We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Cash ISAs: The Best Currently Available List

Comments

-

flaneurs_lobster said:

I'm not aware of any provider that is supporting the holding of 2 (or more) Cash ISAs with themselves. I'm sure someone must have found one?RetSol said:

This is notwithstanding that Coventry BS has yet to implement the new ISA regime.flaneurs_lobster said:

That's Moneyweek's conclusion (that a provider's Terms can preclude you from having a Cash ISA with another provider). Don't think that's the conclusion of the majority of the contributors here.gwapenut said:

And neither provider supports splitting the ISA allowance with other providers, from a summary I've read here: https://moneyweek.com/personal-finance/savings/isas/multiple-isa-rule-how-it-works ?

I am holding several Cash ISAs with Skipton, all opened in 2023/24 tax year, one funded with new (now old) money, others by ISA transfers.

0 -

That's cheatingEmily_Joy said:flaneurs_lobster said:

I'm not aware of any provider that is supporting the holding of 2 (or more) Cash ISAs with themselves. I'm sure someone must have found one?RetSol said:

This is notwithstanding that Coventry BS has yet to implement the new ISA regime.flaneurs_lobster said:

That's Moneyweek's conclusion (that a provider's Terms can preclude you from having a Cash ISA with another provider). Don't think that's the conclusion of the majority of the contributors here.gwapenut said:

And neither provider supports splitting the ISA allowance with other providers, from a summary I've read here: https://moneyweek.com/personal-finance/savings/isas/multiple-isa-rule-how-it-works ?

I am holding several Cash ISAs with Skipton, all opened in 2023/24 tax year, one funded with new (now old) money, others by ISA transfers. looking for a provider that has/will allow 2 Cash ISAs to be opened/funded 2024/25. 1

looking for a provider that has/will allow 2 Cash ISAs to be opened/funded 2024/25. 1 -

Some ISA providers have been offering a 'portfolio' approach (allowing you to spread your ISA allowance over different cash ISA accounts with themselves) for quite a while now.flaneurs_lobster said:

That's cheatingEmily_Joy said:flaneurs_lobster said:

I'm not aware of any provider that is supporting the holding of 2 (or more) Cash ISAs with themselves. I'm sure someone must have found one?RetSol said:

This is notwithstanding that Coventry BS has yet to implement the new ISA regime.flaneurs_lobster said:

That's Moneyweek's conclusion (that a provider's Terms can preclude you from having a Cash ISA with another provider). Don't think that's the conclusion of the majority of the contributors here.gwapenut said:

And neither provider supports splitting the ISA allowance with other providers, from a summary I've read here: https://moneyweek.com/personal-finance/savings/isas/multiple-isa-rule-how-it-works ?

I am holding several Cash ISAs with Skipton, all opened in 2023/24 tax year, one funded with new (now old) money, others by ISA transfers. looking for a provider that has/will allow 2 Cash ISAs to be opened/funded 2024/25.

looking for a provider that has/will allow 2 Cash ISAs to be opened/funded 2024/25.

Paragon, Nationwide and Zopa spring to mind and there may be others.2 -

Kent Reliance, too.refluxer said:

Some ISA providers have been offering a 'portfolio' approach (allowing you to spread your ISA allowance over different cash ISA accounts with themselves) for quite a while now.flaneurs_lobster said:

That's cheatingEmily_Joy said:flaneurs_lobster said:

I'm not aware of any provider that is supporting the holding of 2 (or more) Cash ISAs with themselves. I'm sure someone must have found one?RetSol said:

This is notwithstanding that Coventry BS has yet to implement the new ISA regime.flaneurs_lobster said:

That's Moneyweek's conclusion (that a provider's Terms can preclude you from having a Cash ISA with another provider). Don't think that's the conclusion of the majority of the contributors here.gwapenut said:

And neither provider supports splitting the ISA allowance with other providers, from a summary I've read here: https://moneyweek.com/personal-finance/savings/isas/multiple-isa-rule-how-it-works ?

I am holding several Cash ISAs with Skipton, all opened in 2023/24 tax year, one funded with new (now old) money, others by ISA transfers. looking for a provider that has/will allow 2 Cash ISAs to be opened/funded 2024/25.

looking for a provider that has/will allow 2 Cash ISAs to be opened/funded 2024/25.

Paragon, Nationwide and Zopa spring to mind and there may be others.

And MandS Bank seem to allow the customer to open more than one product.1 -

Even before the changes this week some providers (eg Nationwide) have been using a "portfolio" ISA system, legally just 1 Cash ISA but with multiple products within it.flaneurs_lobster said:

I'm not aware of any provider that is supporting the holding of 2 (or more) Cash ISAs with themselves. I'm sure someone must have found one?RetSol said:

This is notwithstanding that Coventry BS has yet to implement the new ISA regime.flaneurs_lobster said:

That's Moneyweek's conclusion (that a provider's Terms can preclude you from having a Cash ISA with another provider). Don't think that's the conclusion of the majority of the contributors here.gwapenut said:

And neither provider supports splitting the ISA allowance with other providers, from a summary I've read here: https://moneyweek.com/personal-finance/savings/isas/multiple-isa-rule-how-it-works ?1 -

Try MandS Bank.flaneurs_lobster said:

I'm not aware of any provider that is supporting the holding of 2 (or more) Cash ISAs with themselves. I'm sure someone must have found one?RetSol said:

This is notwithstanding that Coventry BS has yet to implement the new ISA regime.flaneurs_lobster said:

That's Moneyweek's conclusion (that a provider's Terms can preclude you from having a Cash ISA with another provider). Don't think that's the conclusion of the majority of the contributors here.gwapenut said:

And neither provider supports splitting the ISA allowance with other providers, from a summary I've read here: https://moneyweek.com/personal-finance/savings/isas/multiple-isa-rule-how-it-works ?

And they do not ask the customer to vow to forsake all others.3 -

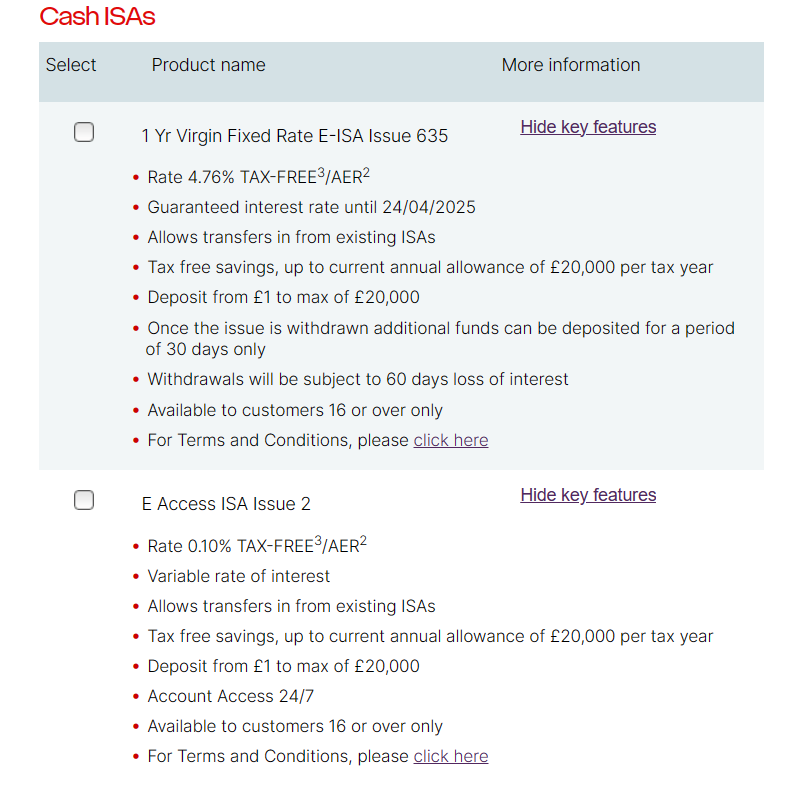

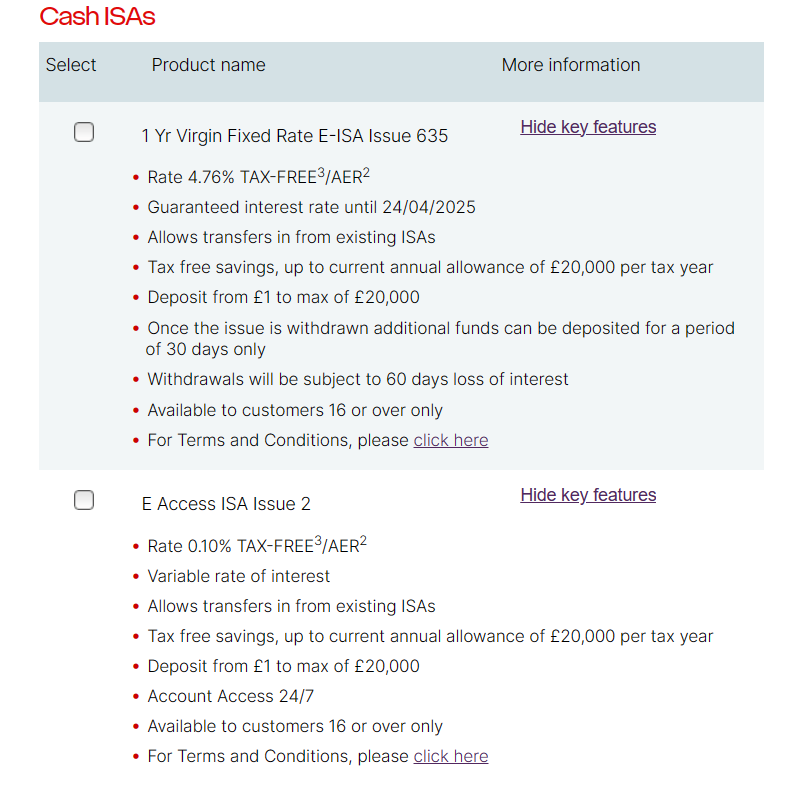

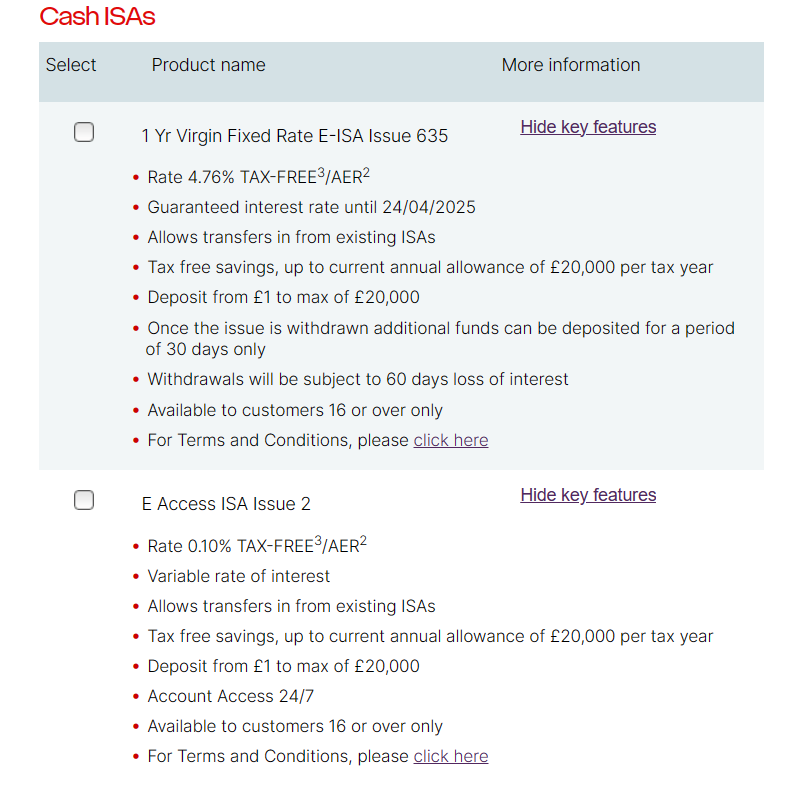

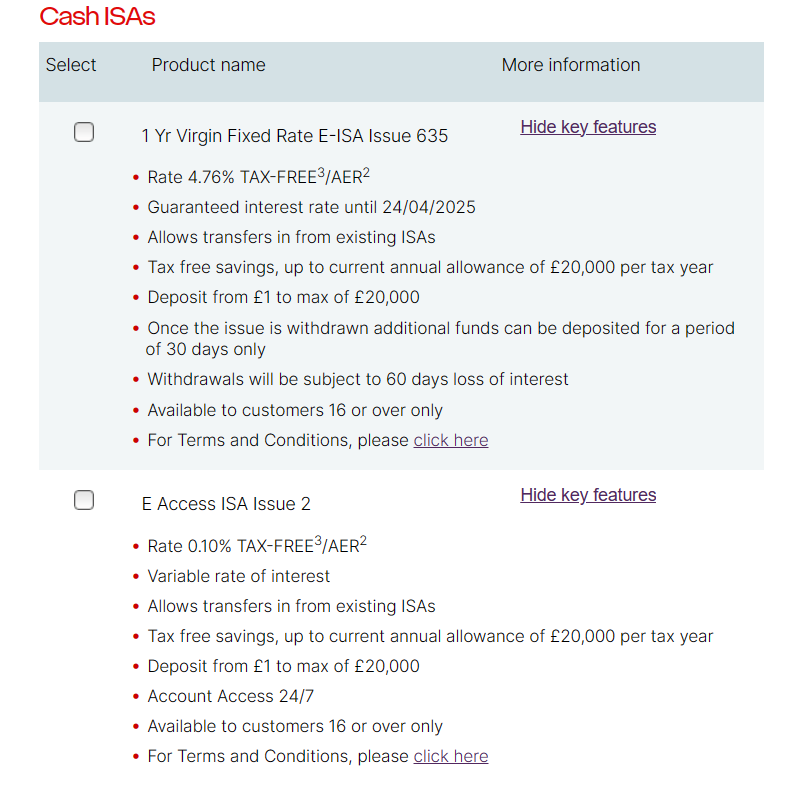

So I've got my "your fixed ISA is maturing soon" email from Virgin. Here are the choices .

As I want an easy access cash ISA, and they don't have one at the moment (apart one for current account holders only), bless them they are doing me a favour by allowing me to take advantage of one that is not available @ 0.10 % AER. While I am flattered to be so special I do want to transfer. My question is do I have to wait for the maturity date to transfer, and hence loose money, or is there some rule/law that allows me to transfer now.

0 -

Transfers I've done in the past have given the option to avoid penalty and have waited until the current fixed term ends before transferring.flobbalobbalob said:So I've got my "your fixed ISA is maturing soon" email from Virgin. Here are the choices .

As I want an easy access cash ISA, and they don't have one at the moment (apart one for current account holders only), bless them they are doing me a favour by allowing me to take advantage of one that is not available @ 0.10 % AER. While I am flattered to be so special I do want to transfer. My question is do I have to wait for the maturity date to transfer, and hence loose money, or is there some rule/law that allows me to transfer now.

1 -

Thanks, I've checked with Zopa and they offer that. However Zopa want the account number for the transfer but that will change at some point at maturity. Does giving Zopa instructions in advance have any benefit or should I wait till after maturity to avoid any confusion.Ozzig said:

Transfers I've done in the past have given the option to avoid penalty and have waited until the current fixed term ends before transferring.flobbalobbalob said:So I've got my "your fixed ISA is maturing soon" email from Virgin. Here are the choices .

As I want an easy access cash ISA, and they don't have one at the moment (apart one for current account holders only), bless them they are doing me a favour by allowing me to take advantage of one that is not available @ 0.10 % AER. While I am flattered to be so special I do want to transfer. My question is do I have to wait for the maturity date to transfer, and hence loose money, or is there some rule/law that allows me to transfer now.0 -

Surprised the EA is so low as VM have a Flexible EA exclusive currently at 4.76% AER. But you do need to have a VM current account.flobbalobbalob said:So I've got my "your fixed ISA is maturing soon" email from Virgin. Here are the choices .

As I want an easy access cash ISA, and they don't have one at the moment (apart one for current account holders only), bless them they are doing me a favour by allowing me to take advantage of one that is not available @ 0.10 % AER. While I am flattered to be so special I do want to transfer. My question is do I have to wait for the maturity date to transfer, and hence loose money, or is there some rule/law that allows me to transfer now.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.3K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.5K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards