We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Cash ISAs: The Best Currently Available List

Comments

-

Does anyone know the funding window for Lloyds or Shawbrook, or are they truly indefinite so far?0

-

Dont know about LLoyds but Shawbrook have confirmed that (at the moment) they will accept funding throughout the term of the account .....

1 -

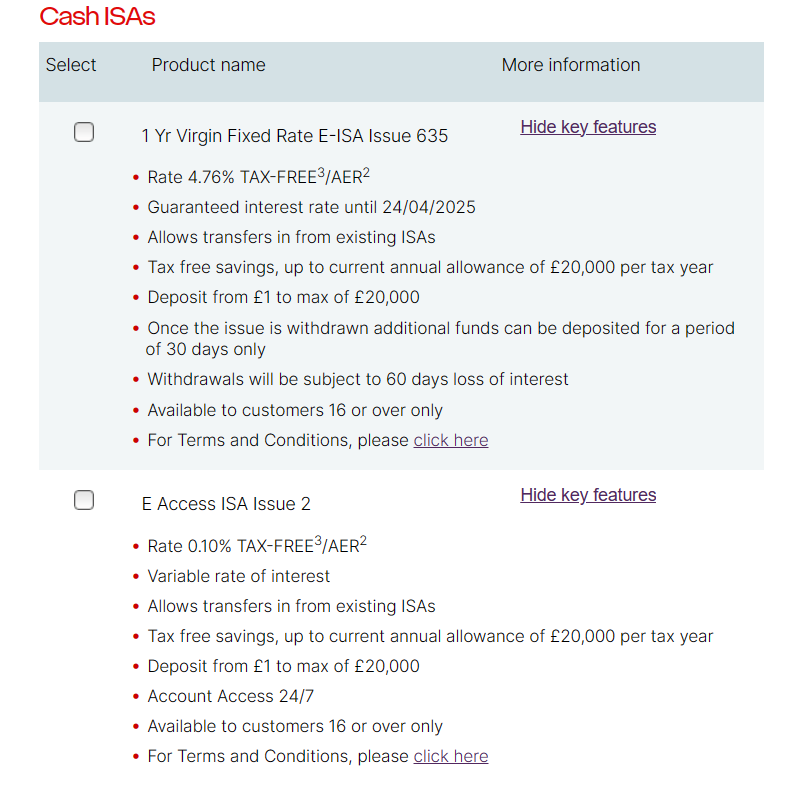

flobbalobbalob said:So I've got my "your fixed ISA is maturing soon" email from Virgin. Here are the choices .

As I want an easy access cash ISA, and they don't have one at the moment (apart one for current account holders only), bless them they are doing me a favour by allowing me to take advantage of one that is not available @ 0.10 % AER. While I am flattered to be so special I do want to transfer. My question is do I have to wait for the maturity date to transfer, and hence loose money, or is there some rule/law that allows me to transfer now.How come they don't mention this? I notice it's not on the list on p.1 either

0 -

@gwapenut

hi, i opened the lloyds 2yr isa the other day - the blurb/t&cs i read while accepting said the £3k- their minimum - to be paid in within 60 days.#40 in 2026's 365x1p challenge - assigning amounts randomly on a daily basis

#26 in 2026's make2026in2026

#23 in make2025in2025 final tally : £585.24 (funded Knitfest trip)

2025 = 365x1p challenge #33 final tally £667.37

2024 = 365x1p challenge #10 final tally £668.10

i apologise now, i can't type. Or, my keyboard skills cant keep up with my brain.2 -

Received my Saffron Regular Saver ISA details in the post today, sent first class on Monday.

There's a passbook once again and a three digit reference that didn't seem to refer to anything obvious - I wonder if they have a target number as they have said that the account can be pulled before 24th April, and are literally counting them out.

1 -

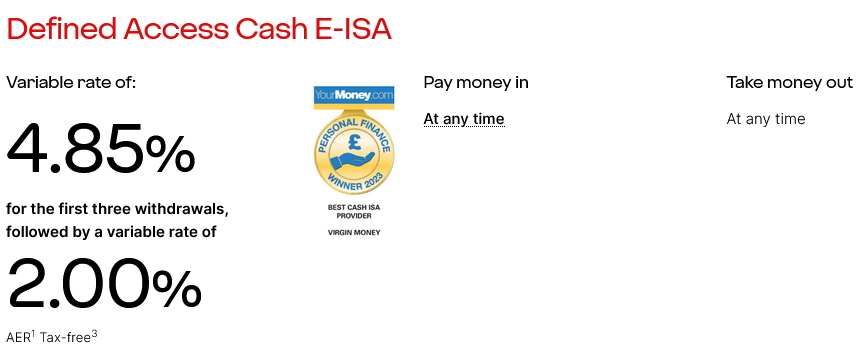

The rates for certain types of ISA account have changed a lot in the last few weeks, so it's likely that the list on page 1 of this thread has gotten out of date.kuepper said:How come they don't mention this? I notice it's not on the list on p.1 either

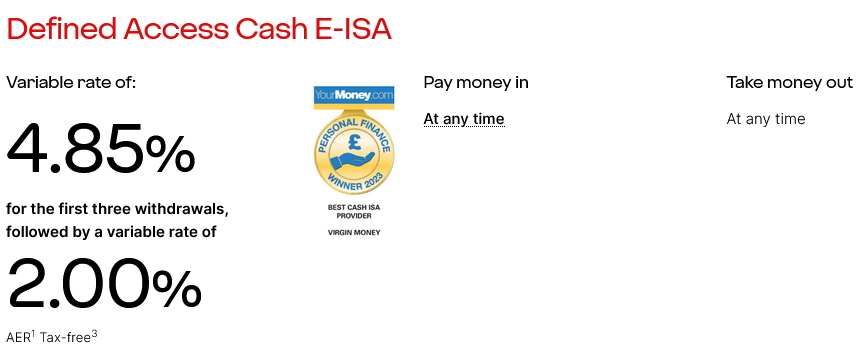

I think that particular account might be very new and may have only been launched as recently as yesterday or today, which would explain why it wasn't mentioned in the maturity options quoted above. It was paying 5.06% prior to this and was withdrawn at some point before being relaunched at this new rate.0 -

The options still do not include this one.refluxer said:

The rates for certain types of ISA account have changed a lot in the last few weeks, so it's likely that the list on page 1 of this thread has gotten out of date.kuepper said:How come they don't mention this? I notice it's not on the list on p.1 either

I think that particular account might be very new and may have only been launched as recently as yesterday or today, which would explain why it wasn't mentioned in the maturity options quoted above. It was paying 5.06% prior to this and was withdrawn at some point before being relaunched at this new rate.0 -

I guess it's possible that the maturity options are set at the time they're provided and their IT systems can't cope with any rate changes or new accounts becoming available after that.flobbalobbalob said:

The options still do not include this one.refluxer said:

The rates for certain types of ISA account have changed a lot in the last few weeks, so it's likely that the list on page 1 of this thread has gotten out of date.kuepper said:How come they don't mention this? I notice it's not on the list on p.1 either

I think that particular account might be very new and may have only been launched as recently as yesterday or today, which would explain why it wasn't mentioned in the maturity options quoted above. It was paying 5.06% prior to this and was withdrawn at some point before being relaunched at this new rate.

That's not to say that you can't apply for the account if you want it though, presumably. It may just not be possible to do it via their usual maturity instruction submission procedure and might require a phone call or temporary relocation to the other easy access ISA account that was offered.0 -

Tried to open this account but on registration (Im new to West Brom) says I'm only allowed to pay into one Cash ISA a year and because I said I already have they want me to transfer my other one over. Are they just a bit behind in updating their website?0

-

Probably they are. The other downside for me is that it's not flexi, so if you want to take money out but retain it within the ISA system you need to do a transfer.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.3K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.5K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards