We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The Old Regular Savers Discussion Thread 28/12/24-29/1/26

Comments

-

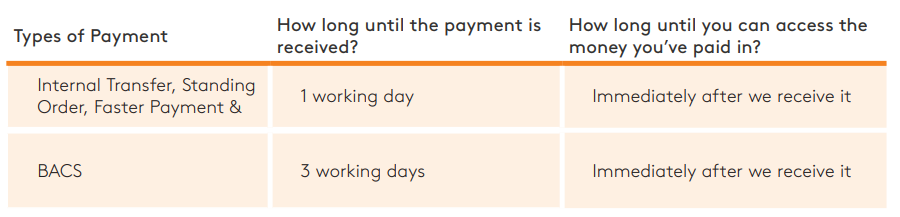

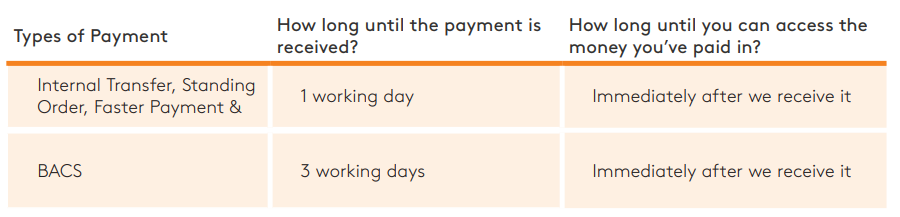

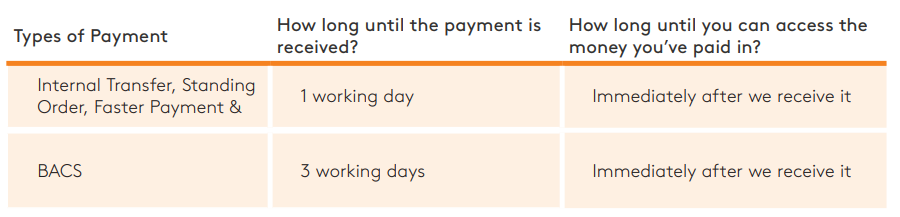

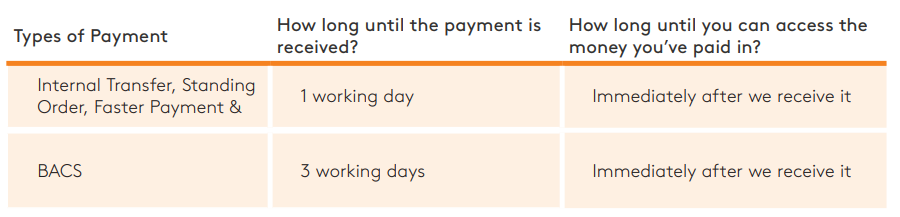

Monmouthshire - just wondering if I've interpreted this correctly?

So if I paid in by faster payment on a Friday, it wouldn't be received (and therefore earning interest) until Monday? Or even Tuesday if the Monday is a bank holiday?

If so, best to avoid funding on a Friday, to minimise loss of interest.0 -

I’ve found that you won’t see it until next working day but the ‘posting date’ will be the day you pay it, regardless of weekend or weekday so all should be good.clairec666 said:Monmouthshire - just wondering if I've interpreted this correctly?

So if I paid in by faster payment on a Friday, it wouldn't be received (and therefore earning interest) until Monday? Or even Tuesday if the Monday is a bank holiday?

If so, best to avoid funding on a Friday, to minimise loss of interest.1 -

Ah. I wonder whether it will earn interest from the 'posting date'? The T&Cs say "As soon as we receive the money, the amount you deposit through an electronic payment will start to earn interest"jaypers said:

I’ve found that you won’t see it until next working day but the ‘posting date’ will be the day you pay it, regardless of weekend or weekday so all should be good.clairec666 said:Monmouthshire - just wondering if I've interpreted this correctly?

So if I paid in by faster payment on a Friday, it wouldn't be received (and therefore earning interest) until Monday? Or even Tuesday if the Monday is a bank holiday?

If so, best to avoid funding on a Friday, to minimise loss of interest.

I know I said a couple of pages back that I can't be bothered messing around with days for the sake of a tiny bit of interest, but as I'm depositing £1500 I reckon it's worth the effort!0 -

If you have an existing Coventry Loyalty Seasonal Saver account (NLA), withdrawals are now penalty-free from today (prior to today any withdrawals would have cost you 30 calendar days interest on the amount withdrawn).As the interest rate of this account is no longer particularly competitive (down to 5.25% AER), keen regular savers may wish to start using this account to trickle feed into better paying regular saver accounts from now.

2 -

It shows as the date sent, but according to page 1 of this thread:jaypers said:

I’ve found that you won’t see it until next working day but the ‘posting date’ will be the day you pay it, regardless of weekend or weekday so all should be good.clairec666 said:Monmouthshire - just wondering if I've interpreted this correctly?

So if I paid in by faster payment on a Friday, it wouldn't be received (and therefore earning interest) until Monday? Or even Tuesday if the Monday is a bank holiday?

If so, best to avoid funding on a Friday, to minimise loss of interest.

'Deposits on non-working days: Treated as having been received the next working day.'0 -

Decided to give it a go - instantly appears in the account, but I'll see tomorrow if the extra accrued interest is on the basis of a £300 or £600 balance...SJMALBA said:Hanley - will a debit card payment be credited/earn interest today, or should I leave it until Monday?1 -

We use SO`s to fund our many RS`s because of ease and simplicity over manual payments. Since the rise of EA interest rates we do not fund hub current account until the actual day SO`s go out. We are well into 5 figures for Monday`s deposit and I calculate we avoid losing interest of about £2 a day gained in 5% EA accounts. Because Monday is the first working day of November the gain over a weekend is greater.

On Monday we will get an early morning text explaining lack of funds and then we transfer the fund to cover all payments.

Hopefully their are no ramifications from the bank concerning this procedure.0 -

Good point... nofriolento said:

Did you start your Zopa on a 1st?topyam said:Just went through all mine and made a note of which ones to fund today, and which to leave until Monday

Those i need to leave are:

AIB

Co-Op

Progressive

Those I can fund:

Principality

Zopa

Newcastle

Manchester

They do accept working days, but i need to wait on that one.0 -

Same here. I wonder if whoever composed the banner forgot the 1st is a Saturday and it won't be visible until Monday 3rd, presumably dated 31st October,happybagger said:Surprised not had Stafford (Railway) BS RS interest today, due 31 Oct. They had a banner on their website yesterday saying it "would be credited at midnight and viewable on 1st Nov"1 -

Now credited.Hattie627 said:

Same here. I wonder if whoever composed the banner forgot the 1st is a Saturday and it won't be visible until Monday 3rd, presumably dated 31st October,happybagger said:Surprised not had Stafford (Railway) BS RS interest today, due 31 Oct. They had a banner on their website yesterday saying it "would be credited at midnight and viewable on 1st Nov"1

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards