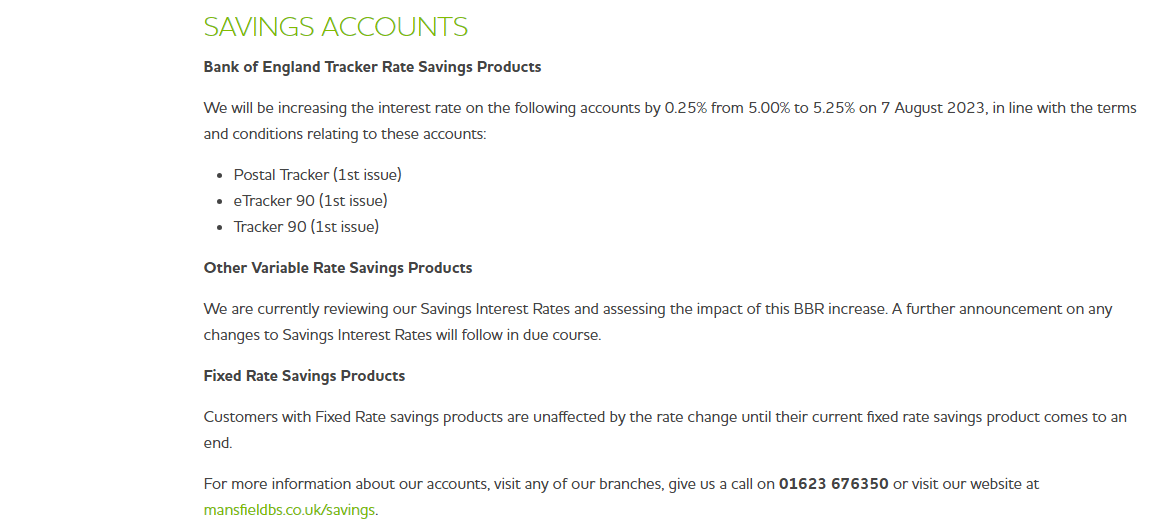

Mansfield are also drip feeding information:Wheres_My_Cashback said:Darlington BS seem to be drip feeding info, their latest states - Following the Bank of England’s decision to increase the Bank Base Rate by 0.25 percentage points, to 5.25% on 3 August 2023, the below changes will apply:

Savings

Increase interest rates on all savings accounts on 1 September 2023, with some accounts benefitting from the full 0.25% rate increase.

Savings accounts which are directly linked to and track the Bank Base Rate will increase by 0.25% on 1 September 2023.

https://www.darlington.co.uk/news/update-following-bank-base-rate-increase-in-august-2023/

{...}

Newbury have come up with this:

Leek BS have just given their generic response:

H&R have told me that they will soon be announcing increases to some of their savings accounts with effect from 17/8/23. They couldn't specify which accounts would be rising though so it's unclear yet as to whether the regular saver will rise. Whilst I remember if anyone sends H&R their passbook requesting a withdrawal and then change their mind you can telephone them and cancel the withdrawal if you want, I managed to do this the other week and they just sent the updated passbook back on the day the withdrawal was due to take place. Just something that may be of use if they announce an increase the day before one of your withdrawals is due to take place.

9 -

Mansfield haven't changed the closed issue RS accounts since June 1st. I have 2 and they are in my hit list. One likely to be closed. The other cut to minimum.

In my experience they won't reveal the new rate even on a branch visit until the date of implementation0 -

Is this the 30 day notice one? I gave notice 28 days ago in the hope that rates might rise but now just looking forward to receiving the cash and depositing elsewhere.happybagger said:Mansfield haven't changed the closed issue RS accounts since June 1st. I have 2 and they are in my hit list. One likely to be closed. The other cut to minimum.

In my experience they won't reveal the new rate even on a branch visit until the date of implementation0 -

Im a bit baffled to see the gap between instant and RS so narrow now. A rate around 5% is hardly worth it by this point.

4 -

If you go to their website https://www.penrithbs.co.uk/news/interest-rates/ForumUser7 said:

The find out more button brings you to a page that has a button for information on current rates. No RS300 increase yetOneUser1 said:Penrith Building Society have sent me an email saying they have increased their variable rates. But you have to contact them to find out the new rates. Anyone know whether this means the 6% Regular Saver has increased?

it has details of the rate increase happening on 22/08/2023. Many accounts eg the RG 200 is going up, but no mention of the RS 300, so therefore we can take it that there is no increase, which is pretty poor.

0 -

My lowest paying RS is currently 5.25%, I can get the money should I want it, and it's a better rate (just) than EA accounts. So I'm happy... for now.Kaizen917 said:Im a bit baffled to see the gap between instant and RS so narrow now. A rate around 5% is hardly worth it by this point.1 -

Banks were using keen regular saver deals to respond to criticism about interest rates, but that was not accepted by the politicians, nor by the press.Kaizen917 said:Im a bit baffled to see the gap between instant and RS so narrow now. A rate around 5% is hardly worth it by this point.

I think the debate has moved on and RS accounts are not being pushed by banks as they were.

I'm funding more than I can afford from income, all at over 5%, so they have served a purpose for me.2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards