We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The New Top Easy Access Savings Discussion Area

Comments

-

I see. Sorry I misunderstood your post. Of course everyone has their own threshold, I'm not 100% efficient either, I sometimes choose convenience over effectiveness. Nevertheless, I wouldn't keep £1500 at -1% unless I really have to.crumpet_man said:

I do understand how it works, I do the Halifax debit card payments to a savings account but leave it in there for the month, withdraw and deposit the next month etc.allegro120 said:

I don't think you understood how it works. Halifax reward account pays you £5 a month if you deposit £1500 and make £500 worth of debit card payments. You can have up to 3 Halifax reward accounts, so that's £180 a year earned on nothing.crumpet_man said:

I should have quoted one of the previous comments regarding the £500 Halifax payments as that is the specific scenario I was referring to. I did not mean it to be a general open ended question.allegro120 said:

It depends on the difference of interest rates between the accounts in question, the sum you are moving and the length of time and consistency of this practice. I've never attempted to calculate how much I gained by moving funds, probably a few thousands in this millennium. All I know is if I move money from lower paying account to a higher paying account I earn more.crumpet_man said:How much extra do you think you are earning by withdrawing the cash and moving to another account?

For me, £1500 a month paid into and immediately withdrawn from an account paying ~3% to deposit in an account paying ~4% does not seem worth the risk of getting an account closed for roughly £15 more per year.

I wonder what others are doing that maybe I have missed?

The discussion you are referring to is about debit card payments, naturally people on here are trying to minimise the loss of interest resulting from debit card transactions and sharing their methods and experiences.

Some people are withdrawing funds ASAP (with the risk of getting the account closed and having to wait possibly weeks to access their funds) for a potential £15 per year in extra interest. I suppose we have our own threshold for what makes it worthwhile, if it was £100 extra interest then I would do it too, but not for £15 a year.0 -

Plus £60 for simply moving money around is not insignificant.0

-

Agreed keeping £1500 at such a low rate wouldn't be good, but I don't see anything in the Halifax Reward Current account terms that say you have to keep £1500 in the account, only that you pay at least that much in every month (and then to get the 5 pounds do £500+ in debit card transactions).allegro120 said:I see. Sorry I misunderstood your post. Of course everyone has their own threshold, I'm not 100% efficient either, I sometimes choose convenience over effectiveness. Nevertheless, I wouldn't keep £1500 at -1% unless I really have to.0 -

That's not what is happening, funds are not left in the Halifax account.mon3ysav3r said:

Agreed keeping £1500 at such a low rate wouldn't be good, but I don't see anything in the Halifax Reward Current account terms that say you have to keep £1500 in the account, only that you pay at least that much in every month (and then to get the 5 pounds do £500+ in debit card transactions).allegro120 said:I see. Sorry I misunderstood your post. Of course everyone has their own threshold, I'm not 100% efficient either, I sometimes choose convenience over effectiveness. Nevertheless, I wouldn't keep £1500 at -1% unless I really have to.

£1500 in NSI at 3.3% AER, at beginning of month withdraw to Halifax current account number 1, transfer £1500 from Halifax current account number 1 to number 2 then number 2 to number 3. Transfer £500 from account 3 to account 1 and account 2.

Pay £500 into NSI using debit card from each of the 3 current accounts.

£1500 stays in NSI until next month.

If you withdraw £1500 from NSI ASAP you could deposit it in a higher paying savings account and potentially earn an extra ~1% AER on that £1500.4 -

That's what I do, £1500 from 7% EA into Halifax, fund a couple of RS from the CA, "spend" £500 funding Revolut with the debit card, residual funds + Revolut transfer back to EA.crumpet_man said:

If you withdraw £1500 from NSI ASAP you could deposit it in a higher paying savings account and potentially earn an extra ~1% AER on that £1500.1 -

Does Revolut allow immediate withdrawal again or only after the transaction cleared?flaneurs_lobster said:

That's what I do, £1500 from 7% EA into Halifax, fund a couple of RS from the CA, "spend" £500 funding Revolut with the debit card, residual funds + Revolut transfer back to EA.crumpet_man said:

If you withdraw £1500 from NSI ASAP you could deposit it in a higher paying savings account and potentially earn an extra ~1% AER on that £1500.0 -

No, I meant keeping £1.5k in a savings account (used for Halifax card payment) that pays 1% less than another savings accountmon3ysav3r said:

Agreed keeping £1500 at such a low rate wouldn't be good, but I don't see anything in the Halifax Reward Current account terms that say you have to keep £1500 in the account, only that you pay at least that much in every month (and then to get the 5 pounds do £500+ in debit card transactions).allegro120 said:I see. Sorry I misunderstood your post. Of course everyone has their own threshold, I'm not 100% efficient either, I sometimes choose convenience over effectiveness. Nevertheless, I wouldn't keep £1500 at -1% unless I really have to. . Of corse there's no point keeping any money in Halifax current account. 0

. Of corse there's no point keeping any money in Halifax current account. 0 -

Yes, it's a big advantage of using Revolut, it allows immediate use of pending funds. In my case that £500 is never at Revolut for more that 5 minutes.pecunianonolet said:

Does Revolut allow immediate withdrawal again or only after the transaction cleared?flaneurs_lobster said:

That's what I do, £1500 from 7% EA into Halifax, fund a couple of RS from the CA, "spend" £500 funding Revolut with the debit card, residual funds + Revolut transfer back to EA.crumpet_man said:

If you withdraw £1500 from NSI ASAP you could deposit it in a higher paying savings account and potentially earn an extra ~1% AER on that £1500.3 -

That's very convenient, minimum admin, but in this scenario you could gain more interest if you used better paying accounts for this. You could do exactly the same with Family BS currently paying 4.6% for example.crumpet_man said:

That's not what is happening, funds are not left in the Halifax account.mon3ysav3r said:

Agreed keeping £1500 at such a low rate wouldn't be good, but I don't see anything in the Halifax Reward Current account terms that say you have to keep £1500 in the account, only that you pay at least that much in every month (and then to get the 5 pounds do £500+ in debit card transactions).allegro120 said:I see. Sorry I misunderstood your post. Of course everyone has their own threshold, I'm not 100% efficient either, I sometimes choose convenience over effectiveness. Nevertheless, I wouldn't keep £1500 at -1% unless I really have to.

£1500 in NSI at 3.3% AER, at beginning of month withdraw to Halifax current account number 1, transfer £1500 from Halifax current account number 1 to number 2 then number 2 to number 3. Transfer £500 from account 3 to account 1 and account 2.

Pay £500 into NSI using debit card from each of the 3 current accounts.

£1500 stays in NSI until next month.

If you withdraw £1500 from NSI ASAP you could deposit it in a higher paying savings account and potentially earn an extra ~1% AER on that £1500.

0 -

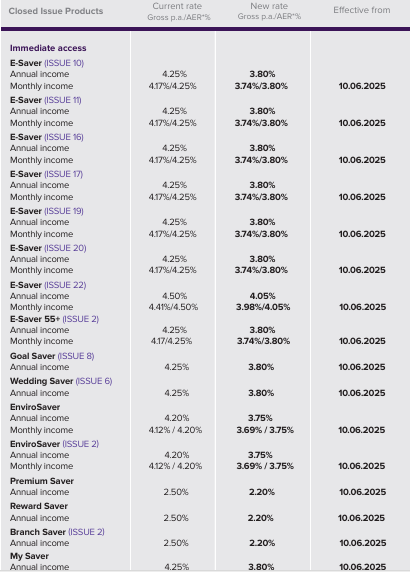

As mentioned on the main regular savers thread Saffron BS are cutting the rates on their variable rate accounts on 10/6/25.

There's a few sharp drops among them, of note the NLA E-Saver Issue 22 is to be cut from 4.5% to 4.05%. See:

For the full list of cuts see:

https://www.saffronbs.co.uk/sites/default/files/2025-05/VariableRateGuide10.06.2025.pdf7

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.7K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards