We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The Top Easy Access Savings Discussion Area

Comments

-

Now fixed, credit to Daliah.

0 -

Seeing that at only 3 of the 9 mpc members voted for a 0.75 rise, I'd think it unlikely that there would be a majority for a 1% rise in base rates at the next meeting.SJMALBA said:Amongst the apparent economic carnage being caused by Kwarteng's 'mini-bidget', there are increasing suggestions that the BoE will now be forced into more aggressive action, with a 1% rise in November already being talked about... e.g.'The BoE, which has been reluctant to hike rates aggressively, will need to roll up its sleeves and fight inflation with larger rate hikes for here. Expectations for a 1% hike in November are already climbing.It’s difficult to see how the pound can recover from here. Investors are pulling out of UK assets rapidly and who can blame them? Drawing comparisons historically, the last big tax giveaway in 1972 resulted in rampant inflation, unmanageable debt, and an IMF bailout.' Fiona Cincotta, Senior Financial Markets Analyst at City Index.

0 -

SeriousHoax said:Come on Cynergy bank I'm waiting on you to go top of the table.🤪😜🤔🤔🤔

Anyone think they will raise there intrest rates.Seeing as at the moment their account is only "Exclusively available to existing Cynergy Bank customers" possibly not I think.It sounds like they don't need any extra funds at the moment, so unless there is a mass exodus of money, I am not that hopeful.

1 -

I have done the same with £1 in issue 12 :-)ScarletBea said:

I opened issue 12 with £1 in case the increases only applied to the latest account but it seems the previous one is always being updated as well.mebu60 said:

The same rates also apply to Issue 11.Bridlington1 said:YBS have announced they are increasing the rate on their Internet Saver Plus issue 12 on 5/10/22 to:

1.8% below £10k

2% between £10k and £50k

2.05% above £50k

Full list of increases: https://www.ybs.co.uk/boe-rate-change

Also they've withdrawn the family saver account, which has now risen by 0.3% for all interest tiers.0 -

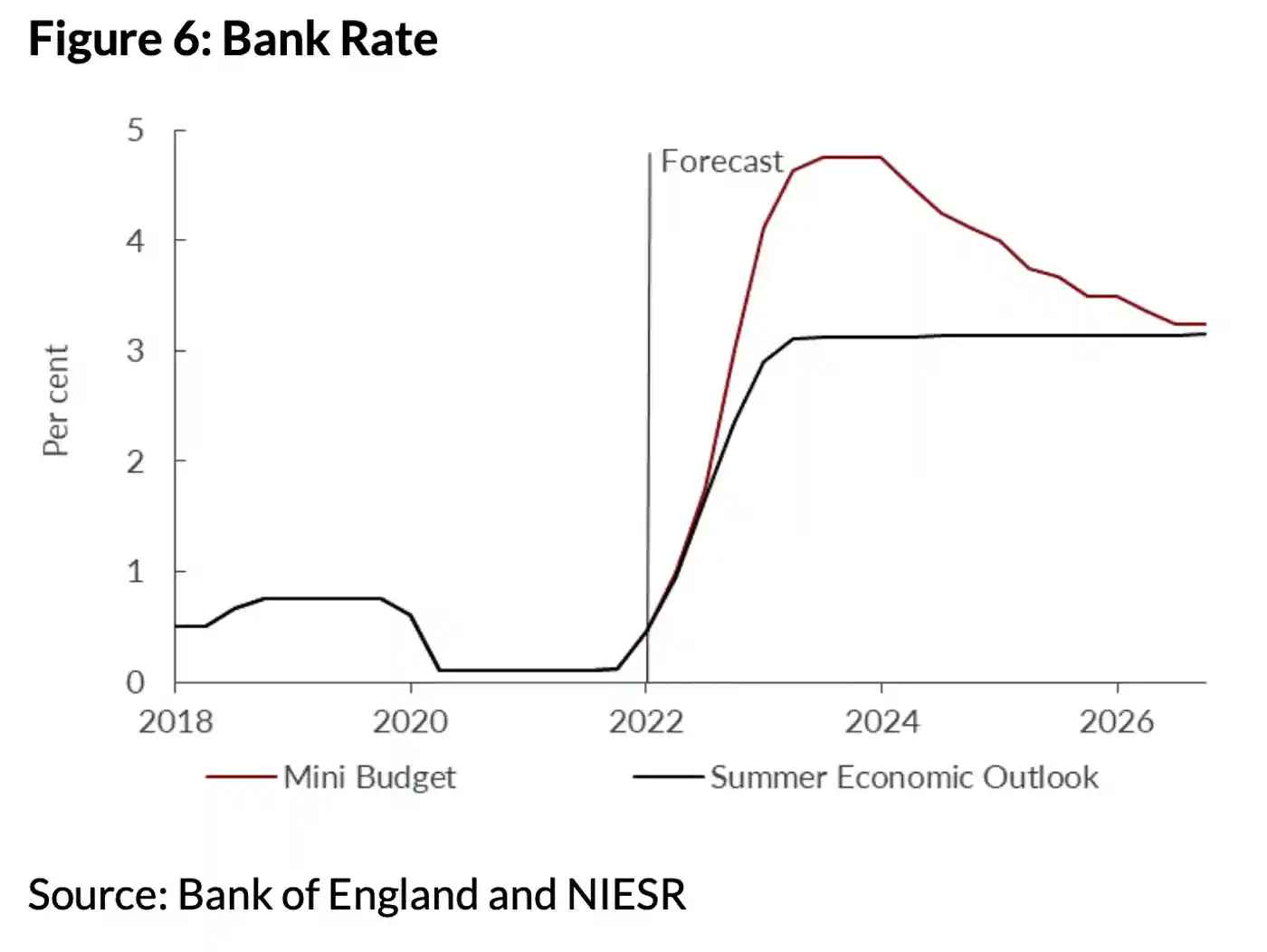

But that meeting was before the mini-budget (unless the government gave them full details). The National Institute of Economic and Social Research has raised its interest rate expectations a lot:jimexbox said:

Seeing that at only 3 of the 9 mpc members voted for a 0.75 rise, I'd think it unlikely that there would be a majority for a 1% rise in base rates at the next meeting.SJMALBA said:Amongst the apparent economic carnage being caused by Kwarteng's 'mini-bidget', there are increasing suggestions that the BoE will now be forced into more aggressive action, with a 1% rise in November already being talked about... e.g.'The BoE, which has been reluctant to hike rates aggressively, will need to roll up its sleeves and fight inflation with larger rate hikes for here. Expectations for a 1% hike in November are already climbing.It’s difficult to see how the pound can recover from here. Investors are pulling out of UK assets rapidly and who can blame them? Drawing comparisons historically, the last big tax giveaway in 1972 resulted in rampant inflation, unmanageable debt, and an IMF bailout.' Fiona Cincotta, Senior Financial Markets Analyst at City Index.

1 -

Yorkshire BS-Tiered** Intrnt Svr Plus iss 12 is still available but not according to the above post which says it has been withdrawn in the Note below.soulsaver said:

Weekend end update, full list inc drop offs still here.soulsaver said:ToTP

Al Rayan still on top... for now: 2.10% epr

OK rate trappers: Easy(ish) Access, Top (10ish) Of The Pots.. BoE base rate +0.5 =2.25% (22/09)

Updated at 23/09/2022 c.13.30hrs - Starter for 10; not comprehensive, DYOR.

Latest/recent changes in bold. Links added for all accounts. TIA for all contributions.

Bracketed dates = date rate added/amended here.1 Al Rayan Everyday Saver iss 3. £5k min 2.10% (01/09) App onlyish. Everyday Saver (Issue 3) | Islamic banking | Sharia compliant & ethical (alrayanbank) Thnx Ed

2 Gatehouse EA 2.00% EPR (01/09) New Min £1.00! Easy access account | Gatehouse Bank | Gatehouse Bank plc

3 Yorkshire BS-Tiered** Intrnt Svr Plus iss 12 (22/09) wef 07/10: 2.00% (1.8%<£10k 2.05%>£50k). View our Easy Access Savings Accounts | Savings | YBS Thnx @Bridlington1

4 Ford 1.95% (21/09) Flexible Savings Account - Easy access savings | Ford Money thnx @kazza242

5 Atom 1.90% app only (23/09) Instant Saver 1.90% Interest Rate - Easy Access Savings | Atom bank thnx TomDolan

6 Zopa Smart Saver (App only) - £85k max. Improved rates(12/09) Access 1.85%; Boosted 7day notice 1.90%; 31day 2.05%; 95day 2.25% Smarter Savings built for real life

7 Harpenden BS 1.90% triple access (21/09) Triple Access Saver Account - Harpenden Building Society (harpendenbs.co.uk) Branch/Postal opening thnx @Bridlington1

8 Cynergy EA; 1.85% inc 1st yr bonus (16/08) 'existing customers' Cynergy Bank

9 Bucks BS 1.85% single access calendar year (20/09) Buckinghamshire Building Society (bucksbs.co.uk)@Bridlington1

10 Shawbrook EA iss30 1.81% £1k min (02/09)* Easy Access Savings Accounts | Shawbrook Bank (Shawbrook iss 29 @ 1.86 NLA*)

11= Secure Trust Bank 'Access' 1.80% £1k min (05/09) Access Account - Secure Trust Bank

11= Paragon triple access 1.80% (19/08) Triple Access Savings Account | Paragon Bank

11= Marcus/Saga 1.80 (inc 0.25% bonus) (22/09) Online Savings Account | Marcus by Goldman Sachs®

**Note: YBS 2.05% wef 07/10 upto £10k with w/d restrictions now NLA*: Savings Account - More Information | YBS

* NLA = No Longer available to new applicants

Recent/Upcoming Drop offs: (23/09) Principality1.78%, Charter, Nationwide, Cambridge BS all @ 1.75%.

(20/09) Tesco, Virgin Money both @1.71%

Check terms for yourself - DYOR.

Note: These rates may, or may not be applied to existing accounts, plse check.

Small balance, high rate: Virgin Money 2.0% £1k limit, Nationwide FlexDirect 5% on £1.5k (1st year only) Others of note?

Also see Regular Savings Accounts: The Best Currently Available List! — MoneySavingExpert Forum

And Cash ISAs: The Best Currently Available List — MoneySavingExpert ForumAnd Notice Accounts: Notice Accounts - Page 11 — MoneySavingExpert Forum

**Note: YBS 2.05% wef 07/10 upto £10k with w/d restrictions now NLA*: Savings Account - More Information | YBS0 -

I am flamboozled as to why YBS bothered to bring out issue 12, when it has kept an identical interest rate to issue 11 for its entire existence.ScarletBea said:

I opened issue 12 with £1 in case the increases only applied to the latest account but it seems the previous one is always being updated as well.mebu60 said:

The same rates also apply to Issue 11.Bridlington1 said:YBS have announced they are increasing the rate on their Internet Saver Plus issue 12 on 5/10/22 to:

1.8% below £10k

2% between £10k and £50k

2.05% above £50k

Full list of increases: https://www.ybs.co.uk/boe-rate-change

Also they've withdrawn the family saver account, which has now risen by 0.3% for all interest tiers.0 -

I believe the above post refers to the fact that the Family Savings Account has been withdrawn, not the internet saver issue 12.paul235 said:

Yorkshire BS-Tiered** Intrnt Svr Plus iss 12 is still available but not according to the above post which says it has been withdrawn in the Note below.soulsaver said:

Weekend end update, full list inc drop offs still here.soulsaver said:ToTP

Al Rayan still on top... for now: 2.10% epr

OK rate trappers: Easy(ish) Access, Top (10ish) Of The Pots.. BoE base rate +0.5 =2.25% (22/09)

Updated at 23/09/2022 c.13.30hrs - Starter for 10; not comprehensive, DYOR.

Latest/recent changes in bold. Links added for all accounts. TIA for all contributions.

Bracketed dates = date rate added/amended here.1 Al Rayan Everyday Saver iss 3. £5k min 2.10% (01/09) App onlyish. Everyday Saver (Issue 3) | Islamic banking | Sharia compliant & ethical (alrayanbank) Thnx Ed

2 Gatehouse EA 2.00% EPR (01/09) New Min £1.00! Easy access account | Gatehouse Bank | Gatehouse Bank plc

3 Yorkshire BS-Tiered** Intrnt Svr Plus iss 12 (22/09) wef 07/10: 2.00% (1.8%<£10k 2.05%>£50k). View our Easy Access Savings Accounts | Savings | YBS Thnx @Bridlington1

4 Ford 1.95% (21/09) Flexible Savings Account - Easy access savings | Ford Money thnx @kazza242

5 Atom 1.90% app only (23/09) Instant Saver 1.90% Interest Rate - Easy Access Savings | Atom bank thnx TomDolan

6 Zopa Smart Saver (App only) - £85k max. Improved rates(12/09) Access 1.85%; Boosted 7day notice 1.90%; 31day 2.05%; 95day 2.25% Smarter Savings built for real life

7 Harpenden BS 1.90% triple access (21/09) Triple Access Saver Account - Harpenden Building Society (harpendenbs.co.uk) Branch/Postal opening thnx @Bridlington1

8 Cynergy EA; 1.85% inc 1st yr bonus (16/08) 'existing customers' Cynergy Bank

9 Bucks BS 1.85% single access calendar year (20/09) Buckinghamshire Building Society (bucksbs.co.uk)@Bridlington1

10 Shawbrook EA iss30 1.81% £1k min (02/09)* Easy Access Savings Accounts | Shawbrook Bank (Shawbrook iss 29 @ 1.86 NLA*)

11= Secure Trust Bank 'Access' 1.80% £1k min (05/09) Access Account - Secure Trust Bank

11= Paragon triple access 1.80% (19/08) Triple Access Savings Account | Paragon Bank

11= Marcus/Saga 1.80 (inc 0.25% bonus) (22/09) Online Savings Account | Marcus by Goldman Sachs®

**Note: YBS 2.05% wef 07/10 upto £10k with w/d restrictions now NLA*: Savings Account - More Information | YBS

* NLA = No Longer available to new applicants

Recent/Upcoming Drop offs: (23/09) Principality1.78%, Charter, Nationwide, Cambridge BS all @ 1.75%.

(20/09) Tesco, Virgin Money both @1.71%

Check terms for yourself - DYOR.

Note: These rates may, or may not be applied to existing accounts, plse check.

Small balance, high rate: Virgin Money 2.0% £1k limit, Nationwide FlexDirect 5% on £1.5k (1st year only) Others of note?

Also see Regular Savings Accounts: The Best Currently Available List! — MoneySavingExpert Forum

And Cash ISAs: The Best Currently Available List — MoneySavingExpert ForumAnd Notice Accounts: Notice Accounts - Page 11 — MoneySavingExpert Forum

**Note: YBS 2.05% wef 07/10 upto £10k with w/d restrictions now NLA*: Savings Account - More Information | YBS3 -

They may be amongst the best on taxable instant access savings (1.85%) but seeing that their current instant access ISA rate is 1.65% and many of their competitors were paying 1.85% before the base rate increase, I would be surprised if they did not lose a lot of the ISA deposits over the coming months without increases (especially as even big banks like Santander are offering 1.85% now), I am looking to reduce my balance in Cynergy as their rates are falling behind the best (I am sure they will be quaking in their boots!).SpanishBlue said:SeriousHoax said:Come on Cynergy bank I'm waiting on you to go top of the table.🤪😜🤔🤔🤔

Anyone think they will raise there intrest rates.Seeing as at the moment their account is only "Exclusively available to existing Cynergy Bank customers" possibly not I think.It sounds like they don't need any extra funds at the moment, so unless there is a mass exodus of money, I am not that hopeful.

So who knows? but once the money is gone, it is always more difficult to get it back. Coventry will be paying me 2.25% from the 7th October, so the money won't be staying there if they are only paying 1.85%, I am sure I am not alone.1 -

I was thinking this as well when I heard the market were pricing in a 1% rise in November...the MPC seem extremely dovish so if was a betting man, I'd look at what the markets are pricing in, and then lower it by 0.25% and that's probably what the BOE will do!jimexbox said:

Seeing that at only 3 of the 9 mpc members voted for a 0.75 rise, I'd think it unlikely that there would be a majority for a 1% rise in base rates at the next meeting.SJMALBA said:Amongst the apparent economic carnage being caused by Kwarteng's 'mini-bidget', there are increasing suggestions that the BoE will now be forced into more aggressive action, with a 1% rise in November already being talked about... e.g.'The BoE, which has been reluctant to hike rates aggressively, will need to roll up its sleeves and fight inflation with larger rate hikes for here. Expectations for a 1% hike in November are already climbing.It’s difficult to see how the pound can recover from here. Investors are pulling out of UK assets rapidly and who can blame them? Drawing comparisons historically, the last big tax giveaway in 1972 resulted in rampant inflation, unmanageable debt, and an IMF bailout.' Fiona Cincotta, Senior Financial Markets Analyst at City Index.

1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards