We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

NS&I 1 Year Guaranteed Growth Bonds and Guaranteed Income Bonds at 6.20%

Comments

-

granta said:Does anyone know if the bond can be funded using more than one debit card? Thinking of using my Halifax Reward cards to meet the £500 target per card.You fund it at the time of opening with no opportunity to top upTo use 2 cards you would need to open 2 bonds, no real problem with that1

-

Good point. Multiple bonds it is! Hopefully it won't have been pulled by tomorrow which is when I need to do September's debit card paymentsColdIron said:granta said:Does anyone know if the bond can be funded using more than one debit card? Thinking of using my Halifax Reward cards to meet the £500 target per card.You fund it at the time of opening with no opportunity to top upTo use 2 cards you would need to open 2 bonds, no real problem with that0 -

Given the problems that have been regularly reported about NS&I I think I'm gonna give it a miss. I don't have a lot of confidence in their processes. I'm expecting the competition will be along shortly with something comparable.

2 -

Thanks Boingy and Swipe. Yes the email address was misspelt. So as suggested, I've done a quick test and thankfully the email has bounced back (undelivered). So I assume I can rest assured that my data has not been lost.

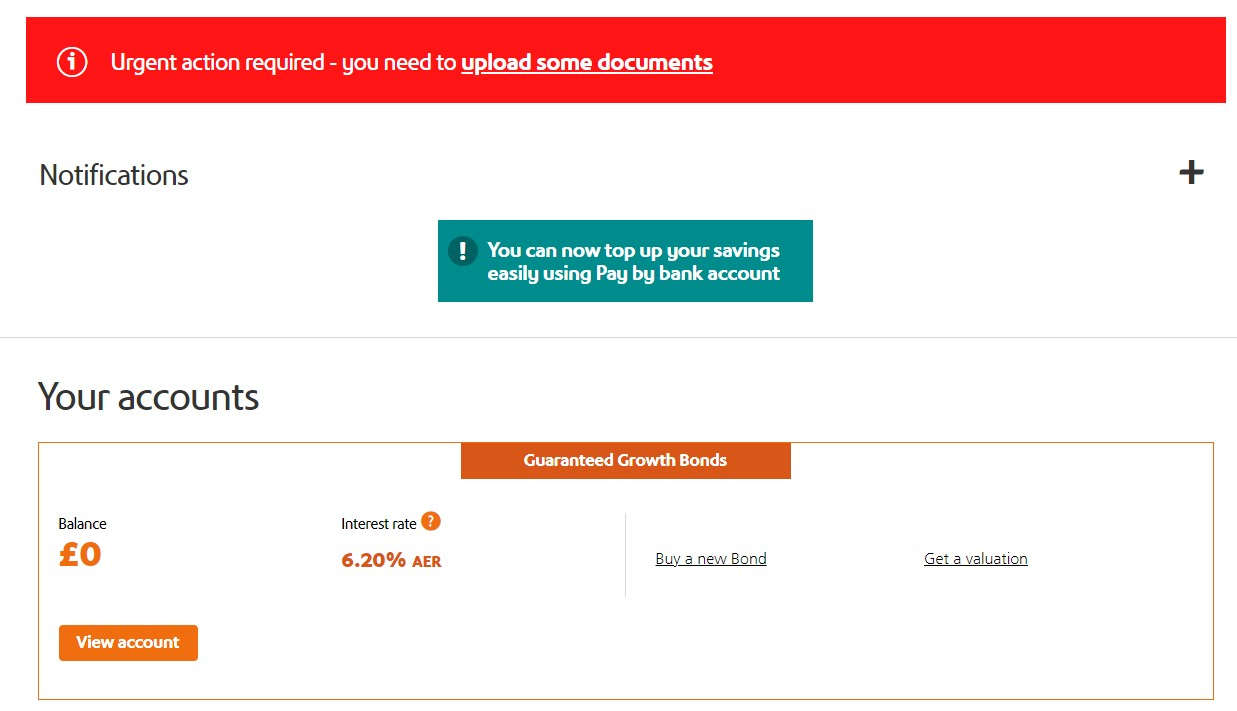

However I've not received any of the emails you guys have posted, so I feel at least that bit needs to be sorted and also the interest-rate needs to be backdated. The other problem I have is that I've got reminder on my account to upload ID documents, but I can't do that until the name is corrected. My money is being held and my balance is also showing £0.

0 -

They really are useless. They should have double checked everything was correct before opening the bond. The bond is now open so you'll get the interest from the opening date.1

-

Why not just transfer it to a one year fixed rate with another provider. You can get around 5.6% tax free which works out better than 6.2% minus 20% .curlywig73 said:Is it worth withdrawing money (25k) from a low interest Virgin cash ISA to put into the new NS&I bond for the much better rate, thus losing the tax free status of that money for ever? I was going to transfer it to my Vanguard ISA but it has been a bit volatile this year and the NS&I bond seems a safer bet for a year in terms of growth. The tax free status is useful to me as I do go over the PSA each year and likely will for the next few years. Trying to work out whether it's worth paying the extra tax on the higher NS&I interest or it would be better to preserve its tax free status and put it in my Vanguard ISA but with the risk that it performs poorly this coming year. It's hard to know what to do for the best long term when interest rates start changing as much as this. Vanguard ISA was a no-brainer when interest rates were 1%.

Best 1 Year ISA Rates | Rates up to 6.10% (moneyfactscompare.co.uk)

1 -

Correction above.curlywig73 said:I'm not a newie to investment by the way. But I'm still learning about the best strategies for moving money around to get the best returns during a time when interest rates are changing and the stock market outlook is always uncertain at times. and always has been and always will be.0 -

Quick question: I am already putting money into a regular cash ISA, opened in the 22/23 tax year.Albermarle said:

Why not just transfer it to a one year fixed rate with another provider. You can get around 5.6% tax free which works out better than 6.2% minus 20% .curlywig73 said:Is it worth withdrawing money (25k) from a low interest Virgin cash ISA to put into the new NS&I bond for the much better rate, thus losing the tax free status of that money for ever? I was going to transfer it to my Vanguard ISA but it has been a bit volatile this year and the NS&I bond seems a safer bet for a year in terms of growth. The tax free status is useful to me as I do go over the PSA each year and likely will for the next few years. Trying to work out whether it's worth paying the extra tax on the higher NS&I interest or it would be better to preserve its tax free status and put it in my Vanguard ISA but with the risk that it performs poorly this coming year. It's hard to know what to do for the best long term when interest rates start changing as much as this. Vanguard ISA was a no-brainer when interest rates were 1%.

Best 1 Year ISA Rates | Rates up to 6.10% (moneyfactscompare.co.uk)Can I still open a fixed rate ISA for the 23/24 year?0 -

JonSalji said:

Quick question: I am already putting money into a regular cash ISA, opened in the 22/23 tax year.Albermarle said:

Why not just transfer it to a one year fixed rate with another provider. You can get around 5.6% tax free which works out better than 6.2% minus 20% .curlywig73 said:Is it worth withdrawing money (25k) from a low interest Virgin cash ISA to put into the new NS&I bond for the much better rate, thus losing the tax free status of that money for ever? I was going to transfer it to my Vanguard ISA but it has been a bit volatile this year and the NS&I bond seems a safer bet for a year in terms of growth. The tax free status is useful to me as I do go over the PSA each year and likely will for the next few years. Trying to work out whether it's worth paying the extra tax on the higher NS&I interest or it would be better to preserve its tax free status and put it in my Vanguard ISA but with the risk that it performs poorly this coming year. It's hard to know what to do for the best long term when interest rates start changing as much as this. Vanguard ISA was a no-brainer when interest rates were 1%.

Best 1 Year ISA Rates | Rates up to 6.10% (moneyfactscompare.co.uk)Can I still open a fixed rate ISA for the 23/24 year?

You can but only for the purposes of an ISA transfer, not for new money. Best ask your Q on the ISA forum: https://forums.moneysavingexpert.com/categories/isas-tax-free-savings

1 -

You can only pay new subscriptions from the current tax year into one cash ISA at any one time so if you've paid into your existing ISA since 6th April this year, then you can't open a new ISA and also pay into that. There is one exception to this, however, and that is if the current ISA provider operates a 'portfolio' approach which can allow you to spread this year's allowance over multiple different cash ISAs with the same provider. Some examples of providers who offer this are Zopa, Nationwide and Paragon.JonSalji said:

Quick question: I am already putting money into a regular cash ISA, opened in the 22/23 tax year.Albermarle said:

Why not just transfer it to a one year fixed rate with another provider. You can get around 5.6% tax free which works out better than 6.2% minus 20% .curlywig73 said:Is it worth withdrawing money (25k) from a low interest Virgin cash ISA to put into the new NS&I bond for the much better rate, thus losing the tax free status of that money for ever? I was going to transfer it to my Vanguard ISA but it has been a bit volatile this year and the NS&I bond seems a safer bet for a year in terms of growth. The tax free status is useful to me as I do go over the PSA each year and likely will for the next few years. Trying to work out whether it's worth paying the extra tax on the higher NS&I interest or it would be better to preserve its tax free status and put it in my Vanguard ISA but with the risk that it performs poorly this coming year. It's hard to know what to do for the best long term when interest rates start changing as much as this. Vanguard ISA was a no-brainer when interest rates were 1%.

Best 1 Year ISA Rates | Rates up to 6.10% (moneyfactscompare.co.uk)Can I still open a fixed rate ISA for the 23/24 year?

If your current ISA provider doesn't offer this facility, then one option would be to transfer the current tax year subscriptions into a fixed rate ISA and top up with the remaining 2023/24 allowance. The existing ISA would have to allow partial transfers out though and the new provider would have to allow partial transfers in. Once you do this, you obviously wouldn't be able to continue to pay into the original ISA.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.4K Work, Benefits & Business

- 602.7K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards