We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The Top Easy Access Savings Discussion Area

Comments

-

The only money I still have in Zopa is what's in the 95 day notice account. The rest was moved out beginning of the month, and I can't wait for my notice period to end. Shame, I really love their app.0

-

The social media team who wrote this are extremely unlikely to be privvy to any info regarding future rate increases and are only able to send out scripted approved responses on such matters.S_uk said:I was hoping that Zopa might increase their rates today, but I just noticed their reply to someone's tweet asking about this:

"Our smart saver accounts were recently increased on the 13th of September. There is currently no scope to increase the amount again this month. We will inform everyone publicly when this is due to change again."

This message is absolutely no indication of whether rates will increase or not.

1 -

But if that's the case surely the best thing to do would be to put out a bland non-committal statement, rather than specifically stating something (no rate change this month) if they weren't 100% sure? Plus their twitter account has answered specific account queries in the past, so you'd assume they'd be giving the same information as customer service staff that you ring?Wheres_My_Cashback said:

The social media team who wrote this are extremely unlikely to be privvy to any info regarding future rate increases and are only able to send out scripted approved responses on such matters.S_uk said:I was hoping that Zopa might increase their rates today, but I just noticed their reply to someone's tweet asking about this:

"Our smart saver accounts were recently increased on the 13th of September. There is currently no scope to increase the amount again this month. We will inform everyone publicly when this is due to change again."

This message is absolutely no indication of whether rates will increase or not.

And I didn't say it was absolutely true anyway, I was simply quoting a tweet they put out themselves given we had no other information.0 -

Where it’s getting 2.25%…where would you rather it was if you don’t need it in the immediate future? My 31 day which has most of my money in it just matured and I’ve stuck it all into my 95 day pot which has 28 days left to run, thereby getting 2.25% for 4 weeks. That’ll be one of the best virtually easy access rates in this time I would think.Daliah said:The only money I still have in Zopa is what's in the 95 day notice account. The rest was moved out beginning of the month, and I can't wait for my notice period to end. Shame, I really love their app.1 -

I'd get 2.52% at BLME.CheekyMikey said:

Where it’s getting 2.25%…where would you rather it was if you don’t need it in the immediate future? My 31 day which has most of my money in it just matured and I’ve stuck it all into my 95 day pot which has 28 days left to run, thereby getting 2.25% for 4 weeks. That’ll be one of the best virtually easy access rates in this time I would think.Daliah said:The only money I still have in Zopa is what's in the 95 day notice account. The rest was moved out beginning of the month, and I can't wait for my notice period to end. Shame, I really love their app.

But anyway, that's not easy access accounts.1 -

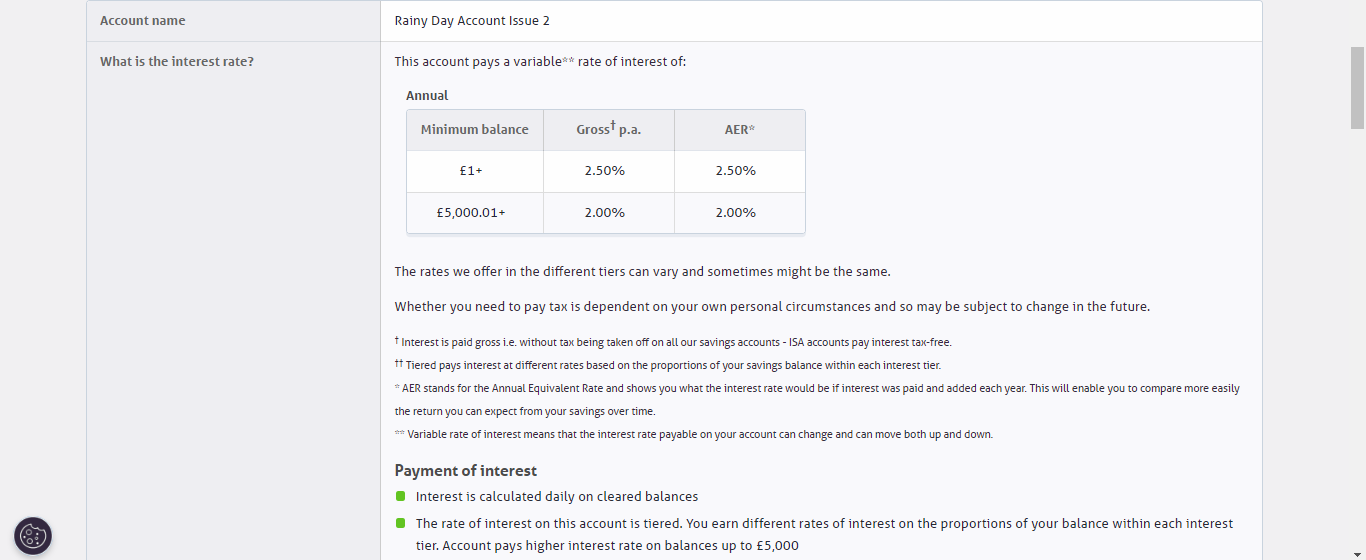

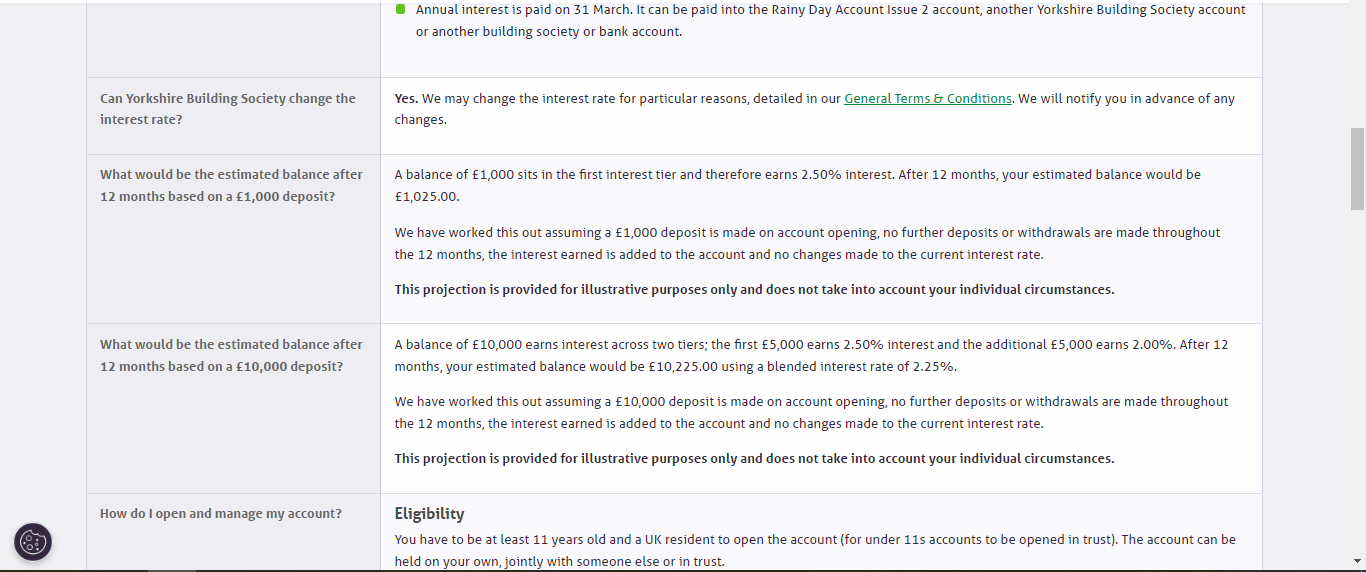

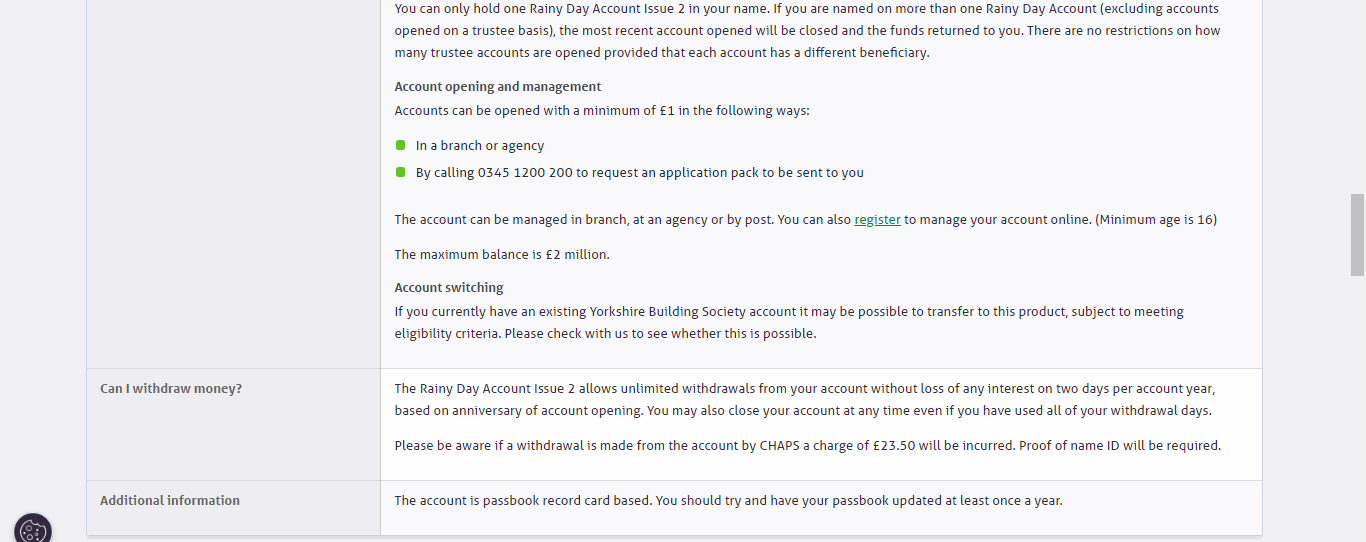

According to Moneyfacts, Yorkshire Building Society are launching two new accounts:

- Rainy Day Account (issue 2) - open in branch or via post

- Online Rainy Day Account (issue 2) - open online

They pay 2.50% on £1 - £5,000 and 2.00% on £5,000.01 and above.

Minimum opening balance £1.

Max investment £2,000,000 for the branch/postal account/£500,000 for the online account. (FSCS compensation limit £85K).

Two penalty-free withdrawal days per year.

https://www.ybs.co.uk/savings/compare-savings-account-rates

Edited to include direct links:

Online Rainy Day Account (issue 2) - https://www.ybs.co.uk/savings/product?id=YB931629W

Rainy Day Account (issue 2) - https://www.ybs.co.uk/savings/product?id=YB921628B

Please call me 'Kazza'.8 -

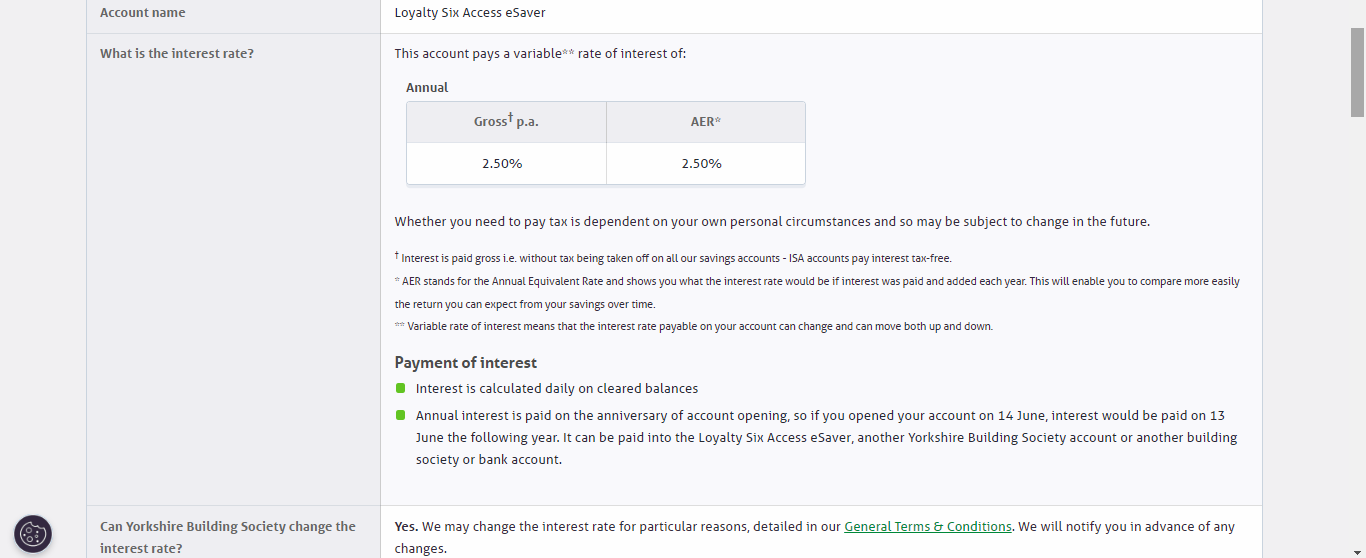

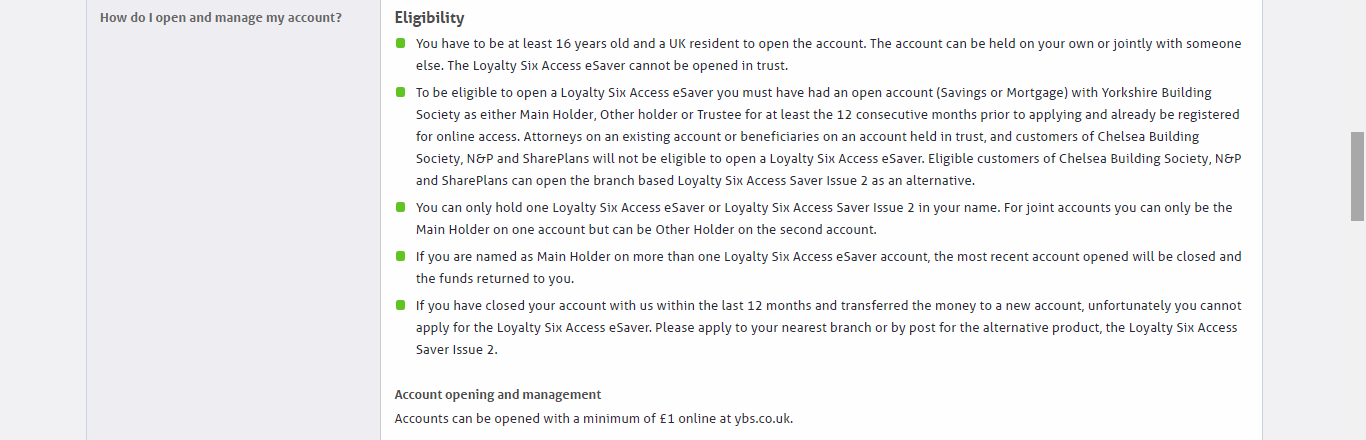

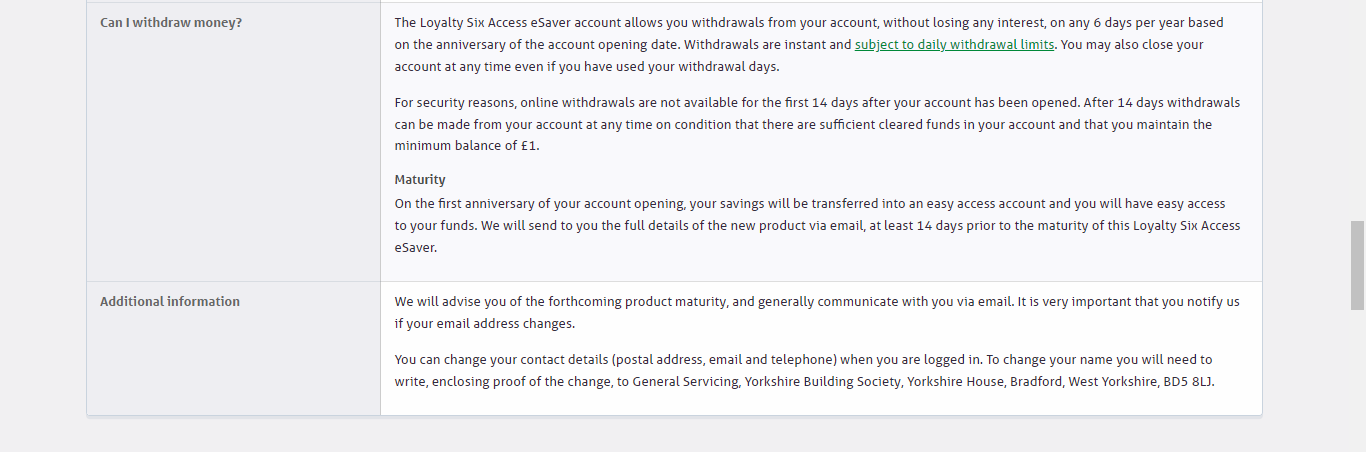

also on that page is Loyalty Six Access Saver Issue 2 / Loyalty Six Access eSaver, also paying 2.5% with 6 withdrawal days per year, but limited to existing members joined at least 12 months ago.Kazza242 said:According to Moneyfacts, Yorkshire Building Society are launching two new accounts:

- Rainy Day Account (issue 2) - open in branch or via post

- Online Rainy Day Account (issue 2) - open online

They pay 2.50% on £1 - £4,999 and 2.00% on £5,000 and above.

Minimum opening balance £1.

Max investment £2,000,000 for the branch/postal account/£500,000 for the online account. (FSCS compensation limit £85K).

Two penalty-free withdrawal days per year.

https://www.ybs.co.uk/savings/compare-savings-account-rates

3 -

YBS have now launched a Loyalty Six Access eSaver and a Loyalty Six Access saver Issue 2 at 2.5%. You have to have been an existing member for 12 months to open the account.

2 -

Online Rainy Day Account Issue 2 and Rainy Day Account Issue 2 are now on the YBS website.Kazza242 said:According to Moneyfacts, Yorkshire Building Society are launching two new accounts:

- Rainy Day Account (issue 2) - open in branch or via post

- Online Rainy Day Account (issue 2) - open online

They pay 2.50% on £1 - £4,999 and 2.00% on £5,000 and above.

Minimum opening balance £1.

Max investment £2,000,000 for the branch/postal account/£500,000 for the online account. (FSCS compensation limit £85K).

Two penalty-free withdrawal days per year.

https://www.ybs.co.uk/savings/compare-savings-account-rates

0 -

Annoyingly, like they also did for the YBS Loyalty Regular Saver, their online apply doesn't think I've been with them for 12 months (consecutively I've had accounts overlapping periods with them since 2020, but the oldest account was closed), so my only option is the postal version, which they allowed for the regular saver.

Anyway, I'm not making that mistake again, and so am keeping my current oldest account open.1

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.3K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.4K Work, Benefits & Business

- 602.6K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards