We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The New Top Easy Access Savings Discussion Area

Comments

-

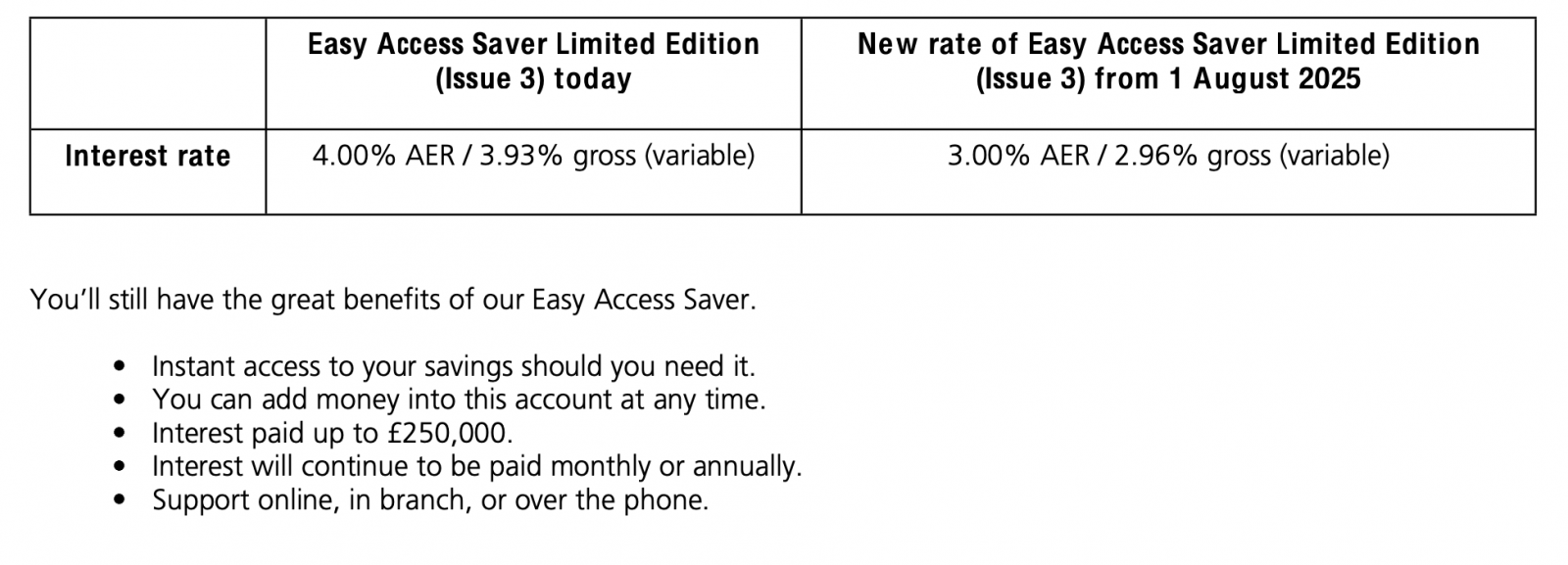

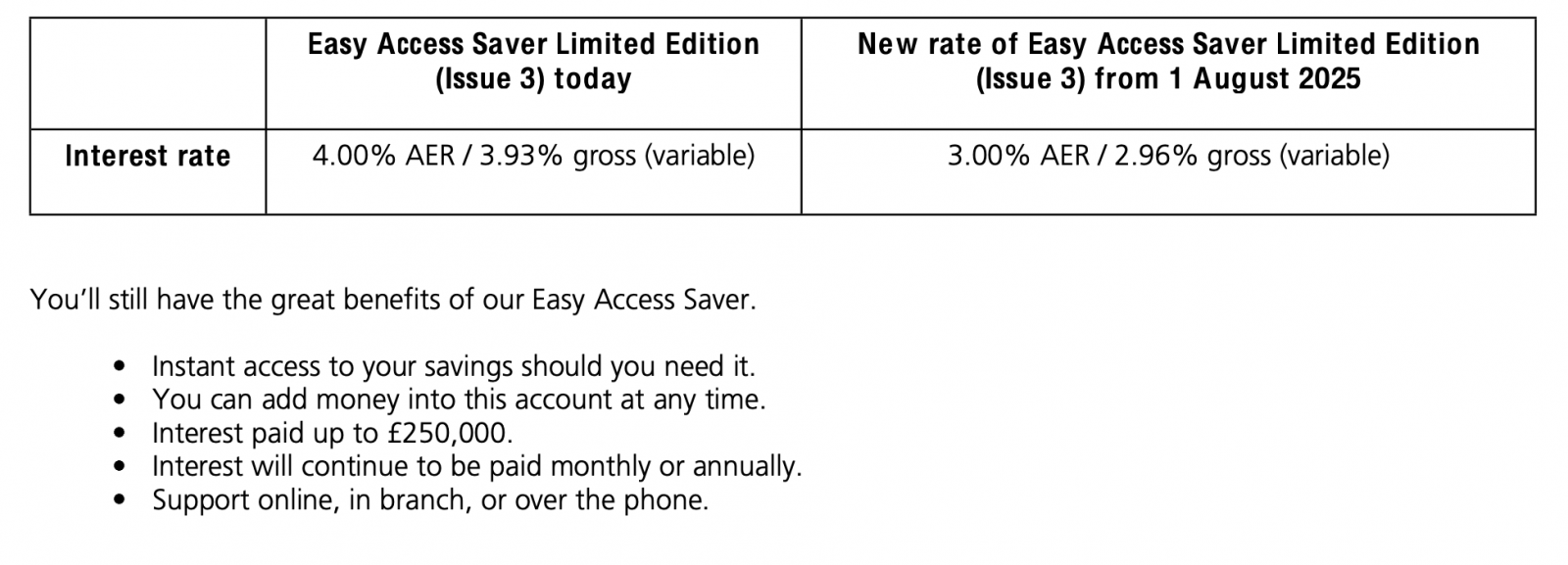

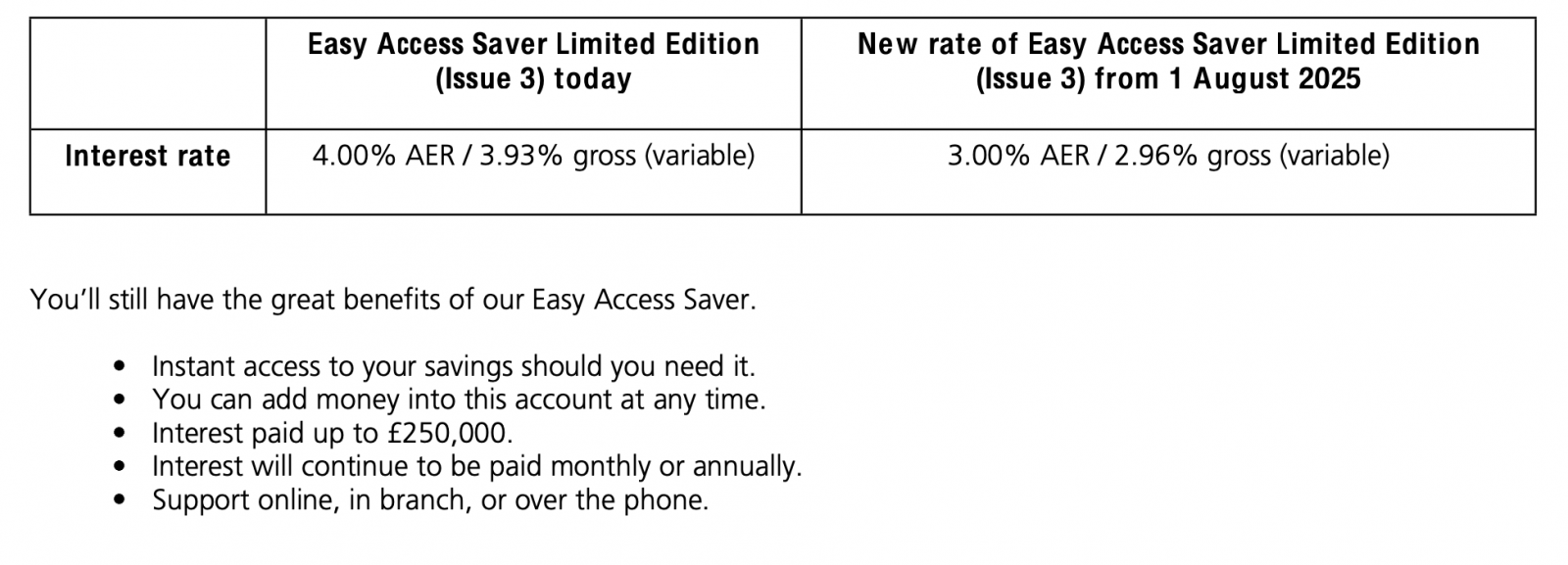

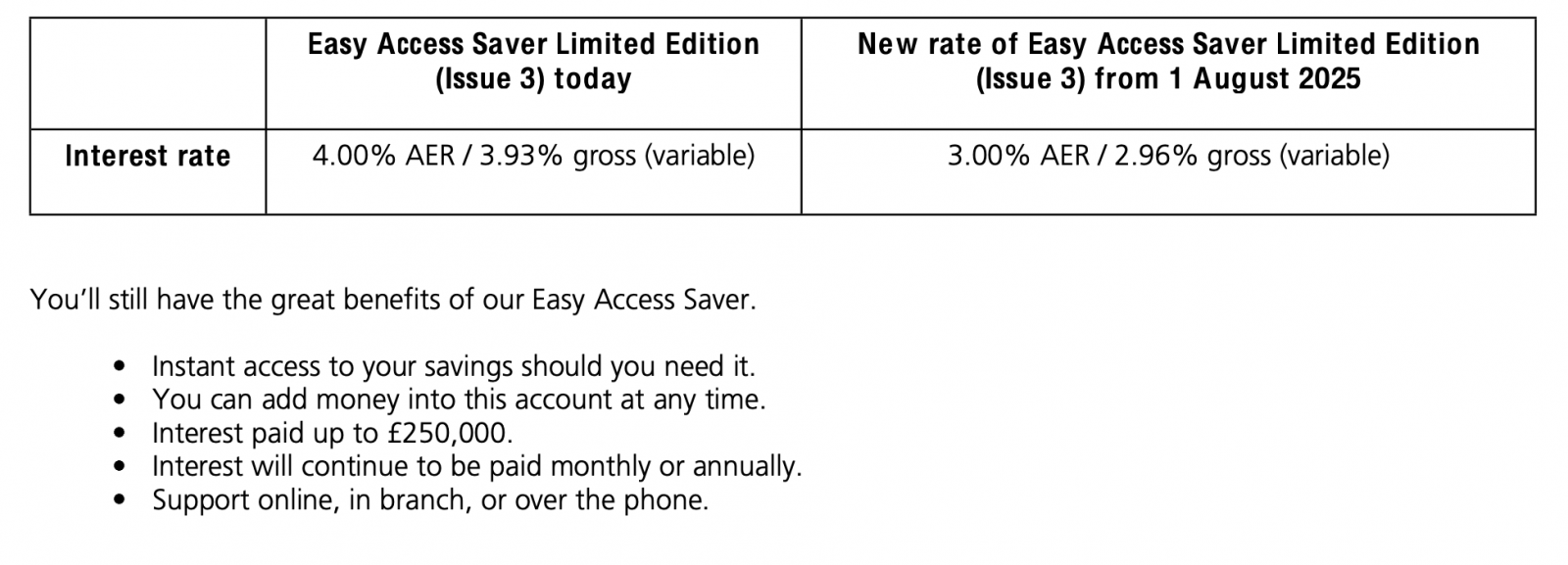

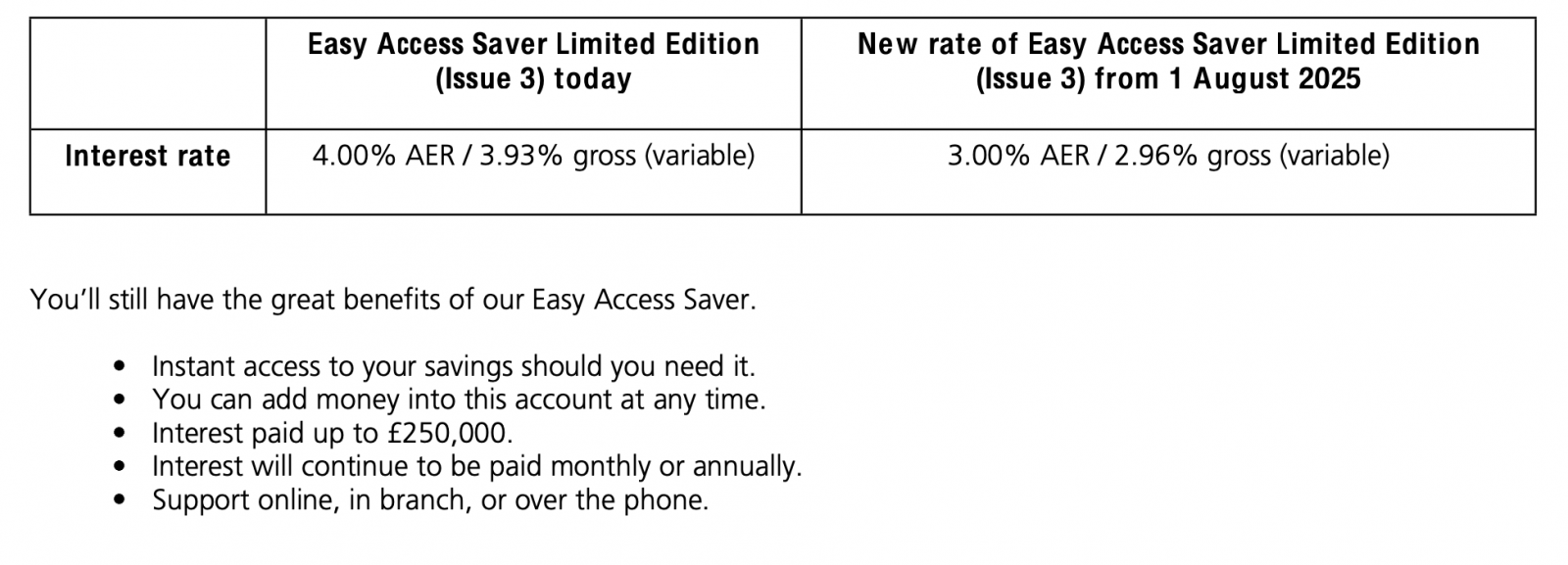

I received my annual statement for my Santander Easy Access Saver Limited Edition (Issue 3) [no longer available] today and, on page 5, there was the following information:We’re extending the term of your Easy Access Saver by an extra 12 months, with a new interest rate of 3.00% AER / 2.96% gross (variable) from 1 August 2025. You can still withdraw or add money in at any time.

We’re pleased to let you know that we’re extending the term of your Easy Access Saver Limited Edition (Issue 3) so you can continue enjoying a great rate. It was due to mature onto an Everyday Saver with an interest rate of 1.00% AER/gross (variable).

We’re giving you a further 12 months in your Easy Access Saver, with an interest rate of 3.00% AER / 2.96% gross (variable) from 1 August 2025. This is currently our best instant access savings rate for balances up to £250,000.

Remember that your account has a variable interest rate, which means it can go up and down.The interest rate is currently 4.00% AER / 3.93% gross (variable).

Also posted in this thread.

6 -

Seems they are trying to do a stepped decrease. Unfortunate there is no new higher rate issue yet!GalacticaActual said:I received my annual statement for my Santander Easy Access Saver Limited Edition (Issue 3) [no longer available] today and, on page 5, there was the following information:We’re extending the term of your Easy Access Saver by an extra 12 months, with a new interest rate of 3.00% AER / 2.96% gross (variable) from 1 August 2025. You can still withdraw or add money in at any time.

We’re pleased to let you know that we’re extending the term of your Easy Access Saver Limited Edition (Issue 3) so you can continue enjoying a great rate. It was due to mature onto an Everyday Saver with an interest rate of 1.00% AER/gross (variable).

We’re giving you a further 12 months in your Easy Access Saver, with an interest rate of 3.00% AER / 2.96% gross (variable) from 1 August 2025. This is currently our best instant access savings rate for balances up to £250,000.

Remember that your account has a variable interest rate, which means it can go up and down.The interest rate is currently 4.00% AER / 3.93% gross (variable).

Also posted in this thread.

If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.3 -

Useful to know. Use the 4% occasionally for overnight balances where money is in transit and keep a small reserve in there that would normally just sit in the current account.GalacticaActual said:I received my annual statement for my Santander Easy Access Saver Limited Edition (Issue 3) [no longer available] today and, on page 5, there was the following information:We’re extending the term of your Easy Access Saver by an extra 12 months, with a new interest rate of 3.00% AER / 2.96% gross (variable) from 1 August 2025. You can still withdraw or add money in at any time.

We’re pleased to let you know that we’re extending the term of your Easy Access Saver Limited Edition (Issue 3) so you can continue enjoying a great rate. It was due to mature onto an Everyday Saver with an interest rate of 1.00% AER/gross (variable).

We’re giving you a further 12 months in your Easy Access Saver, with an interest rate of 3.00% AER / 2.96% gross (variable) from 1 August 2025. This is currently our best instant access savings rate for balances up to £250,000.

Remember that your account has a variable interest rate, which means it can go up and down.The interest rate is currently 4.00% AER / 3.93% gross (variable).

Also posted in this thread.

1 -

Yeah I got the same mail, it says in it that this is their highest paying EA account .ForumUser7 said:

Seems they are trying to do a stepped decrease. Unfortunate there is no new higher rate issue yet!GalacticaActual said:I received my annual statement for my Santander Easy Access Saver Limited Edition (Issue 3) [no longer available] today and, on page 5, there was the following information:We’re extending the term of your Easy Access Saver by an extra 12 months, with a new interest rate of 3.00% AER / 2.96% gross (variable) from 1 August 2025. You can still withdraw or add money in at any time.

We’re pleased to let you know that we’re extending the term of your Easy Access Saver Limited Edition (Issue 3) so you can continue enjoying a great rate. It was due to mature onto an Everyday Saver with an interest rate of 1.00% AER/gross (variable).

We’re giving you a further 12 months in your Easy Access Saver, with an interest rate of 3.00% AER / 2.96% gross (variable) from 1 August 2025. This is currently our best instant access savings rate for balances up to £250,000.

Remember that your account has a variable interest rate, which means it can go up and down.The interest rate is currently 4.00% AER / 3.93% gross (variable).

Also posted in this thread.

Normally it would be going into a 1% account it says and adds we should be grateful they’re not putting it there (ok I made the last bit up)2 -

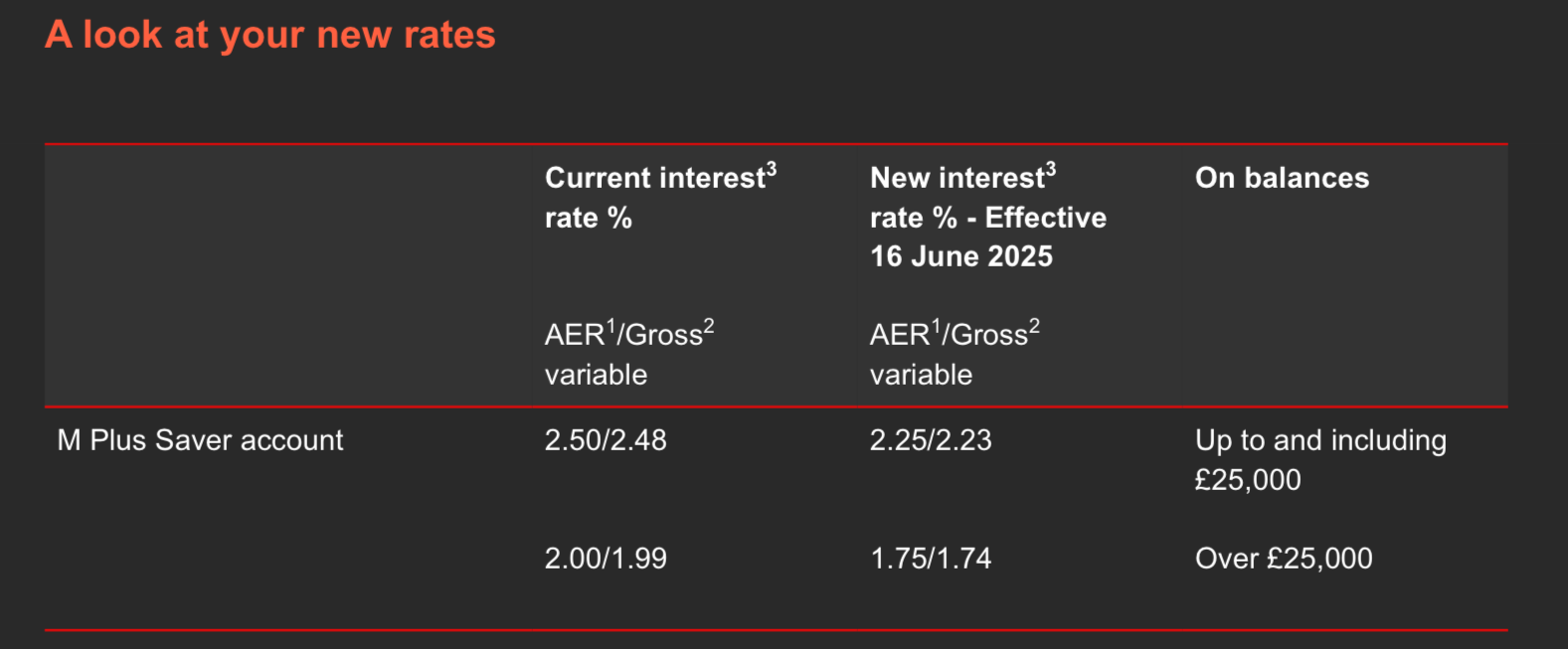

Although not a high interest savings account, those with a linked Virgin Money M Plus Saver Account should receive notification about a drop in interest rate from 16th June 2025, like I did this afternoon. I will be moving money from that savings account in due course.

1 -

It used to be my main EA account (Sept 2023 - Feb 2024). It paid the top EA rate (5.2%). I stopped using it when they dropped the rate to 4.2%.RedImp_2 said:

Yeah I got the same mail, it says in it that this is their highest paying EA account .ForumUser7 said:

Seems they are trying to do a stepped decrease. Unfortunate there is no new higher rate issue yet!GalacticaActual said:I received my annual statement for my Santander Easy Access Saver Limited Edition (Issue 3) [no longer available] today and, on page 5, there was the following information:We’re extending the term of your Easy Access Saver by an extra 12 months, with a new interest rate of 3.00% AER / 2.96% gross (variable) from 1 August 2025. You can still withdraw or add money in at any time.

We’re pleased to let you know that we’re extending the term of your Easy Access Saver Limited Edition (Issue 3) so you can continue enjoying a great rate. It was due to mature onto an Everyday Saver with an interest rate of 1.00% AER/gross (variable).

We’re giving you a further 12 months in your Easy Access Saver, with an interest rate of 3.00% AER / 2.96% gross (variable) from 1 August 2025. This is currently our best instant access savings rate for balances up to £250,000.

Remember that your account has a variable interest rate, which means it can go up and down.The interest rate is currently 4.00% AER / 3.93% gross (variable).

Also posted in this thread.

Normally it would be going into a 1% account it says and adds we should be grateful they’re not putting it there (ok I made the last bit up)1 -

Just discovered by chance that some interest was added to my Tesco EA accounts on 31/3. The 1.50% part I discover by reading the T&Cs again. Could have caught me out had I already submitted my 2024/25 return.1

-

AFAIK the bonus element has, in the past, been added separately to the normal interest date, but for accounts opened recently the T&Cs now maybe suggest it will be added on the same date.

The account does seem true instant, but Post Office savings which also has a 1 year bonus simply adds interest at the higher rate and with a monthly option.

When interest rates drop it can be that having a large bonus element gives a useful rate towards the end of the term.

0 -

Where in the T&Cs did you see the suggestion? From the current T&Csjak22 said:AFAIK the bonus element has, in the past, been added separately to the normal interest date, but for accounts opened recently the T&Cs now maybe suggest it will be added on the same date.- When will you pay me interest?

- Interest earned throughout each year will be paid on the last day of March.

- If Bonus Interest applies to your account, we will apply this at the end of your Bonus term.

1 -

4

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.7K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards