We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The Old Regular Savers Discussion Thread 28/12/24-29/1/26

Comments

-

Extra money. I've never been interested in calculating this. I know that avoiding cash drag helps to maximise the return, so it is definitely better to control the deposits manually.friolento said:Out of interest, how much extra money are people typically make by doing manual transfers rather than SOs? How much effort goes into doing the transfers manually, and how much effort goes into figuring out whether the money gets credited in the RA earlier than via SOs? How do you handle being on holidays / work / busy / sick on a 1st?

I used to use SOs for this some years ago without giving it any thought, but stopped when I ended up being charged an overdraft fee. It was Nationwide. Unlike others, they process internal SOs at weekends so the deposit scheduled for Nationwide current account arrived 3 days (extended weekend) after the SO was paid into RS. This made me think about the appropriateness of using SOs.

I'm glad I stopped using standing orders, manual deposits are much more convenient. It would've been a nightmare if I had to go back to SO method now. I don't mind FD, it's the only one with this requirement and I get notification on my phone when £300 it taken so I can bring my 1st Account back to zero.

Holidays/being away from home. I use my phone and iPad. Not as convenient as desktop for some transactions and admin, but I don't mind because it is rare when I'm away on RS distribution dates. I have all relevant spreadsheets on my google drive so can access everything I need at any time. Had a bit of problem in Italy a couple of months ago, Lebara didn't work there. It wasn't at transactional time of the month, but if I faced that problem I'd just accept it and do my distribution when I'm back home (could be much worse if I used SOs in that situation).

Effort. I don't feel like making a lot of effort, but it is a bit tedious to do all transactions in one go. I recently started scheduling some of my deposits at the end of month when I am sure what I'm funding in upcoming month. I'm currently feeding mainly from my Sunny Cahoots and have enough funds there to do it without pre-funding from elsewhere.

1 -

SJMALBA said:Hanley - will a debit card payment be credited/earn interest today, or should I leave it until Monday?After a two day wait for the initial transfer by "Faster" payment, I've just made a card deposit. Was from a CA with £0 balance and an overdraft, and deposit was credited immediately by Hanley. Transaction was shown as pending by CA bank, but because I don't know exactly when this transaction will be posted, I transferred £300 in.If this goes well, from now on I will only fund Hanley by card. Best case with faster payment is a days lost interest, as I understand it.1

-

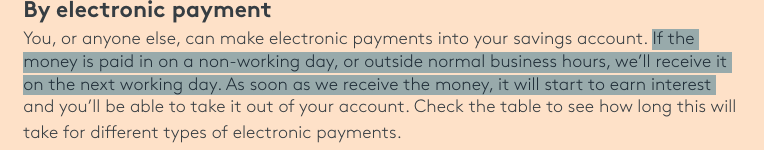

Page 1 of this thread goes off the Monmouthshire BS's General Ts&Cs, which state:SJMALBA said:

It shows as the date sent, but according to page 1 of this thread:jaypers said:

I’ve found that you won’t see it until next working day but the ‘posting date’ will be the day you pay it, regardless of weekend or weekday so all should be good.clairec666 said:Monmouthshire - just wondering if I've interpreted this correctly?

So if I paid in by faster payment on a Friday, it wouldn't be received (and therefore earning interest) until Monday? Or even Tuesday if the Monday is a bank holiday?

If so, best to avoid funding on a Friday, to minimise loss of interest.

'Deposits on non-working days: Treated as having been received the next working day.'

My interpretation is that even though the money may show in the account if paid in on a non-working day, the money isn't received for interest purposes until the next working day and thus for interest purposes, deposits on non-working days are treated as having been received the next working day.

They are not unlike Skipton BS in this regard.6 -

topyam said:Just went through all mine and made a note of which ones to fund today, and which to leave until Monday

Those i need to leave are:

AIB

Co-Op

Progressive

Those I can fund:

Principality

Zopa

Newcastle

Manchester

I funded my Co-Op saver today and funds were received and credited today.2 -

After doing a number of RS funding transfers, is your bank/building society forcing you to go through further security to complete each transfer ?I fund most of my RS with manual faster payments with Nationwide. After doing around 30 transfers now, I have to verify most of the following transfers using a card and the card reader calculator type device. I find this a complete PITA, it slows me down significantly and I lose the rhythm. My process involves taking screen shots before and after each transfer and before I do the transfer I double check the account number and amount with my list.I haven't spoken to Nationwide about this, but I suspect if I did I'll get some fob off answer about security procedures. I can sort of understand that, however it would be nice if I could some how turn on a higher number of transfers I can do, do them, then turn off and go back to normal. Bit like self defined transfer limits with some banks and accounts.What would be really good is to be able to have complete faster payments transfers set up and ready to go. This would include all the payee details and an amount of money. Then I can just select and transfer. No need to enter amounts. Also I control when the transfer happens.Any suggestions / comments ? I don't really want to use standing orders because of their unpredictability and other issues.1

-

I seem to recall Santander did this to me a while back but all the payments still went through without issues, just had to enter a OTP and security number each time.Born2Save_3 said:After doing a number of RS funding transfers, is your bank/building society forcing you to go through further security to complete each transfer ?I fund most of my RS with manual faster payments with Nationwide. After doing around 30 transfers now, I have to verify most of the following transfers using a card and the card reader calculator type device. I find this a complete PITA, it slows me down significantly and I lose the rhythm. My process involves taking screen shots before and after each transfer and before I do the transfer I double check the account number and amount with my list.I haven't spoken to Nationwide about this, but I suspect if I did I'll get some fob off answer about security procedures. I can sort of understand that, however it would be nice if I could some how turn on a higher number of transfers I can do, do them, then turn off and go back to normal. Bit like self defined transfer limits with some banks and accounts.What would be really good is to be able to have complete faster payments transfers set up and ready to go. This would include all the payee details and an amount of money. Then I can just select and transfer. No need to enter amounts. Also I control when the transfer happens.Any suggestions / comments ? I don't really want to use standing orders because of their unpredictability and other issues.

These days I tend to spread my regular saver deposits across multiple different banks/building societies, so currently pay some regular savers from Santander, Nationwide, Co-op, NatWest, RBS, Ulster, First Direct, HSBC and TSB and aim to have roughly an even number of regular savers getting fed from each.

It also has the added advantage of ensuring that if one account ever did become unusable for whatever reason, e.g. frozen account, IT meltdown etc the overall impact it is likely to have on me is reduced in comparison to just using the one account to fund everything.

0 -

I assume you don't have the money sitting in these banks for a period of time but instead transfer in from feeder accounts paying higher interest?Bridlington1 said:

I seem to recall Santander did this to me a while back but all the payments still went through without issues, just had to enter a OTP and security number each time.Born2Save_3 said:After doing a number of RS funding transfers, is your bank/building society forcing you to go through further security to complete each transfer ?I fund most of my RS with manual faster payments with Nationwide. After doing around 30 transfers now, I have to verify most of the following transfers using a card and the card reader calculator type device. I find this a complete PITA, it slows me down significantly and I lose the rhythm. My process involves taking screen shots before and after each transfer and before I do the transfer I double check the account number and amount with my list.I haven't spoken to Nationwide about this, but I suspect if I did I'll get some fob off answer about security procedures. I can sort of understand that, however it would be nice if I could some how turn on a higher number of transfers I can do, do them, then turn off and go back to normal. Bit like self defined transfer limits with some banks and accounts.What would be really good is to be able to have complete faster payments transfers set up and ready to go. This would include all the payee details and an amount of money. Then I can just select and transfer. No need to enter amounts. Also I control when the transfer happens.Any suggestions / comments ? I don't really want to use standing orders because of their unpredictability and other issues.

These days I tend to spread my regular saver deposits across multiple different banks/building societies, so currently pay some regular savers from Santander, Nationwide, Co-op, NatWest, RBS, Ulster, First Direct, HSBC and TSB and aim to have roughly an even number of regular savers getting fed from each.

It also has the added advantage of ensuring that if one account ever did become unusable for whatever reason, e.g. frozen account, IT meltdown etc the overall impact it is likely to have on me is reduced in comparison to just using the one account to fund everything.0 -

Thanks for your reply and good points. It made me wonder are there any/many RS accounts that are particular over which account funds it ? In other words, if you fund a RS with an account other than the nominated account you have set up with the RS organisation, will it bounce ?Bridlington1 said:

I seem to recall Santander did this to me a while back but all the payments still went through without issues, just had to enter a OTP and security number each time.Born2Save_3 said:After doing a number of RS funding transfers, is your bank/building society forcing you to go through further security to complete each transfer ?I fund most of my RS with manual faster payments with Nationwide. After doing around 30 transfers now, I have to verify most of the following transfers using a card and the card reader calculator type device. I find this a complete PITA, it slows me down significantly and I lose the rhythm. My process involves taking screen shots before and after each transfer and before I do the transfer I double check the account number and amount with my list.I haven't spoken to Nationwide about this, but I suspect if I did I'll get some fob off answer about security procedures. I can sort of understand that, however it would be nice if I could some how turn on a higher number of transfers I can do, do them, then turn off and go back to normal. Bit like self defined transfer limits with some banks and accounts.What would be really good is to be able to have complete faster payments transfers set up and ready to go. This would include all the payee details and an amount of money. Then I can just select and transfer. No need to enter amounts. Also I control when the transfer happens.Any suggestions / comments ? I don't really want to use standing orders because of their unpredictability and other issues.

These days I tend to spread my regular saver deposits across multiple different banks/building societies, so currently pay some regular savers from Santander, Nationwide, Co-op, NatWest, RBS, Ulster, First Direct, HSBC and TSB and aim to have roughly an even number of regular savers getting fed from each.

It also has the added advantage of ensuring that if one account ever did become unusable for whatever reason, e.g. frozen account, IT meltdown etc the overall impact it is likely to have on me is reduced in comparison to just using the one account to fund everything.

0 -

Those who run a large portfolio of RS but do not frequent the "how many do you have thread" might want to review the following post about a suspicious activity investigation a bank launched as a result of the multiple transactions to and from RS: https://forums.moneysavingexpert.com/discussion/comment/81718883/#Comment_81718883

10 -

Progressive are the only one I have currently that insist that payments in come from the nominated account, I think.Born2Save_3 said:

Thanks for your reply and good points. It made me wonder are there any/many RS accounts that are particular over which account funds it ? In other words, if you fund a RS with an account other than the nominated account you have set up with the RS organisation, will it bounce ?Bridlington1 said:

I seem to recall Santander did this to me a while back but all the payments still went through without issues, just had to enter a OTP and security number each time.Born2Save_3 said:After doing a number of RS funding transfers, is your bank/building society forcing you to go through further security to complete each transfer ?I fund most of my RS with manual faster payments with Nationwide. After doing around 30 transfers now, I have to verify most of the following transfers using a card and the card reader calculator type device. I find this a complete PITA, it slows me down significantly and I lose the rhythm. My process involves taking screen shots before and after each transfer and before I do the transfer I double check the account number and amount with my list.I haven't spoken to Nationwide about this, but I suspect if I did I'll get some fob off answer about security procedures. I can sort of understand that, however it would be nice if I could some how turn on a higher number of transfers I can do, do them, then turn off and go back to normal. Bit like self defined transfer limits with some banks and accounts.What would be really good is to be able to have complete faster payments transfers set up and ready to go. This would include all the payee details and an amount of money. Then I can just select and transfer. No need to enter amounts. Also I control when the transfer happens.Any suggestions / comments ? I don't really want to use standing orders because of their unpredictability and other issues.

These days I tend to spread my regular saver deposits across multiple different banks/building societies, so currently pay some regular savers from Santander, Nationwide, Co-op, NatWest, RBS, Ulster, First Direct, HSBC and TSB and aim to have roughly an even number of regular savers getting fed from each.

It also has the added advantage of ensuring that if one account ever did become unusable for whatever reason, e.g. frozen account, IT meltdown etc the overall impact it is likely to have on me is reduced in comparison to just using the one account to fund everything.

I have definitely used multiple accounts to fund Principality, Monmouthshire, Melton and Market Harborough.

0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards