We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The Old Regular Savers Discussion Thread 28/12/24-29/1/26

Comments

-

So we going with Virgin defo went down then?, sorry it's just Virgin IG said to me there were no known issues yet I was on several calls to them and on at least 2 calls they told me there were.OrangeBlueGreen said:I wonder how long we’ll have to wait to get our closing Virgin interest if their systems were down on Friday and of course the 10% will have attracted a lot of customers in the first place so I imagine the queue to be very long.

They really should update their systems so customers can close accounts themselves, it is 2025. The zero balance thing may make sense internally, but it’s not customer friendly at all and nonsensical. Though now Nationwide has bought them, they won’t care. Hopefully Nationwide will soon merge everything into their own systems, getting rid of double profiles and the mess that was never ironed out when they merged the 2 old Yorkshire and Clydesdale banks.I don’t mind Virgin as a bank and their products, but it does feels that behind the scenes it’s very old school like a telephone exchange with cables and connections between a multitude of systems that do not make for a good customer experience.

Edit: Really they should just have it so that final interest is paid when a regular saver matures and it would save customers from having to do all of this.

There's also been multiple posts here and elsewhere saying there's been no issues yet others clearly have.

Maybe that's the problem with Virgin, like my mobile provider they clearly lie, departments dont talk to eachother etc.😏

If Clydesdale couldn't merge everything dating back to when they took over the original Virgin Money etc what makes you think Nationwide would be upto the job?, god knows how many systems Nationwide have now inherited in addition to their own 🤣, I expect it will be multiple online logins for a while.

Virgin seems to be more modern than say Monmouthshire BS but Virgin is clearly bigger as the Bank it is and clearly has big issues.

Just have to hope Nationwide can make things better for what were/still are Virgin Money customers.0 -

pedrodelgado said:Question. Would it be more beneficial to open say 4 regular savers from different providers and put the maximum allowed in each one for say the first couple of months then a nominal amount to keep them open for the remaining months, thus having a bigger overall sum for 11 or 12 months than you would have had if opening one and saving monthly into that? Any thoughts?

Best I can rustle upI'm sure @Bobblehat can rustle up a good spreadsheet to come up with the best strategy!

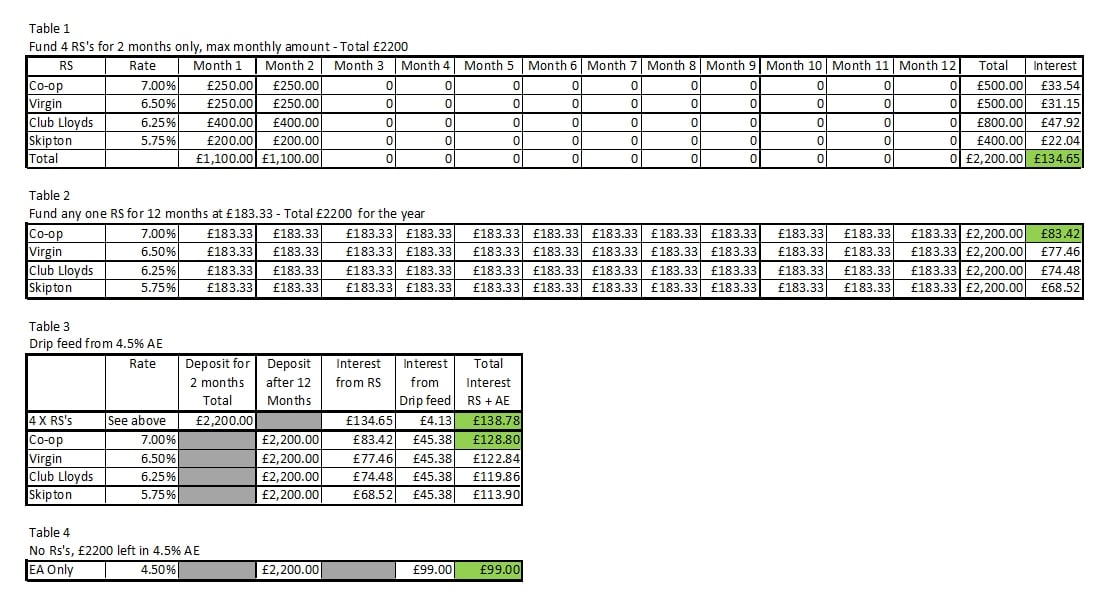

So comparing results ...

Using the 4 x RS's Pedrodelgardo mentioned (I make it £1100pm using Bridlington1's page 1 figures).

Those 4 RS's can be funded with £0 for the 10 months.

Using £2200/12 = £183.33 for 12 equal monthly fund comparison.

Picking a typical EA rate now ~ 4.5%.

4 x RS's no drip feed Total £134.65

4 x RS's + drip feed Total £138.78

Best single RS + drip feed £128.80

Best single RS no drip feed £83.42

No RS's, leave fund in EA £99

If I've made any errors, I can fix and repost.

Edit: Fat-fingered EA and cloned it throughout - corrected in tables (if reprinted) and text now.

Compiler of the RS League Table.

Being nosey... How many Regular Saver accounts do you have? — MoneySavingExpert Forum11 -

20122013 said:These are the VM's Current accounts I can see on their website, which one is the cheapest / no frills account which qualifies for the VM RS account, please?

https://uk.virginmoney.com/current-accounts/pca/

0 -

Monmouthshire RS now showing as up-and-running (I applied through the website), with first payment credited on 31st July, the day I sent it (in spite of their no transactions until activated comment). Hope it's the same for others.3

-

For some reason, my standing order to my Skipton RS (from Santander) on the 1st August has only been credited by Skipton today (4th August)Digital_Payback said:

I’m still waiting for 2 automated payments to be credited to 2 separate Skipton regular savers, funds sent from Starling Bank at 1.40am yesterday, 1st August.easysaver said:Skipton BS

Anyone else waiting for their deposits (faster payment from Chase at 01:23 on 1st Aug) from yesterday to show on their account(s)? I've experienced this before and it's irritating to say the least.

What do others do to avoid it? Can I fund my base rate tracker and do internal transfers from there? But won't that payment not get credited on time too? Fundamentally, is Skipton BS just unreliable?1 -

I sent 2 automated payments to be credited to 2 separate Skipton regular savers, funds sent from Starling Bank at 1.40am on 1st August.badger09 said:Skipton

Thanks for the heads up on Skipton’s slow processing of incoming SOs early hours on 1st. I intended to set up SO from BoS from 1Sept but will fund by FP or debit card instead.They are both showing today and credited today, 4th August.I’ll be doing a manual posting from now on at a later time of the day. Until now Skipton deposits always showed same day as posted, usually within a couple of hours.

Lesson learned.Digital Payback

The National Lottery : A tax on those who aren’t good at maths.0 -

Same here. From Santander as well.gt94sss2 said:

For some reason, my standing order to my Skipton RS (from Santander) on the 1st August has only been credited by Skipton today (4th August)Digital_Payback said:

I’m still waiting for 2 automated payments to be credited to 2 separate Skipton regular savers, funds sent from Starling Bank at 1.40am yesterday, 1st August.easysaver said:Skipton BS

Anyone else waiting for their deposits (faster payment from Chase at 01:23 on 1st Aug) from yesterday to show on their account(s)? I've experienced this before and it's irritating to say the least.

What do others do to avoid it? Can I fund my base rate tracker and do internal transfers from there? But won't that payment not get credited on time too? Fundamentally, is Skipton BS just unreliable?0 -

My deposits to Skipton from 30.07.25 and 01.08.25 are still not showing.0

-

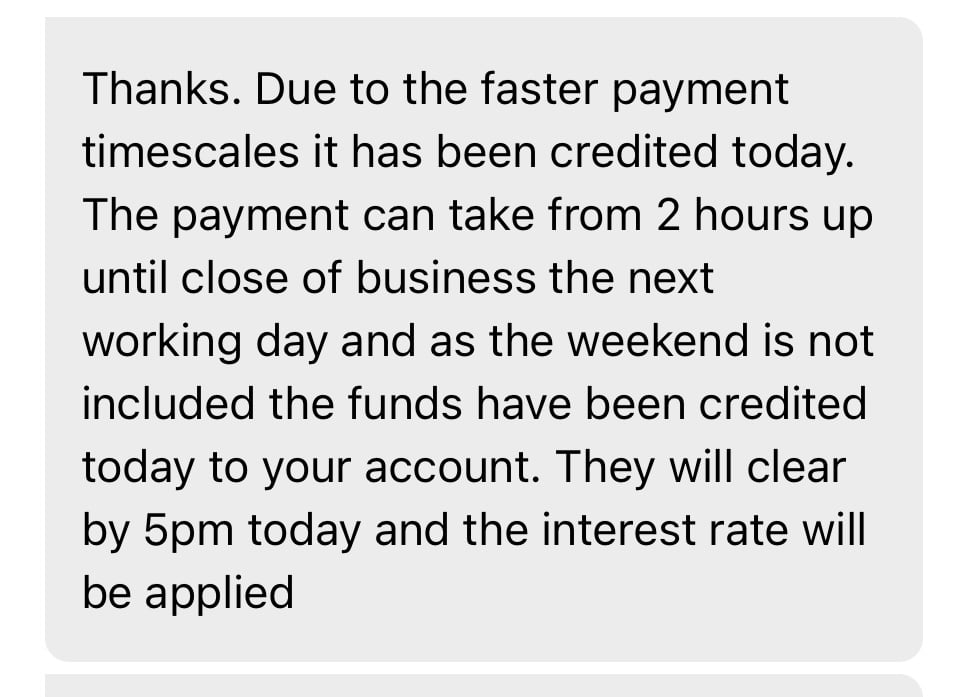

I made a manual payment to Skipton from Cahoot at approx 1am on the 1st August. The same issue (so not just SOs) - credited today. This is the response I got with the chat function on Skipton. I’ll wait until working hours next time, despite it never being a problem in the past.

0

0 -

Skipton are not a clearing bank, so they will not see or credit payments until the next working day.Digital_Payback said:

I sent 2 automated payments to be credited to 2 separate Skipton regular savers, funds sent from Starling Bank at 1.40am on 1st August.badger09 said:Skipton

Thanks for the heads up on Skipton’s slow processing of incoming SOs early hours on 1st. I intended to set up SO from BoS from 1Sept but will fund by FP or debit card instead.They are both showing today and credited today, 4th August.I’ll be doing a manual posting from now on at a later time of the day. Until now Skipton deposits always showed same day as posted, usually within a couple of hours.

Lesson learned.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards