We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

If we vote for Brexit what happens

Comments

-

Jacob Rees-Mogg as always gave a fantastic speech...."I want to die peacefully in my sleep like my grandfather, not screaming in terror like his passengers."0

-

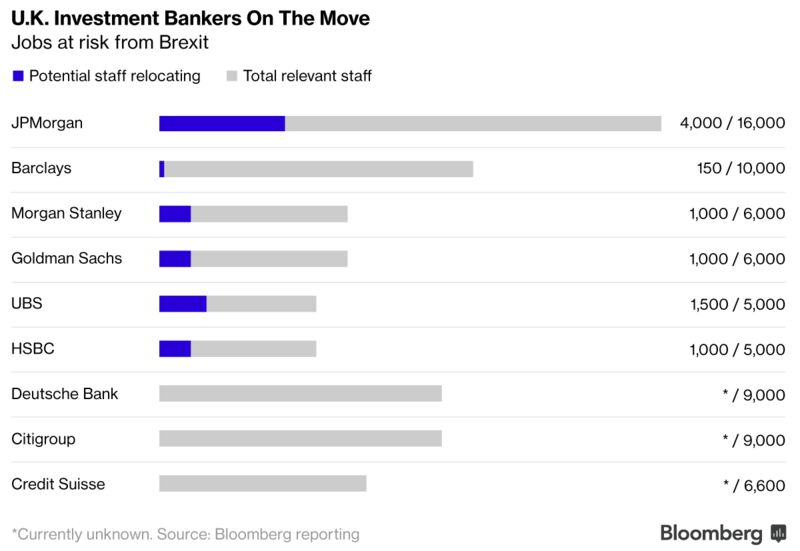

Lloyd Blankfein [Goldman Sachs' CEO] states that Brexit has slowed the pace of Goldman’s expansion in the UK:

https://www.bloomberg.com/politics/articles/2017-01-31/what-the-world-s-biggest-banks-say-about-fleeing-brexit-britainThe Wall Street firm is considering making Frankfurt its main hub inside the EU and could move as many as 1,000 employees, including traders and senior managers, according to a person familiar with the matter. Chief Executive Officer Lloyd Blankfein has publicly said the bank has shelved plans to move more key operations to the U.K.

“We were on track to move more and more of our global activities, so global ops, global tech -- all those things made more and more sense to operate out of the U.K.,” because of the time zone, Blankfein said in a Bloomberg interview in Davos, Switzerland, in January. “Now, we’re slowing down that decision, and only moving there what we have to move there. We don’t value doing things twice; moving them there and then moving them away from there.” 0

0 -

davomcdave wrote: »Lloyd Blankfein [Goldman Sachs' CEO] states that Brexit has slowed the pace of Goldman’s expansion in the UK:

Uh-huh.

Is this the same Goldman Sachs that donated a six-figure sum to back the pro-EU campaign in the referendum?

http://www.bbc.co.uk/news/uk-politics-35366994

In other news I see that The National Institute of Economic and Social Research is today upgrading it's forecast for the UK economy this year.

Not that they have shown much of a propensity for accuracy in their forecasts recently; in August last year they predicted growth for 2016 of 1% - and the actual figure was double that.

http://uk.reuters.com/article/uk-britain-boe-niesr-idUKKBN15G2Y4?il=0Britain's economy now looks set to slow only slightly in 2017 after its resilient response to last year's Brexit vote, but growth is still likely to be a lot weaker than if the country had decided to stay in the European Union, a think tank said.

Slower than if the UK had decided to stay in the EU?

Righty-ho.

But still the fastest-growing of the G7 economies.0 -

Great interview here on Globalisation...Immelt on Globalization, Trump's Policies and GE's Future

https://www.bloomberg.com/news/videos/2017-02-01/immelt-on-globalization-trump-s-policies-and-ge-s-future0 -

davomcdave wrote: »Lloyd Blankfein [Goldman Sachs' CEO] states that Brexit has slowed the pace of Goldman’s expansion in the UK

The Good News just keeps on coming......:beer::beer:0 -

London midday: Stocks rise after upbeat manufacturing PMIsLondon stocks gained on Wednesday after positive manufacturing reports and ahead of the Federal Reserve’s interest rate decision.

At midday, the FTSE 100 rose 0.50% to 7,134.43 points.

The pound strengthened, rising 0.44% against the dollar to $1.2634 and 0.43% versus the euro to €1.1699Markit’s UK manufacturing purchasing managers’ index for January fell to 55.9 from December's two-and-a-half-year high of 56.1, exactly in line with forecasts. A reading above 50 signals expansion in sector activity.

http://www.digitallook.com/news/market-report-midday/london-midday-stocks-rise-after-upbeat-manufacturing-pmis--2503660.html0 -

UK plans to adopt EU's trade agreements with third countries after Brexit: minister

http://uk.reuters.com/article/us-britain-eu-trade-idUKKBN15G46EBritain expects to be able to adopt the European Union's free trade agreements (FTA) with around 40 countries after it leaves the bloc rather than negotiate new deals, trade minister Liam Fox said on Wednesday.

Fox said the agreements were not all of equal value and Britain would prioritize the EU-Korea and EU-Switzerland deals as they accounted for about 80 percent of the trade by value.

"We see it as simply being transitions," he told a committee of lawmakers.

"We have made it very clear to countries that we would like to see a transition of their agreements to a UK agreement when we leave the EU. So far we have not yet had a country that didn’t want to do that. That is a lot easier as a process than negotiating a new FTA."0 -

It came as Mr Trump’s trade chief put the US on a collision course with Germany after he accused Berlin of using a “grossly undervalued” euro to “exploit” the US and the rest of the EU.

Peter Navarro, who heads the US president’s new National Trade Council, described the single currency as an “implicit Deutsche Mark” that gave Germany a competitive advantage over its trade partners.The economics professor also said Germany was the main obstacle to a trade deal between the US and European bloc as he dismissed a revival of Transatlantic Trade and Investment Partnership (TTIP) talks.

“A big obstacle to viewing TTIP as a bilateral deal is Germany, which continues to exploit other countries in the EU as well as the US with an 'implicit Deutsche Mark’ that is grossly undervalued,” Mr Navarro said.

“The German structural imbalance in trade with the rest of the EU and the US underscores the economic heterogeneity within the EU — ergo, this is a multilateral deal in bilateral dress.”

Mr Trump has highlighted a preference for “one-on-one” trade deals. He pulled the US out of the Trans-Pacific Partnership (TPP) with 11 Pacific Rim nations on his first full day in office.

http://www.telegraph.co.uk/business/2017/01/31/donald-trumps-trade-chief-peter-navarro-accuses-germany-abusing/0 -

The Risk to Germany’s Economy

Germany is, perhaps, the biggest de facto currency manipulator in the G-8. It has the second highest trade surplus as a percentage of GDP (after Holland) of any leading exporting country, including China and was added to a “watch list” of currency manipulators by the Treasury last year.

While manipulator countries usually sell their own currency for that of other nations to lower the value of the home country currency, Germany’s manipulation is more subtle.

Germany props up the weaker EU economies of Southern Europe with a policy that bankers call “extend and pretend:” lending good money after bad, with the expectation the loans are unlikely to be repaid or, at best, that their terms will be extended far into the future. That keeps the weaker economies in the Eurozone and reduces the value of the euro relative to other currencies, the same objective of traditional manipulators.If Merkel helps the rightists, nationalists and populists come to power in Europe, as discussed above, she puts the euro at risk. If Eurozone governments return to their own sovereign currencies, Germany’s export economy will suffer substantially because its exports would be more expensive. Even Germany’s “extend and pretend” loan portfolio to poorer EU countries will require a substantial write-down that could throw Germany into a deep recession.The chancellor would be wise, then, to tread carefully in trying to impose free movement as a condition for the UK’s access to its market. It is a decidedly unpopular policy with a large segment of European voters.

Merkel’s migration policy was even contested Sunday by Wolfgang Schäuble, her powerful finance minister. Notably, Schäuble reacted strenuously to Theresa May’s threat to make Britain a tax haven in her speech of January 17th. But his support for EU freedom of movement has been much more muted.

Schäuble, an erudite, conservative, politician who has sometimes been more popular than Merkel, has likely already surmised the political risks of continuing the free movement issue and has set other priorities for Germany in the Brexit negotiations.

Chancellor Merkel would be wise to follow his lead.

https://origin-nyi.thehill.com/blogs/pundits-blog/international/317116-angela-merkel-puts-her-foot-down-on-brexit-at-germanys-risk0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards