We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The New Top Easy Access Savings Discussion Area

Comments

-

My instant access money is earning 4.75% AER but it doesn't qualify for the list as it contravenes two of the criteria, the reason I am looking for a second one. At the time you compiled it however, the Saffron Building Society was offering its E-Saver at 4.5%, so was its exclusions solely because of its £10 minimum balance?ircE said: True EA accounts are easy access savings accounts which can be opened (and the headline interest rate earned) from £1 and allow for unlimited deposits and withdrawals. This excludes accounts that are limited to smaller balances, accounts with fees, and accounts only available via savings platforms. Instant True EA accounts are those True EA accounts which advertise immediate deposit and withdrawal times 24/7. Highlighted entries show changes since last time: blue for new entries to the respective table, and red for rate reductions.cahoot and Hampshire Trust Bank return to the scorecard with their latest offerings. Newcastle BS makes a somewhat unusual debut with an account that matures in 6 months - just in time for Christmas.A note on Chip/Chase: their battle continues more than what is shown on the scorecard, which only goes by what I see on moneyfacts for my selected filters. Chip is offering a 4.76% account with limited access to new customers, and Chase is offering selected existing customers a boosted rate of 4.80%. DYOR etc.For those who care neither for Chip nor Chase, Chetwood provides the leading account for True EA accounts, and cahoot takes the lead for those who would like instant access.The MPC announces its next decision next Thursday, 8th May.

True EA accounts are easy access savings accounts which can be opened (and the headline interest rate earned) from £1 and allow for unlimited deposits and withdrawals. This excludes accounts that are limited to smaller balances, accounts with fees, and accounts only available via savings platforms. Instant True EA accounts are those True EA accounts which advertise immediate deposit and withdrawal times 24/7. Highlighted entries show changes since last time: blue for new entries to the respective table, and red for rate reductions.cahoot and Hampshire Trust Bank return to the scorecard with their latest offerings. Newcastle BS makes a somewhat unusual debut with an account that matures in 6 months - just in time for Christmas.A note on Chip/Chase: their battle continues more than what is shown on the scorecard, which only goes by what I see on moneyfacts for my selected filters. Chip is offering a 4.76% account with limited access to new customers, and Chase is offering selected existing customers a boosted rate of 4.80%. DYOR etc.For those who care neither for Chip nor Chase, Chetwood provides the leading account for True EA accounts, and cahoot takes the lead for those who would like instant access.The MPC announces its next decision next Thursday, 8th May.

Does anyone know of any other accounts that would make this list but for a petty minimum balance requirement?0 -

nottsphil said:

My instant access money is earning 4.75% AER but it doesn't qualify for the list as it contravenes two of the criteria, the reason I am looking for a second one. At the time you compiled it however, the Saffron Building Society was offering it's E-Saver at 4.5%, so was its exclusions solely because of its £10 minimum balance?ircE said: True EA accounts are easy access savings accounts which can be opened (and the headline interest rate earned) from £1 and allow for unlimited deposits and withdrawals. This excludes accounts that are limited to smaller balances, accounts with fees, and accounts only available via savings platforms. Instant True EA accounts are those True EA accounts which advertise immediate deposit and withdrawal times 24/7. Highlighted entries show changes since last time: blue for new entries to the respective table, and red for rate reductions.cahoot and Hampshire Trust Bank return to the scorecard with their latest offerings. Newcastle BS makes a somewhat unusual debut with an account that matures in 6 months - just in time for Christmas.A note on Chip/Chase: their battle continues more than what is shown on the scorecard, which only goes by what I see on moneyfacts for my selected filters. Chip is offering a 4.76% account with limited access to new customers, and Chase is offering selected existing customers a boosted rate of 4.80%. DYOR etc.For those who care neither for Chip nor Chase, Chetwood provides the leading account for True EA accounts, and cahoot takes the lead for those who would like instant access.The MPC announces its next decision next Thursday, 8th May.it will be because of that - personally, I think those criteria are silly (no offence to irce) - but I guess if you want to have criteria, you have to draw the line somewhere... I wouldn't have chose there, but hey ho... the only use for me is to see which ones are considered "instant".Does anyone know of any other accounts that would make this list but for a petty minimum balance requirement?

True EA accounts are easy access savings accounts which can be opened (and the headline interest rate earned) from £1 and allow for unlimited deposits and withdrawals. This excludes accounts that are limited to smaller balances, accounts with fees, and accounts only available via savings platforms. Instant True EA accounts are those True EA accounts which advertise immediate deposit and withdrawal times 24/7. Highlighted entries show changes since last time: blue for new entries to the respective table, and red for rate reductions.cahoot and Hampshire Trust Bank return to the scorecard with their latest offerings. Newcastle BS makes a somewhat unusual debut with an account that matures in 6 months - just in time for Christmas.A note on Chip/Chase: their battle continues more than what is shown on the scorecard, which only goes by what I see on moneyfacts for my selected filters. Chip is offering a 4.76% account with limited access to new customers, and Chase is offering selected existing customers a boosted rate of 4.80%. DYOR etc.For those who care neither for Chip nor Chase, Chetwood provides the leading account for True EA accounts, and cahoot takes the lead for those who would like instant access.The MPC announces its next decision next Thursday, 8th May.it will be because of that - personally, I think those criteria are silly (no offence to irce) - but I guess if you want to have criteria, you have to draw the line somewhere... I wouldn't have chose there, but hey ho... the only use for me is to see which ones are considered "instant".Does anyone know of any other accounts that would make this list but for a petty minimum balance requirement?- Cahoot @ 5% is an option if you want to throw in a maximum of £3,000 - it only requires £1 to open, but would fail the above list because it has a "smaller balance".

- existing, and eligible, Chase users might be able to open a 4.8% boosted account for 6 months.

- Vida Savings (never used) is at 4.63% with a £10 opening... fails because it's not £1 to open.

- Kent Reliance is 4.5% if you have £1,000 to open it with (you might need to define what you think is a "petty" balance!) - you can drop the balance down to £1, but would then only receive a nominal interest rate.

you could probably beat those rates with a flexible isa - but that would be off-topic for the list anyway.5 -

Regardless of which criteria is used you're not going to please everyone all the time for not everyone's requirements are identical.IanManc said:

I think the criteria used by @ircE are fine, and that the table provided monthly is extremely useful and I often use it as a reference point.janusdesign said:it will be because of that - personally, I think those criteria are silly (no offence to irce) - but I guess if you want to have criteria, you have to draw the line somewhere... I wouldn't have chose there, but hey ho... the only use for me is to see which ones are considered "instant".

I hope that @ircE isn't discouraged from continuing to provide it due to your disparaging comment followed by your sorry-not-sorry "no offence to irce".

Personally I find the regular updates from @irce interesting and like yourself hope they shall continue and would like to take the opportunity to thank @irce for the time and effort that gets put into them.16 -

ircE said:

True EA accounts are easy access savings accounts which can be opened (and the headline interest rate earned) from £1 and allow for unlimited deposits and withdrawals. This excludes accounts that are limited to smaller balances, accounts with fees, and accounts only available via savings platforms. Instant True EA accounts are those True EA accounts which advertise immediate deposit and withdrawal times 24/7. Highlighted entries show changes since last time: blue for new entries to the respective table, and red for rate reductions.cahoot and Hampshire Trust Bank return to the scorecard with their latest offerings. Newcastle BS makes a somewhat unusual debut with an account that matures in 6 months - just in time for Christmas.A note on Chip/Chase: their battle continues more than what is shown on the scorecard, which only goes by what I see on moneyfacts for my selected filters. Chip is offering a 4.76% account with limited access to new customers, and Chase is offering selected existing customers a boosted rate of 4.80%. DYOR etc.For those who care neither for Chip nor Chase, Chetwood provides the leading account for True EA accounts, and cahoot takes the lead for those who would like instant access.The MPC announces its next decision next Thursday, 8th May.

True EA accounts are easy access savings accounts which can be opened (and the headline interest rate earned) from £1 and allow for unlimited deposits and withdrawals. This excludes accounts that are limited to smaller balances, accounts with fees, and accounts only available via savings platforms. Instant True EA accounts are those True EA accounts which advertise immediate deposit and withdrawal times 24/7. Highlighted entries show changes since last time: blue for new entries to the respective table, and red for rate reductions.cahoot and Hampshire Trust Bank return to the scorecard with their latest offerings. Newcastle BS makes a somewhat unusual debut with an account that matures in 6 months - just in time for Christmas.A note on Chip/Chase: their battle continues more than what is shown on the scorecard, which only goes by what I see on moneyfacts for my selected filters. Chip is offering a 4.76% account with limited access to new customers, and Chase is offering selected existing customers a boosted rate of 4.80%. DYOR etc.For those who care neither for Chip nor Chase, Chetwood provides the leading account for True EA accounts, and cahoot takes the lead for those who would like instant access.The MPC announces its next decision next Thursday, 8th May.

Thanks to your table, I noticed that HTB reintroduced a new issue (Iss 30, 4.4%) with a £1 minimum balance, replacing its Tracker issue (Iss 2, 4.4%, NLA) which had a £20,000 minimum balance. However, the notice period for an interest rate reduction has decreased from 30 days (Iss 29) to 14 days.

0 -

No offense taken from anyone, and in fact thank you all for the kind words.

Some may remember a couple of years ago I posted the first set of tables - what I now call the 'scorecard' - out of idle curiosity more than anything, amid a conversation in the previous iteration of this thread on savings rates for "truly" easy access savings accounts. It was an era when the absolute top of the pots (diligently maintained by soulsaver) were dominated by accounts that required a high minimum opening balance and/or a defined number of withdrawals. So I just set some filters that I thought were appropriate on the moneyfacts website and compiled alternative rankings to see what they looked like by comparison. A few people seemed to find it useful and referred to it... and, well, now I've adopted a routine of posting an update every 3-4 Sundays in sync with the MPC meeting schedule. My curiosity has long since been satisfied but some people, as mentioned, do sometimes refer to the tables, and it's hardly onerous, so I'm happy to keep posting them. My little contribution to the forum. For those interested, this is the set of filters on the moneyfacts website I use.That said, the methodology is not set in stone, and I can maybe flex a bit in the next iteration to see how it looks - maybe with a higher bar of £10? Open to any other suggestions as well while I'm at it.

Some may remember a couple of years ago I posted the first set of tables - what I now call the 'scorecard' - out of idle curiosity more than anything, amid a conversation in the previous iteration of this thread on savings rates for "truly" easy access savings accounts. It was an era when the absolute top of the pots (diligently maintained by soulsaver) were dominated by accounts that required a high minimum opening balance and/or a defined number of withdrawals. So I just set some filters that I thought were appropriate on the moneyfacts website and compiled alternative rankings to see what they looked like by comparison. A few people seemed to find it useful and referred to it... and, well, now I've adopted a routine of posting an update every 3-4 Sundays in sync with the MPC meeting schedule. My curiosity has long since been satisfied but some people, as mentioned, do sometimes refer to the tables, and it's hardly onerous, so I'm happy to keep posting them. My little contribution to the forum. For those interested, this is the set of filters on the moneyfacts website I use.That said, the methodology is not set in stone, and I can maybe flex a bit in the next iteration to see how it looks - maybe with a higher bar of £10? Open to any other suggestions as well while I'm at it. I no longer check the forums as regularly as I used to. If you wish to catch my attention please remember to tag me (@ircE) so I get a notification.23

I no longer check the forums as regularly as I used to. If you wish to catch my attention please remember to tag me (@ircE) so I get a notification.23 -

Thanks, I'll go through thesejanusdesign said:nottsphil said:

My instant access money is earning 4.75% AER but it doesn't qualify for the list as it contravenes two of the criteria, the reason I am looking for a second one. At the time you compiled it however, the Saffron Building Society was offering it's E-Saver at 4.5%, so was its exclusions solely because of its £10 minimum balance?ircE said: True EA accounts are easy access savings accounts which can be opened (and the headline interest rate earned) from £1 and allow for unlimited deposits and withdrawals. This excludes accounts that are limited to smaller balances, accounts with fees, and accounts only available via savings platforms. Instant True EA accounts are those True EA accounts which advertise immediate deposit and withdrawal times 24/7. Highlighted entries show changes since last time: blue for new entries to the respective table, and red for rate reductions.cahoot and Hampshire Trust Bank return to the scorecard with their latest offerings. Newcastle BS makes a somewhat unusual debut with an account that matures in 6 months - just in time for Christmas.A note on Chip/Chase: their battle continues more than what is shown on the scorecard, which only goes by what I see on moneyfacts for my selected filters. Chip is offering a 4.76% account with limited access to new customers, and Chase is offering selected existing customers a boosted rate of 4.80%. DYOR etc.For those who care neither for Chip nor Chase, Chetwood provides the leading account for True EA accounts, and cahoot takes the lead for those who would like instant access.The MPC announces its next decision next Thursday, 8th May.it will be because of that - personally, I think those criteria are silly (no offence to irce) - but I guess if you want to have criteria, you have to draw the line somewhere... I wouldn't have chose there, but hey ho... the only use for me is to see which ones are considered "instant".Does anyone know of any other accounts that would make this list but for a petty minimum balance requirement?

True EA accounts are easy access savings accounts which can be opened (and the headline interest rate earned) from £1 and allow for unlimited deposits and withdrawals. This excludes accounts that are limited to smaller balances, accounts with fees, and accounts only available via savings platforms. Instant True EA accounts are those True EA accounts which advertise immediate deposit and withdrawal times 24/7. Highlighted entries show changes since last time: blue for new entries to the respective table, and red for rate reductions.cahoot and Hampshire Trust Bank return to the scorecard with their latest offerings. Newcastle BS makes a somewhat unusual debut with an account that matures in 6 months - just in time for Christmas.A note on Chip/Chase: their battle continues more than what is shown on the scorecard, which only goes by what I see on moneyfacts for my selected filters. Chip is offering a 4.76% account with limited access to new customers, and Chase is offering selected existing customers a boosted rate of 4.80%. DYOR etc.For those who care neither for Chip nor Chase, Chetwood provides the leading account for True EA accounts, and cahoot takes the lead for those who would like instant access.The MPC announces its next decision next Thursday, 8th May.it will be because of that - personally, I think those criteria are silly (no offence to irce) - but I guess if you want to have criteria, you have to draw the line somewhere... I wouldn't have chose there, but hey ho... the only use for me is to see which ones are considered "instant".Does anyone know of any other accounts that would make this list but for a petty minimum balance requirement?- Cahoot @ 5% is an option if you want to throw in a maximum of £3,000 - it only requires £1 to open, but would fail the above list because it has a "smaller balance".

- existing, and eligible, Chase users might be able to open a 4.8% boosted account for 6 months.

- Vida Savings (never used) is at 4.63% with a £10 opening... fails because it's not £1 to open.

- Kent Reliance is 4.5% if you have £1,000 to open it with (you might need to define what you think is a "petty" balance!) - you can drop the balance down to £1, but would then only receive a nominal interest rate.

Cahoot 5% - I already have one

Chase - requires current account.

Vida - a gem whose petty minimum has denied it a place! (Seriously, does @ircE think anybody would actually find that onerous? These aren't children's accounts!) EDIT: I failed to spot the withdrawal restrictions, so agree that this is no gem and should not be included in the table. Thanks to @janusdesign for that info and apologies to @ircE .

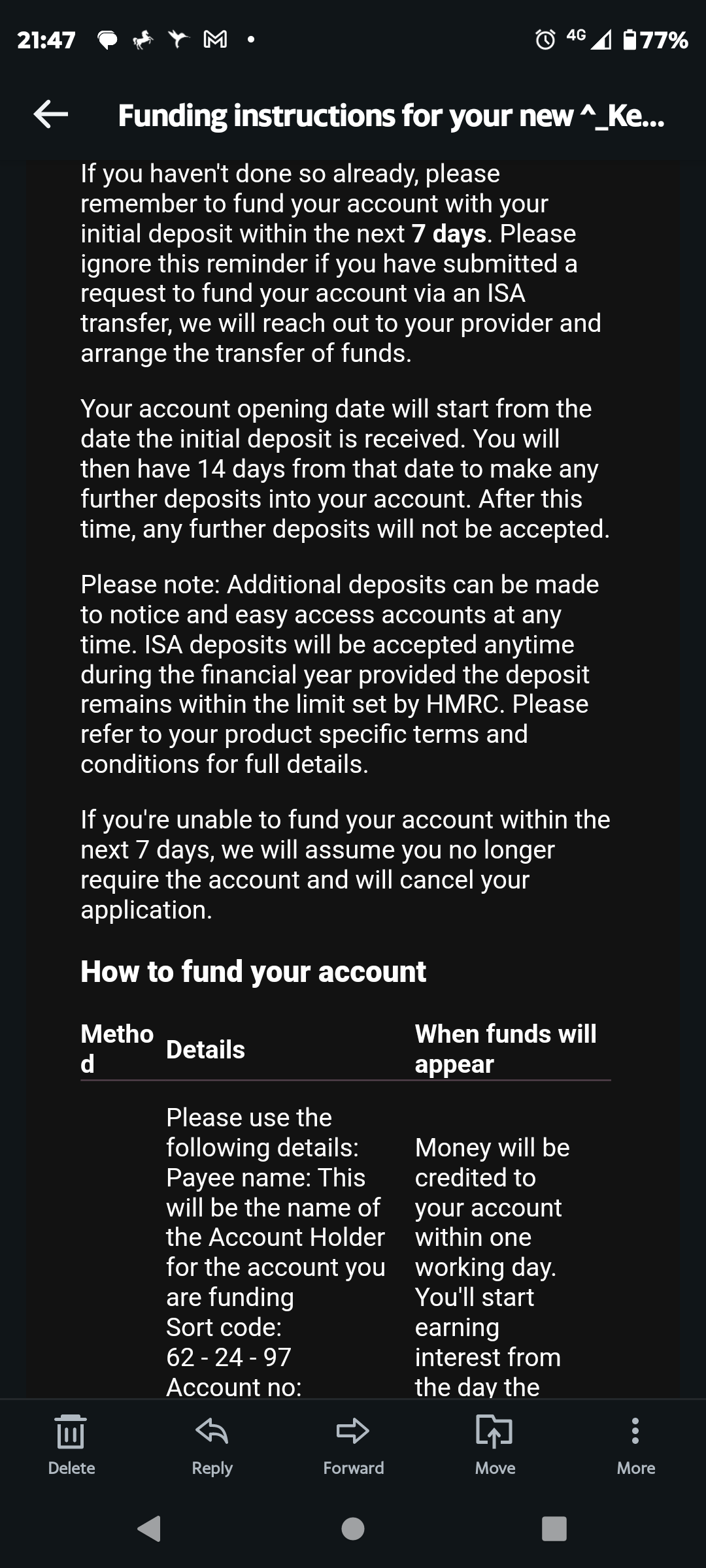

Kent Reliance - you can't pay into it after 14 days, or at least that's what I thought as I read this email (fuming!) so I didn't bother reading any further. Looking at it again though, it completely contradicts itself from the next sentence! So, which is correct?

(OK, so I don't know how to do bullet points on Android ☺️)

1 -

(Removed by Forum Team)That said, the methodology is not set in stone, and I can maybe flex a bit in the next iteration to see how it looks - maybe with a higher bar of £10? Open to any other suggestions as well while I'm at it.looking at a modified version of your Moneyfacts link, I don't think changing the max bar to £10 would currently alter the mean much for the True EA table, but might for the Instant True EA table...

as an example, with £10 I could open an account with Spring (app based launched by Paragon, sharing their FSCS limit and allowing multiple savings pots i.e Zopa) - they have an EA account paying 4.30% with instant withdrawals...with the query set at £1, you wouldn't even see the above option in Moneyfacts.How long will my withdrawal take?

Usually the money arrives in your linked current account instantly or it can take up to two hours.

my position is that if I want to open a savings account, I don't particularly care if the opening deposit needs to be £1, £10 or £100 - even with a max bar set at £10, most of the accounts would still likely only need £1 to pay interest.

with more accounts possibly being launched requiring slightly larger balances (e.g £10), it would be a shame if they were missing from your tables for the sake of £9... but as I said previously, I know you have to set the criteria somewhere, so i'll leave that in your capable hands.Re: Vida - just spotted there is a reduced rate for more than 4 withdrawals, so watch out for that.Thanks, I'll go through these

Cahoot 5% - I already have oneChase - requires current account.

Vida - a gem whose petty minimum has denied it a place! (Seriously, does @ircE think anybody would actually find that onerous? These aren't children's accounts!)

Kent Reliance - you can't pay into it after 14 days, or at least that's what I thought as I read this email (fuming!) so I didn't bother reading any further. Looking at it again though, it completely contradicts itself from the next sentence! So, which is correct?

Re: Kent Reliance - I got the same email, but just assumed that line was from a fixed rate email template and ignored it... from my own experience, you can deposit & withdraw as normal after the 14 days without issue.Thanks to your table, I noticed that HTB reintroduced a new issue (Iss 30, 4.4%) with a £1 minimum balance, replacing its Tracker issue (Iss 2, 4.4%, NLA) which had a £20,000 minimum balance. However, the notice period for an interest rate reduction has decreased from 30 days (Iss 29) to 14 days.their EA accounts and trackers are separate and usually both are available.... worth noting for their trackers (I have Iss 1), that you can open with and have a balance of £1 without issue - it's just that you won't earn any interest until the balance hits £20k+

2 -

Unfortunately Kent Reliance appear to have been sending a confusing email out for a while when opening easy access savings accounts, you CAN continue to fund after 14 days, I have funded long after 14 days.Thanks, I'll go through these

Kent Reliance - you can't pay into it after 14 days, or at least that's what I thought as I read this email (fuming!) so I didn't bother reading any further. Looking at it again though, it completely contradicts itself from the next sentence! So, which is correct?

EDIT: I didn't continue to read the email once I hit the 14 days mentioned. Others have pointed out that later on in the email it states "Please Note: Additional deposits can be made to notice and easy access accounts at any time".1 -

It has just been announced that Bank Base Rate has been reduced by 0.25% to 4.25%

https://www.bankofengland.co.uk/monetary-policy-summary-and-minutes/2025/may-2025

At its meeting ending on 7 May 2025, the MPC voted by a majority of 5–4 to reduce Bank Rate by 0.25 percentage points, to 4.25%. Two members preferred to reduce Bank Rate by 0.5 percentage points, to 4%. Two members preferred to maintain Bank Rate at 4.5%.

Next decision Thursday 19th June 2025

I came, I saw, I melted5 -

Kent Reliancenottsphil said:

Thanks, I'll go through thesejanusdesign said:nottsphil said:

My instant access money is earning 4.75% AER but it doesn't qualify for the list as it contravenes two of the criteria, the reason I am looking for a second one. At the time you compiled it however, the Saffron Building Society was offering it's E-Saver at 4.5%, so was its exclusions solely because of its £10 minimum balance?ircE said: True EA accounts are easy access savings accounts which can be opened (and the headline interest rate earned) from £1 and allow for unlimited deposits and withdrawals. This excludes accounts that are limited to smaller balances, accounts with fees, and accounts only available via savings platforms. Instant True EA accounts are those True EA accounts which advertise immediate deposit and withdrawal times 24/7. Highlighted entries show changes since last time: blue for new entries to the respective table, and red for rate reductions.cahoot and Hampshire Trust Bank return to the scorecard with their latest offerings. Newcastle BS makes a somewhat unusual debut with an account that matures in 6 months - just in time for Christmas.A note on Chip/Chase: their battle continues more than what is shown on the scorecard, which only goes by what I see on moneyfacts for my selected filters. Chip is offering a 4.76% account with limited access to new customers, and Chase is offering selected existing customers a boosted rate of 4.80%. DYOR etc.For those who care neither for Chip nor Chase, Chetwood provides the leading account for True EA accounts, and cahoot takes the lead for those who would like instant access.The MPC announces its next decision next Thursday, 8th May.it will be because of that - personally, I think those criteria are silly (no offence to irce) - but I guess if you want to have criteria, you have to draw the line somewhere... I wouldn't have chose there, but hey ho... the only use for me is to see which ones are considered "instant".Does anyone know of any other accounts that would make this list but for a petty minimum balance requirement?

True EA accounts are easy access savings accounts which can be opened (and the headline interest rate earned) from £1 and allow for unlimited deposits and withdrawals. This excludes accounts that are limited to smaller balances, accounts with fees, and accounts only available via savings platforms. Instant True EA accounts are those True EA accounts which advertise immediate deposit and withdrawal times 24/7. Highlighted entries show changes since last time: blue for new entries to the respective table, and red for rate reductions.cahoot and Hampshire Trust Bank return to the scorecard with their latest offerings. Newcastle BS makes a somewhat unusual debut with an account that matures in 6 months - just in time for Christmas.A note on Chip/Chase: their battle continues more than what is shown on the scorecard, which only goes by what I see on moneyfacts for my selected filters. Chip is offering a 4.76% account with limited access to new customers, and Chase is offering selected existing customers a boosted rate of 4.80%. DYOR etc.For those who care neither for Chip nor Chase, Chetwood provides the leading account for True EA accounts, and cahoot takes the lead for those who would like instant access.The MPC announces its next decision next Thursday, 8th May.it will be because of that - personally, I think those criteria are silly (no offence to irce) - but I guess if you want to have criteria, you have to draw the line somewhere... I wouldn't have chose there, but hey ho... the only use for me is to see which ones are considered "instant".Does anyone know of any other accounts that would make this list but for a petty minimum balance requirement?- Cahoot @ 5% is an option if you want to throw in a maximum of £3,000 - it only requires £1 to open, but would fail the above list because it has a "smaller balance".

- existing, and eligible, Chase users might be able to open a 4.8% boosted account for 6 months.

- Vida Savings (never used) is at 4.63% with a £10 opening... fails because it's not £1 to open.

- Kent Reliance is 4.5% if you have £1,000 to open it with (you might need to define what you think is a "petty" balance!) - you can drop the balance down to £1, but would then only receive a nominal interest rate.

Cahoot 5% - I already have one

Chase - requires current account.

Vida - a gem whose petty minimum has denied it a place! (Seriously, does @ircE think anybody would actually find that onerous? These aren't children's accounts!)

Kent Reliance - you can't pay into it after 14 days, or at least that's what I thought as I read this email (fuming!) so I didn't bother reading any further. Looking at it again though, it completely contradicts itself from the next sentence! So, which is correct?

(OK, so I don't know how to do bullet points on Android ☺️)

However, the 4th paragraph above does state:-

Please note: Additional deposits can be made to notice and easy access accounts at any time.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.7K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards