We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Regular Savings Accounts: The Best Currently Available List!

Comments

-

Good shout, thanks. I was just going to bin them off but thinking about it now I’ll leave the requisite £10 in there.londoner62 said:

I think I'll be the minimum amount in the measly account to maintain membership just in case they follow the route many other BS are taking.jaypers said:For anyone with the Beehive RS, don’t forget to move your money after maturity as they will be moving it into a measly 2.65% paying a/c.

The fixed rate period on your Online Fixed Regular Saver ends on Wednesday 31 July 2024 when we’ll move your balance to our Beehive Easy Access Issue 4 currently at 2.65% gross p.a/AER* variable.

Your savings will be available to access from Thursday 1 August 2024 and you can find details on the account here.0 -

Progressive

When you establish a nominated account do they ask for some sort of verification - like a recent bank statement?

TIA0 -

Didn't ask me for anything, account (First Direct) was approved within seconds.schiff said:Progressive

When you establish a nominated account do they ask for some sort of verification - like a recent bank statement?

TIA1 -

Beehive and Tipton. I'll wait until the second RSs mature and then go for measly accounts, there's no rush whilst the memberships are still maintained.jaypers said:

Good shout, thanks. I was just going to bin them off but thinking about it now I’ll leave the requisite £10 in there.londoner62 said:

I think I'll be the minimum amount in the measly account to maintain membership just in case they follow the route many other BS are taking.jaypers said:For anyone with the Beehive RS, don’t forget to move your money after maturity as they will be moving it into a measly 2.65% paying a/c.

The fixed rate period on your Online Fixed Regular Saver ends on Wednesday 31 July 2024 when we’ll move your balance to our Beehive Easy Access Issue 4 currently at 2.65% gross p.a/AER* variable.

Your savings will be available to access from Thursday 1 August 2024 and you can find details on the account here.1 -

Gers said:

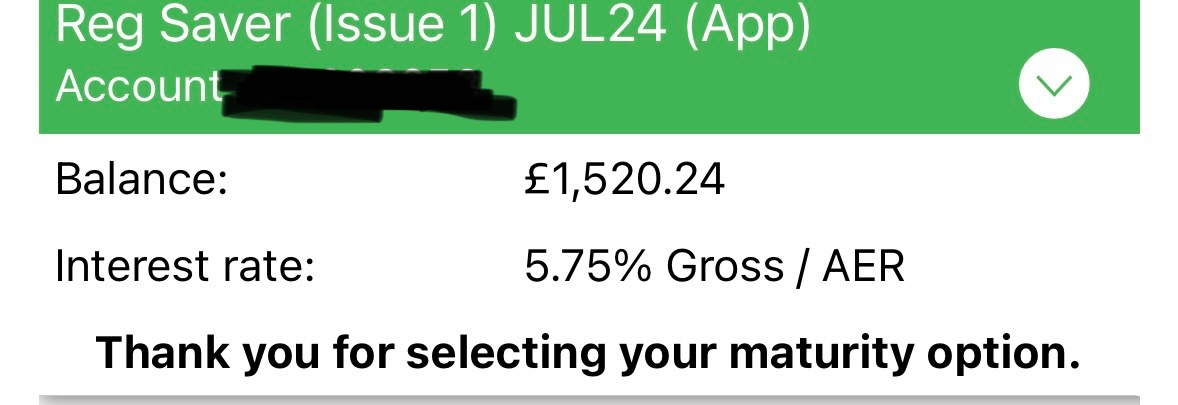

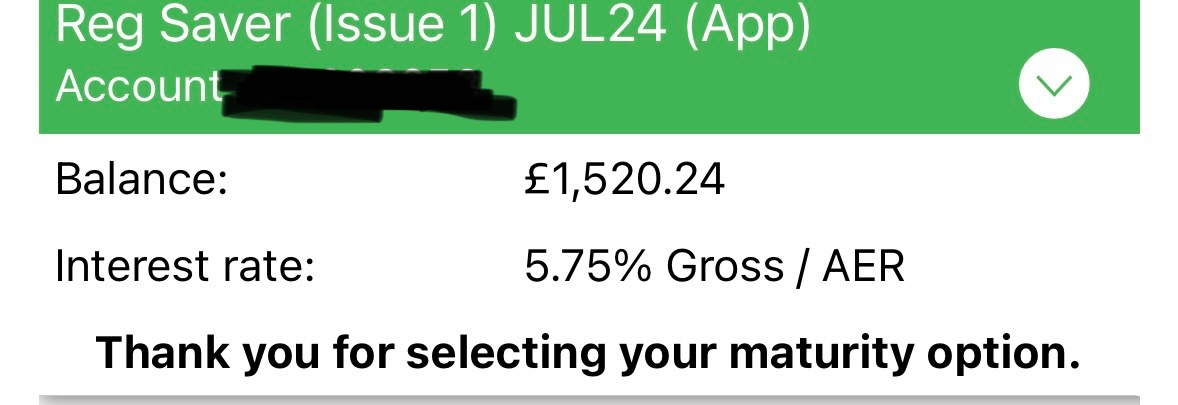

Tiptongt94sss2 said:If anyone has the Tipton RS which ends at the end of the month, your maturity options are now showing in the app

Nothing impressive there and no new RS either. it’s all so disappointing but expected.

Yes, underwhelming from Tipton - easy to set maturity option on App for closure of the 5.75%RS1 (July24). I still have the 6.2%RS2 (Oct24) (14month term!) running and will hope for a decent new RS on offer when it matures on 31/10/24.

0 -

How do you access these please?gt94sss2 said:If anyone has the Tipton RS which ends at the end of the month, your maturity options are now showing in the app

Nothing obvious for me (in the app) and I received the options by post.0 -

TIPTON:simonsmithsays said:

How do you access these please?

Nothing obvious for me (in the app) and I received the options by post.

Where I now have a “thank you” message it originally said about maturity options if that’s any help?

Save £12k in 2022 #54 reporting for duty0 -

That's strange - nothing here.dingling68 said:

TIPTON:simonsmithsays said:

How do you access these please?

Nothing obvious for me (in the app) and I received the options by post.

Where I now have a “thank you” message it originally said about maturity options if that’s any help?

Which app version are you please?

I'm 3.1.410 -

I had to send the top part of my recent bank statement. I downloaded the statement on my iPhone, edited it, and, via the Progressive website, sent the top part with acc. no., name and address to them. No transaction details required. It was confirmed promptly by Progressive.schiff said:Progressive

When you establish a nominated account do they ask for some sort of verification - like a recent bank statement?

TIADigital Payback

The National Lottery : A tax on those who aren’t good at maths.1 -

Digital_Payback said:

I had to send the top part of my recent bank statement. I downloaded the statement on my iPhone, edited it, and, via the Progressive app, sent the top part with acc. no., name and address to them. No transaction details required. It was confirmed promptly by Progressive.schiff said:Progressive

When you establish a nominated account do they ask for some sort of verification - like a recent bank statement?

TIA

I didn't have to do any of that - a Progressive agent phoned me (in response to my contacting them), asked for my details and then set up the linked account. This was in the early days when they didn't have many sort codes on their systems.

0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards