We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Cash ISAs: The Best Currently Available List

Comments

-

Yes got application form emailed to me after appointment, printed out, signed & returned via email this afternoon. Got a txt message late afternoon with my account number for transfer, informing me I have 10 days to fund.bristolleedsfan said:

Is that application form signed and fixed term rate funded ?rawy said:

I had a telephone appointment today which I booked 12 days ago & managed to get one opened.SnowMan said:Some very good Cumberland Building Society fixed rate ISA accounts available to open in branch. They stateThis account is available to open at any Cumberland branch, for customers who live in our operating area1 year fixed rate ISA: 4.25% AER (90 day penalty for transferring to another ISA during the term)2 year fixed rate ISA: 4.75% AER (90 day penalty for transferring to another ISA during the term)5 year fixed rate ISA: 5.05% AER (180 day penalty for transferring to another ISA during the term)edit:Been into a branch and in practice it's impossible to open one of these accounts. You can only open one with a face to face or telephone appointment.And they don't have any appointments available until around 20th December and that's a telephone appointment. And then even though the branch was virtually empty they don't have any face to face appointments available at all at any time. And if the accounts above are gone at that time you don't get these rates even if you specify which account you are interested in.So consider this misleading advertising by the Cumberland.

Got in by the skin of my teeth.

Rawy2 -

Thanks for info particularly the procedure they operate for furnishing customer with funding account numbers.rawy said:

Yes got application form emailed to me after appointment, printed out, signed & returned via email this afternoon. Got a txt message late afternoon with my account number for transfer, informing me I have 10 days to fund.bristolleedsfan said:

Is that application form signed and fixed term rate funded ?rawy said:

I had a telephone appointment today which I booked 12 days ago & managed to get one opened.SnowMan said:Some very good Cumberland Building Society fixed rate ISA accounts available to open in branch. They stateThis account is available to open at any Cumberland branch, for customers who live in our operating area1 year fixed rate ISA: 4.25% AER (90 day penalty for transferring to another ISA during the term)2 year fixed rate ISA: 4.75% AER (90 day penalty for transferring to another ISA during the term)5 year fixed rate ISA: 5.05% AER (180 day penalty for transferring to another ISA during the term)edit:Been into a branch and in practice it's impossible to open one of these accounts. You can only open one with a face to face or telephone appointment.And they don't have any appointments available until around 20th December and that's a telephone appointment. And then even though the branch was virtually empty they don't have any face to face appointments available at all at any time. And if the accounts above are gone at that time you don't get these rates even if you specify which account you are interested in.So consider this misleading advertising by the Cumberland.

Got in by the skin of my teeth.

Rawy

I had telephone appointment last Thursday, application form sent by post as I do not have a printer, advisor replied to me this afternoon by secure email message to say hopefully it will arrive after two more delivery working days if not it can be re-sent.0 -

Do you live in the catchment area? I assumed I couldnt apply because I was outside this arearawy said:

Yes got application form emailed to me after appointment, printed out, signed & returned via email this afternoon. Got a txt message late afternoon with my account number for transfer, informing me I have 10 days to fund.bristolleedsfan said:

Is that application form signed and fixed term rate funded ?rawy said:

I had a telephone appointment today which I booked 12 days ago & managed to get one opened.SnowMan said:Some very good Cumberland Building Society fixed rate ISA accounts available to open in branch. They stateThis account is available to open at any Cumberland branch, for customers who live in our operating area1 year fixed rate ISA: 4.25% AER (90 day penalty for transferring to another ISA during the term)2 year fixed rate ISA: 4.75% AER (90 day penalty for transferring to another ISA during the term)5 year fixed rate ISA: 5.05% AER (180 day penalty for transferring to another ISA during the term)edit:Been into a branch and in practice it's impossible to open one of these accounts. You can only open one with a face to face or telephone appointment.And they don't have any appointments available until around 20th December and that's a telephone appointment. And then even though the branch was virtually empty they don't have any face to face appointments available at all at any time. And if the accounts above are gone at that time you don't get these rates even if you specify which account you are interested in.So consider this misleading advertising by the Cumberland.

Got in by the skin of my teeth.

Rawy0 -

Cumberland B.S - Available to Locals (Cumbria (all CA and LA), SW Scotland (all DG and TD9), W Northumberland (NE45 - NE49), N Lancashire (all PR, FY, LA and BB1-2 and BB5-7)1

-

Yes I'm in the catchment area but was quicker to get an appointment over the phone than go in branch.Tom_Hendo said:

Do you live in the catchment area? I assumed I couldnt apply because I was outside this arearawy said:

Yes got application form emailed to me after appointment, printed out, signed & returned via email this afternoon. Got a txt message late afternoon with my account number for transfer, informing me I have 10 days to fund.bristolleedsfan said:

Is that application form signed and fixed term rate funded ?rawy said:

I had a telephone appointment today which I booked 12 days ago & managed to get one opened.SnowMan said:Some very good Cumberland Building Society fixed rate ISA accounts available to open in branch. They stateThis account is available to open at any Cumberland branch, for customers who live in our operating area1 year fixed rate ISA: 4.25% AER (90 day penalty for transferring to another ISA during the term)2 year fixed rate ISA: 4.75% AER (90 day penalty for transferring to another ISA during the term)5 year fixed rate ISA: 5.05% AER (180 day penalty for transferring to another ISA during the term)edit:Been into a branch and in practice it's impossible to open one of these accounts. You can only open one with a face to face or telephone appointment.And they don't have any appointments available until around 20th December and that's a telephone appointment. And then even though the branch was virtually empty they don't have any face to face appointments available at all at any time. And if the accounts above are gone at that time you don't get these rates even if you specify which account you are interested in.So consider this misleading advertising by the Cumberland.

Got in by the skin of my teeth.

Rawy

Cheers

Rawy0 -

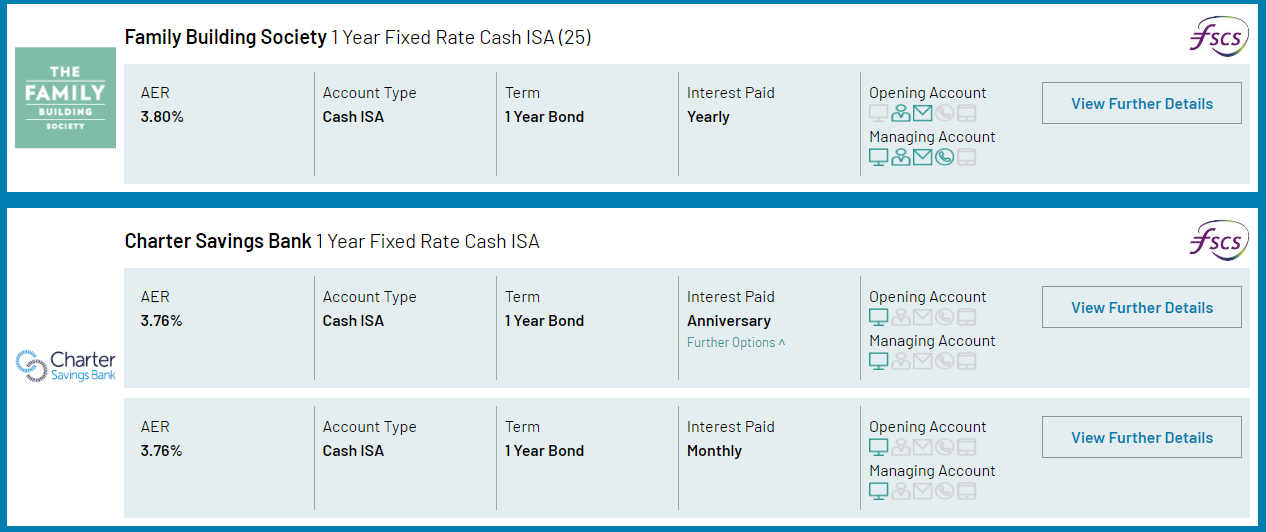

The Family Building Society 1 year fix for 3.8% is now gone as well. Was only considering it yesterday and been busy all day and now seen it's gone grrr

0 -

Cynergy Bank Online ISA (Issue 27) now available at 2.50%.

https://www.cynergybank.co.uk/personal-savings/online-isa/online-isa-issue-27/

Stompa2 -

Currently available easy access interest rates for both ISA and non-ISA accounts seem generally at the moment to be converging at about 0.5% lower than the Bank of England base rate of 3%.Stompa said:Cynergy Bank Online ISA (Issue 27) now available at 2.50%.

https://www.cynergybank.co.uk/personal-savings/online-isa/online-isa-issue-27/

My question is:- Why are currently available easy access interest rates generally converging at c.2.50% and not closer to or at 3% at the present time?0 -

Financial institutions can borrow from BoE at 3% so paying savers 2.5% is cheaper. Only intense competition for savers' money is likely to close the margin, I would say.cricidmuslibale said:

My question is:- Why are currently available easy access interest rates generally converging at c.2.50% and not closer to or at 3% at the present time?

Warning: In the kingdom of the blind, the one-eyed man is king.

2

Warning: In the kingdom of the blind, the one-eyed man is king.

2 -

Fair enough, but when the B of E base rate was 2.25% back in late September and October, leaving aside Santander, Cynergy and Sainsburys who went out on a limb by offering 2.75% to both new and existing customers for a short time, there were quite a few easy access accounts, both ISAs and non ISAs, either matching or slightly exceeding this 2.25% interest rate.Consumerist said:

Financial institutions can borrow from BoE at 3% so paying savers 2.5% is cheaper. Only intense competition for savers' money is likely to close the margin, I would say.cricidmuslibale said:

My question is:- Why are currently available easy access interest rates generally converging at c.2.50% and not closer to or at 3% at the present time?

The only ‘easy access’ accounts that are presently matching the current 3% base rate are Aldermore’s double access saver (only available to existing customers currently), HSBC’s Online Bonus Saver (for months where no withdrawals are made) and Virgin Money’s exclusive flexible cash ISA (only available to their current account customers).

So why has the latest B of E base rate of 3% not generally been acknowledged by banks and building societies in respect to their current easy access savings interest rates in the way that the previous base rate of 2.25% was? Any ideas, please?1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards