We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Cash ISAs: The Best Currently Available List

Comments

-

My Experience has been good.rallycurve said:What are people experiences transferring ISAs out of Natwest?

I got a text from them on Thursday morning confirming they are progressing my transfer but money is still sitting there, earning a poor 1.15%.

Just wondering how much longer it'll take them

My ISA matured last Friday 5th Sept and I requested a transfer to CHIP. On Saturday I received a text from NatWest advising that the transfer had been requested by CHIP. I noticed earlier today that my ISA disappeared from the Nat West App and I recently received an email from CHIP advising that they had credited the funds to my ISA2 -

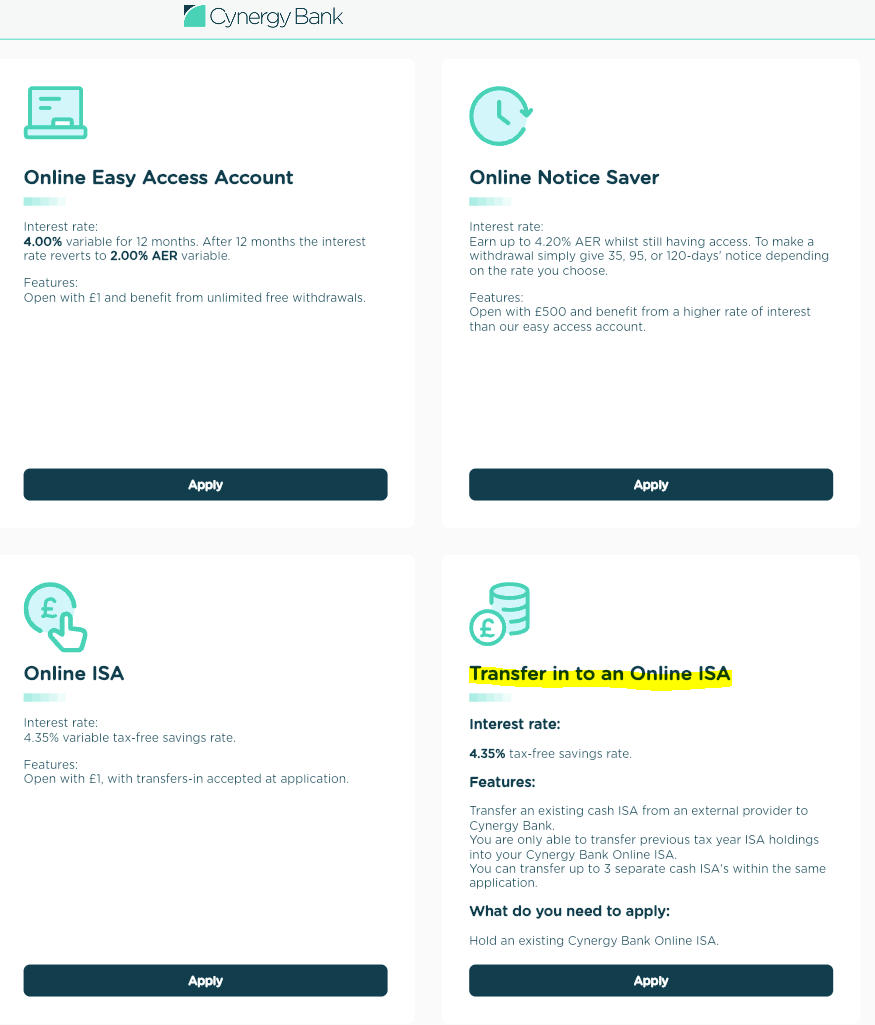

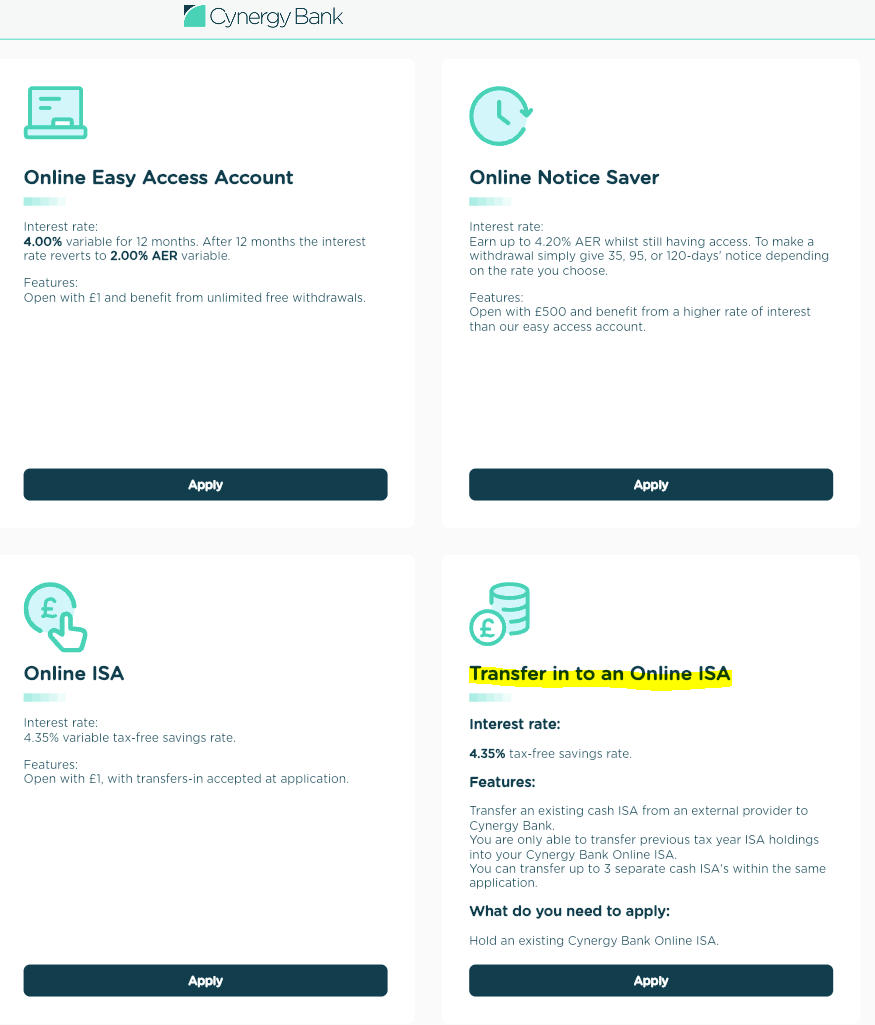

Cynergy Bank

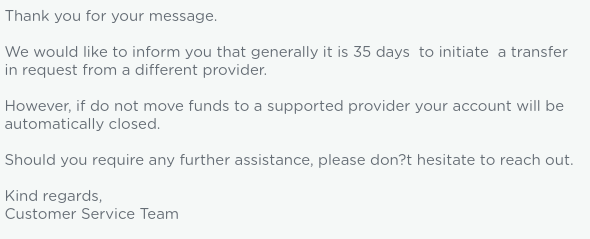

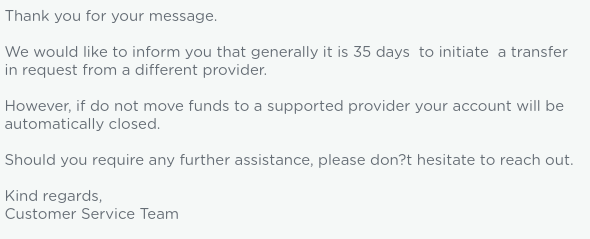

In case some wonder about the transfer in window, I have had confirmation today from customer service that once the ISA has been opened, you have 35 days to provide transfer in instructions or the account will get closed. This means transfer in instructions do not have to be provided during account opening.

I inquired about this because my ISA with CMC is not accepted by Cynergy so I need to go via an intermediary provider, in my case Coventry BS, in order to get my funds into the 4.35% Cynergy Cash ISA.

As a side note, and as reported before, you may run into issues opening the ISA via fast track route if they don't have your NI number on file. I sent a secure message and it was added within 24h, so great service.

Hope it helps somebody and you can open the ISA even if you not have funds available straight away as the account could be withdrawn at any time as it is market leading, considering the rate applies to transferd funds.3 -

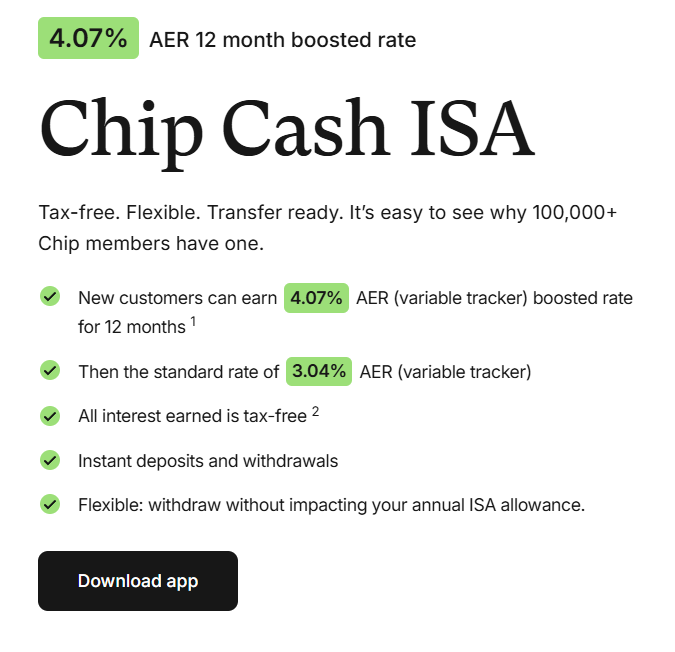

Chip ISA @ 4.32% NLA and replaced with a lower rate of 4.07%

1 -

Cynergypecunianonolet said:Cynergy Bank

In case some wonder about the transfer in window, I have had confirmation today from customer service that once the ISA has been opened, you have 35 days to provide transfer in instructions or the account will get closed. This means transfer in instructions do not have to be provided during account opening.

I inquired about this because my ISA with CMC is not accepted by Cynergy so I need to go via an intermediary provider, in my case Coventry BS, in order to get my funds into the 4.35% Cynergy Cash ISA.

As a side note, and as reported before, you may run into issues opening the ISA via fast track route if they don't have your NI number on file. I sent a secure message and it was added within 24h, so great service.

Hope it helps somebody and you can open the ISA even if you not have funds available straight away as the account could be withdrawn at any time as it is market leading, considering the rate applies to transferd funds.

I've made an attempt to transfer into my existing ISA which I opened a couple of days ago with £1. There is no transfer option on website or app so I had to call them. You can't transfer into the account that has money from this year's allowance so I had to open another issue 56 ISA for this transfer. They assured me that I will be able to make further transfers to this new account, in order to do this I'll have make another ISA application. I've never come across system like this.1 -

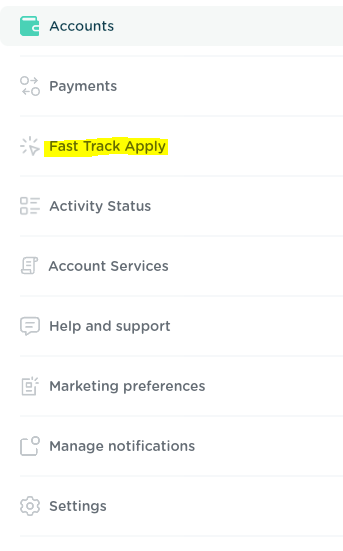

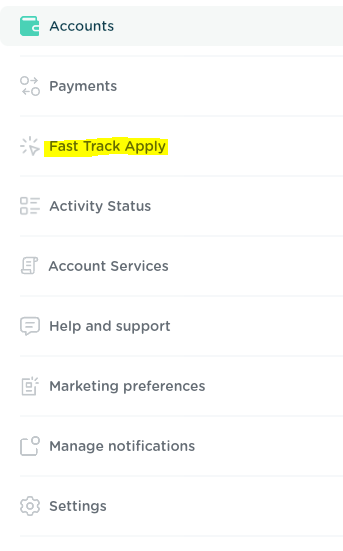

It should be possible from what I saw:

On the website, go to Account Services then click Fast track apply under the Open a new account section (it says 'transfer in an ISA' below it).

Then click Apply in the Transfer in to an Online ISA section.

Please let me know if that works because I am planning on transferring in too.

0 -

I can't see 'transfer in ISA', "Fast track apply" takes me to application form for a new ISA account. Looks to me that every time you want to make a transfer you have to open a new ISA account.0

-

In online banking go to fast track Apply

In the selection should be the below (if you have an ISA open, otherwise it is greyed out):

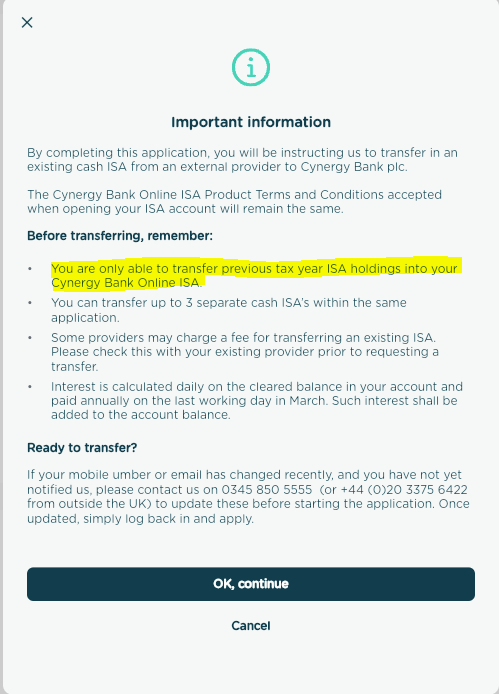

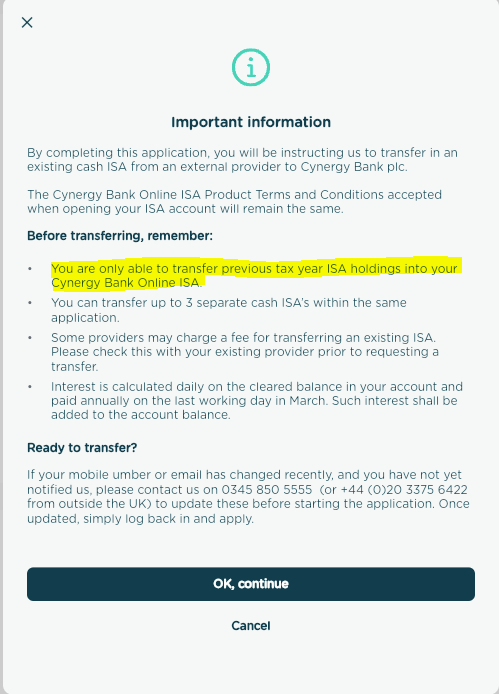

You hit apply and the below will appear with a strange message that indicates that you can only transfer in up to 3 ISA's from different suppliers and only funds from previous years.

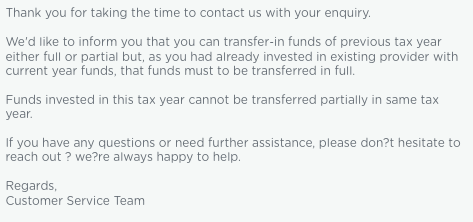

The above made me curious so I sent a private message explaining that I'd like to move my ISA over but since CMC is not a provider they deal with I need to go via Coventry BS as an intermediary provider. I told them that my ISA with CMC has previous year funds and that I already made contributions to it this year. I asked them to clarify if that means I can only transfer in previous year funds and my current tax year contributions would need to stay behind or if I can move the full amount in.

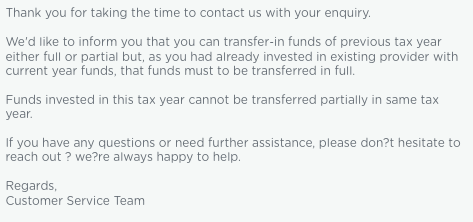

Below response from CS:

To me the message above and the message in the CS response are contradictory. So once my funds from CMC, including this years contributions have moved in full to Coventry I will initiate a full transfer from Coventry to Cynergy. Should this be declined I have reason to complain as the customer service message is pretty clear to me that they accept current year funds but only in full, which is in line ith the ISA regulations that current year funds always need to move in full and only previous years funds can be transferred partial, if the provider provides partial transfer in requests (and out outgoing provider also offers that).

All in all, a huge mess and something that would be fab if the government could tidy up and make electronic transfers mandatory and scrap paper forms. That's, however, is a topic for another day.3 -

Thank you. I didn't notice this, these boxes looked to me as a selection of Cynergy accounts I can apply forpecunianonolet said:In online banking go to fast track Apply

In the selection should be the below (if you have an ISA open, otherwise it is greyed out):

You hit apply and the below will appear with a strange message that indicates that you can only transfer in up to 3 ISA's from different suppliers and only funds from previous years.

The above made me curious so I sent a private message explaining that I'd like to move my ISA over but since CMC is not a provider they deal with I need to go via Coventry BS as an intermediary provider. I told them that my ISA with CMC has previous year funds and that I already made contributions to it this year. I asked them to clarify if that means I can only transfer in previous year funds and my current tax year contributions would need to stay behind or if I can move the full amount in.

Below response from CS:

To me the message above and the message in the CS response are contradictory. So once my funds from CMC, including this years contributions have moved in full to Coventry I will initiate a full transfer from Coventry to Cynergy. Should this be declined I have reason to complain as the customer service message is pretty clear to me that they accept current year funds but only in full, which is in line ith the ISA regulations that current year funds always need to move in full and only previous years funds can be transferred partial, if the provider provides partial transfer in requests (and out outgoing provider also offers that).

All in all, a huge mess and something that would be fab if the government could tidy up and make electronic transfers mandatory and scrap paper forms. That's, however, is a topic for another day. . What a strange place for a transfer form. I would've thought a CS person would be able to guide me through this, but they didn't. I will wait until I have the result of my existing transfer request from Moneybox, if it is successful I'll request another one from Paragon.

. What a strange place for a transfer form. I would've thought a CS person would be able to guide me through this, but they didn't. I will wait until I have the result of my existing transfer request from Moneybox, if it is successful I'll request another one from Paragon.

0 -

According to this, it's 5 business days for the old provider to send the funds to the new provider.:gwapenut said:The 15 working days is for the entire ISA transfer process though, with bits of that split between different elements of the ISA transfer process. Not all of those days are for NatWest to squander.The 15 days are broken down as:- The new ISA manager has 5 business days to forward the instruction to you.

- You have 5 business days to send the funds and information to be provided to the new ISA manager.

- The new ISA manager has 3 business days to apply the funds to the new ISA.

- The other 2 days are to allow for time taken for first class post between you and the new manager.

Natwest confirmed they were "progressing the transfer of my ISA" last Thursday 8am. It's now 6 full working days later and the money hasn't moved. I have contacted them and they said they have a large volume of requests and it's taking longer than expected.

Is there a case for a complaint if they take longer than those 5 days?

0 -

No - and if you did complain about the length of time it is taking to transfer your ISA (over 15 days etc), you would need to complain to your new ISA provider who are responsible for the transfer process - not the losing one.rallycurve said:

According to this, it's 5 business days for the old provider to send the funds to the new provider.:gwapenut said:The 15 working days is for the entire ISA transfer process though, with bits of that split between different elements of the ISA transfer process. Not all of those days are for NatWest to squander.The 15 days are broken down as:- The new ISA manager has 5 business days to forward the instruction to you.

- You have 5 business days to send the funds and information to be provided to the new ISA manager.

- The new ISA manager has 3 business days to apply the funds to the new ISA.

- The other 2 days are to allow for time taken for first class post between you and the new manager.

Natwest confirmed they were "progressing the transfer of my ISA" last Thursday 8am. It's now 6 full working days later and the money hasn't moved. I have contacted them and they said they have a large volume of requests and it's taking longer than expected.

Is there a case for a complaint if they take longer than those 5 days?0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards