We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The New Top Easy Access Savings Discussion Area

Comments

-

After all my upgrading with sunny day savers I can confirm they're all showing 5%(even my 3 expired ones) and now all have an account opening date of 2nd April 2025 for 12 months3

-

For now it seems both accounts can still be opened via the following links:Bridlington1 said:@soulsaver

Skipton Bonus Saver 4.50% £1 min; £50k max inc. 1.7% fixed 1st yr bonus NLA

Skipton Member Bonus Saver at 5% also NLA.

Bonus Saver:

https://secure.skipton.co.uk/portal/NewAccount/29856

Member Bonus Saver:

https://secure.skipton.co.uk/portal/OpenAccount/29788

I'd imagine these links shall go dead very soon but I've just managed to ``refresh" the Member Bonus Saver this way and open a Bonus Saver. I'll fund these in early September to push the maturity date on as late as possible.

EDIT: Above links now appear to be dead.3 -

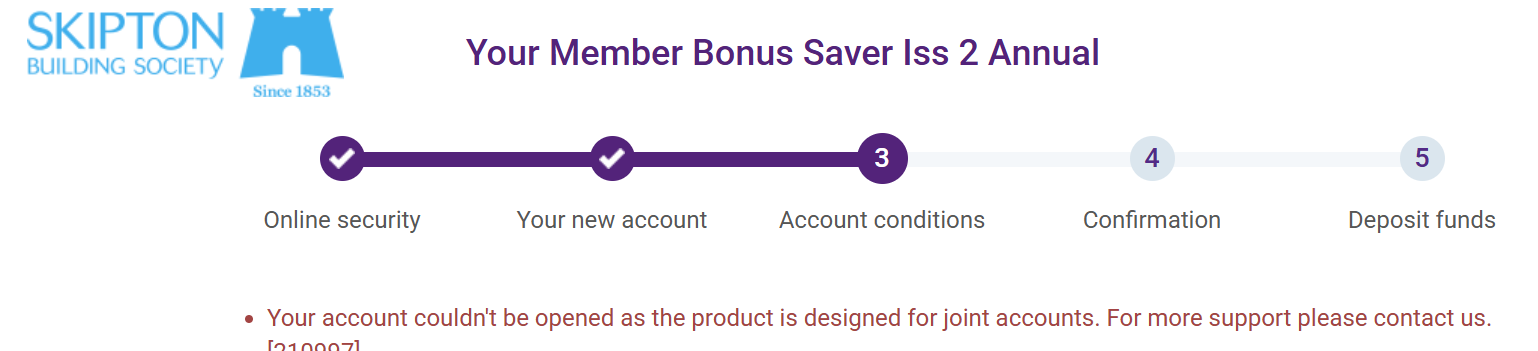

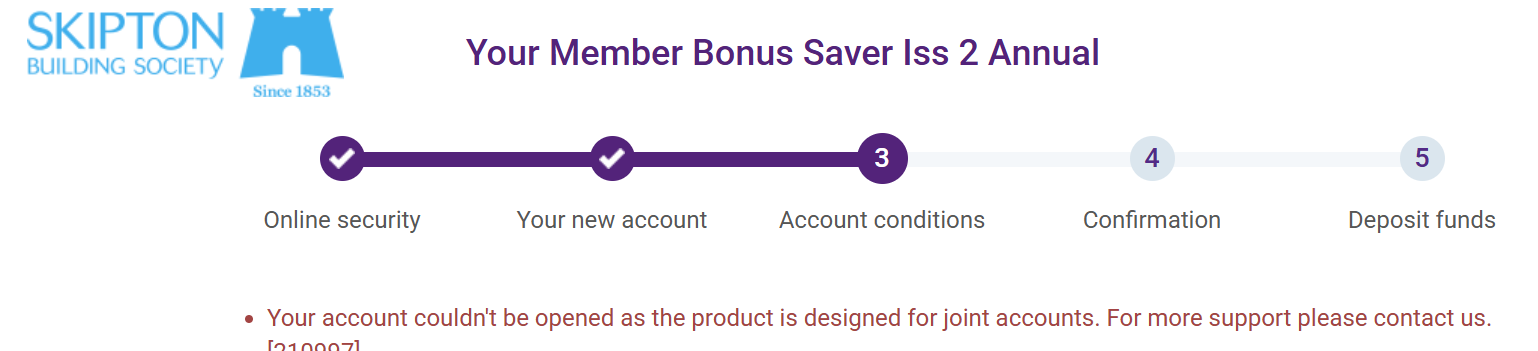

Can you clarify your 'refresh' method? I hit a brick wall having already opened and funded a MBS issue 2 back in JuneBridlington1 said:

For now it seems both accounts can still be opened via the following links:Bridlington1 said:@soulsaver

Skipton Bonus Saver 4.50% £1 min; £50k max inc. 1.7% fixed 1st yr bonus NLA

Skipton Member Bonus Saver at 5% also NLA.

Bonus Saver:

https://secure.skipton.co.uk/portal/NewAccount/29856

Member Bonus Saver:

https://secure.skipton.co.uk/portal/OpenAccount/29788

I'd imagine these links shall go dead very soon but I've just managed to ``refresh" the Member Bonus Saver this way and open a Bonus Saver. I'll fund these in early September to push the maturity date on as late as possible. 0

0 -

Close your existing issue 2 and then immediately open a new one. I would imagine it's a bit risky refreshing now though given that the link could stop working at any minute.cadguy77 said:

Can you clarify your 'refresh' method? I hit a brick wall having already opened and funded a MBS issue 2 back in JuneBridlington1 said:

For now it seems both accounts can still be opened via the following links:Bridlington1 said:@soulsaver

Skipton Bonus Saver 4.50% £1 min; £50k max inc. 1.7% fixed 1st yr bonus NLA

Skipton Member Bonus Saver at 5% also NLA.

Bonus Saver:

https://secure.skipton.co.uk/portal/NewAccount/29856

Member Bonus Saver:

https://secure.skipton.co.uk/portal/OpenAccount/29788

I'd imagine these links shall go dead very soon but I've just managed to ``refresh" the Member Bonus Saver this way and open a Bonus Saver. I'll fund these in early September to push the maturity date on as late as possible. 1

1 -

It has just been announced that Bank Base Rate has reduced from 4.25% to 4%

https://www.bankofengland.co.uk/monetary-policy-summary-and-minutes/2025/august-2025At its meeting ending on 6 August 2025, the MPC voted by a majority of 5–4 to reduce Bank Rate by 0.25 percentage points, to 4%, rather than maintaining it at 4.25% ...... Four of these five members preferred a 0.25 percentage point reduction in Bank Rate at this meeting ..... One of these five members preferred a 0.5 percentage point reduction in Bank Rate at this meeting ..... Four members preferred to hold Bank Rate at 4.25% at this meetingNext decision Thursday 18th September 2025I came, I saw, I melted3 -

@soulsaverSnowMan said:It has just been announced that Bank Base Rate has reduced from 4.25% to 4%

https://www.bankofengland.co.uk/monetary-policy-summary-and-minutes/2025/august-2025

At its meeting ending on 6 August 2025, the MPC voted by a majority of 5–4 to reduce Bank Rate by 0.25 percentage points, to 4%, rather than maintaining it at 4.25%Next decision Thursday 18th September 2025

Due to the above:

Chip Instant Access Account to fall from 5.1% to 4.85%

Chase Boosted Rate Svr to fall from 5.00% to 4.75%

Oxbury EA Bonus Base Rate Trckr 1 to fall from 4.61% to 4.36%1 -

Or 4.30% depending which one you have. Both will reduce on 14/08.Bridlington1 said:

@soulsaverSnowMan said:It has just been announced that Bank Base Rate has reduced from 4.25% to 4%

https://www.bankofengland.co.uk/monetary-policy-summary-and-minutes/2025/august-2025

At its meeting ending on 6 August 2025, the MPC voted by a majority of 5–4 to reduce Bank Rate by 0.25 percentage points, to 4%, rather than maintaining it at 4.25%Next decision Thursday 18th September 2025

Due to the above:

Chase Boosted Rate Svr to fall from 5.00% to 4.75%1 -

Kent RelianceMalchester said:

Yes, on the new platform deposits and withdrawals are truly instant. I am very impressed compared with the old platform.tg99 said:I have various Kent savings accounts on the ‘old’ platform where I believe the cut off for withdrawals was 330pm and they generally took a few hours to arrive. Have just opened the 4.41% account on the ‘new’ platform - am I right in thinking on the new platform payments in and out are truly instant 24/7? And has the old platform changed to be the same or still operates with the cut off times and non instant arrival into destination account? Thks

The old platform has not changed. The new is excellent.1 -

@soulsaverBridlington1 said:

@soulsaverSnowMan said:It has just been announced that Bank Base Rate has reduced from 4.25% to 4%

https://www.bankofengland.co.uk/monetary-policy-summary-and-minutes/2025/august-2025

At its meeting ending on 6 August 2025, the MPC voted by a majority of 5–4 to reduce Bank Rate by 0.25 percentage points, to 4%, rather than maintaining it at 4.25%Next decision Thursday 18th September 2025

Oxbury EA Bonus Base Rate Trckr 1 to fall from 4.61% to 4.36%

The above account has now had a change of link to:

https://www.oxbury.com/savings-accounts/personal-savings/easy-access-bonus-base-rate-tracker-1-436-aer/

Still seems to be the same account though, new listing below (don't know if you wish to include it in case other rates fall):

Oxbury EA Bonus Base Rate Trckr 1 4.36%

1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards