We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Being nosey... How many Regular Saver accounts do you have?

Comments

-

How many Regular Saver accounts do you have?

Finding the answer was a bit frightening after deciding early this year to reduce and only look at 6% and over - currently have 24 all except Cumberland fully funded (only keep it as it doesn't have an end date and just funded with minimum £25). Also have the NatWest & RBS ones which were at maximum £5000 but are now being used to fund other savers.

Monthly payments in total £6210

Current value £365041 -

Is that 24 including NW & RBS, or 26 including those two? TIA.saverkev said:How many Regular Saver accounts do you have?

Finding the answer was a bit frightening after deciding early this year to reduce and only look at 6% and over - currently have 24 all except Cumberland fully funded (only keep it as it doesn't have an end date and just funded with minimum £25). Also have the NatWest & RBS ones which were at maximum £5000 but are now being used to fund other savers.

Monthly payments in total £6210

Current value £36504Compiler of the RS League Table.

Being nosey... How many Regular Saver accounts do you have? — MoneySavingExpert Forum0 -

26 including those 2Bobblehat said:

Is that 24 including NW & RBS, or 26 including those two? TIA.saverkev said:How many Regular Saver accounts do you have?

Finding the answer was a bit frightening after deciding early this year to reduce and only look at 6% and over - currently have 24 all except Cumberland fully funded (only keep it as it doesn't have an end date and just funded with minimum £25). Also have the NatWest & RBS ones which were at maximum £5000 but are now being used to fund other savers.

Monthly payments in total £6210

Current value £365041 -

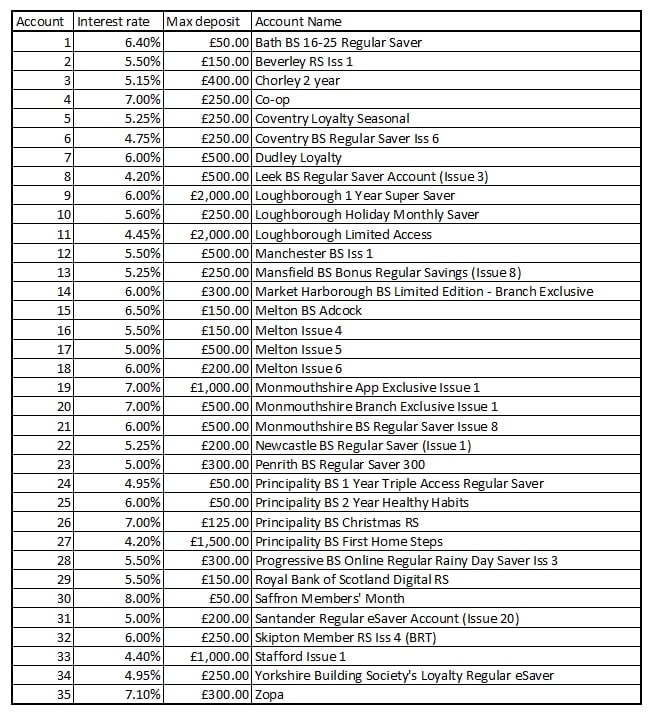

You got me!Bridlington1 said:

Darlington 12 Month RS Issue 1 is number 6.Bobblehat said:

You're a hard quizmaster! I give up!Bridlington1 said:

Still wrong for number 6.Bobblehat said:2nd attempt ...

Edit: just noticed 3 is correct building society but wrong account.

Compiler of the RS League Table.

Compiler of the RS League Table.

Being nosey... How many Regular Saver accounts do you have? — MoneySavingExpert Forum1 -

I've got 12 the moment. 5 Principality, 2 Monmouthshire and 5 providers with just 1. Normally I don't open them unless I've already got some sort of account with that provider already. Monmouthshire is the latest exception to that rule.1

-

7 but only 5 at fixed rate, so 2 have come down since opening. Still better than easy access though.1

-

Wowza, amazed at some of the numbers here! Only have 2, linked to my 2 current accounts (burned once when my main bank had issues). Generally don't intend to have too much in fixed income, both from a tax and growth perspective.

However I did wonder if it could be neat to have 12 if you could get them at the same monthly contribution. Open a new one each month to spread out the opening admin. Then after the first year, you have one maturing each month, with the cash going out to the other 11, and the 12th bit to re-start with the same bank that's just matured. That could circulate the same money each month, so its always earning the higher Regular Saver rates, rather than having (much) money in a lower paying easy access ready to fund. I suppose in practice the dates might not quite line up etc.

2 -

Wow indeed!

I have zero! I loaded up a 4.5% or so 5 year fix with just enough to fill my PSA (interest paid monthly). I have some cash in ISAs, but anything else I need to save I now stick into short term low coupon gilts.2 -

That would be good, but generally the higher paying accounts don't stick around long enough to risk waiting until the ideal time for your planning, and several tend to turn up at once. Many RS are easy access, so it makes sense to hold money in those rather than a normal easy access account, whether or not you can get the timings to match your calendar..saajan_12 said:Wowza, amazed at some of the numbers here! Only have 2, linked to my 2 current accounts (burned once when my main bank had issues). Generally don't intend to have too much in fixed income, both from a tax and growth perspective.

However I did wonder if it could be neat to have 12 if you could get them at the same monthly contribution. Open a new one each month to spread out the opening admin. Then after the first year, you have one maturing each month, with the cash going out to the other 11, and the 12th bit to re-start with the same bank that's just matured. That could circulate the same money each month, so its always earning the higher Regular Saver rates, rather than having (much) money in a lower paying easy access ready to fund. I suppose in practice the dates might not quite line up etc.

Eco Miser

Saving money for well over half a century1 -

My Grand Total, 21.

Regular Savers List

1, Principality 6.0% Max £ 50 £1171.40

2, TSB 6.0% Max £250 £3000.00

3, Principality 7.5% Max £125 £1800.00

4, Principality 7.0% Max £200 £1000.00

5, M Harborough 6.0% Max £250 £3500.00

6, Coventry 5.75% Max £250 £2750.00

7, Progressive 5.5% Max £300 £2700.00

8, Zopa 7.5% Max £300 £2100.00

9, West Brom 6.0% Max £250 £2250.00

10, M Harborough 6.0% Max £250 £2750.00

11, Principality 5.4% Max £ 50 £ 350.00

12, First Direct 7.0% Max £300 £1800.00

13, Skipton 6.25% Max £250 £1500.00

14, Virgin Money 6.5% Max £250 £ 750.00

15, Principality 7.5% Max £200 £ 600.00

16, Principality 7.5% Max £200 £ 600.00

17, Principality 7.5% Max £200 £ 400.00

18, Monmouth 6.0% Max £500 £1500.00

19, Monmouth 7.0% Max £1000 £3000.00

20, Nationwide 6.5% Max £200 £ 400.00

21, YBS 6.0% Max £ 50 £ 100.00

Total For October £34,021.40

1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.7K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards