We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The Old Regular Savers Discussion Thread 28/12/24-29/1/26

Comments

-

chris_the_bee said:

Skipton are not a clearing bank, so they will not see or credit payments until the next working day.Digital_Payback said:

I sent 2 automated payments to be credited to 2 separate Skipton regular savers, funds sent from Starling Bank at 1.40am on 1st August.badger09 said:Skipton

Thanks for the heads up on Skipton’s slow processing of incoming SOs early hours on 1st. I intended to set up SO from BoS from 1Sept but will fund by FP or debit card instead.They are both showing today and credited today, 4th August.I’ll be doing a manual posting from now on at a later time of the day. Until now Skipton deposits always showed same day as posted, usually within a couple of hours.

Lesson learned.Not being a clearing bank is an irrelevance. Nationwide is not a clearing bank, nor are many of the fintechs.This is a 'slow old system' issue.

3 -

Skipton Regular Saver - deposit date

I have been told on chat that the interest will be calculated from 1st August, as the late date of 4th August is due to a processing delay at their end but I guess we won't know for sure until the interest is credited

Save £12k in 2022 #54 reporting for duty0 -

I had this problem with a manual payment sent at 12.10am on Friday. It was finally credited this morning. There seems to a delay when payments are sent in the early hours of the morning of the 1st of the month. The system at either Skipton or Barclays (who process payments on behalf of Skipton) seems to not recognise that it's a new month until later in the day. RBS and Nationwide do not have this problem though.Digital_Payback said:

I’m still waiting for 2 automated payments to be credited to 2 separate Skipton regular savers, funds sent from Starling Bank at 1.40am yesterday, 1st August.easysaver said:Skipton BS

Anyone else waiting for their deposits (faster payment from Chase at 01:23 on 1st Aug) from yesterday to show on their account(s)? I've experienced this before and it's irritating to say the least.

What do others do to avoid it? Can I fund my base rate tracker and do internal transfers from there? But won't that payment not get credited on time too? Fundamentally, is Skipton BS just unreliable?

0 -

Just managed to pay into a Principality 6 month despite Virgin telling me on phone they released the payment and getting a notification on app following a block days ago.

Got several adjustments on my current account transactions list too which are to do with the 1st of August payments I made & disappeared off the transactions list.

So basically nothing went anywhere & £200 went into my current account today.

*SIGH*0 -

Ditto for Bank Holidays. Nationwide can do instant internal transfers on weekends and BHs though.SH88SH88 said:Digital_Payback said:

It maybe that Standing Order payments are treated differently from Faster Payment. The latter seem to be processed faster and on the same day.easysaver said:Unreliable Skipton BS

My deposits made early hours on 1st Aug are now showing but dated 4th Aug.

Standing orders/scheduled payments have now been cancelled. I'll make manual payments during business hours, if I remember/have time etc.

Question for MSE's, does this happen with any other bank/building society who also offer RS's? It's the randomness of the process that irritates me more than the actual delay. Does anyone actually have an explanation for why some payments get credited on the day and others are only credited the following business day? I've not heard any explanation that holds up.

Very poor form from Skipton BS.

Skipton seem to be allergic to Weekends, if you try to do an INTERNAL transfer on a Saturday it refuses and says only on weekdays, so this gets forward dated to be actioned on Monday .....Digital_Payback said:

It maybe that Standing Order payments are treated differently from Faster Payment. The latter seem to be processed faster and on the same day.easysaver said:Unreliable Skipton BS

My deposits made early hours on 1st Aug are now showing but dated 4th Aug.

Standing orders/scheduled payments have now been cancelled. I'll make manual payments during business hours, if I remember/have time etc.

Question for MSE's, does this happen with any other bank/building society who also offer RS's? It's the randomness of the process that irritates me more than the actual delay. Does anyone actually have an explanation for why some payments get credited on the day and others are only credited the following business day? I've not heard any explanation that holds up.

Very poor form from Skipton BS.0 -

badger09 said:

I queried this with MONBS and was told it was not possible to close this RS. Mine was due to mature late August but I closed it online several months early. Expected amount of interest was credited to date of closure.Reg_Smeeton said:Re: Monmouthshire Exclusive RS issue 2 ( the 4.9% one)

I thought this account had no withdrawals before maturity but I can see online that I have the option to withdraw or transfer to my other MBS accounts. Is this due to the interest rate recently dropping or was I mistaken in my assumption? Just assessing my options as mine still has six weeks to run and could do with freeing up some money to fund more competitive RS’s at the momentHave attempted to close mine online now, I sent MonBS the instruction over the weekend, now showing in the online portal as “processed” but still displaying with the full balance, and interest hasn’t been added yet.I’m fairly sure I’m operating outside of the T&Cs but will report back whether they are currently allowing closure as I’m sure other forumites will have similarly uncompetitive accounts still some weeks from maturitySave £12k in 2020 #42 £12,551.25 / £14,000 89.65%1 -

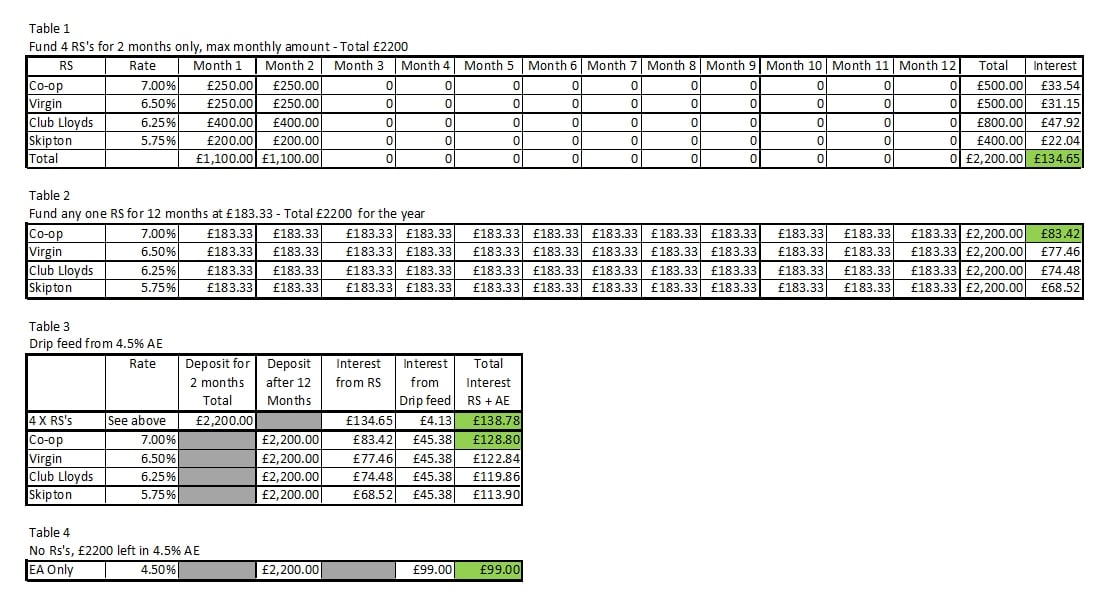

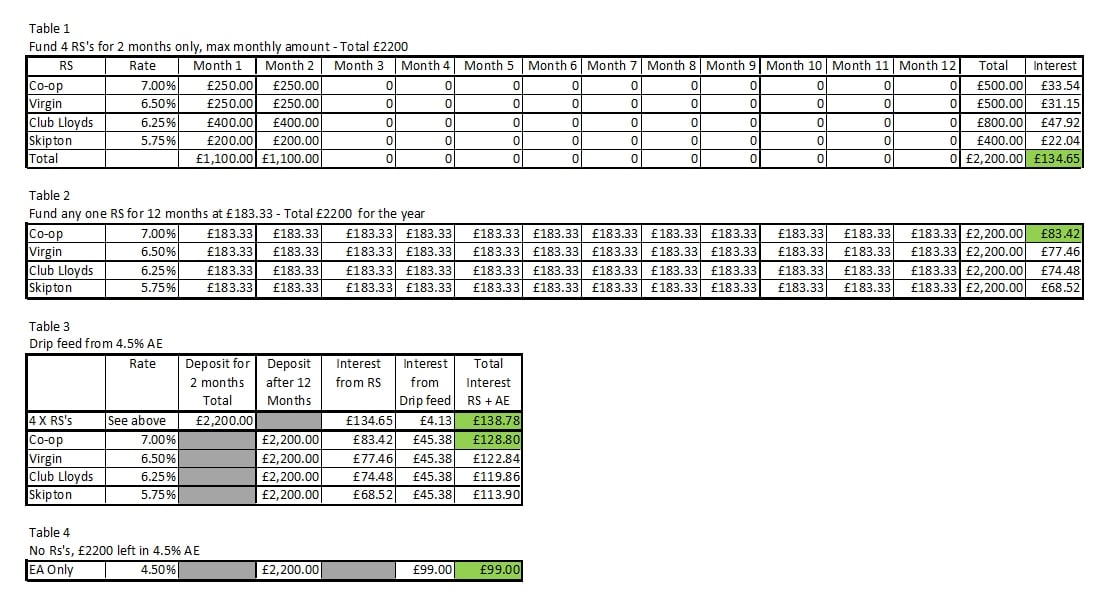

Wow, thats incredible. Thanks. Couple of things to bear in mind, the drip feed easy access is probably going to be lower in a few months time, as are the RS accounts that are not fixed rate.Bobblehat said:pedrodelgado said:Question. Would it be more beneficial to open say 4 regular savers from different providers and put the maximum allowed in each one for say the first couple of months then a nominal amount to keep them open for the remaining months, thus having a bigger overall sum for 11 or 12 months than you would have had if opening one and saving monthly into that? Any thoughts?

Best I can rustle upI'm sure @Bobblehat can rustle up a good spreadsheet to come up with the best strategy!

So comparing results ...

Using the 4 x RS's Pedrodelgardo mentioned (I make it £1100pm using Bridlington1's page 1 figures).

Those 4 RS's can be funded with £0 for the 10 months.

Using £2200/12 = £183.33 for 12 equal monthly fund comparison.

Picking a typical EA rate now ~ 4.5%.

4 x RS's no drip feed Total £134.65

4 x RS's + drip feed Total £138.78

Best single RS + drip feed £128.80

Best single RS no drip feed £83.42

No RS's, leave fund in EA £99

If I've made any errors, I can fix and repost.

Edit: Fat-fingered EA and cloned it throughout - corrected in tables (if reprinted) and text now.0 -

Glad you like it!pedrodelgado said:

Wow, thats incredible. Thanks. Couple of things to bear in mind, the drip feed easy access is probably going to be lower in a few months time, as are the RS accounts that are not fixed rate.Bobblehat said:pedrodelgado said:Question. Would it be more beneficial to open say 4 regular savers from different providers and put the maximum allowed in each one for say the first couple of months then a nominal amount to keep them open for the remaining months, thus having a bigger overall sum for 11 or 12 months than you would have had if opening one and saving monthly into that? Any thoughts?

Best I can rustle upI'm sure @Bobblehat can rustle up a good spreadsheet to come up with the best strategy!

So comparing results ...

Using the 4 x RS's Pedrodelgardo mentioned (I make it £1100pm using Bridlington1's page 1 figures).

Those 4 RS's can be funded with £0 for the 10 months.

Using £2200/12 = £183.33 for 12 equal monthly fund comparison.

Picking a typical EA rate now ~ 4.5%.

4 x RS's no drip feed Total £134.65

4 x RS's + drip feed Total £138.78

Best single RS + drip feed £128.80

Best single RS no drip feed £83.42

No RS's, leave fund in EA £99

If I've made any errors, I can fix and repost.

Edit: Fat-fingered EA and cloned it throughout - corrected in tables (if reprinted) and text now.

Rates dropping will just compress the difference between the top and bottom figures and lower the overall total interest. But what can you do? We were happy enough when rates were rising!

One thing I've noticed .. the RS novice might think that leaving their £2200 in the EA (£99 interest) is better than putting it in the Best of the 4 RS's (Co-op £83.42 interest), but taking into account that seasoned MSE'ers would usually try to drip feed the RS (or RS's) from an interest paying account (e.g. an EA), then the addition of the interest from the EA plus the £83.42 would beat £99!Compiler of the RS League Table.

Being nosey... How many Regular Saver accounts do you have? — MoneySavingExpert Forum2 -

Hi.

not sure if I was seeing things, but I was able to open a second principality regular saver issue 3 but having just logged in for the first time in a while it seems to have changed to Regular Saver Bond Issue 36. Anyone else had this?0 -

Re matured Virgin RS, now everday saver, has anyone been successful in getting it closed?0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards