We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The New Top Easy Access Savings Discussion Area

Comments

-

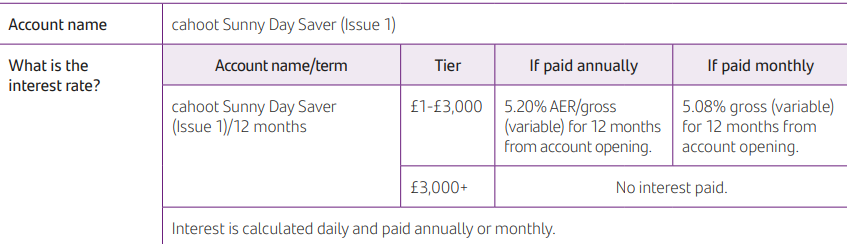

I have not been given any notice from Cahoot directly yet, though they still have a month to give me the requisite notice.SnowMan said:Interesting that the no longer available Cahoot Simple Saver (issue 4) is dropping to 4.35% AER from 4.85% AER from 11th February 2025 (as per above). They only had to give 2 months notice but they've given 3 months instead. A lot of people endured the often difficult opening process in anticipation that this account would become temporarily really good after a base rate reduction.The Cahoot Sunny Day saver (issue 2) is still showing as available at 5% AER for balances up to £3,000, and as already stated above the Cahoot Sunny Day saver (issue 1) joins it at 5% AER for balances up to £3,000 from 18th November after its rate reduces from 5.2% AER (for those whose year isn't coming to an end soon).0 -

I have the Issue 2 (NLA) paying 5.12% AER, not had any notification of any change nor any secure messages sent in the inbox, looks like a good deal as my 12 months (product transfer date) is up on 20 January, so any 60 day notification would take me through almost to there anyway.Bridlington1 said:

I've just noticed this on Cahoot's website though:wiseonesomeofthetime said:Luckily, I am gripping on to Cahoot Simple Saver Issue 4 at 4.85% (NLA obv)

<snip>0 -

I reckon they have just decided not to bother changing issue 2, since it looks like the end of the 12 month period for the final people who applied for it will be 29th January 2025, so even if they gave notice of adjusting the rate now, it would only have any effect for a couple of weeks at most.happybagger said:

I have the Issue 2 (NLA) paying 5.12% AER, not had any notification of any change nor any secure messages sent in the inbox, looks like a good deal as my 12 months (product transfer date) is up on 20 January, so any 60 day notification would take me through almost to there anyway.Bridlington1 said:

I've just noticed this on Cahoot's website though:wiseonesomeofthetime said:Luckily, I am gripping on to Cahoot Simple Saver Issue 4 at 4.85% (NLA obv)

<snip>0 -

The same here. Mine expires on 18th January, it looks like Cahoot decided to let this issue to wind down without changing the rate. It's good to have two more months of 5.12%.happybagger said:

I have the Issue 2 (NLA) paying 5.12% AER, not had any notification of any change nor any secure messages sent in the inbox, looks like a good deal as my 12 months (product transfer date) is up on 20 January, so any 60 day notification would take me through almost to there anyway.Bridlington1 said:

I've just noticed this on Cahoot's website though:wiseonesomeofthetime said:Luckily, I am gripping on to Cahoot Simple Saver Issue 4 at 4.85% (NLA obv)

<snip>0 -

wiseonesomeofthetime said:

I have not been given any notice from Cahoot directly yet, though they still have a month to give me the requisite notice.SnowMan said:Interesting that the no longer available Cahoot Simple Saver (issue 4) is dropping to 4.35% AER from 4.85% AER from 11th February 2025 (as per above). They only had to give 2 months notice but they've given 3 months instead. A lot of people endured the often difficult opening process in anticipation that this account would become temporarily really good after a base rate reduction.The Cahoot Sunny Day saver (issue 2) is still showing as available at 5% AER for balances up to £3,000, and as already stated above the Cahoot Sunny Day saver (issue 1) joins it at 5% AER for balances up to £3,000 from 18th November after its rate reduces from 5.2% AER (for those whose year isn't coming to an end soon).Having opted to pay the interest back into Cahoot, its showing the current interest rate as 0%, had presumed that it would stay at 5 % as the interest was paid in, Do they not pay any interest when this is the scenario?Thanks for any help0 -

@gesdt50 - Not entirely sure about what you mean, however, if your balance is £3,000, any interest added over that figure will yield 0% as no interest is paid above £3k.

I chose annual interest, so mine will not be added until account anniversary.

If you are referring to the Cahoot Simple Saver, which I was referring to, then I don't know why your's is showing 0% tbh, however, you mentioning 5% suggest Sunny Saver.0 -

After more research they won't give any interest even if you reduce back to 3,000, Thanks

0 -

The Cahoot Sunny Day Saver? Where are you doing your "research"?gesdt50 said:After more research they won't give any interest even if you reduce back to 3,000, Thanks

It's a "tiered" interest product, £1-3000 pays 5%, anything above £3k earns 0%.

Actually, mine's an issue 1 paying 5.08% - has a reduction been announced for this one?0 -

That’s not correct. It’s just the way their interest indicator works is very unhelpful. It only updates once every 24 hours. If, when the update occurs, your balance is over £3k, the interest rate will show as 0% (even though you are still getting 5% on the first £3k and nothing only on the balance above that). If, when the update occurs, your balance is below £3k, the interest rate will show as 5%.gesdt50 said:After more research they won't give any interest even if you reduce back to 3,000, ThanksThe TL;DR: bring your balance down to £3k or less, wait 24 hours, and the interest will show as 5% again.1 -

This - there's a tip when you hover over the interest rate field on the website:Mr._H_2 said:

That’s not correct. It’s just the way their interest indicator works is very unhelpful. It only updates once every 24 hours. If, when the update occurs, your balance is over £3k, the interest rate will show as 0% (even though you are still getting 5% on the first £3k and nothing only on the balance above that). If, when the update occurs, your balance is below £3k, the interest rate will show as 5%.gesdt50 said:After more research they won't give any interest even if you reduce back to 3,000, ThanksThe TL;DR: bring your balance down to £3k or less, wait 24 hours, and the interest will show as 5% again.Your interest rate may show as 0% for balances higher than the limit on your account.Please refer to your Key Facts Document for more information.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.5K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards