We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

The Top Easy Access Savings Discussion Area

Comments

-

Hipearl123 said:

I hope that savings accounts with limited access become a trend. They're a pain.Kazza242 said:

The account is opened and managed online and the minimum opening amount is £1. It allows 3 penalty-free withdrawals per year.

Interest is paid yearly (on the anniversary of account opening).

https://www.sainsburysbank.co.uk/savings/sav_definedsaver_skip

They can and they can't.

We have the bulk of our tens of k's in two limited access acounts as we find a pin fixed accounts/rates

We then have max holdings in P/Bonds

We then have several tens of k's in current accounts - yes, especially now rates are going up we are throwing money down the drain

One of the limited saving accounts has one witdrawl - we open that as we were well over the max with the coverntry, older savings account via phone/net etc that allows 6 withdrawals and rate atm is about 2.9% going to 3-15% in Feb i think

In all honest, we never had a problem and we could go fixed, but like you think limited access is a pin, we feel fixed is a pin as I do things overnight at times.

Even with limited access, like the coverntry 6 times allowed but an old account, put money in there you feel you would only need when upgrading your house or buying a top of the range suv and the rest in current accounts for very easy of access, p/bonds and ordianrry saving accounts. Your choice your money

Yes to all I am aware re having that much money in our joint current account, not sensible but we have always been like that0 -

Just registered with the CHIP app to enable me to transfer money into the Instant Access Savings @ 3%, when their bonus changes to interest on 11th February.Not sure if this is common knowledge (not seen it mentioned on here - just the possible Topcashback) reward, but they are offering various bonuses ranging from £10 on a £5,000 deposit up to £50 on a £20,000 deposit, to new customers. You enter the appropriate code on your app before 30th January and I have up to the 31st July to make the deposit.Only snag is you have to keep the deposit in there for 6 months.

2 -

mebu60 said:On the plus side, Issue 37 now appears immediately rather than the new account taking 5 or so days. If at all, which also occurred twice!

Capital transferred (from Issue 33, 2.75% since October), secure message sent requesting closure of old account and interest to be transferred too.

If Sainsbury's (and Tesco) are going to continue with this MO they could take a leaf out of Cynergy's book and have an online 'close and transfer' option for the old account.It is bonkers. I opened the Issue 37 and transferred the entire balance from Issue 36, which then had a zero balance even though the minimum balance is £1.Would that trigger the closure? No.The FAQ says when you click on an account there's a "Close" option on the right of the screen.Was there? No.So I had to spend half an hour on hold to speak to someone to close the account and transfer the interest. Totally nuts.As you say, Cynergy is a total breeze.

0 -

TiVo_Lad said:

The FAQ says when you click on an account there's a "Close" option on the right of the screen.mebu60 said:On the plus side, Issue 37 now appears immediately rather than the new account taking 5 or so days. If at all, which also occurred twice!

Capital transferred (from Issue 33, 2.75% since October), secure message sent requesting closure of old account and interest to be transferred too.

If Sainsbury's (and Tesco) are going to continue with this MO they could take a leaf out of Cynergy's book and have an online 'close and transfer' option for the old account.Was there? No.there should be - there is for me...looking at the closure form, it seems you could have used it to transfer the balance upon closing the old account to the newer account.

0 -

I don't have that option to "close my account" either for some unknown reason, so I have the same issue as TiVo_Lad. I just sent them a secure message to ask them to close it.janusdesign said:TiVo_Lad said:

The FAQ says when you click on an account there's a "Close" option on the right of the screen.mebu60 said:On the plus side, Issue 37 now appears immediately rather than the new account taking 5 or so days. If at all, which also occurred twice!

Capital transferred (from Issue 33, 2.75% since October), secure message sent requesting closure of old account and interest to be transferred too.

If Sainsbury's (and Tesco) are going to continue with this MO they could take a leaf out of Cynergy's book and have an online 'close and transfer' option for the old account.Was there? No.there should be - there is for me...looking at the closure form, it seems you could have used it to transfer the balance upon closing the old account to the newer account. 0

0 -

janusdesign said:there should be - there is for me...looking at the closure form, it seems you could have used it to transfer the balance upon closing the old account to the newer account.

Looks like different folks get different options:As I said. Bonkers.

Looks like different folks get different options:As I said. Bonkers.

1 -

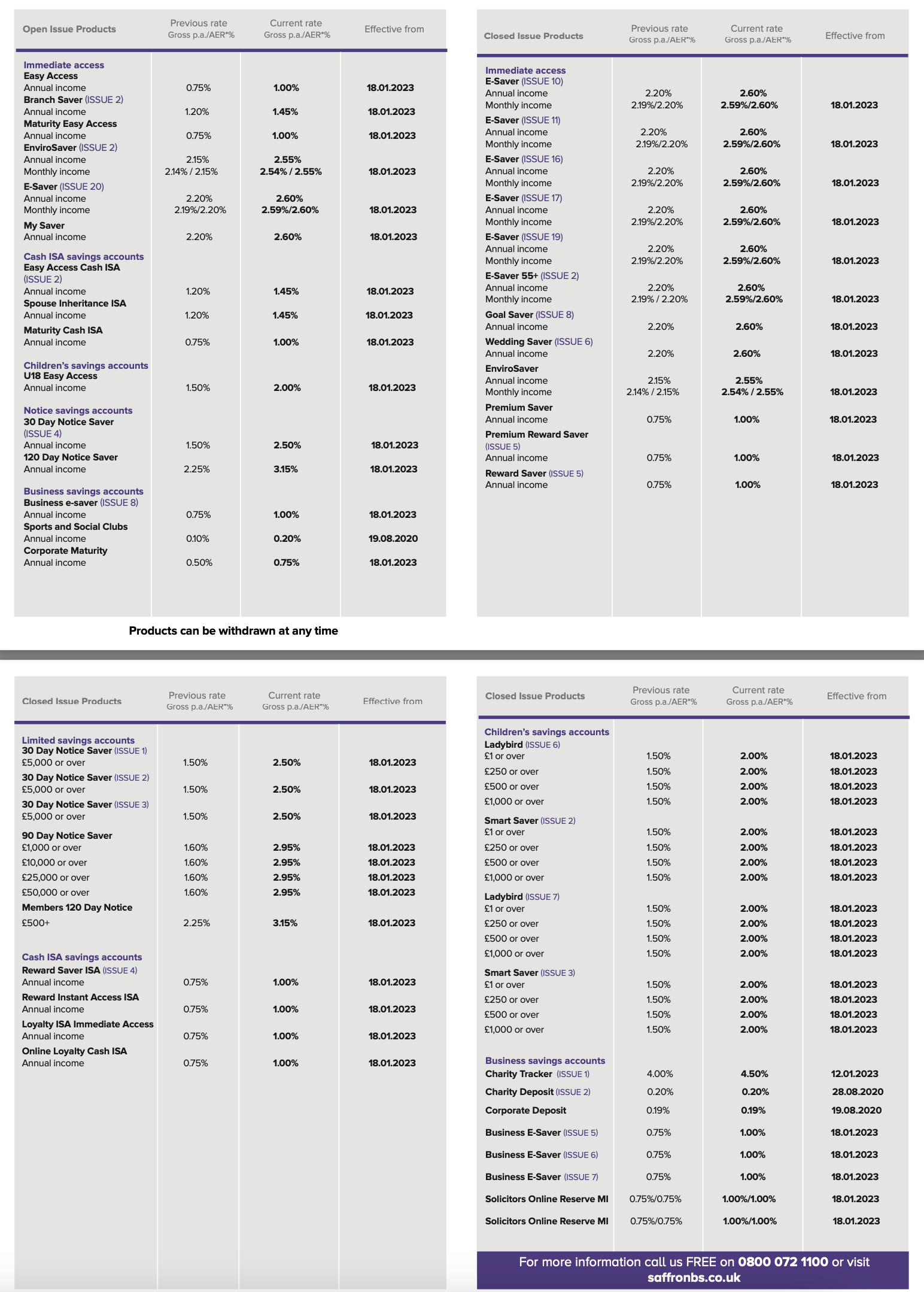

Saffron Building Society has increased some of their variable rates from today 18th January 2023.

https://www.saffronbs.co.uk/sites/default/files/2023-01/VariableRateGuide18.01.23.pdf

If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.2 -

-

TiVo_Lad said:

It might be worth trying with a different browser. I had a similar situation recently whilst closing a First Direct savings account. The relevant field wasn't there on Firefox but was on Chrome.

0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards