|

We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Virgin Money Current Account

Comments

-

Surely 999 is indicatively better than say 499. Not sure what you mean by 'should re-apply with information they are looking for'Hasbeen said:

Surprised the regular posters have not mentioned the made up credit score of 999 is basically worthless. LOL.ovusa said:I know that each bank has differing criteria when vetting an application but Virgin Money Current & Saving account have just declined my daughter's application even though she has an Experian score of 999, no debts and money to deposit!

But your daughter should reapply with information that they are looking for?

With out the errors.

Worth a shot?

They do not say what they are looking for, presumably just truthful answers.

Of course the formatting errors in their application were spotted and corrected before submitting.

0 -

It doesn't say £5,000 per month etc. on the summary.ovusa said:

Surely 999 is indicatively better than say 499. Not sure what you mean by 'should re-apply with information they are looking for'Hasbeen said:

Surprised the regular posters have not mentioned the made up credit score of 999 is basically worthless. LOL.ovusa said:I know that each bank has differing criteria when vetting an application but Virgin Money Current & Saving account have just declined my daughter's application even though she has an Experian score of 999, no debts and money to deposit!

But your daughter should reapply with information that they are looking for?

With out the errors.

Worth a shot?

They do not say what they are looking for, presumably just truthful answers.

Of course the formatting errors in their application were spotted and corrected before submitting.

It says £5,000 - Monthly.

I agree it's unclear but as per the questions asked it means £5,000 in total over the year saved in monthly installments.1 -

Depends what you mean by better. We've seen plenty of instances of people having a 999 score with a poor credit history but it may well be that a bank will prefer someone with a poorer credit score with better potential to cross sell other products such as credit cards, loans etc with higher profit.ovusa said:

Surely 999 is indicatively better than say 499. Not sure what you mean by 'should re-apply with information they are looking for'Hasbeen said:

Surprised the regular posters have not mentioned the made up credit score of 999 is basically worthless. LOL.ovusa said:I know that each bank has differing criteria when vetting an application but Virgin Money Current & Saving account have just declined my daughter's application even though she has an Experian score of 999, no debts and money to deposit!

But your daughter should reapply with information that they are looking for?

With out the errors.

Worth a shot?

They do not say what they are looking for, presumably just truthful answers.

Of course the formatting errors in their application were spotted and corrected before submitting.0 -

I'm in the same boat. I applied, was deferred and rejected a few days - got the same emails as well as a letter in the mail a few days later.ovusa said:

Email - extractEd-1 said:

How did they notify her of the decline?ovusa said:Ed-1 said:

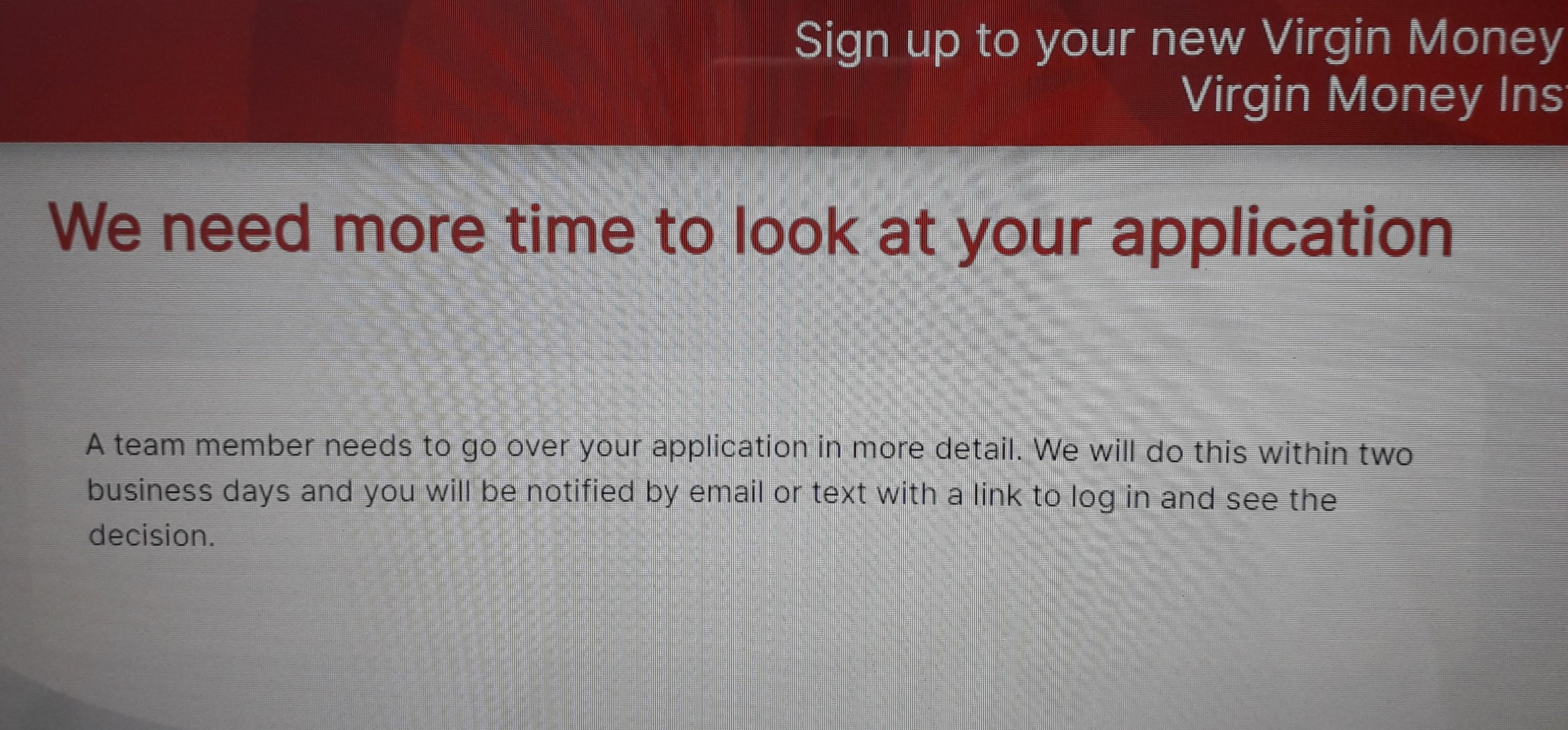

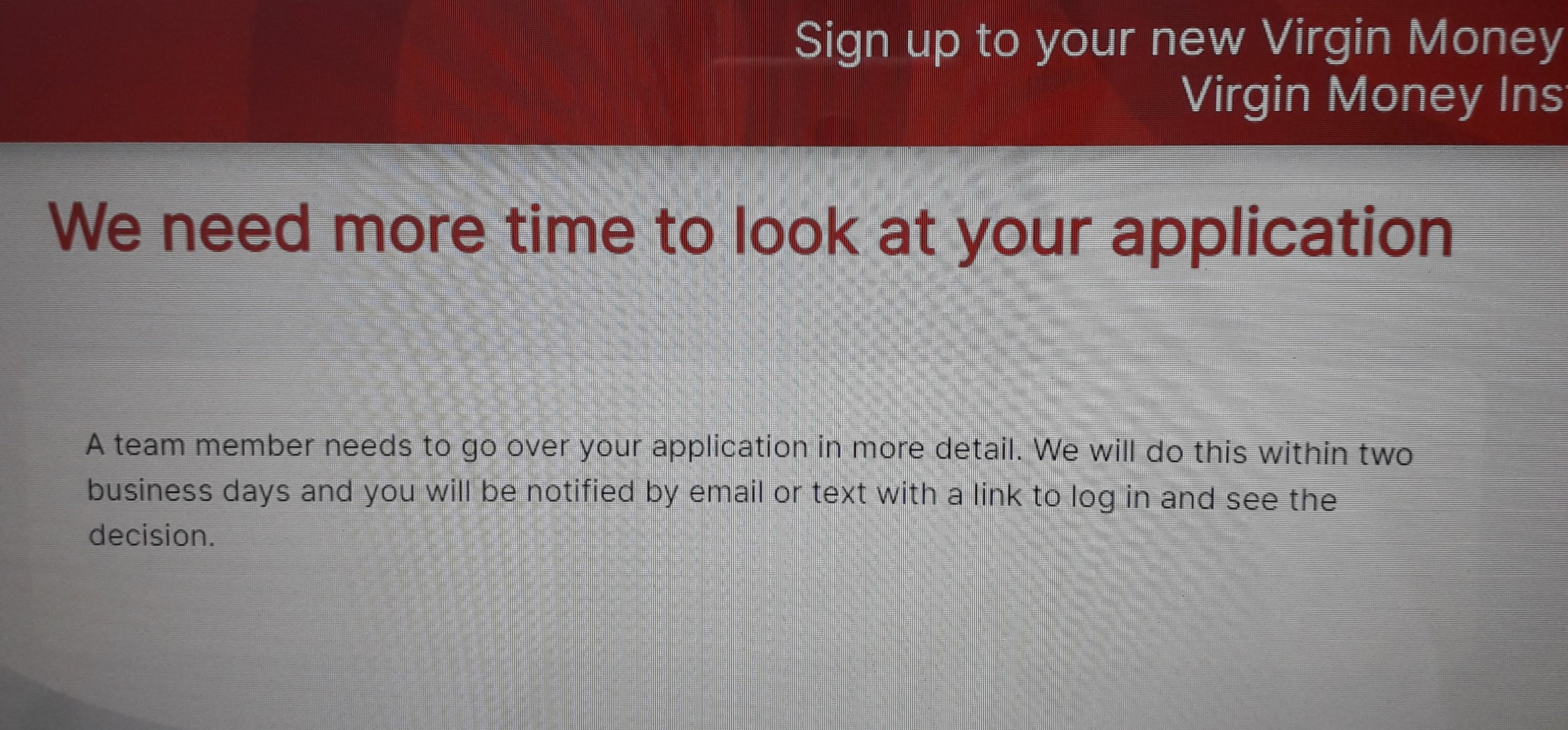

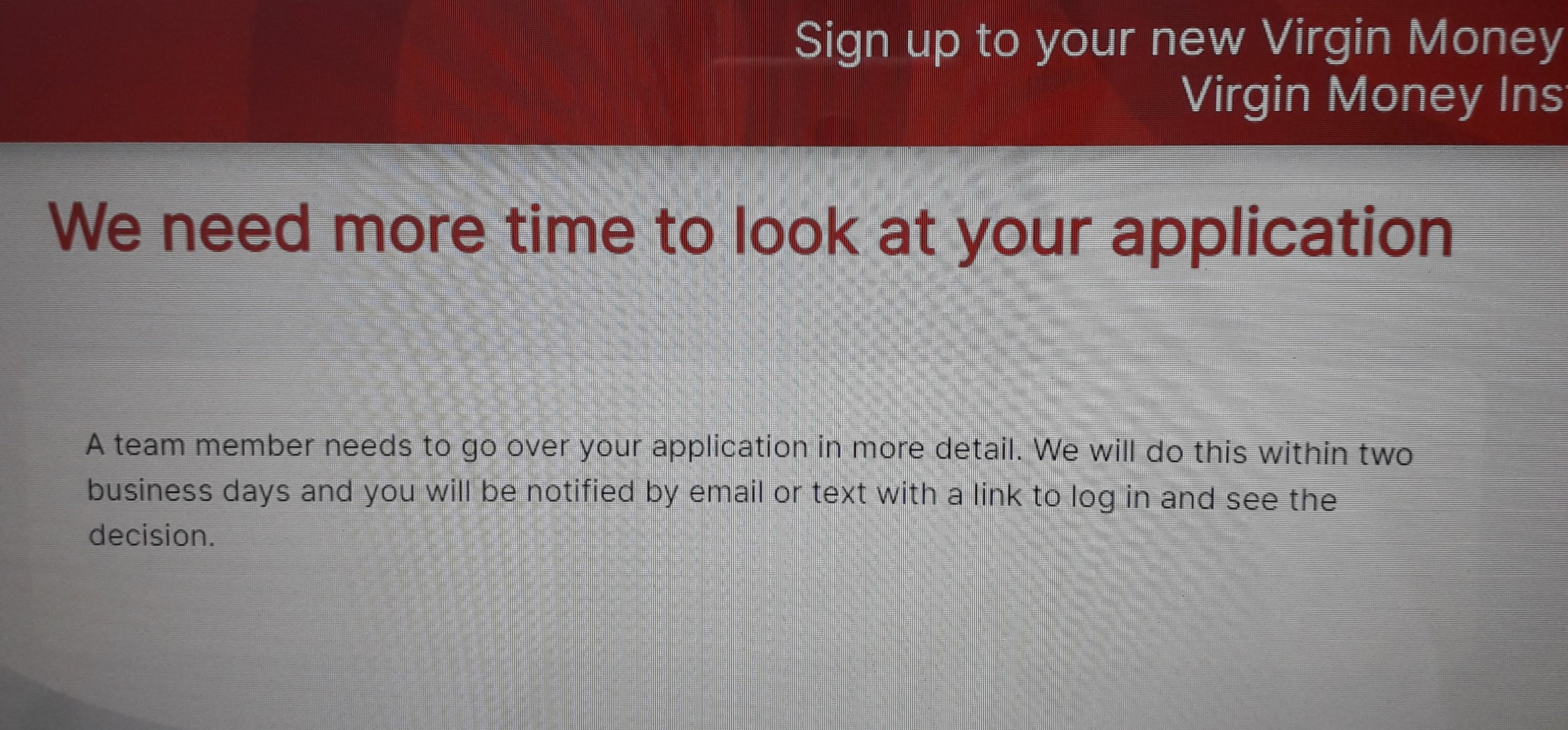

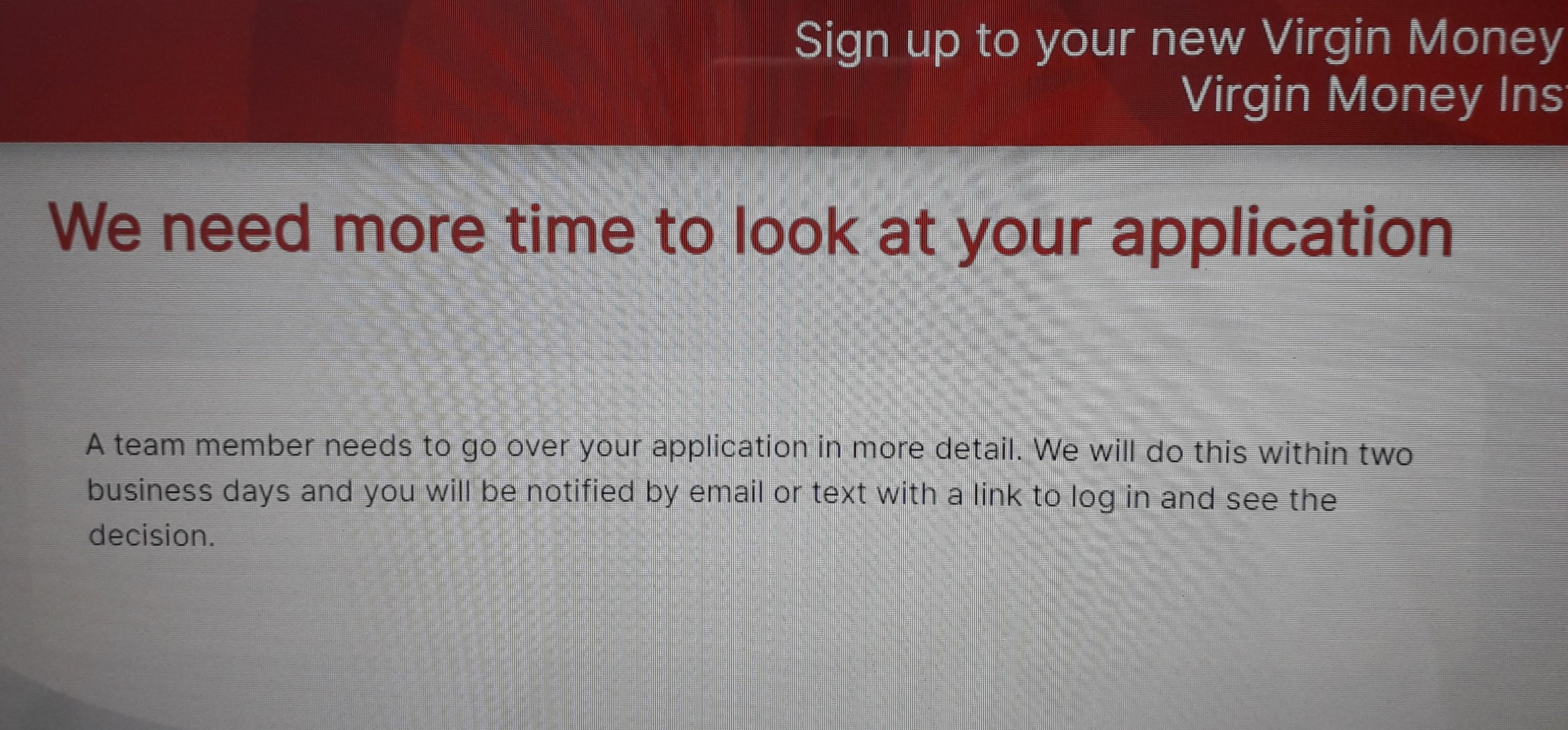

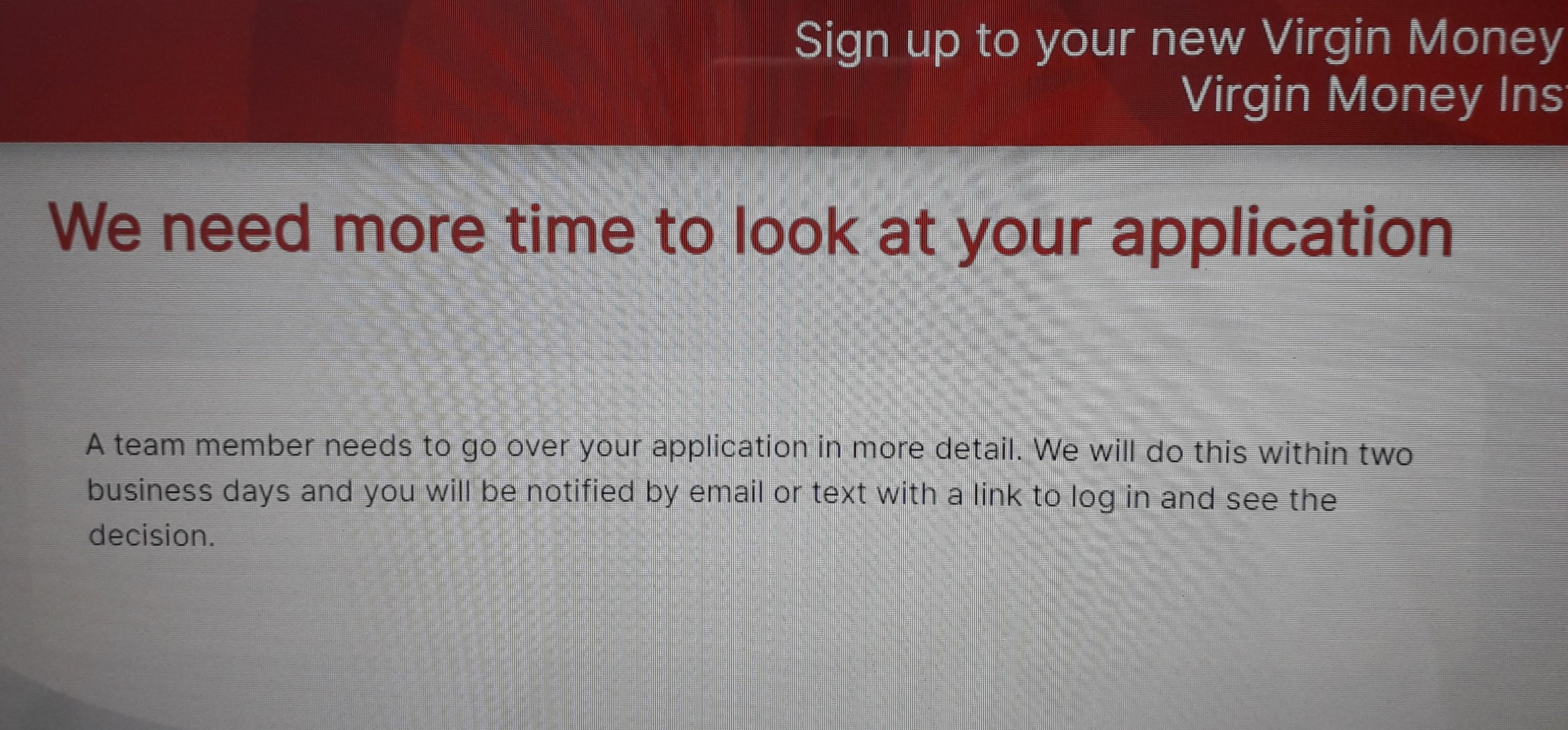

Did she get the following message or was it outright declined?ovusa said:I know that each bank has differing criteria when vetting an application but Virgin Money Current & Saving account have just declined my daughter's application even though she has an Experian score of 999, no debts and money to deposit!

She got that message after submitting her application. Would have thought Virgin would have contacted her if there was any query rather than reject her!

Their application form has a number of errors as described in my previous post 20 November [page 65]

One question asks: how much do you hope to save per annum - entered £5000.

Next question: how often do you plan to save weekly/monthly/annually - entered monthly.In the review section it then shows £5000 per month

Thanks for applying for a Virgin Money Current Account.

We've given it a lot of thought, but we're sorry to say we won't be offering you an account at the moment and on this occasion we've had to decline your application.How we made our decision

We use a credit scoring system and information from the credit reference agencies Experian and TransUnion. This is to make sure we treat all applications fairly and consistently.

Nothing you can do - Virgin has decided for whatever reason that they do not want to offer you an account. They are under no obligation to do so, so you're better off focusing your attention elsewhere.0 -

Be interesting to know if anyone has been approved after a referral.PRAISETHESUN said:

I'm in the same boat. I applied, was deferred and rejected a few days - got the same emails as well as a letter in the mail a few days later.ovusa said:

Email - extractEd-1 said:

How did they notify her of the decline?ovusa said:Ed-1 said:

Did she get the following message or was it outright declined?ovusa said:I know that each bank has differing criteria when vetting an application but Virgin Money Current & Saving account have just declined my daughter's application even though she has an Experian score of 999, no debts and money to deposit!

She got that message after submitting her application. Would have thought Virgin would have contacted her if there was any query rather than reject her!

Their application form has a number of errors as described in my previous post 20 November [page 65]

One question asks: how much do you hope to save per annum - entered £5000.

Next question: how often do you plan to save weekly/monthly/annually - entered monthly.In the review section it then shows £5000 per month

We've got an update for you

Thanks for applying for a Virgin Money Current Account.

We've given it a lot of thought, but we're sorry to say we won't be offering you an account at the moment and on this occasion we've had to decline your application.How we made our decision

We use a credit scoring system and information from the credit reference agencies Experian and TransUnion. This is to make sure we treat all applications fairly and consistently.

Nothing you can do - Virgin has decided for whatever reason that they do not want to offer you an account. They are under no obligation to do so, so you're better off focusing your attention elsewhere.0 -

referral?Ed-1 said:

Be interesting to know if anyone has been approved after a referral.PRAISETHESUN said:

I'm in the same boat. I applied, was deferred and rejected a few days - got the same emails as well as a letter in the mail a few days later.ovusa said:

Email - extractEd-1 said:

How did they notify her of the decline?ovusa said:Ed-1 said:

Did she get the following message or was it outright declined?ovusa said:I know that each bank has differing criteria when vetting an application but Virgin Money Current & Saving account have just declined my daughter's application even though she has an Experian score of 999, no debts and money to deposit!

She got that message after submitting her application. Would have thought Virgin would have contacted her if there was any query rather than reject her!

Their application form has a number of errors as described in my previous post 20 November [page 65]

One question asks: how much do you hope to save per annum - entered £5000.

Next question: how often do you plan to save weekly/monthly/annually - entered monthly.In the review section it then shows £5000 per month

We've got an update for you

Thanks for applying for a Virgin Money Current Account.

We've given it a lot of thought, but we're sorry to say we won't be offering you an account at the moment and on this occasion we've had to decline your application.How we made our decision

We use a credit scoring system and information from the credit reference agencies Experian and TransUnion. This is to make sure we treat all applications fairly and consistently.

Nothing you can do - Virgin has decided for whatever reason that they do not want to offer you an account. They are under no obligation to do so, so you're better off focusing your attention elsewhere.

0 -

Referred for further checks.Zanderman said:

referral?Ed-1 said:

Be interesting to know if anyone has been approved after a referral.PRAISETHESUN said:

I'm in the same boat. I applied, was deferred and rejected a few days - got the same emails as well as a letter in the mail a few days later.ovusa said:

Email - extractEd-1 said:

How did they notify her of the decline?ovusa said:Ed-1 said:

Did she get the following message or was it outright declined?ovusa said:I know that each bank has differing criteria when vetting an application but Virgin Money Current & Saving account have just declined my daughter's application even though she has an Experian score of 999, no debts and money to deposit!

She got that message after submitting her application. Would have thought Virgin would have contacted her if there was any query rather than reject her!

Their application form has a number of errors as described in my previous post 20 November [page 65]

One question asks: how much do you hope to save per annum - entered £5000.

Next question: how often do you plan to save weekly/monthly/annually - entered monthly.In the review section it then shows £5000 per month

We've got an update for you

Thanks for applying for a Virgin Money Current Account.

We've given it a lot of thought, but we're sorry to say we won't be offering you an account at the moment and on this occasion we've had to decline your application.How we made our decision

We use a credit scoring system and information from the credit reference agencies Experian and TransUnion. This is to make sure we treat all applications fairly and consistently.

Nothing you can do - Virgin has decided for whatever reason that they do not want to offer you an account. They are under no obligation to do so, so you're better off focusing your attention elsewhere.0 -

I see what you mean. I'd prefer 'deferral' though!Ed-1 said:

Referred for further checks.Zanderman said:

referral?Ed-1 said:

Be interesting to know if anyone has been approved after a referral.PRAISETHESUN said:

I'm in the same boat. I applied, was deferred and rejected a few days - got the same emails as well as a letter in the mail a few days later.ovusa said:

Email - extractEd-1 said:

How did they notify her of the decline?ovusa said:Ed-1 said:

Did she get the following message or was it outright declined?ovusa said:I know that each bank has differing criteria when vetting an application but Virgin Money Current & Saving account have just declined my daughter's application even though she has an Experian score of 999, no debts and money to deposit!

She got that message after submitting her application. Would have thought Virgin would have contacted her if there was any query rather than reject her!

Their application form has a number of errors as described in my previous post 20 November [page 65]

One question asks: how much do you hope to save per annum - entered £5000.

Next question: how often do you plan to save weekly/monthly/annually - entered monthly.In the review section it then shows £5000 per month

We've got an update for you

Thanks for applying for a Virgin Money Current Account.

We've given it a lot of thought, but we're sorry to say we won't be offering you an account at the moment and on this occasion we've had to decline your application.How we made our decision

We use a credit scoring system and information from the credit reference agencies Experian and TransUnion. This is to make sure we treat all applications fairly and consistently.

Nothing you can do - Virgin has decided for whatever reason that they do not want to offer you an account. They are under no obligation to do so, so you're better off focusing your attention elsewhere.

My own experience, btw, is slightly different again to the recent posts. I too reached an impasse with the 'you look familiar' screen and told to ring 0800 678 3654. But instead I tried the solution suggested by a poster a few days ago, starting again and saying I did have an account and using the details of an old one. That got me only a short way in before a screen saying I had two minutes to confirm identity via the app. I don't have the app. So I installed it and started over, again, and tried to log in to that but, not surprisingly, the app kicked me out saying I needed to ring. A different number 0800 121 7365.

So I stopped trying to be clever and rang the first number. Went through the usual details, fudged the monthly savings question by saying it would be variable, which seemed to satisfy. And was told, after a few mins on hold, that I was approved, with a code in the post to set everything up. Nothing in the post yet but early days.

0 -

I have bad credit (paid CCJ and a couple of defaults), been with Virgin for several years and had their basic account / savings accounts as that's where I stored a lot of my mortgage deposit. I waited a month or two after completing my purchase and moving, to allow some of the CRA information to update and show me at my new address, had next to no money with them at this point and had closed a few accounts due to not needing them anymore.

When asked how much I will be paying in I said £400pm (my disposable income), but had to wait for the letter to come through the post / them to do checks and provide proof of ID.

The last two current accounts I've opened ask how much will be paid in and where the money comes from. Same when I open savings accounts, my SIPP and S&S ISA; the latter two ask me each time I pay in where the money is from. It's probably part of the due diligence and knowing customer side of thingsMortgage started 2020, aiming to clear 31/12/2029.0 -

Zanderman, when you called 0800 678 3654 did they deal with you there and then or arrange a call back?0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards