We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Cash ISAs: The Best Currently Available List

Comments

-

Looking just now, no Virgin 1 year fix, now only a 2 year fix available.

Will it change tomorrow?Yeah, cheers but nah, I will stick with yes, thank you and no.

Thank you.0 -

savit4l8er said:Looking just now, no Virgin 1 year fix, now only a 2 year fix available.

Will it change tomorrow?

Before you decide if you want one, look at my post in 'Virgin money cash ISA transfer' ......

0 -

steveksullivan said:savit4l8er said:Looking just now, no Virgin 1 year fix, now only a 2 year fix available.

Will it change tomorrow?

Before you decide if you want one, look at my post in 'Virgin money cash ISA transfer' ......

Probably worded it wrong. Just flagging up there is no longer a 1 year fix (or 3 year for a few days). Thought they might bring some new ones out, for the brave and perhaps mad 😂

Yeah, cheers but nah, I will stick with yes, thank you and no.

Thank you.1 -

Just tried to open a Tesco 1 year at 3.75%, not the highest interest but just a few clicks from my account rather than messing around with proofs of ID etc. Once I had tried and failed due to their usual "application timed out" feature I remembered why I don't open new accounts with them !!

0 -

Hi, I've just opened a Charter 2-year fixed ISA and transfer my Coventry BS one. I enquire about this and they replied that I can now open a 1-year fixed and once I receive the transfer from Coventry, send a secure message to action my ‘right to cancel’ and they can arrange for the funds to be transferred into your new account. A bit of a faff but feasibleShedman said:

Maybe now only available as exclusive to existing customers?steveksullivan said:steveksullivan said:Haven't seen this mentioned elsewhere, but - looks like Charter have pulled their 1 yr fixed ISA - can't see it on their website. 2 yr is still there ....Quoting myself because I'm confused .....If I go to Charter's website and ask for 'Fixed rate ISAs' I only see the 2 year ......If I 'log in' as myself on the site and go to open a new product, the 1 year is still there ......0 -

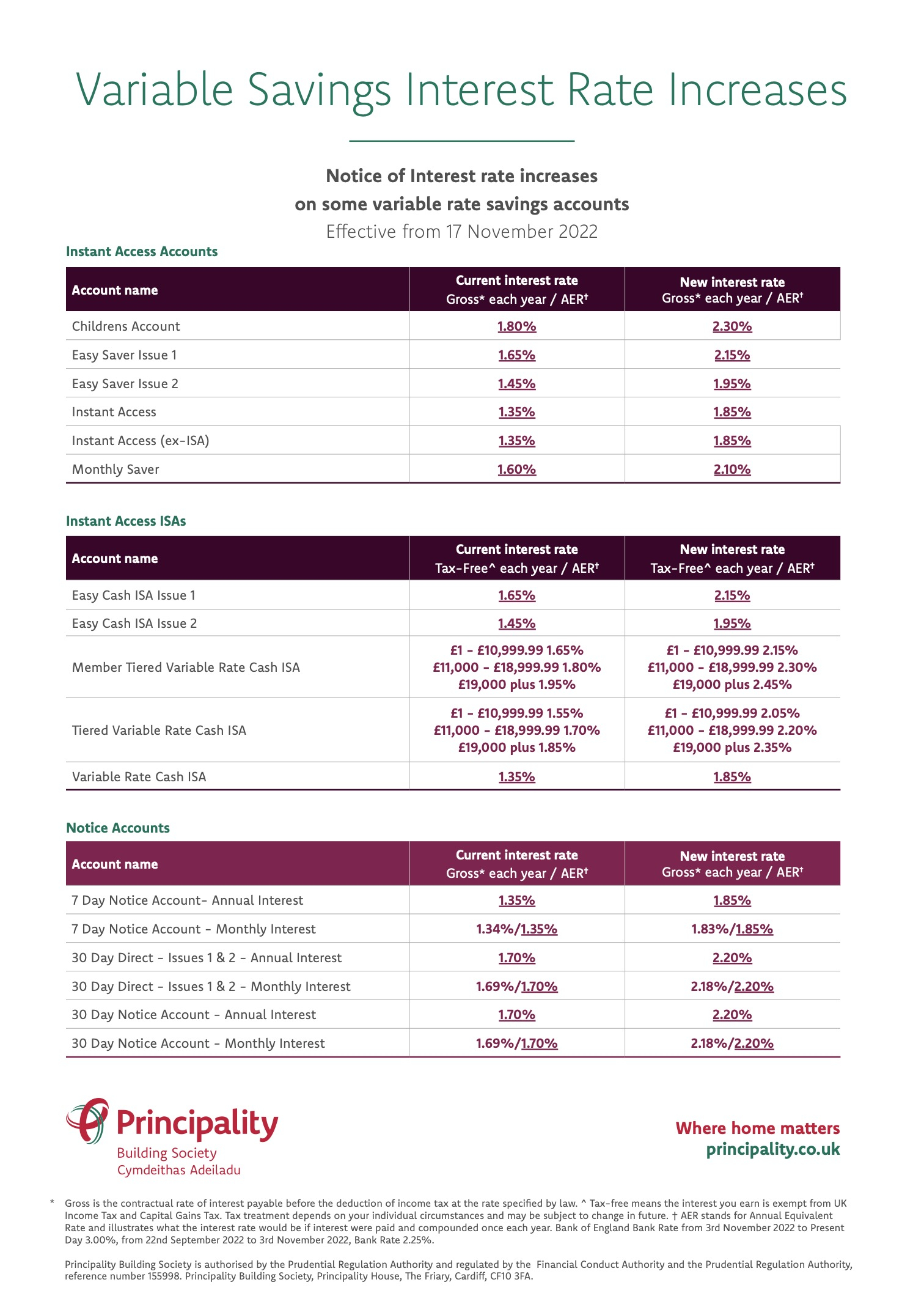

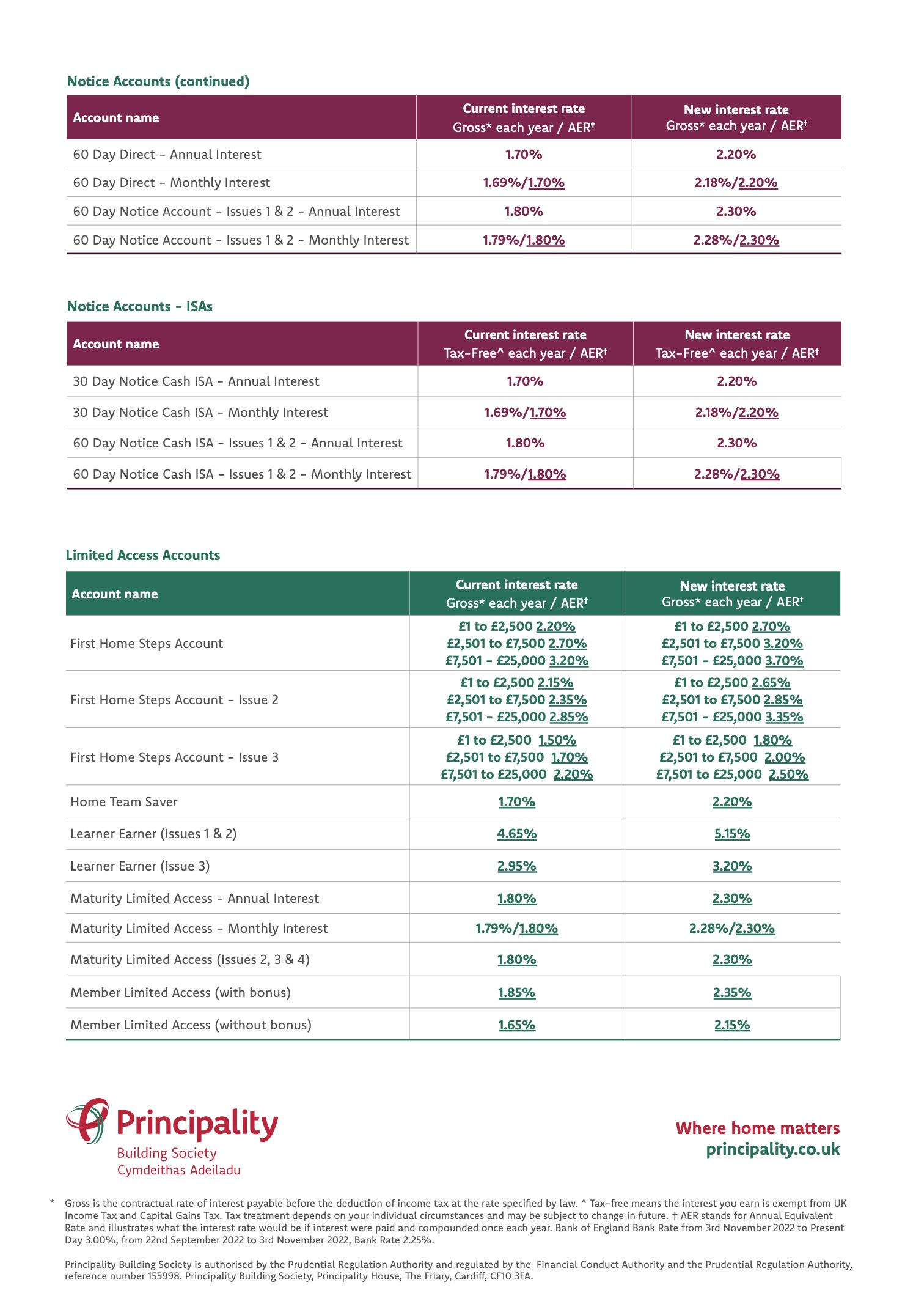

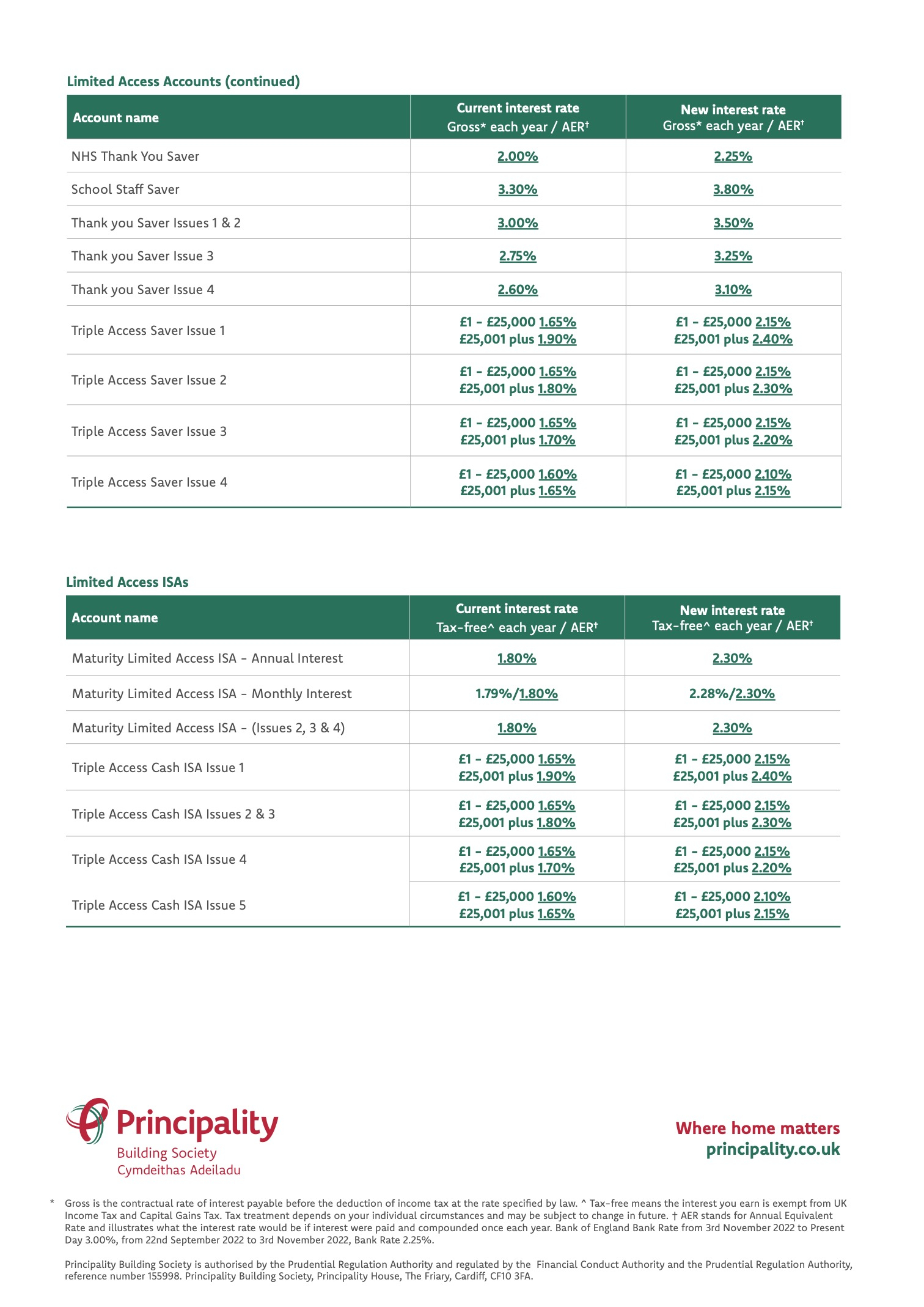

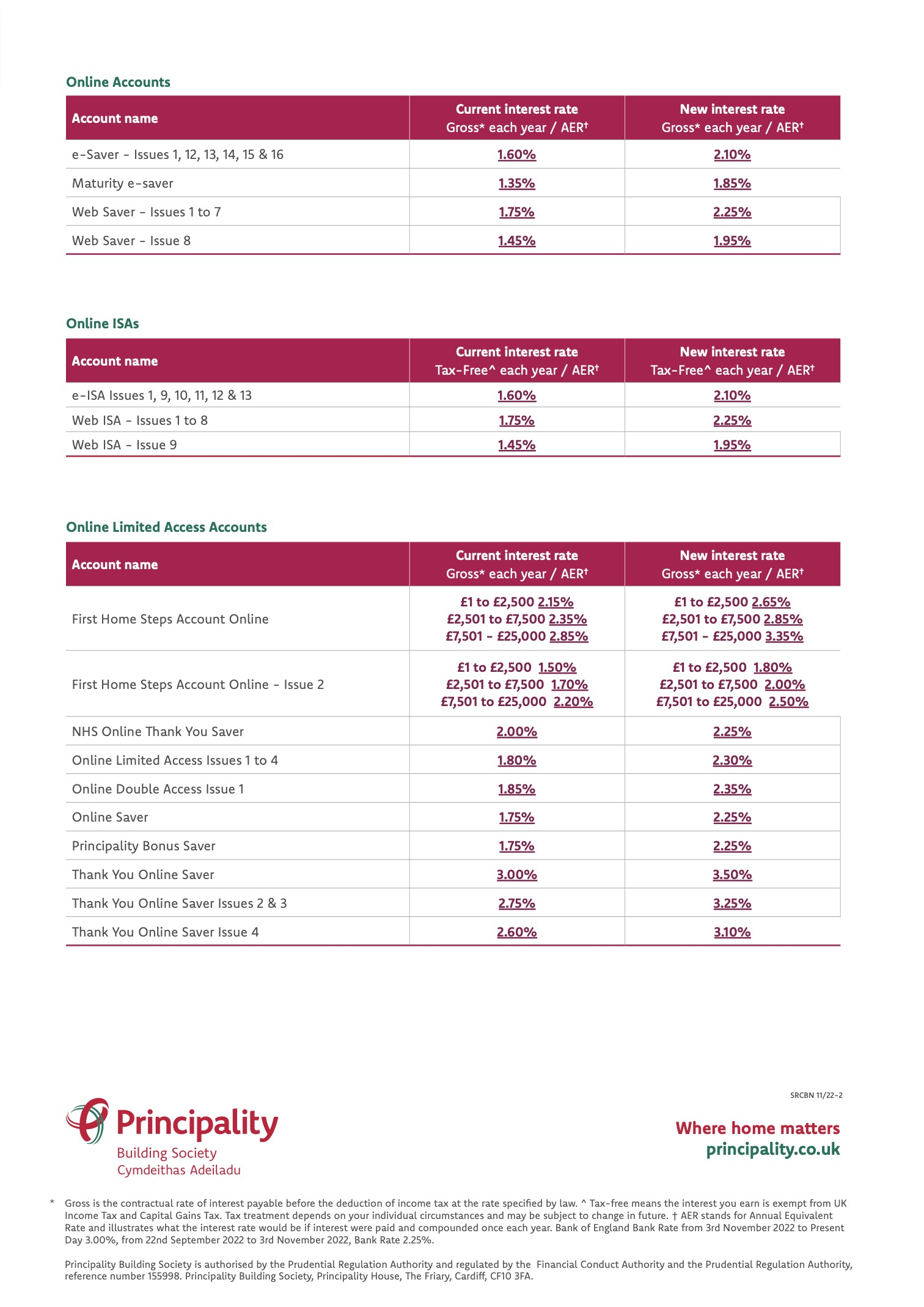

The new Principality rates have been released. Some of the rows are incorrect I believe, i.e. my learner earner issue 3 pays 3.5% not 2.95% so this row is wrong. The First Home Saver Issue 3 rate is also wrong. Therefore perhaps take it with a pinch of salt, but seeing as it is official marketing communication I figured it deserved a post.

*EDIT* I've noticed this document is named 'Savings Rate Change Branch Notice September' despite being headed November

If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.1 -

Looks like Kent Reliance have pulled their 3.95% one-year fixed rate ISA, making Castle Trust Bank now the highest for one year at 3.80%.

Things are changing so often that the comparison sites can't keep up !

2 -

It looks like that’s been pulled from their website?bristolleedsfan said:https://www.skipton.co.uk/savings/isas/easy-accessCash eISA Saver Issue 122.75%tax-free pa/AER variable

They do have a “Cash ISA Saver Issue 16” paying the same 2.75%tax-free pa/AER variable but it’s not available online (Branch, post and phone only).

https://www.skipton.co.uk/savings/isas/cash-isa-saver

“Hardware: The parts of a computer system that can be thrown out of the nearest window!”2 -

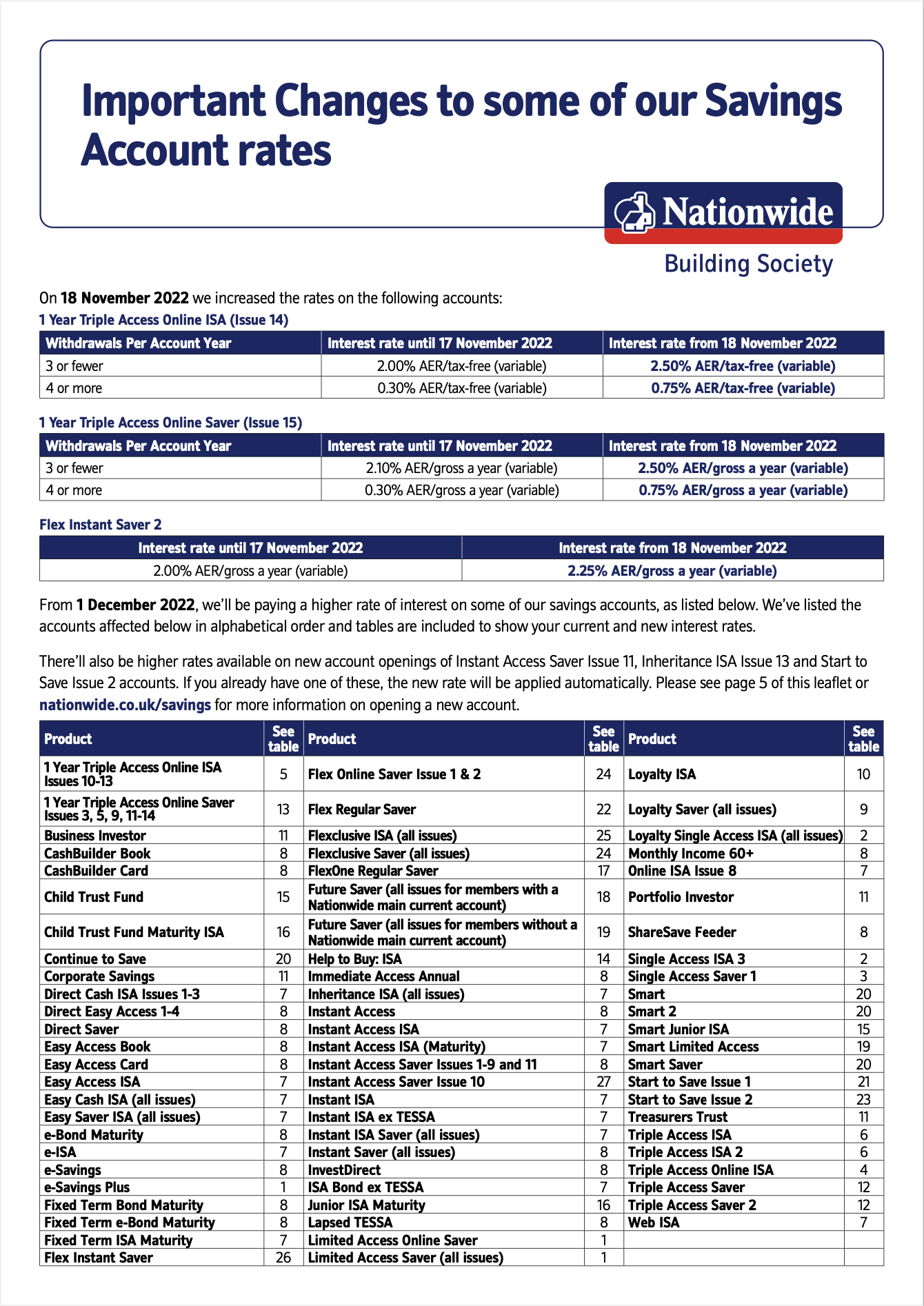

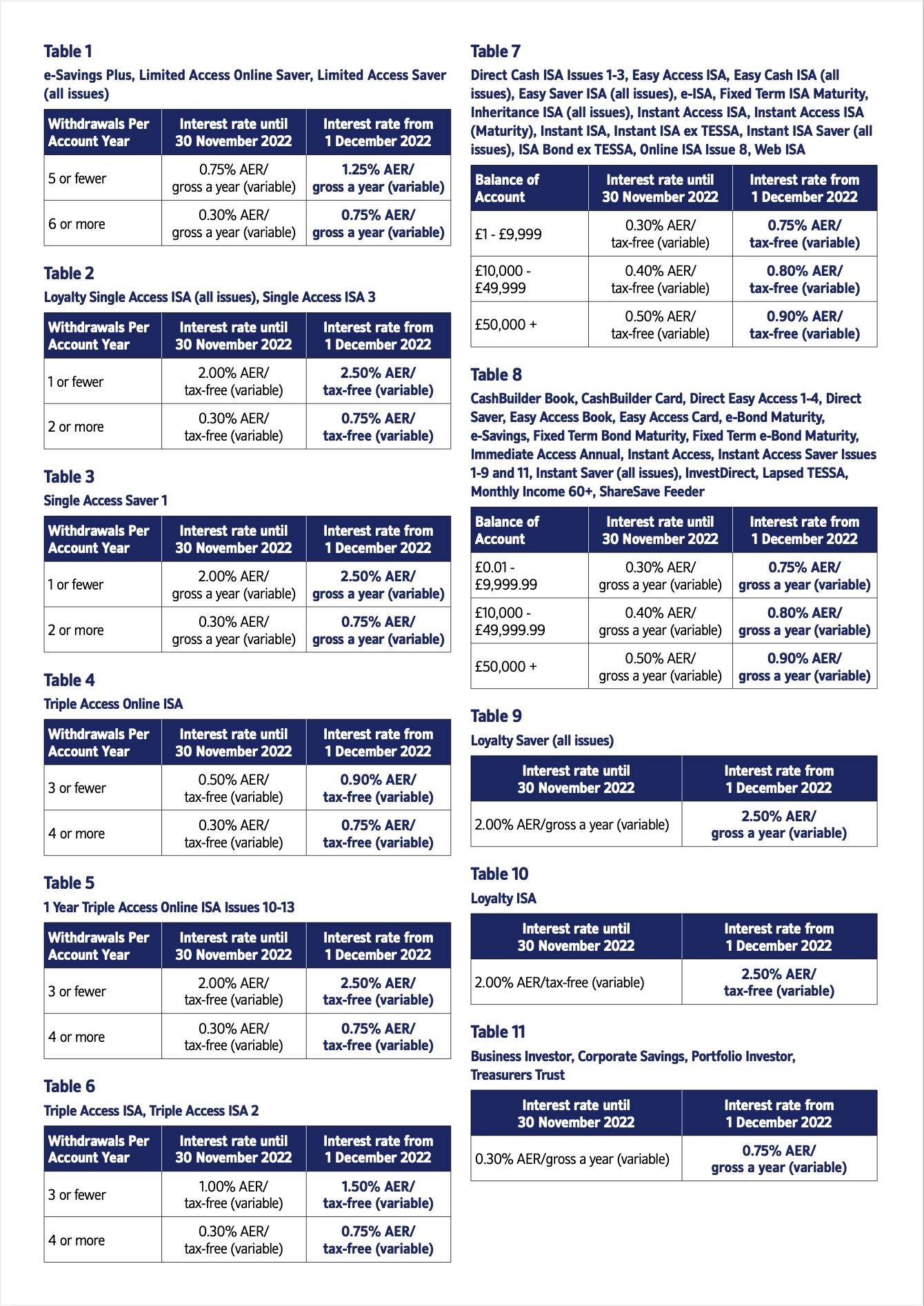

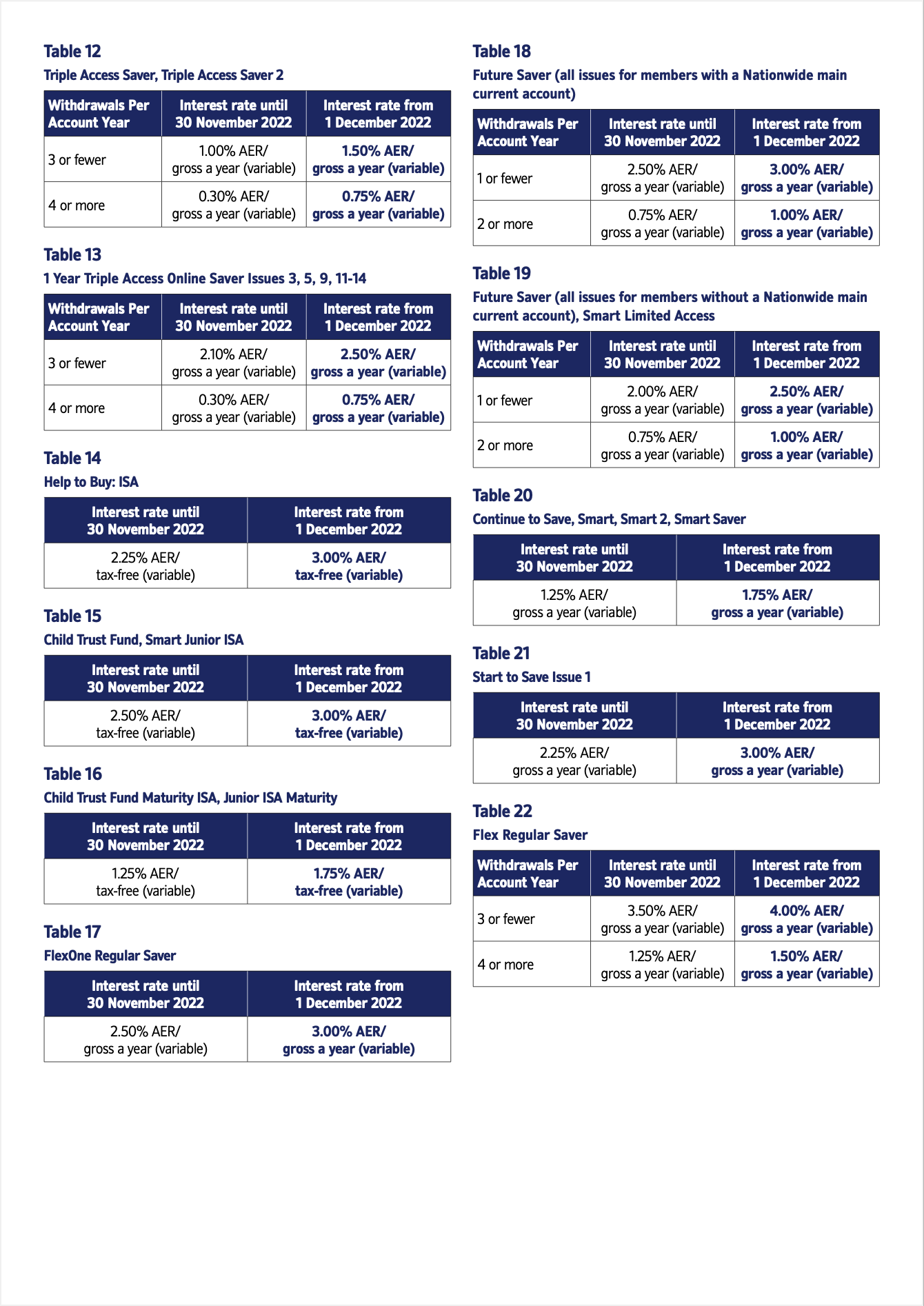

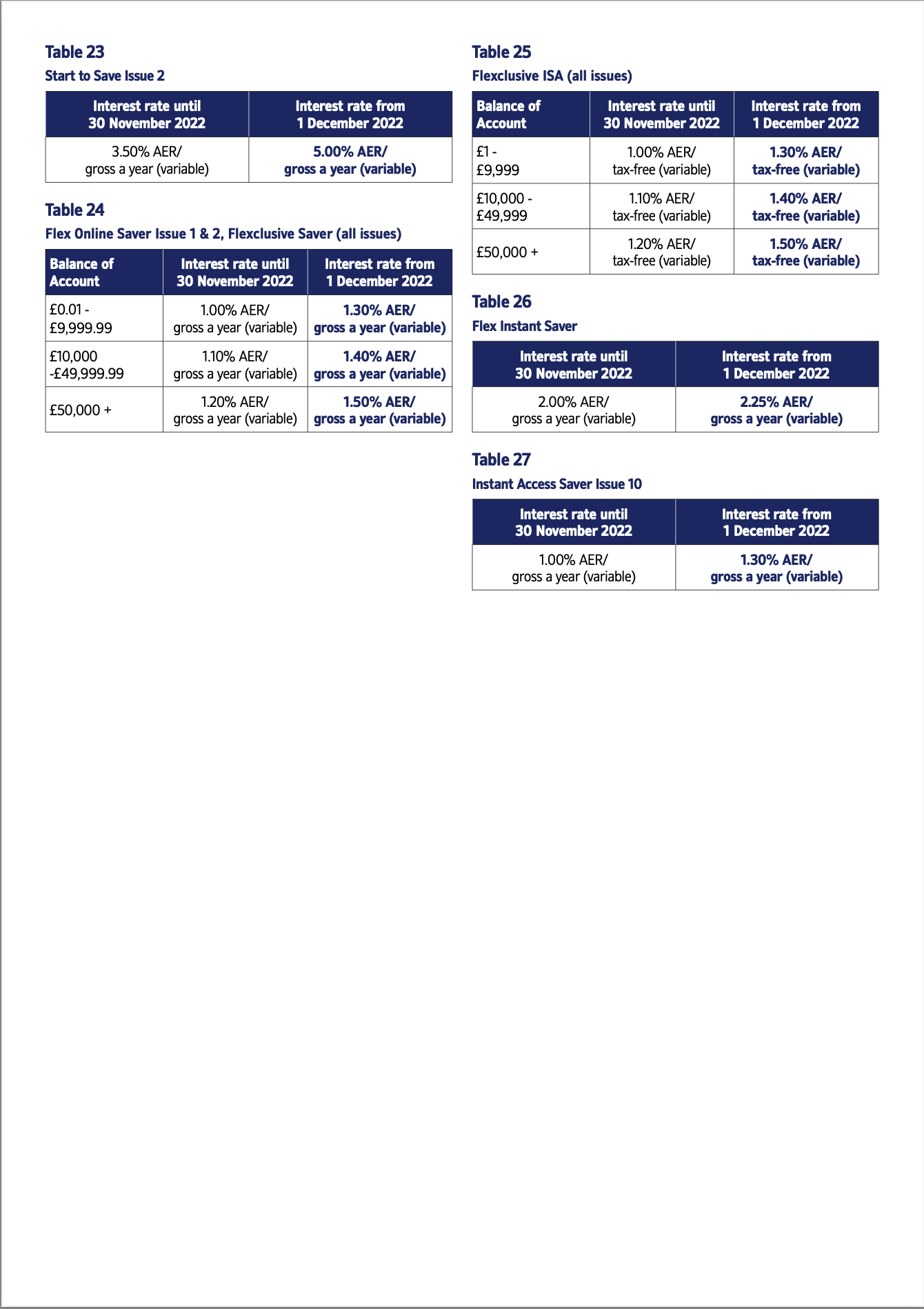

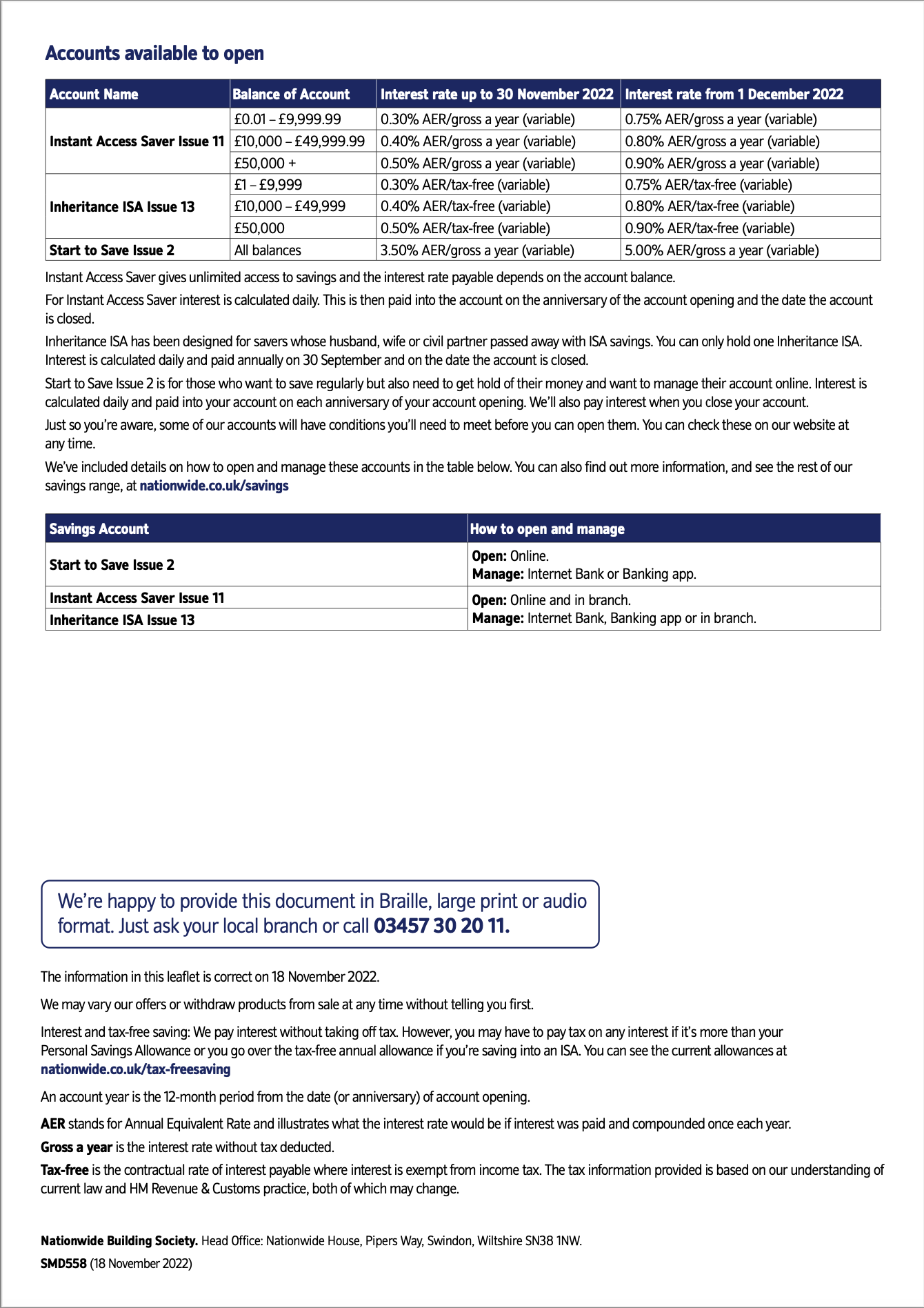

Nationwide Savings Account Rate Changes (Effective 1st December):

On 18 November, we increased the interest rates on some of our savings accounts:

- 1 Year Triple Access Online Saver

- 1 Year Triple Access Online ISA

- Flex Instant Saver.

On 1 December, we’ll be increasing the interest rates on some of our other savings accounts.

Find out how your savings account's interest rate will change: https://www.nationwide.co.uk/-/assets/nationwidecouk/documents/savings/smd558-important-changes.pdf?rev=5d58bb4757754e84bce2f70bd75b6409

If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.4 -

Apologies if already mentioned above but Charter have 1 yr (3.76 %) and 2 yr (4.21%) fixed ISAs on their main page for new customers.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.7K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards